Welcome to our Futures Special Edition. Whether you're familiar with derivatives or just starting your investing journey with futures, our explainers, coverage, and accessible breakdowns of the futures market aim to be an essential resource for traders at any stage. The 45-story Chicago Board of Trade, home of US futures trading, was the tallest building in the city when it was completed in 1930. Atop the building is an Art Deco statue of Ceres, the Roman goddess of agriculture. The statue's sculptor, John Bradley Storrs, reportedly did not bother to sculpt the statue's face because he couldn't imagine another building being tall enough for anyone to see it. On Friday, stocks got an initial bounce after January core CPI inflation didn't have any grim surprises, but the rally fizzled out in late afternoon trading. The S&P 500, Nasdaq 100, and Russell 2000 all posted weekly losses. 🧠 Test your knowledge of futures with our Futures Fun Facts quiz. |

|

|

As anxiety over the AI trade increases and volatility in crypto spikes, traders who have a long-term bullish outlook on their holdings but have near-term concerns about downswings can use futures to manage risk. As their holdings lose value, a short futures contract would gain in value, offsetting some of their losses. Because of the leverage futures offer, a relatively small initial margin requirement can hedge a large portfolio, though regardless of the size of the position you want to hedge, a variety of contract sizes are available. |

- Long-term investors looking to protect their retirement portfolio holistically could use S&P 500 Index futures to hedge against downside risk.

- If, however, you're specifically concerned about AI risk or a downturn in the Magnificent 7, given that roughly 70% of the Nasdaq 100 consists of either a Mag 7 or tech stock, selling Nasdaq 100 futures contracts could offer a broad hedge against a potential AI downswing.

- For traders with a large concentration of crypto, cryptocurrency futures are also available for a wide variety of coins, including bitcoin, ethereum, XRP, solana, cardano, lumens, and chainlink.

|

This summer, CME Group plans to launch Single Stock futures on more than 50 of the top US stocks, which will allow traders to further tailor their hedge for a large exposure in Nvidia, Alphabet, Meta, and more. |

|

|

While the primary purpose of hedging is to offset risk, hedging itself isn't entirely without risk. There's always a possibility that your position will move to the upside, in which case, the loss on your short position will eat into the gains on your long position. For this reason, traders might choose to hedge only a portion of their portfolio. Ultimately, hedging functions a lot like insurance: while you hope you never have to use it, during an unfortunate event, you're very glad to have it. |

|

|

Futures let you take your trades further |

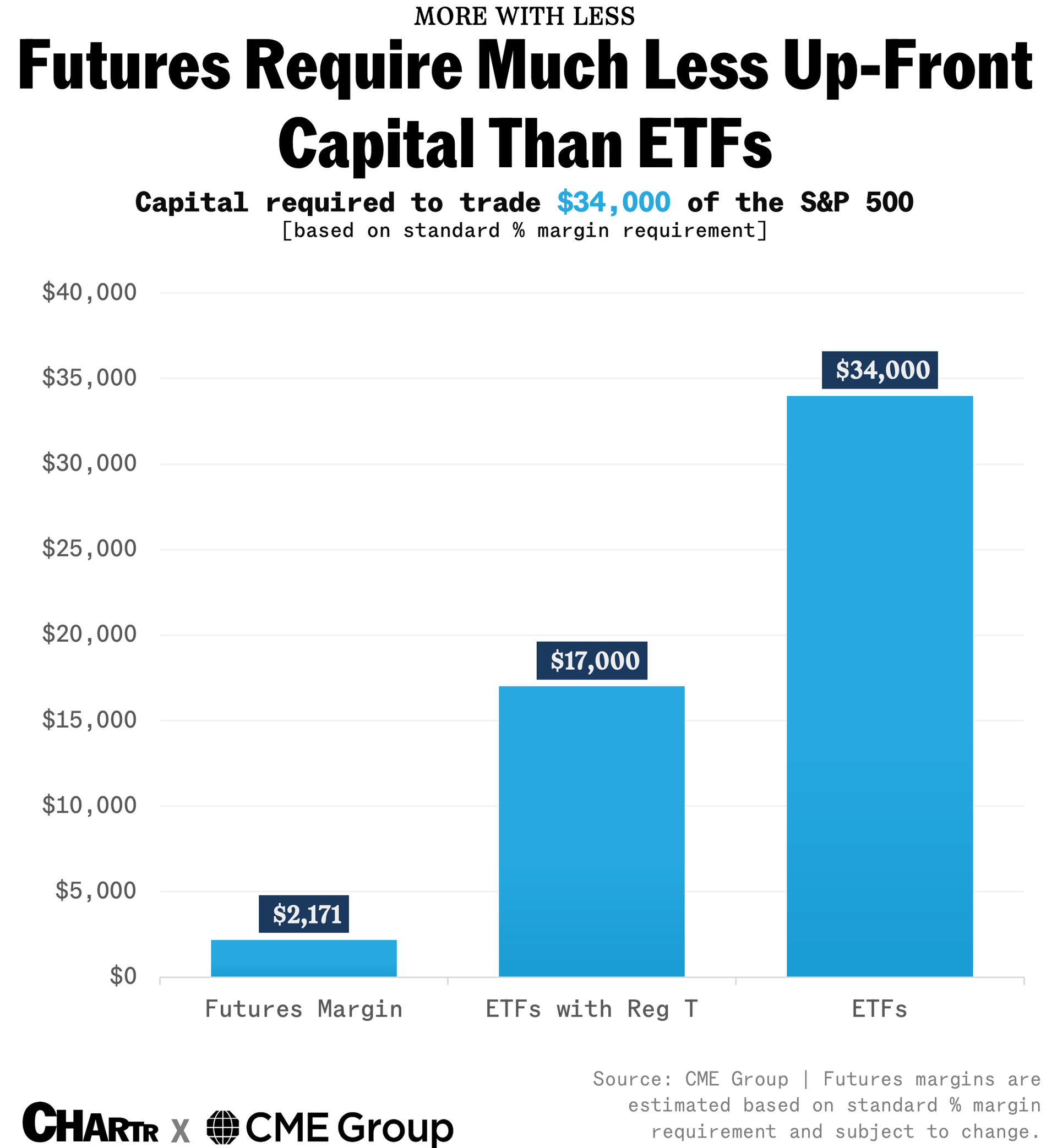

Actively trading the S&P 500? Futures offer unique capital efficiencies that give traders the opportunity to enter positions with 5-10% of the position size.1 |

Unlike ETFs, futures give you the opportunity to go short as easily as you go long,2 without the restrictions of locate requirements and borrow costs. For traders looking to learn about futures and practice in a risk-free environment, CME Group is hosting a trading challenge from March 8 to March 13. Throughout the challenge, professional traders will host live education sessions and talk through best practices and market movements that have been taking place during the competition. Discover CME Group's March Trading Challenge and register here. 1 Margin comes with increased risks. Losses as well as gains will be magnified with the greater amount borrowed. 2 Shorting increases the risk of investing. With short sales, the potential for loss is unlimited. |

|

|

Stories we're obsessed with |

|

|

Long before you could use a "buy now, pay later" option to DoorDash some McDonald's, financial innovation played a key role in delivering the Chicken McNugget. If you ask McDonald's, it will tell you its McNugget is a scrumptious morsel of chicken, water, vegetable oil, enriched flour, and a host of other ingredients available quickly for relatively cheap. But if you ask investor and entrepreneur Ray Dalio to zoom in on the main ingredient, he'd have a different answer. |

|

|

Don't miss out on the powerful benefits of futures trading |

- Trade around the clock: Unlike stocks and ETFs, you can trade futures nearly 24 hours a day.

- Find the right fit: With multiple contract sizes, futures can be cost-efficient for different portfolio sizes.

- Stretch your capital: With a lower margin requirement, equity futures offer more margin savings compared to stocks and ETFs.3

|

Learn more. 3 Margin comes with increased risks. Losses as well as gains will be magnified with the greater amount borrowed. |

|

|

- Tuesday: Earnings expected from Medtronic, Constellation Energy, and Palo Alto Networks

- Wednesday: Fed meeting minutes. Earnings expected from Analog Devices, Booking Holdings, Carvana, DoorDash, Occidental Petroleum, eBay, and Figma

- Thursday: Earnings expected from Walmart, Wayfair, Klarna, Opendoor, Alibaba, John Deere, Southern, and Newmont

- Friday: December PCE, the Fed's preferred inflation gauge. Earnings expected from AngloGold Ashanti

|

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to Snacks and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and The Wrap for quality reads. | |

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment