Dreaming of moving to Europe but not sure if you can afford it? The Economist's European Carrie Bradshaw Index — named after the solo-living protagonist in "Sex and the City" — can help determine where a median wage earner can afford a one-bedroom flat. We mapped 39 European cities, only eight of which passed the affordability test, with Bonn, Germany, being the most affordable and Istanbul, Turkey, the least affordable. See how the other cities stacked up. Stocks wavered on Wednesday as investors awaited the barrage of postmarket earnings from Big Tech (more on that below). The S&P 500 finished flat after briefly crossing the 7,000 milestone for the first time ever. Tech was the best-performing sector ETF, powering the Nasdaq 100 higher, while the Russell 2000 dropped. The Federal Reserve held its policy rate at a range of 3.5% to 3.75% at its January meeting, as expected. |

|

|

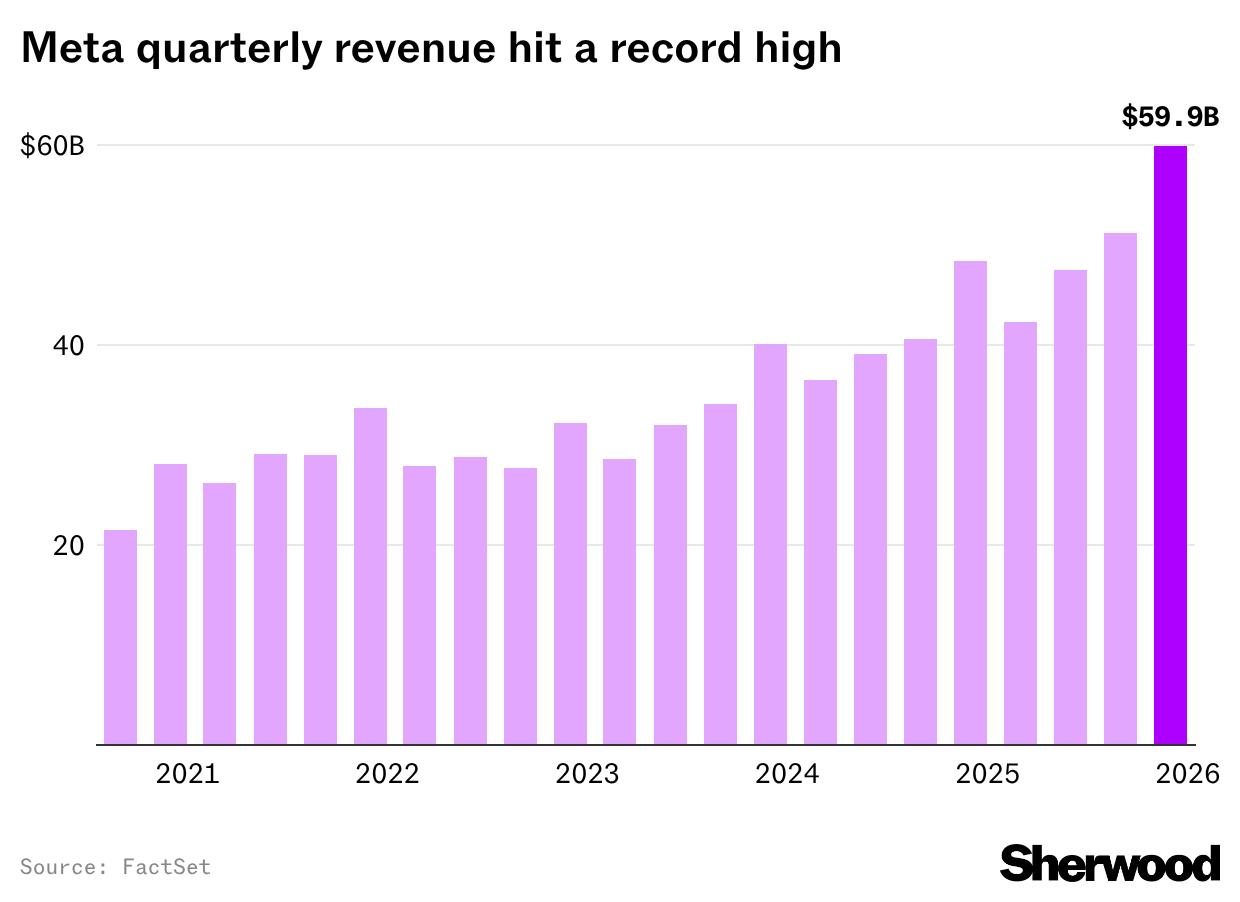

Three stalwart members of the Magnificent 7 reported earnings last night, and while it was beats all around, the market reaction showed that capital expenditure on the AI race is still certainly on investors' minds. First, the numbers: |

But what does it all mean? Well, let's look under the hood here. |

- Over at Microsoft, capital expenditure for the quarter was $37.5 billion, up 66% year on year and ahead of analysts' consensus forecast of $36.6 billion.

- Meta's capex outlook for 2026 is $115 billion to $135 billion, exceeding the $110.6 billion estimate from analysts. Full-year estimated expenses of $162 billion to $169 billion are also much more than the consensus call for $151 billion.

- Tesla's capital expenditures will increase substantially this year, exceeding $20B, well above analysts' expectations of $11B, as the company invests in new factories and AI infrastructure. Tesla also revealed it's invested $2 billion in xAI.

|

|

|

For the first time, Tesla released the number of Full Self-Driving subscriptions, saying it had 1.1 million active subs, up from 0.8 million in the same quarter last year. That's just above 12% of cumulative Tesla deliveries, similar to what Tesla disclosed last year. |

Hyperscalers have been boosting their capital spending as they pour money into the data centers required to fuel their AI ambitions. Meta's capex had been growing faster than its revenue, something that has been raising investor scrutiny more than it has for the tech giant's peers, which have cloud business revenue to more directly offset their spending on AI. But this time, it was Microsoft's ballooning capex that worried investors, while Meta's record revenue washed away investors' fears — for now. |

|

| The view that changes everything. |

When you can see the wall of orders waiting at $75, or the thin support below current prices, you're not just trading—you're strategizing. That's the TotalView advantage. Nasdaq TotalView displays the full open order book depth on Nasdaq, including every single quote and order at every price level for all U.S. securities trading on Nasdaq. Identify support and resistance levels in real-time and make decisions with institutional-grade insights, the same data that professional traders rely on to anticipate price movements. While most retail investors rely on top-line info, you'll have a full view of what's building beneath the surface before it impacts price. Open your trading eyes with Nasdaq TotalView. |

|

|

As the AI boom rumbles into its fourth year of dominating the market, retail traders, professional investors, and Wall Street analysts alike have largely settled on a simple strategy for catching the next wave of gains: find an emerging bottleneck in the build-out of massive data centers that power AI. Then buy lots of it. |

|

|

- 🏛️ Fed: The Federal Reserve held its policy rate at a range of 3.5% to 3.75% at its January meeting, as all eyes turn to the next Fed meeting in March. Markets* are pricing in a 91% chance the Fed maintains the rate again and a 9% chance of a 25-basis point cut.

- 🎬 Best International Feature: This year at the Oscars, the Best International Feature category is absolutely dominated by Neon, a studio that distributed four out of the five nominees. In a sign that this category will be hotly contested this year, for the first time ever, all four of the Neon nominees have at least one nomination in another category. Right now prediction markets say the movie with the best chance to win is "Sentimental Value" (70%), followed by "The Secret Agent" (23%) and "It Was Just An Accident" (8%), all of which are Neon movies.

- 💰 Fed Chair: Yesterday also saw Rick Rieder of BlackRock lose a step in the running for President Trump's pick for Fed chair, with his market-implied chances dropping from a high of 53% as of Saturday to 36% last evening. Meanwhile, Fed Governor Christopher Waller — who dissented at this week's meeting and wanted a rate cut — saw his chances increase from 9% on Tuesday to 16% at market close on Wednesday.

|

*Event contracts are offered through Robinhood Derivatives, LLC — probabilities referenced or sourced from KalshiEx LLC or ForecastEx LLC. |

|

|

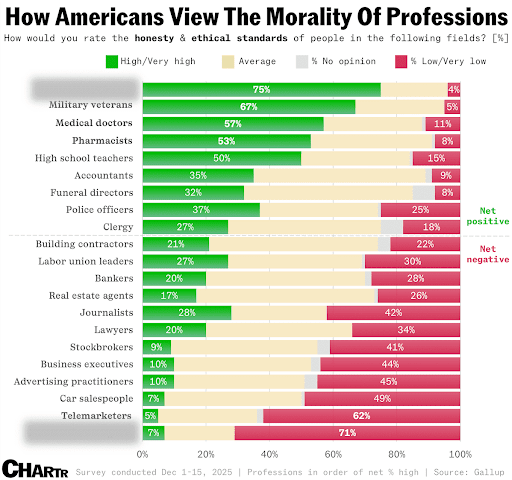

Which occupations do Americans consider the most and least trustworthy? |

|

|

- Earnings expected from Apple, Mastercard, Caterpillar, SAP SE, Lockheed Martin, Altria, Nasdaq, Nokia, Comcast, Visa, Western Digital, and Sandisk

|

|

|

Advertiser's disclosures: Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security, digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or digital asset or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. |

Was this email forwarded to you? Don't miss out on future stories — subscribe to Snacks and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and The Wrap for quality reads. |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment