Hi! This body holding me reminds me of my mortality… Probably a lyric Alex Honnold could relate to as he listened to his "mostly Tool" playlist while free soloing the 1,667-foot Taipei 101 on Sunday — a nerve-racking 1 hour 35 minute journey livestreamed by Netflix. Today we're exploring: |

- Virtual assistance: AI is an everyday workplace aid for a growing number of Americans.

- Hit the books: Barnes & Noble's owner is considering taking the chain public.

- No spend January: More of us are starting the year by cutting back.

|

Have feedback for us? Just hit reply - we'd love to hear from you! |

12% of American workers use artificial intelligence in their roles every day |

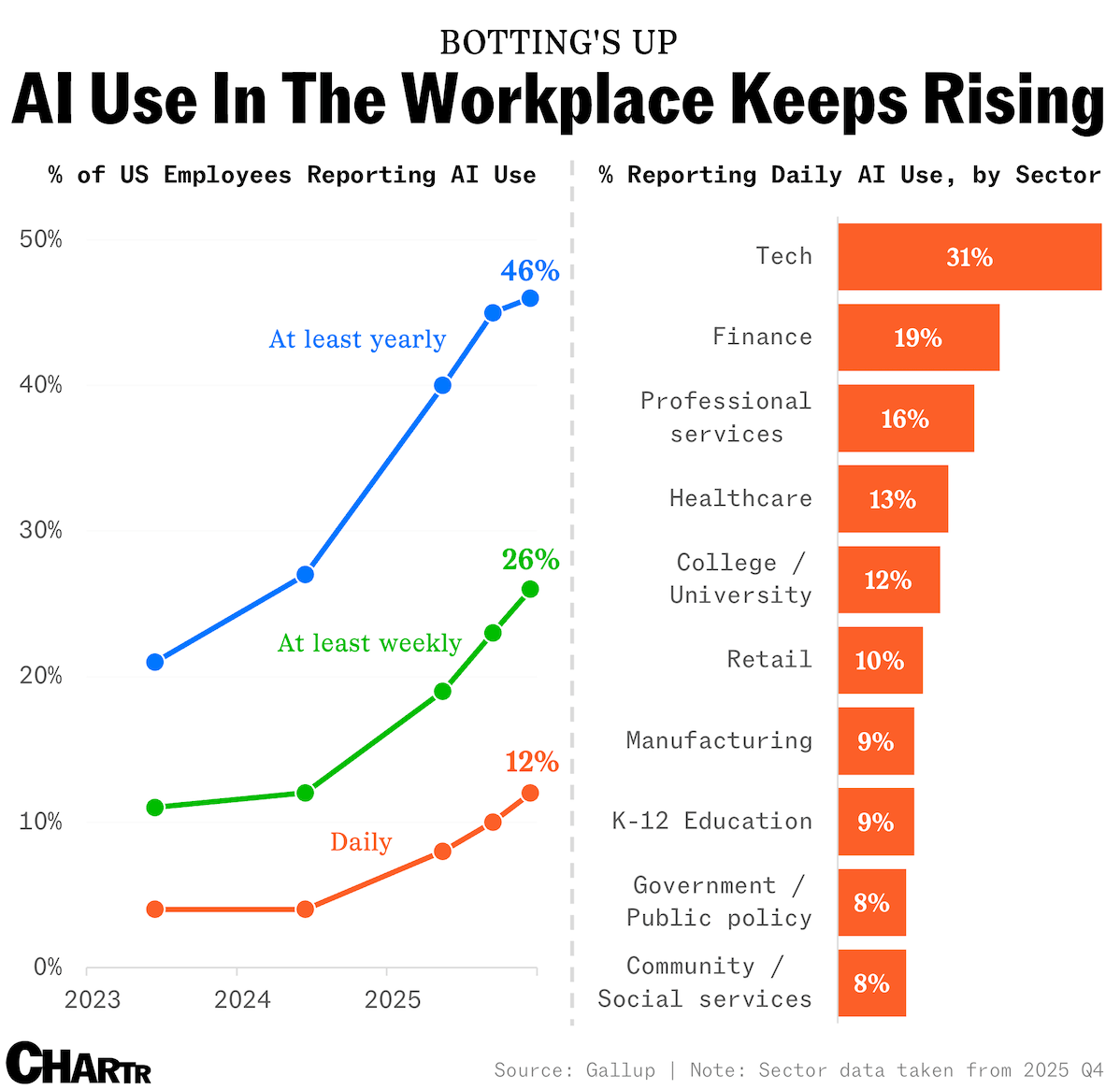

When Anthropic this month announced Claude Cowork, an AI agent designed to help the everyman's working day run a little smoother, it certainly caused a splash, sinking software stocks and scaring the life out of startup founders around the world. Per a new Gallup survey, however, the American workforce has already been getting more hands-on with the tech, even BC (Before Cowork). According to the findings published yesterday, AI use in the workplace continued to rise in the last quarter of 2025, with the share of daily, frequent, and total users all growing in Q4. Indeed, in only about 2.5 years, the percentage of US employees who use the tech every day in their professional lives has tripled, while the share of those using it at least "a few times a week" or at least "a few times a year" have both more than doubled as well, per Gallup's latest data. Still, whether the rise (and rise again) of the machines that help people to get their jobs done comes as any big shock to you likely depends on your office, your company, or even the industry that you work in. |

As of Q4 2025, the share of workers who say they use the tech every day has risen to 12% across the board, up from 4% in the second quarter of 2023. That figure varies quite wildly in certain industries, though, with almost a third of tech workers reporting daily usage, compared to just 8% of government and public policy employees and community and social services workers who say the same. Meanwhile, some 49% of the US workforce reported "never" using AI in their role, in yet another clear sign that the tech's boom has just passed certain professions by entirely — perhaps gladly, too, for many workers in those sectors, with some blue-collar industries seeing a "renaissance" in the AI age. |

Bolstered bookseller Barnes & Noble is planning a major expansion and potential IPO |

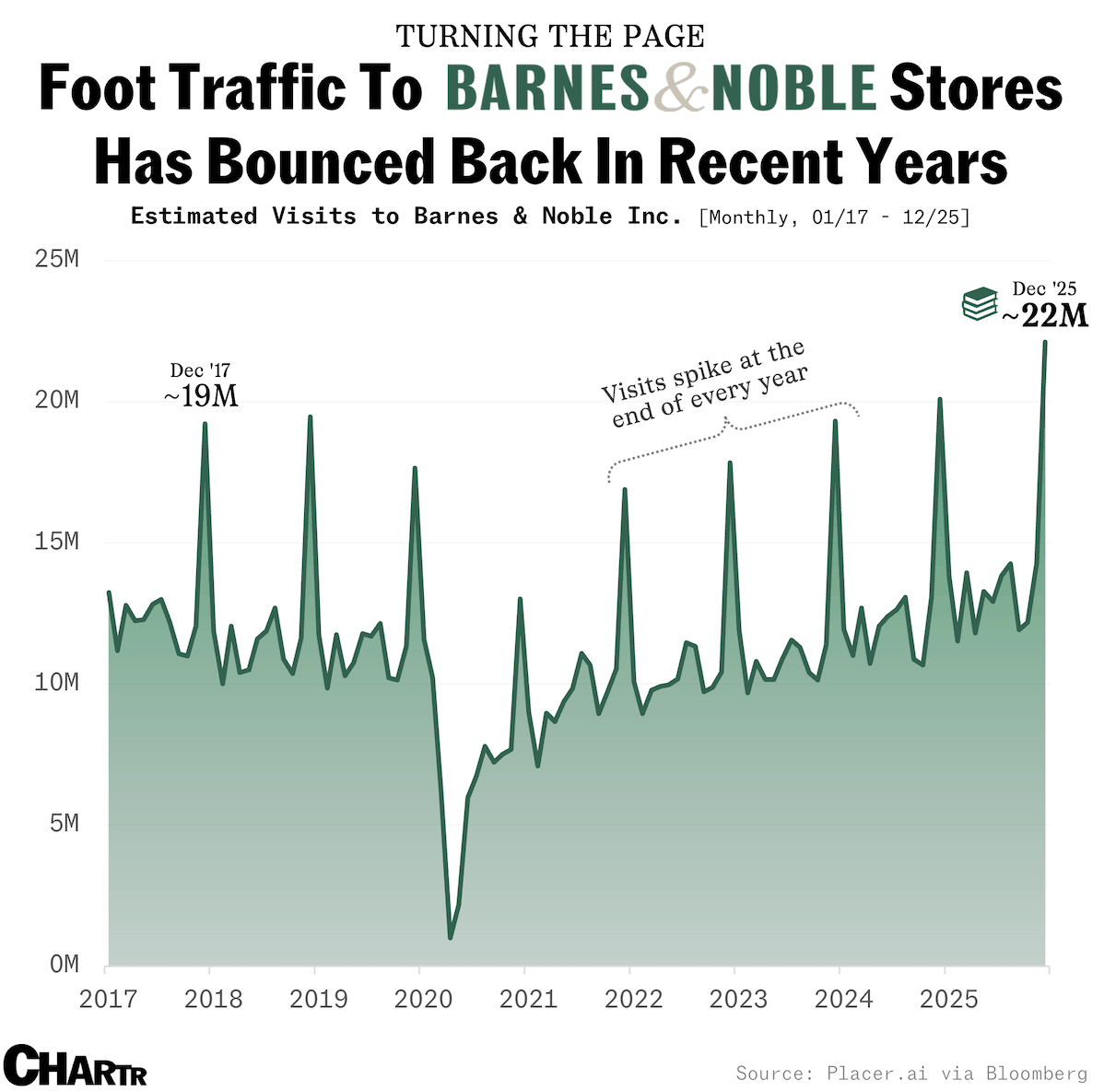

Given the rise of social media use, dwindling news engagement, and literacy rates becoming more worser, a physical bookseller might be one of the last companies you'd expect to be a buzzy candidate for a potential IPO. But among the most remarkable revivals in recent years has been Barnes & Noble — the traditional US-born bookstore chain dating back to 1873, which appeared to have all but ceded victory to Amazon's relentless online book business by the end of the 2010s. |

As reported by Forbes last month, B&N had lost over $1 billion in market value in the five years to 2019, at the same time that Amazon grew to capture a roughly 50% market share of the bookselling sector. Indeed, the brick-and-mortar book chain posted a loss of $125.5 million in FY2018, despite revenues of $3.7 billion across its ~600 stores nationwide. Then, after hedge fund Elliott Management acquired the chain for $683 million in 2019, B&N's fortunes began to change. Headed by a new CEO, the company attempted a return to its indie roots — stripping back offerings like games and toys and giving store owners more autonomy, all while absorbing two other independent local booksellers. |

Looking at Placer.ai data, the company's community-focused efforts, coupled with some help from BookTok, has seen its business boom: visits to stores last December, typically its busiest month, reached a high of 22 million, up 15% from the same period in 2017. Now, the company's planning to turn the latest page in its tumultuous corporate history, as it looks to add 60 new stores in 2026 — while Elliott explores a potential multibillion IPO for B&N and UK chain Waterstones. |

|

|

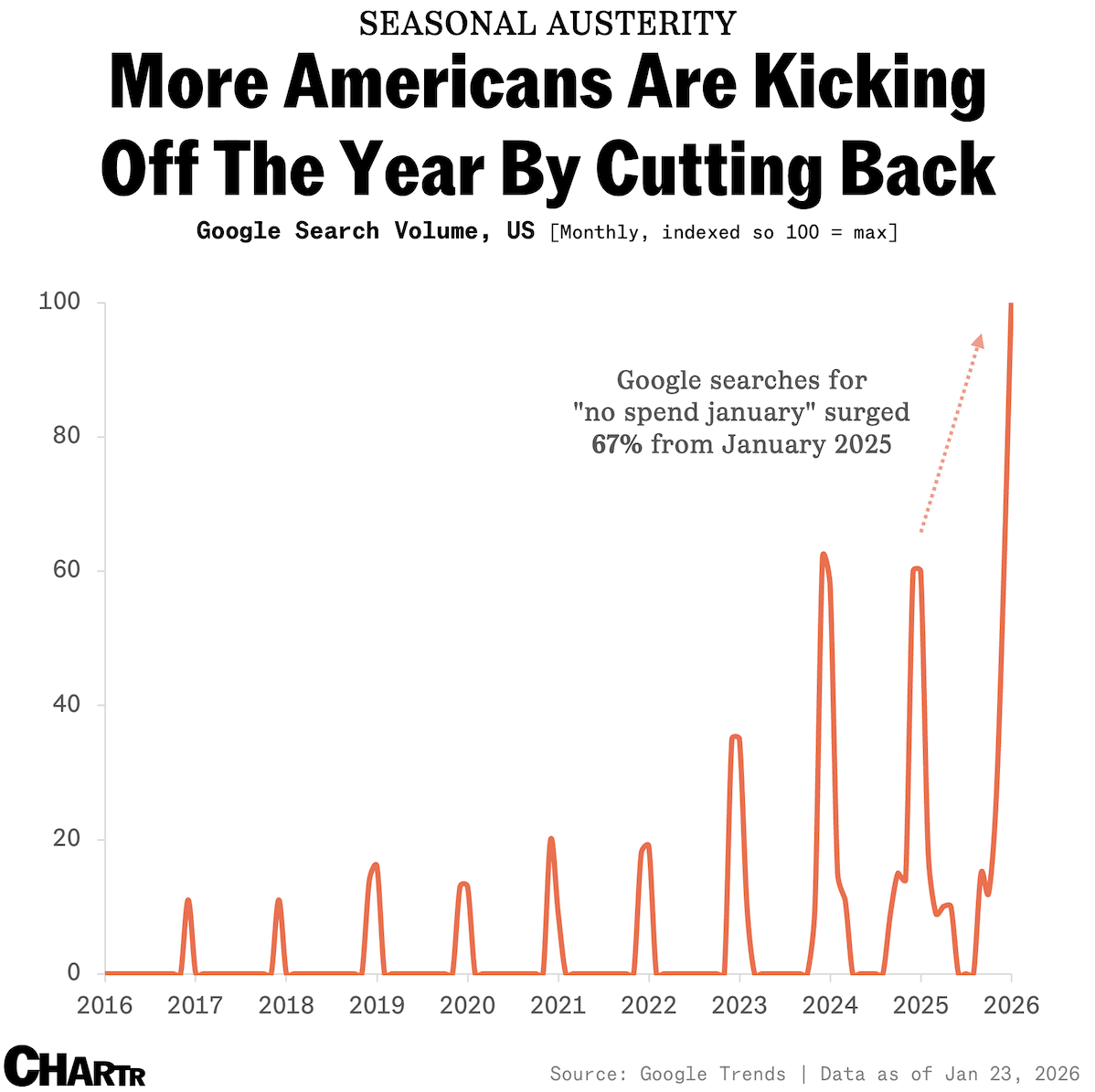

More Americans are trying "No Spend January" as savings rate hits three-year low |

January can be a hard enough month as it is. For many Americans, a new calendar brings with it freezing weather, a return to work from the festive season, and a mental reset. And some people make it even harder by piling on an extra challenge for the month, swearing off things like alcohol, sugar, or meat. This year, that list has a prominent addition: shopping. According to a new survey by NerdWallet, more than a quarter of Americans have tried "No Spend January" at least once, pausing all discretionary spending and limiting purchases to essentials like bills and groceries for 31 days. 12% said they started one in 2026, and 44% of respondents said that "life feels really expensive" right now. |

The thrifty challenge has recently gained traction with Gen Z and millennials on social media. Though not as well known as its alcohol- and meat-free peers, Google search interest for "no spend january" in the US just hit an all-time high, up 67% year on year — growing faster than the 47% increase for "dry january" and the declining search volume for "veganuary." This might be more than just performative frugality. Inflation remains elevated, especially for everyday essentials, while hiring has slowed, leaving more consumers financially squeezed. The personal saving rate fell sharply to a three-year low in November, per last week's data from the Bureau of Economic Analysis, hovering near 2008 and pandemic-era lows. Spending has held up in aggregate, but largely due to wealthier households, while lower- and middle-income consumers are increasingly drawing down savings or leaning more on debt as income growth slows in the so-called K-shaped economy. |

|

|

- My precious: Gold just crossed the $5,100/oz mark for the first time ever, drawing strong retail attention as ETFs tracking gold and silver became the most mentioned tickers on r/wallstreetbets today.

- My not-so-precious: Resale values for luxury items like Birkin bags and Rolex watches are falling, with the former now priced at a 1.5x premium compared to 2.3x in 2021.

- Newsletter platform Substack, which racked up nearly twice as much traffic as the WSJ last month with some 141 million visits, debuted Substack TV on Thursday.

- Over 11,000 flights within, into, or out of the US were canceled due to the winter storm yesterday, in the biggest day for plane disruptions since the pandemic era.

- Days after closing a deal for its US operations, TikTok might be breaking down — Downdetector saw a spike in outage reports on Sunday, with 63% of the issues said to be related to the app itself.

|

|

|

- "I know words, I know the best words," President Trump once said… but which of them has been his favorite to use for posts on Truth Social?

- The Pentagon Pizza Index, a situation-monitoring tool to test the theory that pie orders spike just ahead of major political activity and international crises.

|

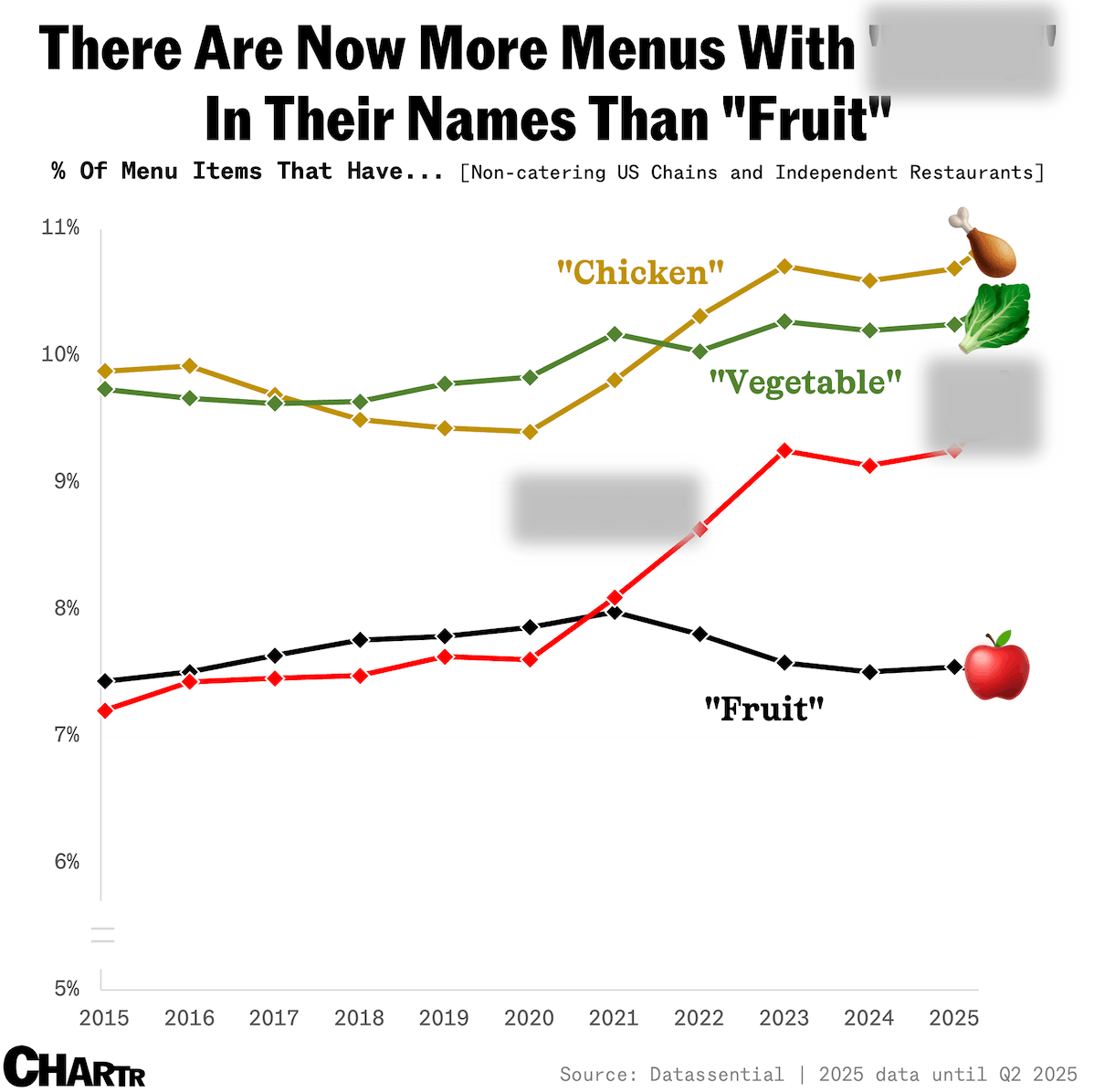

Off the charts: Which food trend has recently gone mainstream in US restaurants, overtaking "fruit" in menu mentions? [Answer below]. |

Not a subscriber? Sign up for free below. |

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment