Hello and Happy Halloween! Trick-or-treaters will descend on neighborhoods across America this evening, with 66% of households planning to hand out candy, per an NRF survey — though sweet spots might be hard to discern, since only 51% plan on decorating. Today we're exploring: |

- Fit check: "KPop Demon Hunters" outfits are expected to dominate Halloween this year.

- Buffett zone: The Oracle of Omaha's key indicator just hit a worrying record.

- Bowl's over: Charting the slop bowl recession.

|

Have feedback for us? Just hit reply - we'd love to hear from you! |

"KPop Demon Hunters" costumes will probably be everywhere this Halloween |

Anyone who's forked out a (severed?) arm and a leg for Halloween candy this year, expect to see lots of little Rumis and Jinus knocking at the door tonight for tricks and your exorbitant treats. For those who have no idea who those two are, they're the main characters from "KPop Demon Hunters." For those still struggling, that's the world's biggest streaming service's most watched film of all time. |

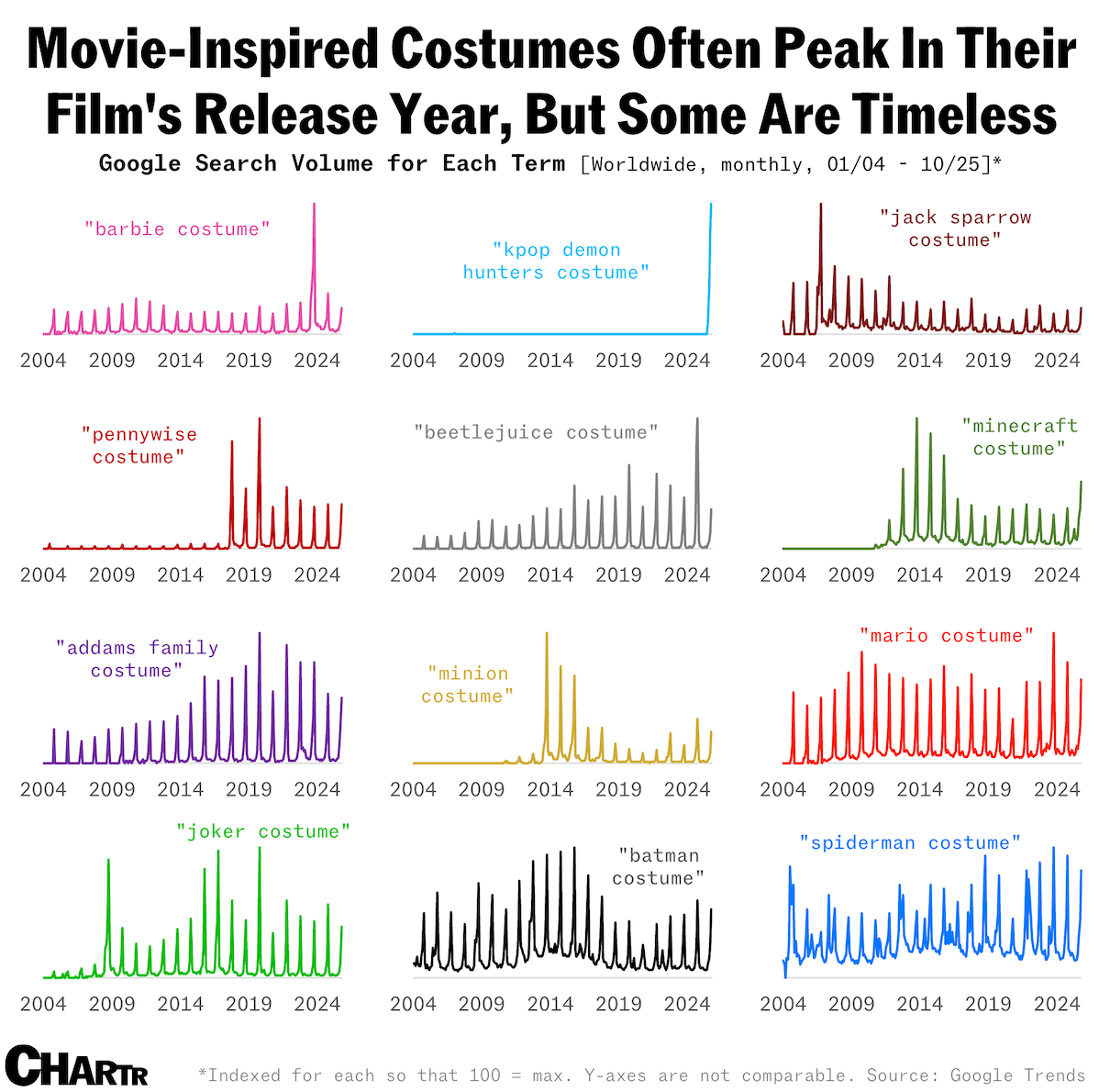

According to Google Trends' "Frightgeist," this year's top trending outfits are dominated by "KPDH," with costumes related to Netflix's smash hit rounding out the entire top 5 for surging search interest. Seasonal retailer Spirit Halloween, which has an exclusive license for selling official "KPDH" attire, not only echoes this in its list of most popular costumes, but has seen its shelves swept of purple plaited wigs and mini yellow jackets, as reported by the NYTimes. Having amassed more than 325 million views on Netflix at the latest count, it's perhaps no surprise that Google searches for "kpop demon hunters costume" have spiked — the latest instance of how pop culture shapes our costumes come October. |

Search volumes for movie-inspired costumes, naturally, seem to peak in the year that the associated film was released. For example, searches for "barbie costume" have tailed off since skyrocketing around Halloween 2023. The same is seen for "minion costume" following the release of "Despicable Me 2" in 2013, as well as "It" fans hunting down Pennywise clown outfits after both installments of the high-grossing horror franchise in 2017 and 2019, respectively. Of course, some costumes based on existing IP, like video games "Minecraft" and "Super Mario," get an extra boost when they're spun off into blockbusters. But some iconic costumes, particularly eerie ones that are actually related to the holiday or those in the superhero bracket, come back every year — proving that no matter how niche some fancy dress gets, there's always room for the classics. |

The Buffett Indicator just hit an all-time high |

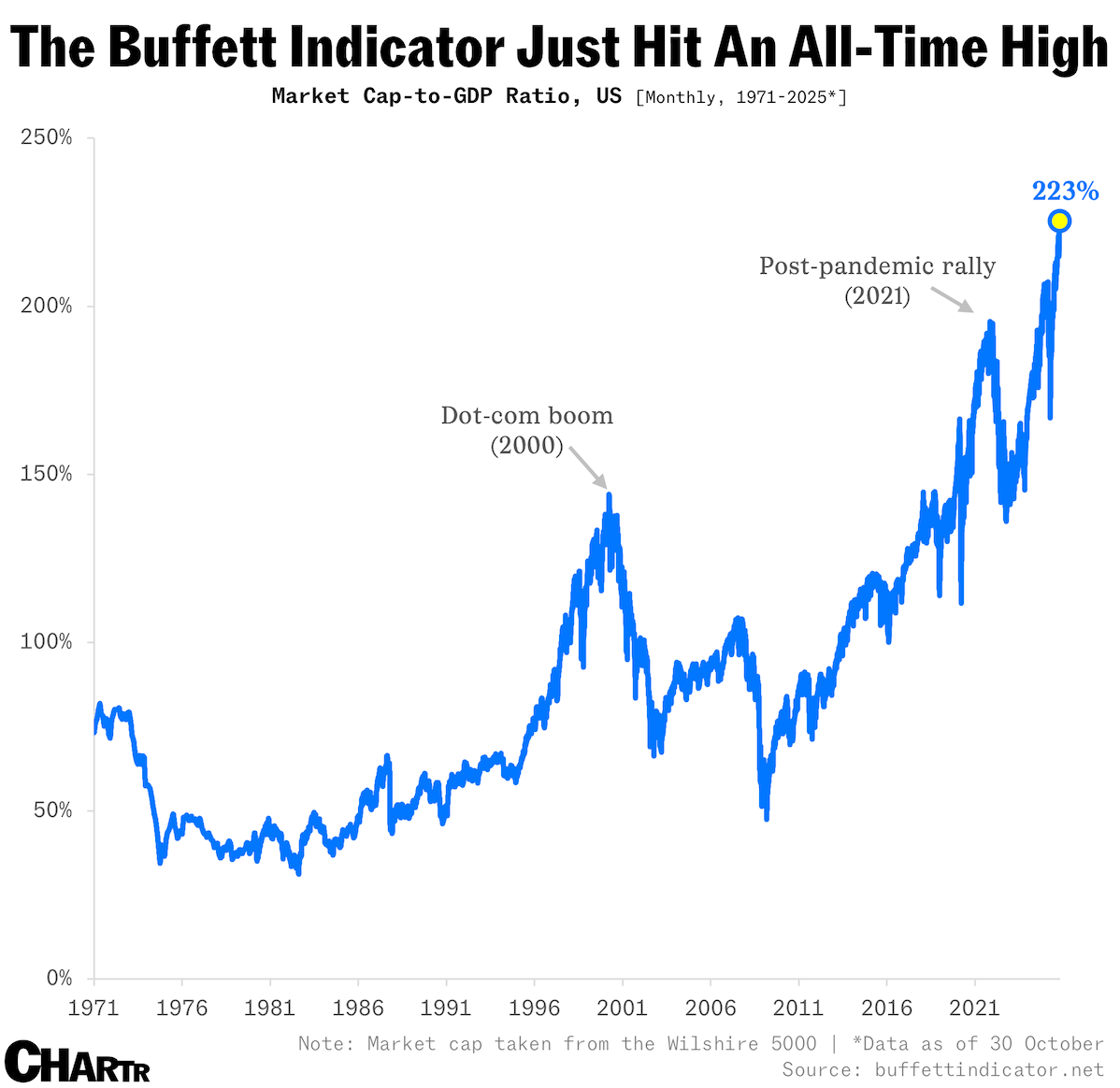

For most, comparing market caps to the GDP of a country is usually a bit of a no-no: GDP is a flow concept (economic activity over a year), while market value is a stock concept (a snapshot of all the pieces of paper multiplied by their latest price). But as with all other disciplines, once you truly master the rules, you can break them. That's exactly what Warren Buffett did when he popularized the "Buffett Indicator" — a ratio of the total US stock market value to the country's GDP. Once hailed by its namesake investor as "probably the best single measure of where valuations stand," this week the indicator hit an alarm-bell-ringing 225% — its highest level on record, adding to the growing chorus of market commentators who think we could be in for a correction. |

Alongside the Buffett Indicator, other metrics are flashing amber or red. Investors are paying record prices for every dollar of future S&P 500 revenue, and the market is increasingly concentrated in a handful of mega-caps, with 8 tech stocks now responsible for ~40% of the S&P 500 Index's value. Back in 2001, Buffett warned that the metric nearing 200% would mean "playing with fire." But, parallel to the valid concerns, there are very legitimate reasons to ignore this particular alarm. Indeed, given the globalization of America's corporate behemoths, their record operating profit margins, and future growth, just how spooked should we be? |

|

|

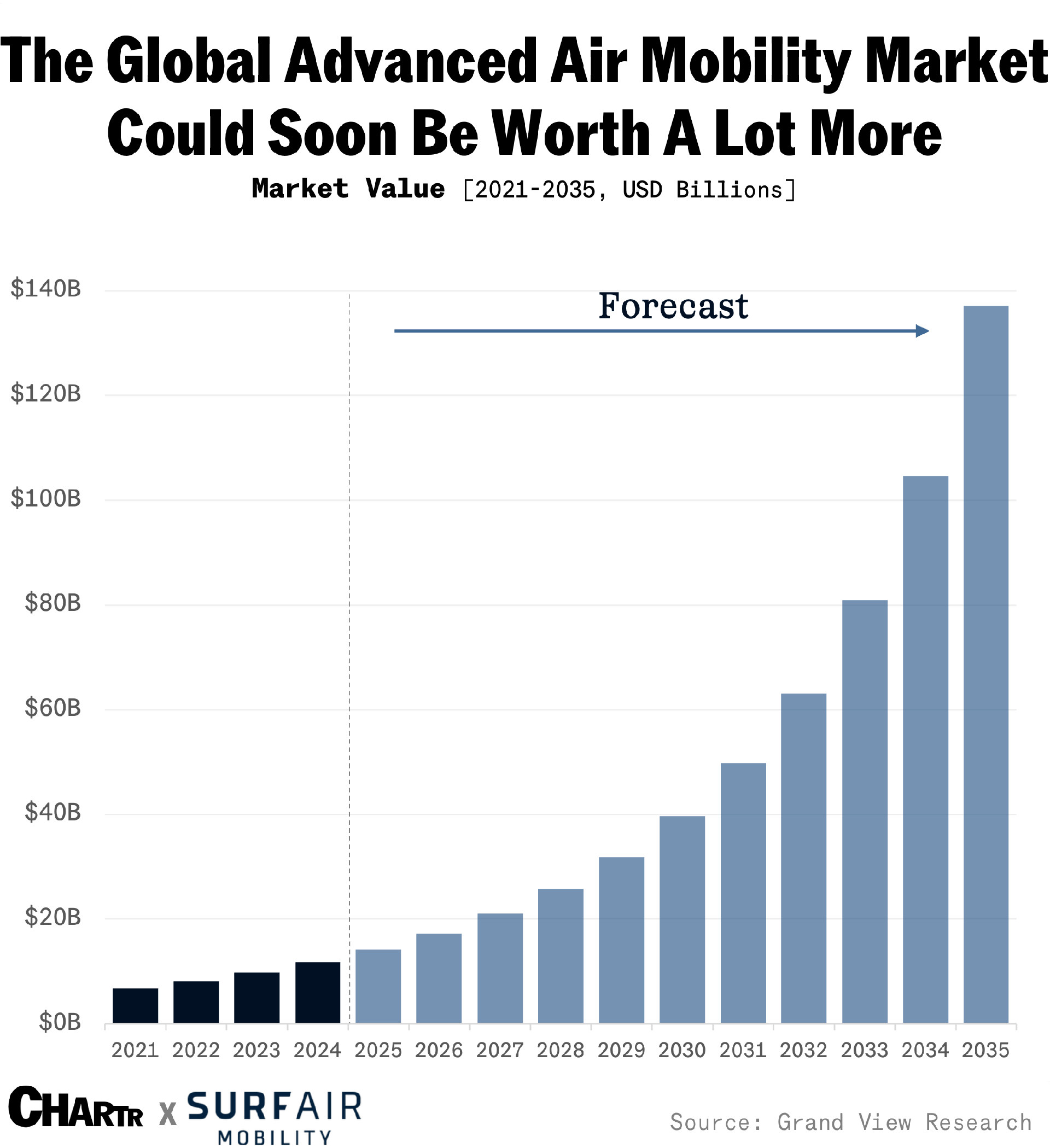

Could AI-enabled electric aviation be on the horizon? |

The global advanced air mobility market was worth nearly $12 billion last year, but is forecast to be worth approximately $130 billion by 2035, growing at an estimated CAGR of 25.5% from 2025 to 2035.1 Surf Air Mobility (NYSE: SRFM) is building the foundation for this new era of flying with its proprietary SurfOS AI-enabled software, a nationwide flight network, and a platform to help bring new electrified aircraft technologies to market. SurfOS is aiming to become the intelligent operating system for the air mobility industry by combining its scale, operational expertise, and next-generation technology to define the future of air mobility. |

|

|

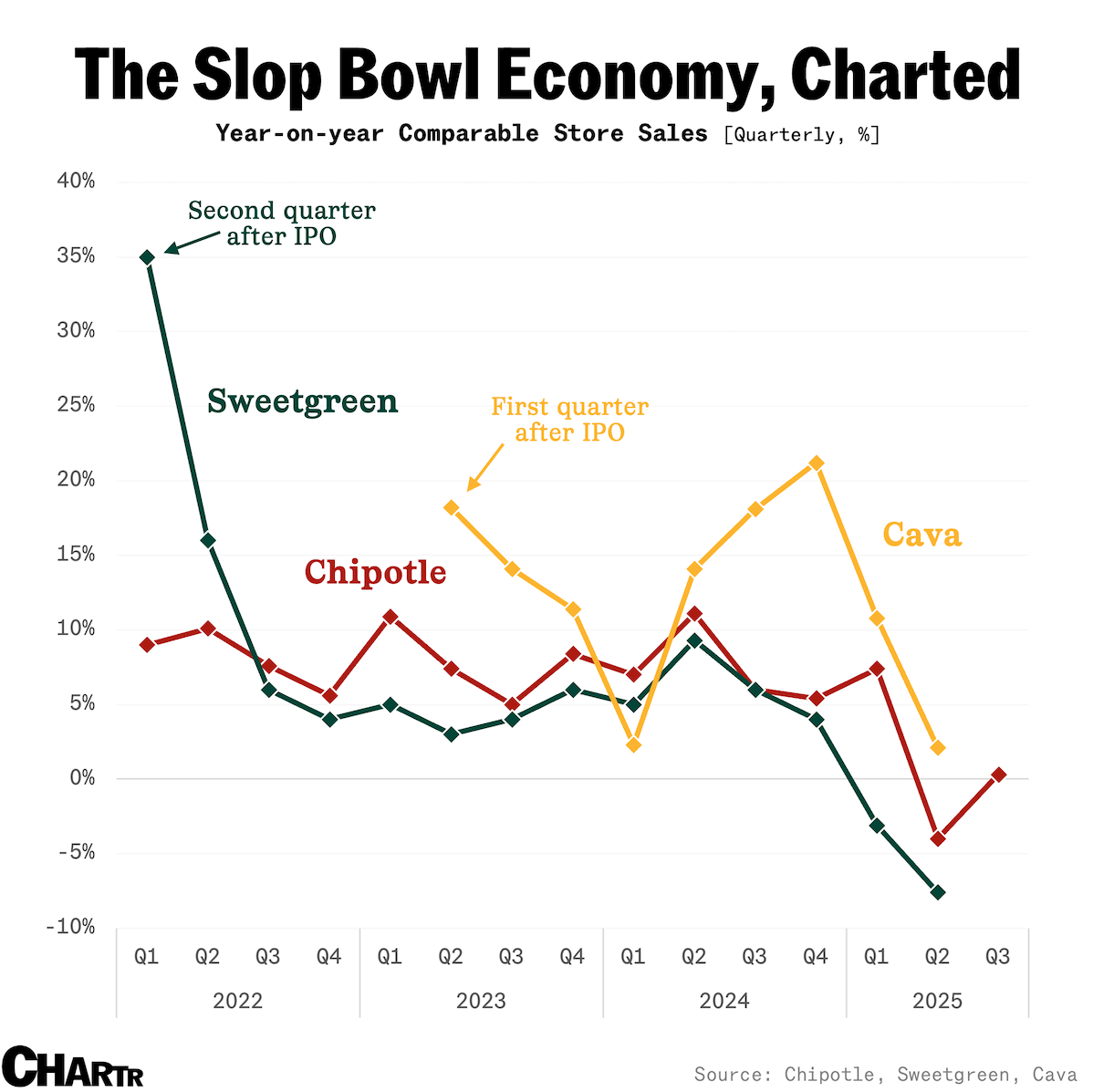

The slop bowl recession has sent Chipotle's stock cratering |

For a long time, the slop bowl and burrito scene has been a gold mine for Chipotle. But now, with competition rising and wallets getting lighter, consumers are turning away from Chipotle's offerings. The company posted just 0.3% growth in its same-store sales yesterday, while simultaneously cutting its outlook for the full year: the chain now expects sales to fall in the "low single-digit" percentages for this year. That news not only burned Chipotle itself, which sank 18%, but also hurt rival bowl sellers Cava and Sweetgreen, which fell 11% and 10%, respectively, yesterday. How long such a downturn will last is hard to tell — we'll hear from Cava and Sweetgreen on November 4 and 6 about how their sales are faring — but with comparable-store sales growth dipping below zero for two of the three companies this year, it's hard to come to any other conclusion: we are in a slop bowl recession. Indeed, if you were to subtract inflation from each of these companies' growth rates, they'd all be well in the red. |

That continued drop comes in stark contrast to fast-casual counterparts like Shake Shack and Restaurant Brands International, the company behind Burger King, which both gained on Thursday after posting better-than-expected growth in established stores, despite facing the same consumer challenges. Per Chipotle's latest earnings call, the deciding factor might have been the youngsters — with CEO Scott Boatwright commenting that customers in their late 20s and early 30s are "particularly challenged" due to unemployment, student loan debt, and slower wage growth. |

|

|

- Big Tech's big capex spend: Amazon, Alphabet, Meta, and Microsoft combined spent almost $100 billion on purchases of property and equipment last quarter.

- Dictionary.com's word of the year is "67" — ask your kids or Gen Z coworkers.

- Last night, YouTube TV removed Disney networks from the platform as much as 30 minutes before the companies' deal expired (in true Disney style) at the stroke of midnight ET.

- OpenAI has reportedly started working on an IPO that could see the ChatGPT maker go public at a $1 trillion valuation as early as next year.

- They say rap's changed… For the first time since 1990, there is not a single hip-hop song on the Billboard Hot 100's top 40.

|

|

|

The global advanced air mobility market is forecasted to be ~$130 billion by 2035.1 Discover how Surf Air Mobility (NYSE: SRFM) is looking to define a new era of flying.2 |

|

|

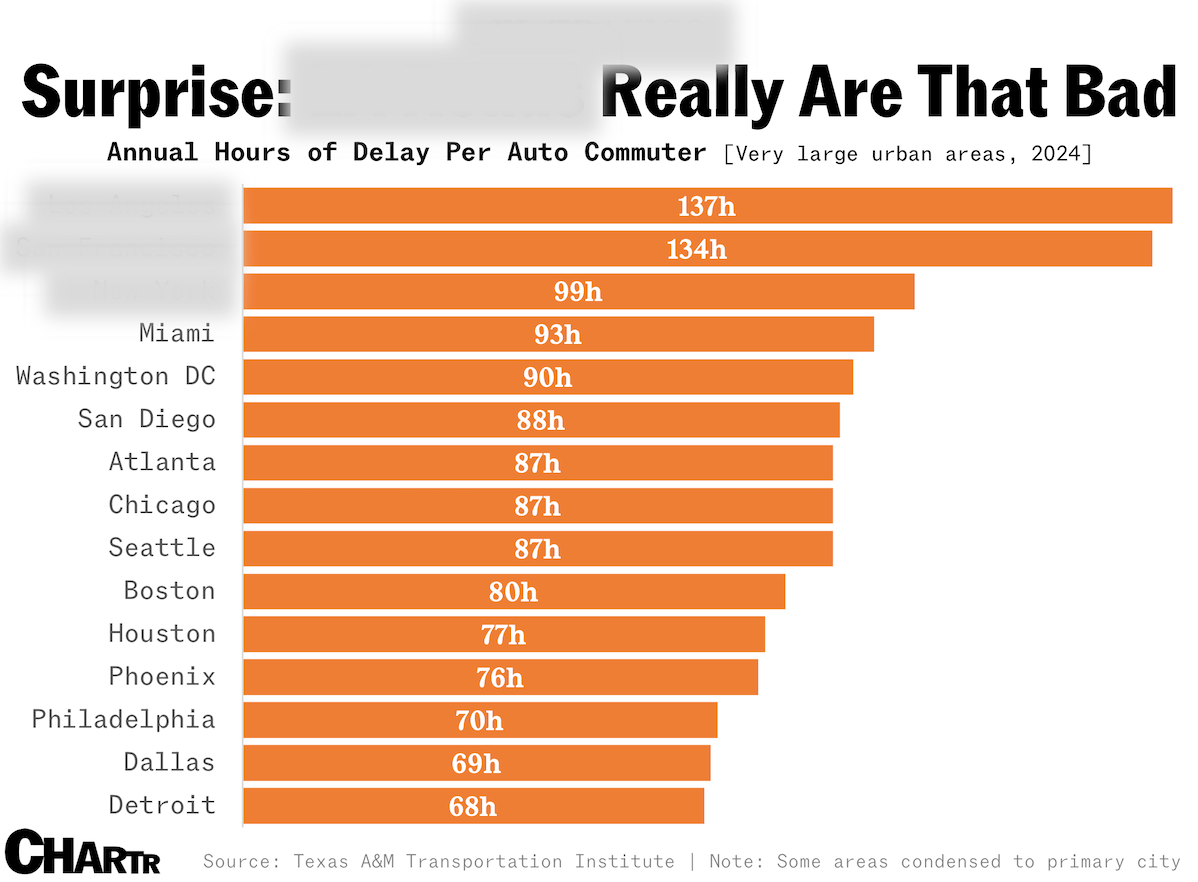

Off the charts: The average American driver now spends 63 hours a year stuck in traffic, but in which three US cities do commuters face the scariest traffic jams? [Answer below]. |

Not a subscriber? Sign up for free below. |

Advertiser's disclosures: 1 See Grand View Research analysis for further details. See the Methodology Overview for further details on the chart forecast methodology. 2 Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Investing in stock involves risks, including the loss of principal. Before investing, carefully assess whether a particular stock aligns with your investment objectives, risk tolerance, and financial situation. This is a paid advertisement for Surf Air Mobility, Inc. |

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 | |

|

|

No comments:

Post a Comment