In partnership with | | | | | | That's the percentage of U.S. GDP that came from the firewood industry in 1830. |

|

|

|

| | | Trillion-dollar valuations are coming to the IPO market Big Tech earnings: Winners, losers, and key takeaways Who is Kevin Warsh, Trump's pick for Fed chair? Newsletter Exclusive: Corporate America pulls back on hiring

|

|

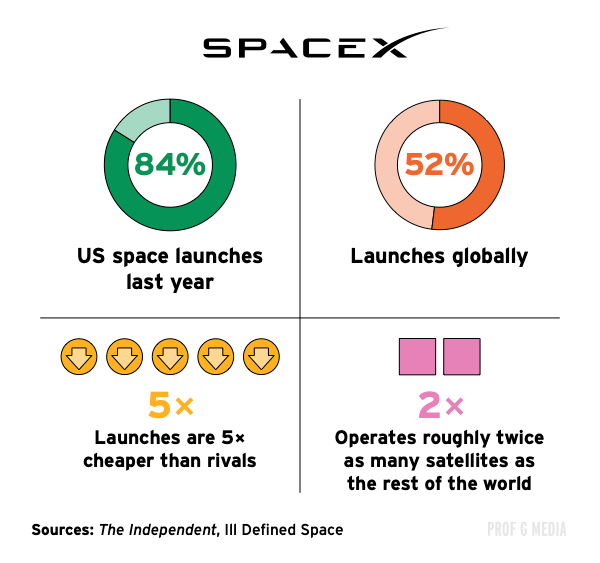

| | SpaceX, OpenAI, and the 2026 IPO Wave | It could be a record-setting year for IPOs. In fact, Blackstone's president said the company had lined up one of the largest IPO pipelines in their history. Two of the most important candidates are SpaceX and OpenAI. | SpaceX is reportedly targeting a mid-June listing and is seeking to raise up to $50 billion at an estimated $1.5 trillion valuation. That would make it the largest IPO in history. | | SpaceX earned $15.5 billion last year, which, assuming a $1.5 trillion valuation, implies a price-to-sales multiple of 97x. Among major tech companies, the only company valued similarly is Palantir. Meta and Alphabet trade at around 10x sales. | Or, maybe not. | Last Thursday, Tesla CEO and SpaceX founder Elon Musk said he's considering merging SpaceX with xAI, his AI company, or Tesla, his struggling electric vehicle firm. Tesla shares jumped as much as 5% on the news. | Meanwhile, startup darling OpenAI is reportedly raising additional funding at a valuation between $750 billion and $830 billion, and discussions are underway about a potential IPO at a $1 trillion valuation in late 2026. OpenAI's annual recurring revenue (ARR) hit $20 billion last year, and it recently announced plans to integrate advertising into its free and low-cost membership tiers. | An $830 billion valuation will make OpenAI roughly as valuable as: the second-biggest bank in the U.S. (Bank of America), the biggest streaming service in America (Netflix), and the biggest sports retailer in the world (Nike) … combined.

| Last Wednesday, Sen. Elizabeth Warren penned a letter to OpenAI, citing a "$300 billion gap" between its $1.4 trillion spending commitments and its actual revenues" and asking for assurances that the company would not seek a government bailout. | Other potential 2026 IPO candidates include Anthropic, Databricks, Strava, Canva, Stripe, and Ledger. | Investing in IPOs: Should You, or Shouldn't You? Buying into an IPO as a retail investor is risky (and that's because it's kind of a rigged game). Institutional investors get early access to better-priced IPO shares; retail investors usually have to buy in the open market after the initial IPO pop. According to the National Bureau of Economic Research, institutional investors earn about 3x more than retail investors on IPO investments. * As Warren Buffett said, "You're not gonna beat the investment banks at their own game." * And, as a recent Wall Street Journal article noted, "You're more likely to be struck by lightning than you are to buy shares directly in most pre-IPO companies."

You might not even want shares in the first place. Companies spend hundreds of thousands of dollars (sometimes even millions) on marketing leading up to their IPOs, generating hype and excitement that can overpower any real scrutiny of their fundamentals. The result is that many get a first-day pop, but end up declining for years after. Between 1980 and 2022, the majority of IPOs lost money over a five-year period following their debut. |

|

|

| | |

| | | | When Microsoft hit a trillion dollar valuation, it had $92 billion in revenue. Google had $183 billion. SpaceX has less than $16 billion in revenue. | If SpaceX does an IPO at $1.5 trillion, Bloomberg estimated that this will increase Elon's net worth to $950 billion. According to Kalshi, the probability that he will become a trillionaire in the next year is 74%, making his net worth equal to 3% of America's GDP. | At the peak of the Gilded Age, John D. Rockefeller's wealth amounted to 2% of America's GDP. | |

| |

| | |

| Big Tech Earnings Roundup | Most of the Magnificent Seven reported earnings last week. Overall, it was a strong quarter, with Microsoft, Meta, and Apple all beating expectations on the top and bottom lines. | Apple | Apple's earnings proved again how good it is to own the rails. The company posted a better-than-expected holiday quarter, with revenue rising 16% — its fastest quarterly growth in more than four years. Sales in China rose nearly 38% year over year, a sharp turnaround after declines in three of the past four quarters. | That strength came despite Apple's underwhelming AI narrative. Growth was driven by stronger-than-expected iPhone demand (quarterly sales jumped 23%) and record services revenue (up 14%). | Meta | Meta CEO Mark Zuckerberg delivered a clean AI growth story this quarter, and investors loved it. | Meta's fourth-quarter sales rose 24%, and the company issued stronger-than-expected sales guidance for the current quarter. | AI is supercharging Meta's ad-targeting capabilities: Users clicked on Facebook ads 3.5% more often this quarter, and conversions increased 1%. For a company of Meta's scale (40% of the world's population uses a Meta product daily), that's meaningful. | The growth helped justify a sharp increase in 2026 capex estimates to $115 billion to $135 billion — around 60% above last year — and the stock jumped as much as 10% after hours. | | Microsoft | Microsoft had another strong quarter, but a slight slowdown in cloud growth rattled investors. Shares fell 5% after hours and plunged 10% the next day, erasing $357 billion in value — the second-largest single-day drop in market history. | Microsoft's AI growth story looked more complicated this quarter. Its cloud backlog grew, but more than half of future bookings are attributable to OpenAI. | There's also growing concern around Microsoft's partnership with Anthropic, as Anthropic's Claude Cowork could end up competing with Microsoft's own AI-powered productivity tools. | Tesla | Tesla's full-year sales declined for the first time ever, and net income fell 61% to $840 million — even after including almost $550 million in regulatory credits. Excluding those credits, profits would have declined 86% year-over-year. | Despite all of that, the stock rose 2% after the earnings announcement. | The earnings call was decidedly not about electric vehicles. Musk mentioned Optimus 28 times on the earnings call and said they will start using Tesla production facilities to build Optimus robots. He also announced that Tesla is investing $2 billion into his AI company, xAI. | |

|

| | | | Meta's earnings showed that it's better to be in the business of leveraging AI than in the business of AI. Anyone who's on Instagram understands the power of AI because you keep getting served more and more relevant content, which increases ad clicks and time spent on site. Time spent on Instagram Reels increased 30% globally last quarter. That's remarkable. | It's better to draft off of the AI wars than to be on the front lines. | Tesla's earnings, on the other hand, were about anything other than their core business. Talk about weapons of mass distraction – on the earnings call, Musk updated investors on Tesla's new mission, which is "to build a world of amazing abundance." I would translate that into an abundance of ketamine before the earnings call. | Automotive revenues declined 10% year over year, and Tesla, which used to have some of the highest margins in the auto industry, now has pre-tax profit margins that are about 6%, less than half of Toyota's. | Make this make sense: Tesla trades at 400x earnings while Toyota, the best-managed automotive company in the world, trades at 10x earnings. |

| |

| | |

| | | | The biggest issue with Microsoft's earnings was their remaining performance obligations. That is how much revenue they have in the pipeline. It grew dramatically to $625 billion, which sounds like great news. But here's the catch: 45% of that backlog is attributable to OpenAI. | And where is OpenAI's money even coming from? It's not coming from profits, it's coming from Microsoft. It's all just a circular transaction. | Apple's earnings were solid but unremarkable. The 16% revenue growth is impressive, but I don't think it's a testament to the product itself. An analysis found that only 14% of people are buying iPhones for the new features. | Apple has gotten so entrenched in our society that the iPhone just sells itself. But in the long term, I don't think what they're doing is very exciting. Apple is becoming more and more of a legacy tech company. | |

| |

| | |

| | ____________sponsored content ____________ |

|

| Anyone Can Find You Online. Fix That. | Truth is, with just a simple Google search, anyone can find out where you live. Whether it's a stalker or scammer, or even selling your data, your personal info is out there, and that's just scary. Every day, more of your information is collected, shared, and exposed without your knowledge. | But there's a way to fight back: Incogni. It doesn't just remove your name from Google results. Incogni works quietly in the background to wipe your personal data from people-search sites, data brokers, and hidden databases you may not even know exist. | Here's what people have to say about Incogni: "Great website saved me a lot of time compared to doing this by myself. I could not believe the amount of stuff that is out there!" — Joe | Your personal data is being collected and sold every time you go online. Take action now to protect your privacy. | Get 55% off Incogni using code PROFG |

|

| ____________sponsored content ____________ |

|

| | Who is Kevin Warsh, Trump's Pick for Fed | President Trump has nominated Kevin Warsh to be the next Federal Reserve Chair. If confirmed by the Senate, Warsh would replace Jerome Powell in May. Major indexes fell slightly on the news, the dollar climbed, and long-term bond yields rose. | Warsh is considered a relatively safe pick. Canadian Prime Minister Mark Carney called him a "fantastic choice." | Warsh is no stranger to the Fed. After working at Morgan Stanley in the M&A division for seven years, he served as a member of the Federal Reserve Board of Governors from 2006 to 2011. | He is best known for the role he played in the response to the financial crisis. In 2008, when the markets crashed, Warsh was considered the "liaison" with Wall Street, acting as a bridge between the Federal Reserve and the banks. According to most reports, he did that job quite well. | Ideologically, Warsh is considered hawkish, suggesting he favors higher interest rates to contain inflation. He has criticized the Fed for policies that he believes enable excessive deficit spending. | Politically and socially, Warsh is closely aligned with elite business circles and has been supportive of Trump's economic agenda. His wife, Jane Lauder, is the Estée Lauder heiress, and her father, Ronald Lauder, is a billionaire who went to school with Donald Trump, backed his 2016 run for president, and is credited with putting the Greenland idea on Trump's radar. |

|

| | | | The markets are doing a collective exhale right now. The fear was that Trump was going to put some sycophant in, and the person was immediately going to cut interest rates to 1% and ignite a death spiral of inflation. |

| |

| | |

| | | | Trump posted on Truth Social that Warsh is straight from "'central casting,' and he will never let you down." | I thought that quote was hilarious. It's possible that he meant that he has the right resume, but I think it's more likely he meant that the guy's good looking and tall. |

| |

| | |

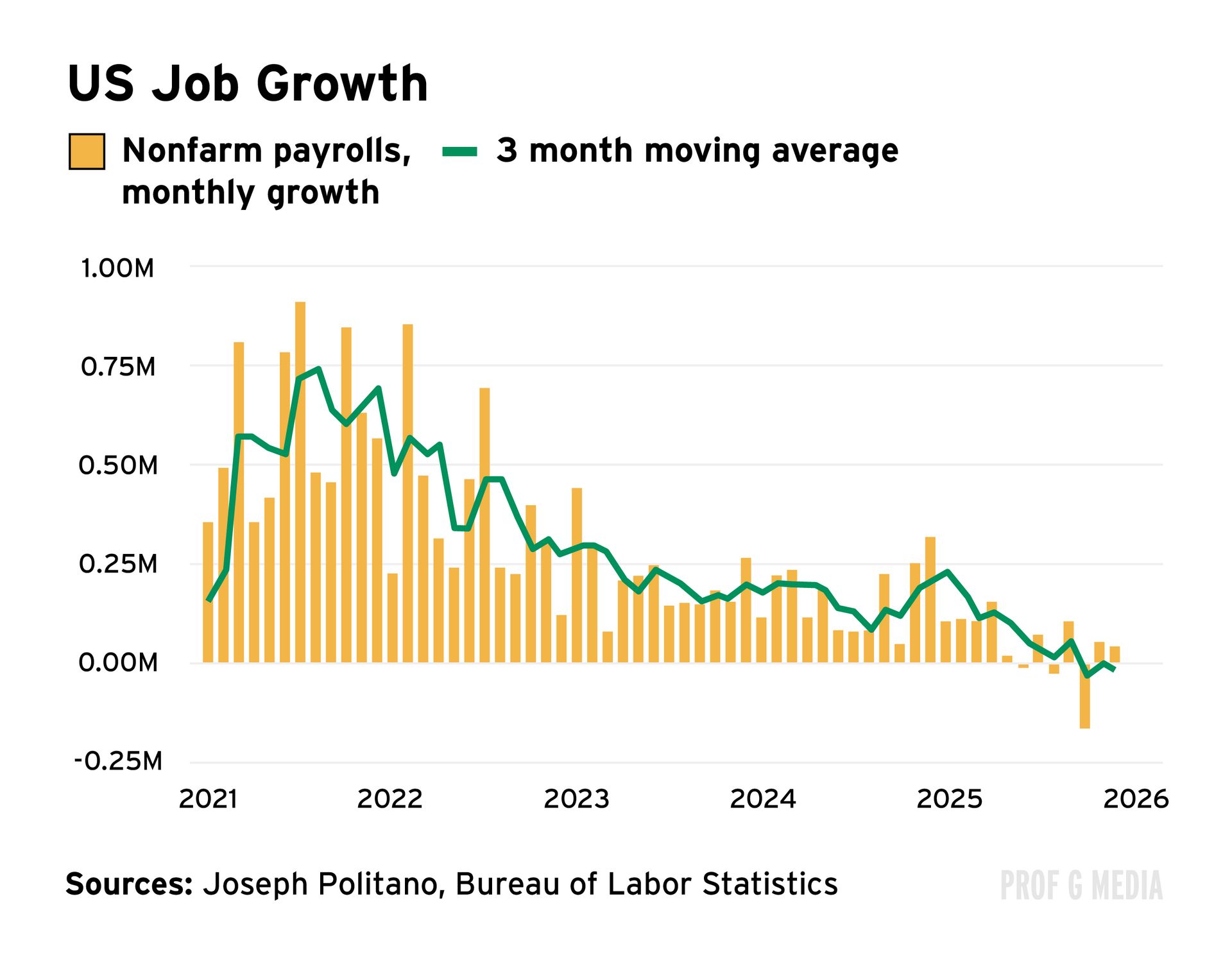

| Newsletter Exclusive: What's Behind the "No Hire, No Fire" Job Market? | Corporate America is pulling back on hiring. Just last week, three major companies announced layoffs: Amazon said it will cut about 16,000 corporate roles, UPS plans to eliminate up to 30,000 jobs this year, and Pinterest is laying off roughly 700 employees, about 15% of its workforce. | These layoffs are happening against the backdrop of an already cooling labor market. Last year was the worst year for job creation since 2009 (excluding 2020). | | Many companies are actively citing AI in their layoff announcements. But is AI the real cause of layoffs, or just a good buzzword? The mainstream media continues to report conflicting narratives: | | Whether it's the uncertain economic environment, AI, or old-fashioned cost cutting, what is clear is that entry-level workers are being hit the hardest. Postings for entry-level jobs in the U.S. overall have declined about 35% since January 2023, and one survey found that 66% of global enterprises expect to slow entry-level hiring. | Those numbers point to a simple conclusion: Policymakers need to do real scenario planning, preparing now for near-term labor shocks. Proposed solutions include expanding tax credits for reskilling workers, and building paid, apprenticeship-style pipelines, like Brookings' Molly Kinder's "medical residency" model.. Others suggest a broad corporate tax that would support retraining programs. More-ambitious options include piloting four-day workweeks and exploring universal basic income. |

|

| | | | When the CEO of an AI company says my technology is so tectonic that it's going to destroy 50% of jobs, that's them saying my company should be worth a trillion dollars. When Sam Altman says he's worried about the future, what he's saying is I'm your new god reshaping the world, and I am worth $850 billion. The catastrophizing from folks in AI is fundraising. | Look at the data: Only 5% of all layoffs last year were attributed to AI. AI is not the great grim reaper of employment yet. Catastrophist headlines get clicks, but the reality is the economy is just slowing down. | Pinterest is trying to position their layoffs as a feature not a bug. I would argue the real answer is AI is enabling Meta to such an extent that advertisers are opting for Meta and TikTok instead of Pinterest. The reason they're laying off people is because of AI, but specifically because their competitors are doing a better job of deploying it. | AI will take and create jobs. Like every major economic shift, it will move workers toward higher-skilled, better-paying information economy jobs. But it's going to happen much more slowly than people think. |

| |

| | |

| | | | The idea that AI isn't taking jobs is completely untrue. | Dow Chemical laid off 4,500 people and said the reason is AI. Pinterest laid off nearly 1,000 people and said the reason is AI. Amazon said they need to be more lean due to the effects of AI, which is pretty much saying this is AI. Companies are telling us outright that AI is taking jobs. | And we're only a couple years into the AI transformation. This is going to play out over five to 10 years. | But what's crazy is the fact that the people in the White House have basically decided that the AI policy of the United States is going to be no AI policy. They've decided that any form of AI regulation is stifling innovation — and that to me is insane. | It's going to be a huge problem, especially if this whole conversation gets hijacked by the false notion that AI isn't having any impact. |

| |

| | |

| | |

Economic strikes are about to become a static part of a new era in how citizens push back on governments.

| The greatest act of radical transformation in a capitalist economy is nonparticipation. If you like what I'm saying, don't like and subscribe. Resist and unsubscribe. |

| | |

| | On the latest episode of First Time Founders, Ed speaks with Chris Best, co-founder and CEO of Substack. They discuss how the company stood out against competitors, why video has become increasingly important to its audience, and where the media industry is headed next. |

| | |

| | | | The economics of a Super Bowl ad Robots are only half as efficient as humans The key to the next generation of museums is... TV?

|

Prof G recommends: The Daily Upside: This fresh, insightful newsletter, created by a team of Wall Street insiders and bankers, delivers deeply valuable insights that go beyond the headlines. The best part? It's completely free.

|

| | |

| | | |

|

No comments:

Post a Comment