Stocks finish flat after blockbuster jobs report |

The S&P 500 finished flat, the Nasdaq 100 rose, while the Russell 2000 fell after this morning's blockbuster January jobs report. Employers added 130,000 jobs last month, crushing estimates for 65,000. Prediction market odds that the Fed will maintain interest rates in its March meeting rose on the robust employment data. (Event contracts are offered through Robinhood Derivatives, LLC — probabilities referenced or sourced from KalshiEx LLC or ForecastEx LLC.) Bitcoin dipped below $67,000 this morning, but the jobs report lifted its price back above that level. Stocks that moved higher: |

- Micron climbed as its CFO said that the company has started HBM4 shipments ahead of schedule.

- Teradata soared after posting Q4 sales and earnings beats and better than expected earnings guidance.

- Cloudflare jumped as the company forecast strong sales.

- Vertiv Holdings soared after its Q4 earnings beat expectations and its 2026 earnings and sales outlooks exceeded every analyst's estimates.

- Electric aircraft maker Beta Technologies surged as Amazon disclosed a 5.3% stake and Jefferies upgraded stock to "buy."

- Gilead rose after quarterly earnings and revenue beat Wall Street estimates, driven by sales of its HIV drugs.

- Ford ticked higher after posting a Q4 revenue beat after the bell yesterday, but the automaker missed on earnings.

- Cryptocurrency Uniswap surged as BlackRock bought tokens.

|

- The software stock slump resumed as Dassault Systèmes and Unity Software cratered after issuing weak guidance, with Atlassian, Adobe, Oracle, ServiceNow, GitLab, Salesforce, and AppLovin falling as well.

- Lyft plunged on an unexpected 2025 operating loss and disappointing Q1 outlook.

- Zillow tanked after its Q4 earnings missed expectations and it flagged margin pressure in 2026.

- Mattel sold off as it missed Q4 profit estimates and issued disappointing guidance.

- Humana fell after its full-year profit guidance trailed estimates, citing a financial drag from Medicare Advantage plans.

- Moderna slumped after the FDA declined to review its mRNA flu shot.

- Astera Labs plummeted despite posting better than expected Q4 results and Q1 outlook. The company also struck a warrant deal with Amazon, which will pressure gross margins.

- Robinhood tumbled after a Q4 sales miss, while analysts gave mixed reviews of the company's results. (Robinhood Markets Inc. is the parent company of Sherwood Media, an independently operated media company subject to certain legal and regulatory restrictions.)

- Shopify sank despite beating Q4 revenue estimates.

|

|

|

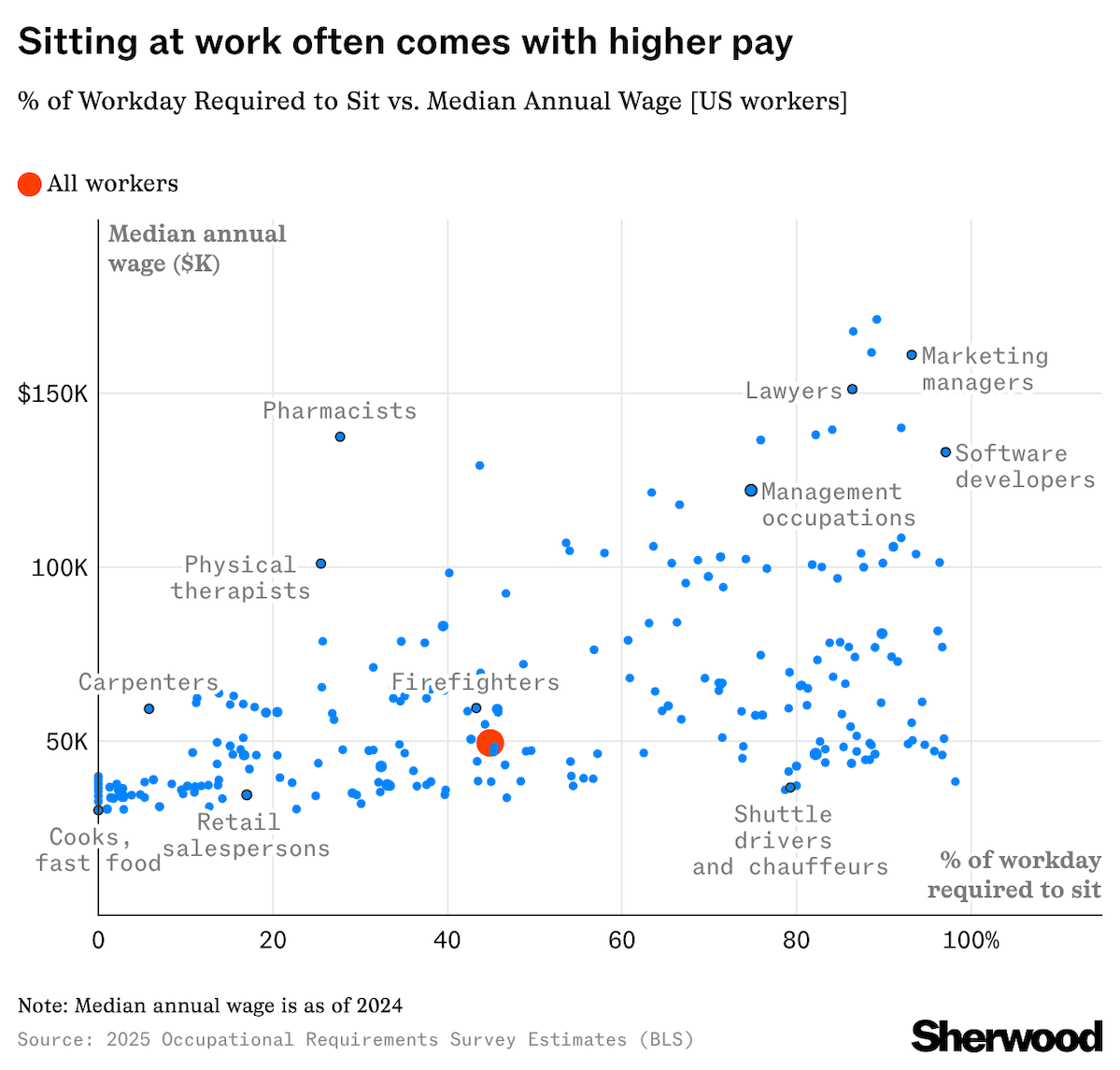

Software developers sit nearly all day and make six figures. Fast-food workers are on their feet almost nonstop, and earn about $30,000 a year. Read more. |

|

|

Sprawling gigawatt data center campuses are all the rage. But the next move in AI's expansion is stuffing data centers into urban buildings to get them closer to the action. Read more. |

|

|

Meta announced today that it broke ground on a new, giant AI data center: This one is located in Indiana, has 1GW of capacity, and will cost more than $10 billion. Read more. |

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to The Wrap and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and Snacks for quality reads. We care what you think! If you have any feedback or comments, feel free to reply and let us know your thoughts! |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment