Hi! Brussels vs. brain rot: In a preliminary investigation published today, the European Commission found that TikTok's "addictive design" breaches EU law, citing features like the platform's "highly personalised recommender system." Today we're exploring: |

- Stipend zone: Just how much would a Super Bowl ticket set the average person back?

- Google bucks: Like most other big tech companies, Alphabet's capex keeps expanding.

- AI washing: Companies are blaming AI for layoffs, but the job data shows little disruption.

|

What does it take to get to the Super Bowl? Well, either you're playing, or it'll cost about four months' rent |

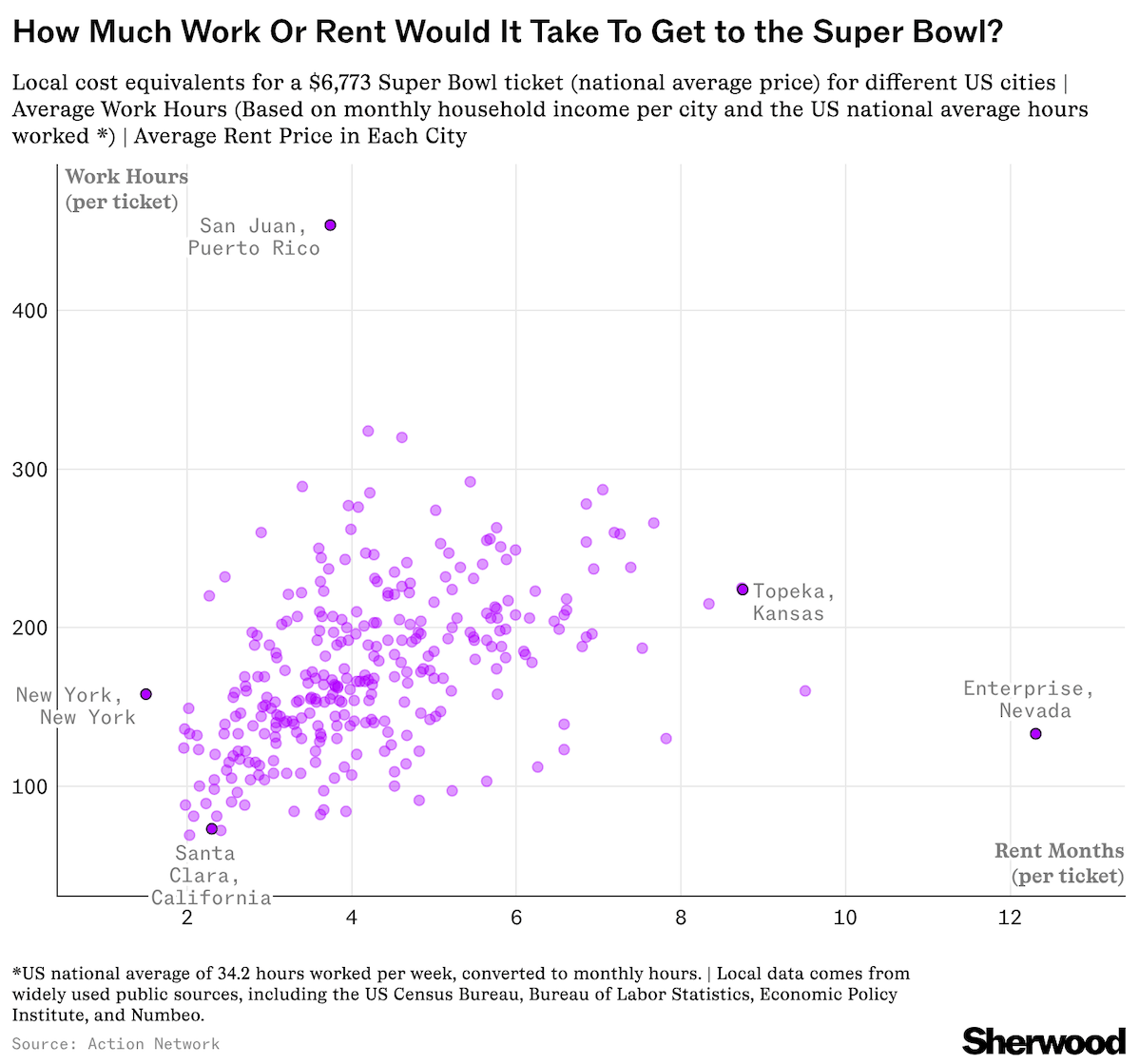

It's not long now until the Big Game, leaving fans with only a couple of days to make their picks and predictions, learn Spanish slang, or get a few bucks together for a last-minute trip to Santa Clara's Levi's Stadium. Or, more specifically, at least $6,773 — the national average price for a ticket to Super Bowl LX, as calculated by Action Network from entry-level listings across marketplaces including Ticketmaster and StubHub. Breaking that number down, Action developed the Super Bowl Ticket Burden Index to work out the financial impact of getting a ticket for the average person in different US cities, based on factors like monthly household income, local rent, utilities, and grocery prices. |

The analysis found that Americans would have to work about 174 hours on average to earn the cash for a Super Bowl ticket — though you'd have to work more than double this if you were in San Juan (454 hours). While high rent prices in the Puerto Rican city make the ticket's cost equivalent to 3.7 months of rent, you'd at least be very close to where halftime performer Bad Bunny grew up. Those already in California's Bay Area would not only have the least distance to travel to get to this year's Super Bowl, but they'd also have to put in the least amount of working hours to get inside the arena, with Santa Clara residents needing to labor for only 73 hours (roughly nine working days) to afford a dream ticket — about 2.3 months' worth of rent. All told, Action Network found that Topeka, Kansas had the highest financial burden to match the ticket price across the six measures analyzed. Go deeper: For coverage around the game itself, subscribe to Sherwood's sports-focused Scoreboard newsletter. |

Alphabet could buy some pretty huge businesses with the amount of money it plans to spend this year |

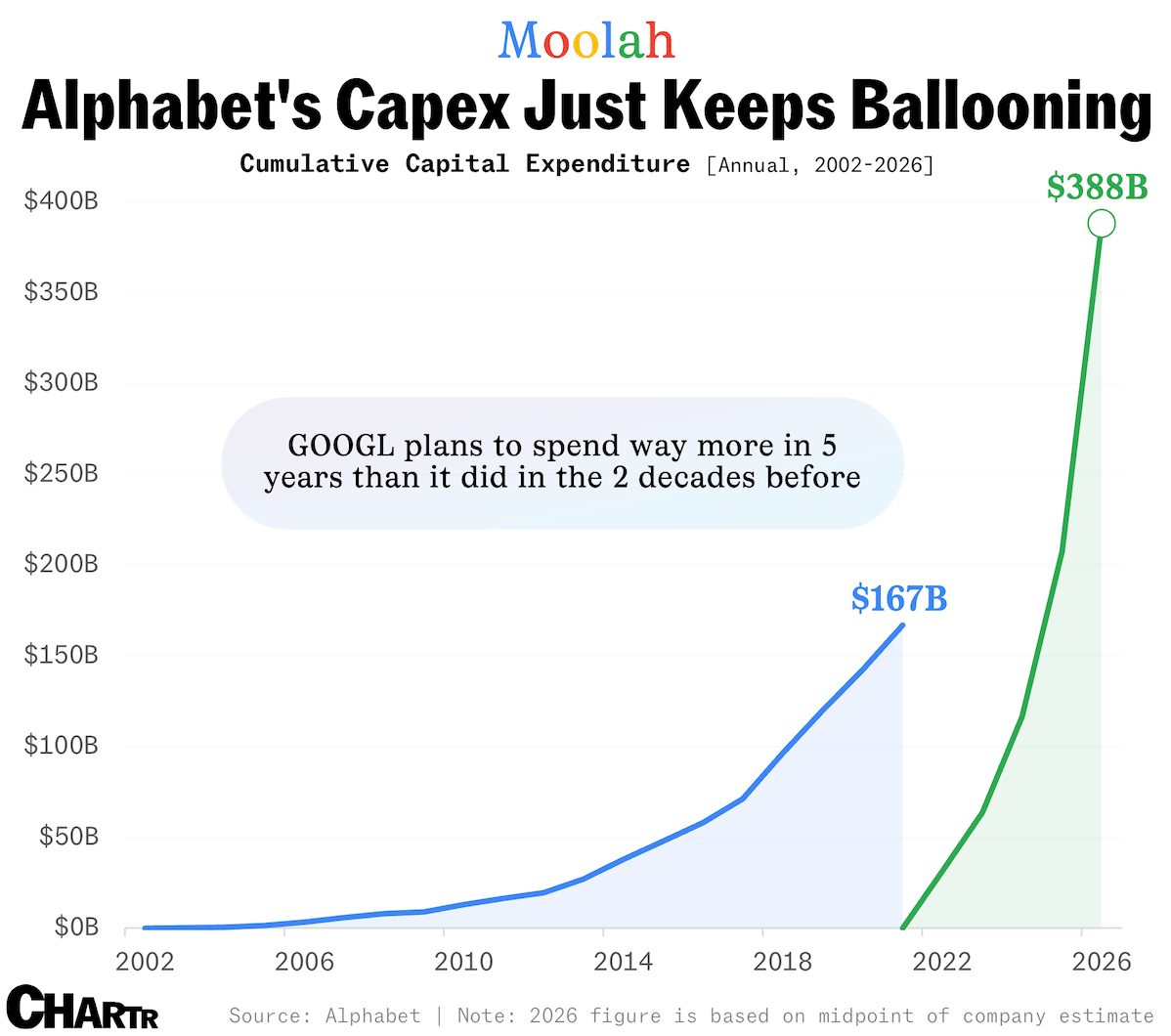

Hey 𝙶̶𝚘̶𝚘̶𝚐̶𝚕̶𝚎̶ big spender! As part of Wednesday's Q4 report, where revenues rose across every division and earnings and sales beat expectations, Alphabet announced that it expects capital expenditure to hit between $175 billion and $185 billion for FY26 — roughly double last year's figure and ~$70 billion more than analysts had forecast. This latest estimate is, unquestionably, a hell of a lot of money. In recent years, however, as Alphabet and its big tech peers (Apple excluded) have doubled down — and doubled down again — on AI ambitions, soaring capex figures have become a standard fixture in GOOGL earnings reports. |

Collectively, the four biggest hyperscalers are expected to spend $600 billion on capex in 2026, up 50% from last year, with Amazon yesterday revealing it's on track to spend the most, at some $200 billion. Still, Alphabet's $180-ish billion estimate perhaps feels more shocking because the company's core product, Google Search, has been so unbelievably capital light previously. Indeed, the sum would take Alphabet's capex bill to almost $390 billion since 2022; it had spent less than half of that across the 20 years prior. For context, with the amount that the company could spend on compute capacity for DeepMind and "strategic investment in other bets" this year, it could buy: |

- A company like Uber, with a market cap of $157 billion, which would leave Alphabet with a decent chunk of change... and maybe an even stronger position in the self-driving car game.

- Almost 80% of the teams in the NFL, after the average value across the 32 franchises was pegged at $7.1 billion last year.

- A Brian Niccol coffee-and-burrito combo, given Starbucks' market cap at the moment sits around $110 billion, while Niccol's former company Chipotle is worth ~$51 billion.

- About 900 new White House ballrooms.

|

|

|

AI is becoming a go-to reason for layoffs — but is it actually replacing workers? |

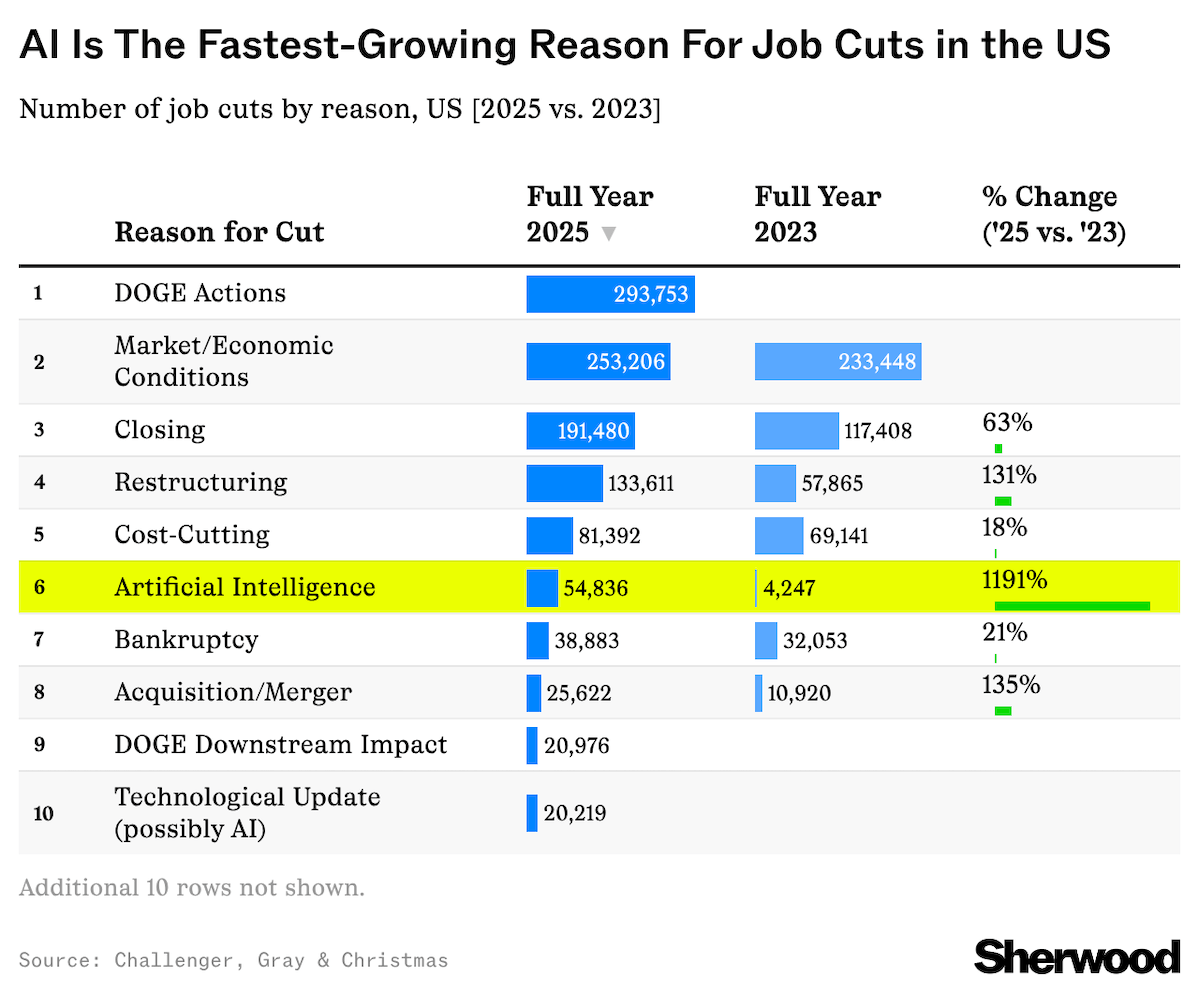

The US labor market is in an interesting place. On one hand, unemployment remains pretty low, but on the other, corporate America is clearly still unwinding some of its pandemic-era hiring binge, with data out yesterday showing that layoffs in January were at the their highest for that month since 2009. And some of those job cuts are being blamed on AI. Just last week, Pinterest said it would trim ~15% of its workforce, with CEO Bill Ready telling staff he was "doubling down on an AI-forward approach." Dow Chemical announced plans to cut about 4,500 jobs while leaning into "AI and automation." Amazon also just slashed 16,000 jobs, continuing cuts from last year alongside tech giants like Microsoft and Meta — all of which have linked job cuts to AI-driven efficiency gains. According to Challenger, Gray & Christmas, nearly 55,000 US job cuts were attributed to AI in 2025. That's roughly a 13-fold increase from two years earlier, when the category was first tracked. |

However, a growing body of research is questioning whether jobs are actually being lost to AI — or whether employers are simply "AI-washing," using the investor-friendly buzzword to explain downsizing decisions. In a January report, Oxford Economics suggested that the role of AI in recent layoffs may be "overstated," noting that productivity growth hasn't accelerated in a way that's consistent with widespread labor replacement. Attributing job cuts to AI, they added, "conveys a more positive message to investors" than citing weak demand or overhiring. Meanwhile, Yale Budget Lab found that employment patterns look largely unchanged from pre-AI trends. So, why is AI looming so large in layoff narratives today, even as its macro impact remains harder to spot? One possibility is that companies are downsizing for what AI might deliver in the future, not what it already can, according to new survey data. |

|

|

- New chapter: Spotify is partnering with Bookshop.org to allow users to buy physical books via its app, with the streamer pointing out that print copies accounted for 73% of trade publishing revenues last year.

- A new report suggests the Big Game could also be a big issue for drivers on Sunday, with speeding and distracted driving spiking 16% and 13%, respectively, in the run up to the Super Bowl.

- Gemini rising: Alphabet's chatbot is growing faster than ChatGPT — up 19% month-on-month versus 4% — but its 2.1 billion January web visits were still less than 50% of the GPT tally.

- With crypto continuing to slide, the total unrealized losses of 22 digital asset treasury firms currently add up to more than $19 billion, per blockchain analytics firm Artemis this week.

- Dave & Buster's are putting $15,000 diamond engagement rings inside their viral "Human Crane" machines for Valentine's Day… and they say romance is dead.

|

|

|

- Slick figures: This Reuters visual unpacks the weighty issues behind Venezuela's oil reserves.

- Rest of World explores why micro EV sales are sputtering around the globe.

|

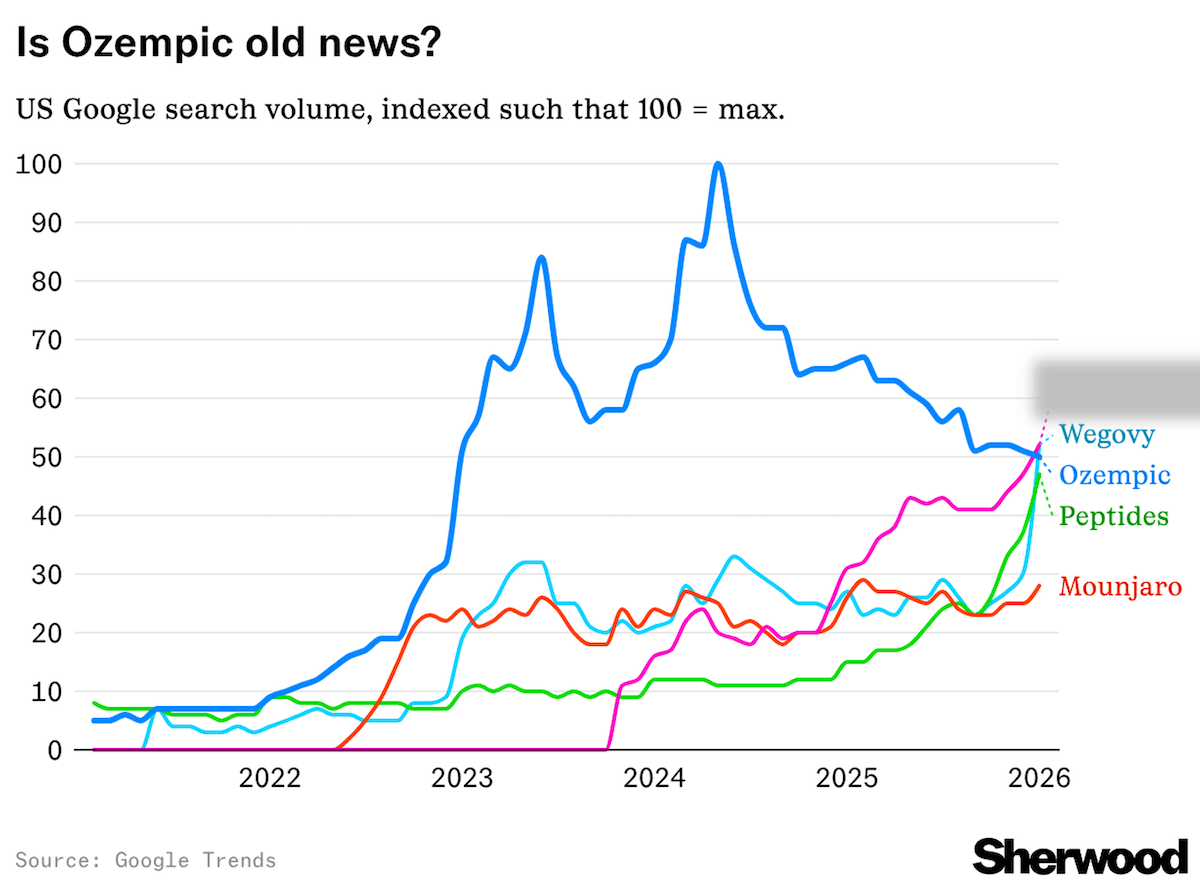

Off the charts: As of last month, Ozempic is no longer the most Googled GLP-1 in the US — but which drug looks to be racing furthest ahead into February? [Answer below]. |

Not a subscriber? Sign up for free below. |

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment