If you can't beat 'em, rent 'em? As Tesla comes off a record quarter, the company is now grappling with how to keep sales from driving off a cliff now that the government's $7,500 EV tax credit has ended. But Tesla has a plan: to get people hooked on driving its EVs, it's allowing customers to rent them from select dealerships starting at $60 a day. To sweeten the deal, the company has thrown in freebie features and $250 credit if you choose to buy a Tesla within a week of your rental experience. The markets rallied on Monday following the Sunday evening announcement by the US Senate that a tentative compromise bill would advance, potentially ending the US government shutdown this week. Tech stocks got an additional boost as Nvidia CEO Jensen Huang "asked for wafers" from TSMC in light of "very strong demand," boosting both stocks and the broader AI trade. The S&P 500 closed up roughly 1.5%, the tech-heavy Nasdaq 100 soared more than 2% for its best day since May, and the Russell 2000 rose over 1%. |

|

|

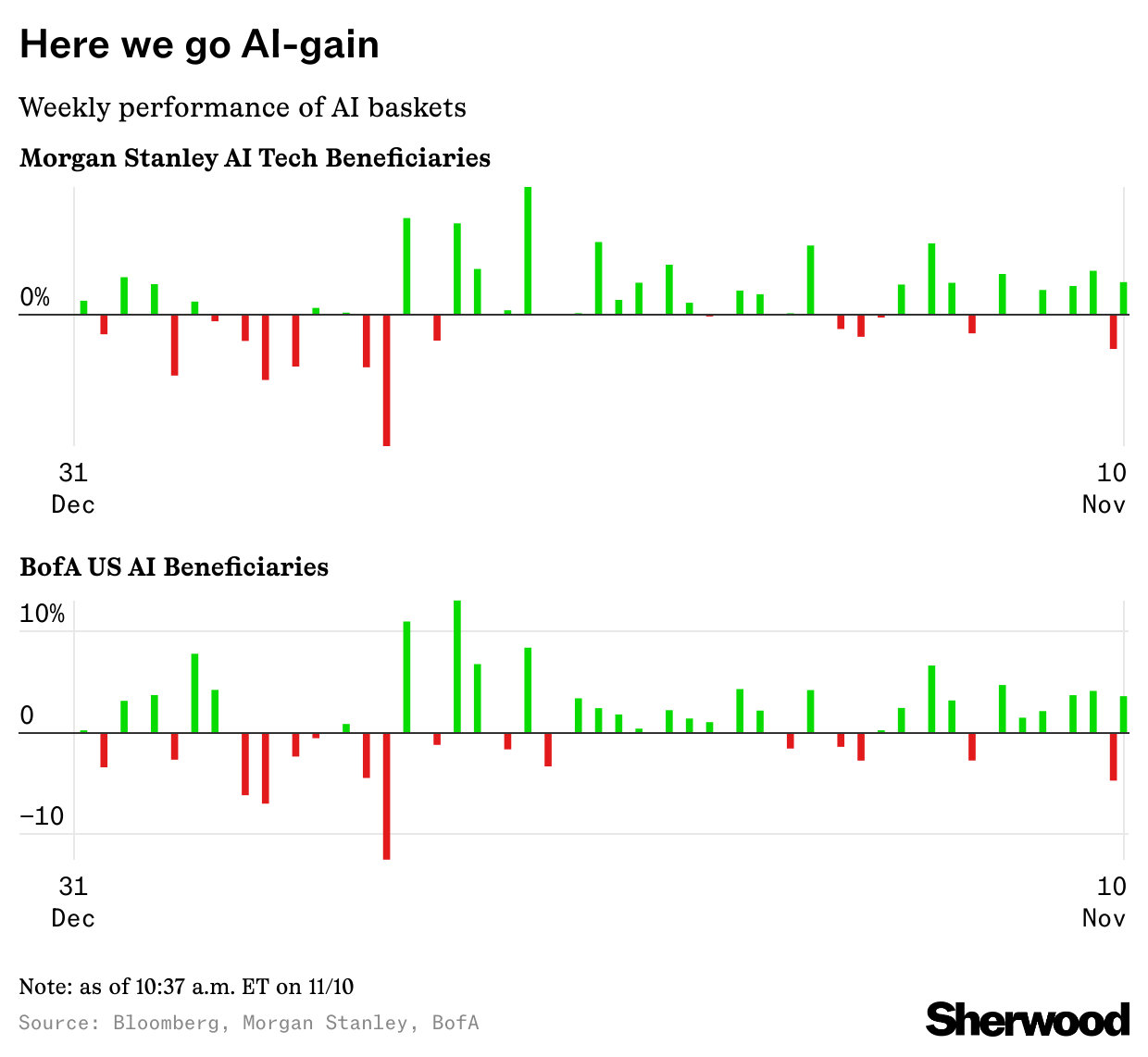

The AI trade is roaring back after getting speed checked last week. Baskets of US AI beneficiaries compiled by Morgan Stanley and Bank of America, which just suffered their worst week since the Rose Garden tariffs announcement, were up big yesterday and led a broad-based market recovery amid optimism that the government shutdown will soon be over. |

- The likes of Palantir (which tumbled despite reporting strong earnings results), Western Digital, and Seagate Technologies were all up more than 5% on the day, with Palantir finishing up nearly 9%.

- Semiconductor stocks also rallied strongly after Nvidia CEO Jensen Huang asked his counterpart at TSMC to boost chip output.

- Bank of America argues (convincingly) that last week's retreat in the cohort had little to do with any industry-specific fundamental news.

- "The pervasive skepticism re AI capex is understandable but likely a contrarian positive, helping minimize overcrowding," BofA analyst Vivek Arya wrote in a note reaffirming his conviction on his preferred data center and semicap stocks. (More on this after the jump.)

|

"While the bears will continue to yell 'AI Bubble' from their hibernation caves we continue to point to this tech cap-ex supercycle that is driving this 4th Industrial Revolution into the next few years," Wedbush Securities analyst Dan Ives wrote. "This is our focus and along with our AI use case work in the field is driving trillions of spending over the next few years and thus will keep this tech bull market alive for at least another 2 years in our view." |

|

|

Further bolstering that argument, 22V Research flagged how earnings expectations are improving much more rapidly for AI-linked firms than the S&P 500 at large. "AI usage and AI related fundamentals are unusually strong," wrote Dennis DeBusschere, chief market strategist at 22V Research. "In 3Q, AI earnings growth rate has been ~3x that of other S&P names." |

|

|

Step into the Future with Nasdaq-100 Micro Index® Options (XND®) |

|

|

- Compact Exposure: Engage with the NDX® at 1/100th the notional size, offering flexibility without large commitments.

- Cash Settlement: Simplify transactions by settling in cash at expiration, eliminating the need for physical delivery of underlying assets.

- European-Style Options: Exercise only at expiration, thereby eliminating early assignment risk.

- Tax Benefits: Enhance overall returns with potentially favorable tax treatment.

- Versatile Use: Generate income or manage risk through hedging against market volatility.

|

Back to that Bank of America note, where analyst Vivek Arya has thrown down the gauntlet: there's one bear case against AI stocks he really doesn't like. "The common argument that 'AI stocks must be overvalued because OpenAI cannot justify $1.4 trillion of long-term commitments' is a lazy/cherry-picked argument in our view," he wrote in yesterday's note to clients. |

- "While we agree OpenAI's plans are very ambitious, none of that spending has yet been put in place and will be gated by practical constraints such as access to power and data center space," he continued.

- "The majority of AI spending is being done by profitable, public hyperscalers for whom upgrading infrastructure is mission-critical (upgrade to accelerated from traditional CPU-computing) and defensive (e.g. Google's $92bn capex 'defends' a $200bn+ search leadership by providing Gemini-chatbot driven results to all customers who might otherwise defect to ChatGPT, Perplexity or other search engines.)"

- Reports that OpenAI is moving toward an IPO, however, would offer some enhanced confidence that it'll be able to get its hands on the cash necessary to follow through on these pledges.

|

"Meanwhile private AI companies are making rapid strides attracting business customers," he added, "which will continue to put pressure on public software and infrastructure-as-a service vendors to raise AI investments." |

|

|

On the one hand, sure: while ChatGPT may have been what brought the AI boom into public consciousness, it's not the alpha and omega of the movement. The continued push from the publicly traded, immensely profitable tech companies that lead the S&P 500 is probably the more important factor behind the mile-deep, inch-wide AI spending boom in the here and now. On the other hand, OpenAI's spending commitments have driven big valuation bumps for Amazon, Broadcom, AMD, and Oracle in just the past two months. In other words, those stocks have priced in that demand being real and realized. To the extent it isn't, or can't be, well then some overvaluation worries would be somewhat justified. |

|

|

After more than a decade, Rockstar's crown jewel — and one of the highest-grossing video games of all time — just hit the brakes... again. CEO Strauss Zelnick said the extra months will help "finish the game with the high level of polish players expect and deserve." Still, shares plunged on the announcement, even as the company raised its full-year bookings outlook. How long we've waited |

|

|

Want Exposure to Pre-IPO Offerings? Start Here. |

Kevin O'Leary is a paid spokesperson for StartEngine. See his 17(b) disclosure, here. |

For years, access to pre-IPO offerings was reserved for insiders. StartEngine is changing that. StartEngine Private gives accredited investors exposure to companies like Discord, Databricks, and xAI for as little as $15K.2 Over $111M has already been committed to these private offerings. Explore pre-IPO offerings.3 StartEngine itself also launched their latest round, learn more about investing in StartEngine's offering.4 |

|

|

- 💸 Crypto: Bitcoin rallied on "renewed optimism" for an end to the shutdown, with market-implied probabilities derived from event contracts* showing that traders now think there's a 29% chance bitcoin gets to $130,000 or above this year.

- 🏛️ Government: Markets are confident that the US government shutdown will resolve by the end of the week, with traders pricing in just a 12% chance that the government will still be shut down through Saturday, November 15. Overall, the market is pricing in a 97% chance that it continues through 10 a.m. Wednesday and just a 36% shot it runs through 10 a.m. Thursday.

- 🎵 Music: Taylor Swift's "The Fate of Ophelia" remains at the top of the Billboard Hot 100 in its fourth week of release, and now the question is how long it will stay there. Prediction markets assign a 96% chance of getting to a fifth week, an 86% shot of making it to seven weeks, but down to a 25% chance of making it all the way out to nine weeks.

|

*Event contracts are offered through Robinhood Derivatives, LLC — probabilities referenced or sourced from KalshiEx LLC or ForecastEx LLC. |

|

|

- Earnings expected from Nebius Group, Oklo, and Beyond Meat

|

Correction: In Monday's Snacks, we reported that last week, Nvidia had its biggest tumble over four days since April 7, but it was its biggest four-day decline since April 21. We regret the error. |

|

|

Advertiser's disclosures:

1 Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or digital asset or any representation about the financial condition of any company. Additionally, nothing contained herein should be construed as tax advice. Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security, digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or digital asset or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. Investing in options carries unique risks. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. 2 The companies listed on StartEngine Private are not involved in or endorsing this investment, and have not approved StartEngine Private LLC or its affiliates. Rather, when you invest through StartEngine Private, you are buying an interest in a separate Series of StartEngine Private LLC, not stock directly in the companies listed. The Series may hold shares directly or through a special-purpose vehicle (SPV). Your interests may differ from the companies' stock in both rights and value, and there may not be a one-to-one economic parity between the value of Series interests and the underlying shares. The Series also bears its own costs (such as transaction and administrative expenses), which may reduce investor returns. 3 Any IPO timing is unknown and general steps to be accepted for an IPO have to be undertaken. There is no guarantee that an actual IPO will occur. This offering is made under Regulation D, Rule 506(c), through StartEngine Primary LLC (member FINRA/SIPC), and is available only to accredited investors. These investments are speculative, illiquid, and high risk, and you should be prepared to hold them indefinitely and to bear the risk of losing your entire investment. StartEngine and its affiliates do not provide financial, investment, legal, or tax advice. This update may include information from third party or public sources that has not been independently verified and may be incomplete or inaccurate. Before investing, please carefully review the full offering documents on the offering page and consult your advisors. 4 This is a paid advertisement for StartEngine's Regulation A+ offering. For more information, please see the most recent Offering Circular and Risks related to this offering. This Reg A+ offering is made available through StartEngine Crowdfunding, Inc. No broker-dealer or intermediary is involved in the offering. In addition, as described in the Offering Circular, the Company retains the right to continue the offering beyond the Termination Date, in its sole discretion. Investing in private company securities is not suitable for all investors. This investment is highly speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. It should only be considered a long-term investment. There is no guarantee that a market will develop for such securities. |

Was this email forwarded to you? Don't miss out on future stories — subscribe to Snacks and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and The Wrap for quality reads. |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment