Hi! Today marks the autumnal equinox — when the Earth is tilted neither toward nor away from the Sun, resulting in an almost equal amount of day and night at all latitudes — or, as it's better known, the first day of fall. Today we're exploring: |

- Robots in disguise: Most Americans don't like surreptitious AI use.

- Momentum stocks: What goes up, must go… up?

- America, tipped: Which jobs qualify for Trump's no-tax-on-tips break?

|

Have feedback for us? Just hit reply - we'd love to hear from you! |

Most Americans don't like surreptitious AI use, but many are unbothered by AI-generated music |

During the unveiling of Meta's new smart glasses last week, besides a few blunders, CEO Mark Zuckerberg said: "It is no surprise that AI glasses are taking off. This feeling of presence is a profound thing..." The hardware will supposedly provide in-person "presence" with a built-in assistant that can interpret surroundings in real time. However, by placing AI literally in front of our eyes, Americans might be even harder pressed by a thoroughly modern issue: the use of AI in unsuspecting scenarios. |

Fool me once, shame on AI |

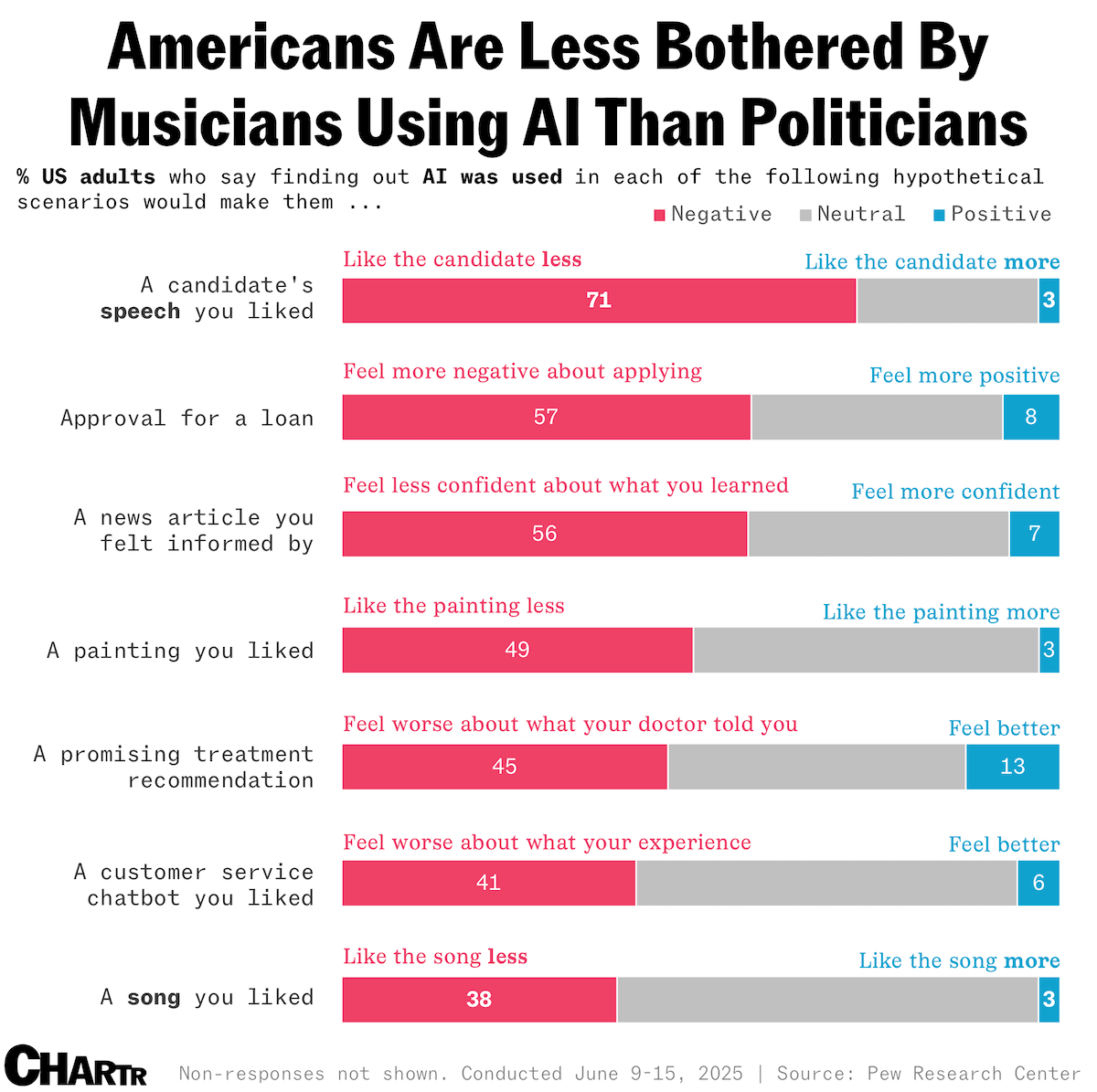

A new study from Pew Research Center asked US adults how they would react in different hypothetical situations — including seeing a painting and talking to customer service — if they found out, after the fact, that AI had been employed to produce whatever they were interacting with. Unsurprisingly, responses in all cases leaned negative. The most negative reaction was where respondents imagined they'd learned that a political candidate had used AI to write a speech they had liked, with 71% of Americans saying they'd like the candidate less as a result. |

The use of AI in the arts was generally more accepted than politics, banking, and journalism, with only 38% of people reporting that they'd like music less after discovering it had been generated by AI. In many cases, Americans were ambivalent about AI being used without their knowledge, with an average of 42% responding neutrally across all seven situations. Interestingly, a sizeable share (13%) felt more positive about doctors recommending treatments with the help of AI, even if unbeknownst to them. And, for what it's worth: AI was not used in the writing of this newsletter. |

Momentum stocks are having a September to remember |

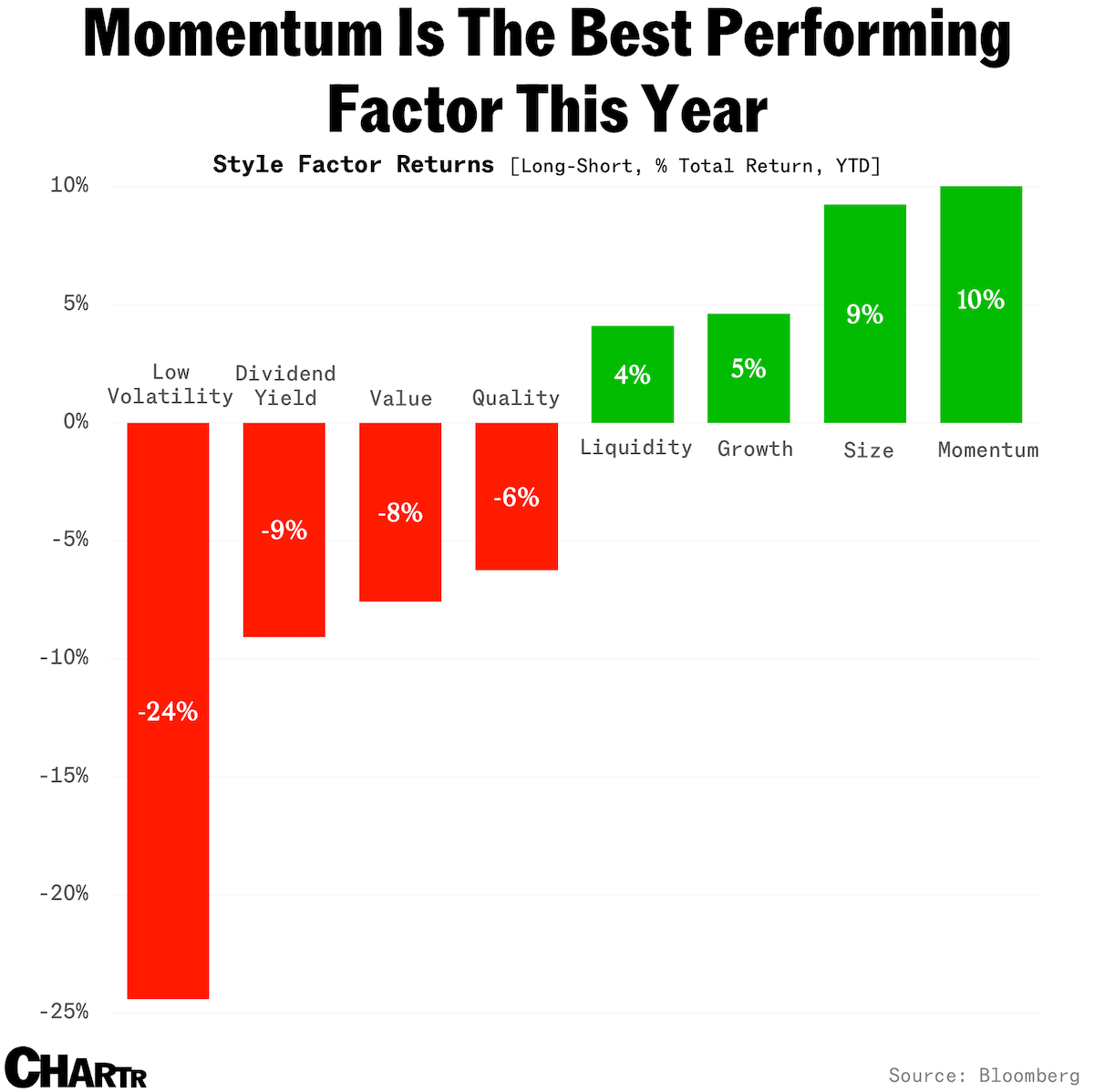

Of all the potential reasons to form an investment idea, none is simpler than the core tenet behind momentum: stocks that have gone up tend to keep going up. It is, perhaps, the most beautiful of all investing strategies. Beloved by Main Street as well as some of the most complicated quantitative investing firms on the planet, momentum was an intuitive idea that became a statistical curiosity when the phenomenon was explored in academia in the 1990s — and it's been blowing up portfolios, and making others rich, ever since. And it is having an incredible year so far. Per data from Bloomberg, which tracks several risk factors, a long-short portfolio of US high-momentum stocks — effectively "buying" the stocks that have already gone up a lot, while simultaneously betting against the ones that have been weaker — has gained 10.5% this year. That's the most of any of the traditional style factors. |

Though epitomized by highfliers like Palantir, this isn't a trend being driven by one, or even a few, stocks: the portfolio has over 300 names in the long leg and 300 names in the short leg. Many of these stocks have had a remarkable few weeks — much to the delight of Main Street, with Sherwood News reporting that retail traders' favorite stocks were on a record 10-day winning streak as of Friday. In fact, momentum is on track for its best month of gains since March 2020, gaining 8% for September alone. But if speculative stocks are in, it's no surprise that boring, stable stocks are out. Indeed, "low volatility" names have been hammered; the favored investing style of icons like Warren Buffett has been under pressure recently, as beaten-down, cheaper stocks have lagged sharply. At some point, those stocks will get too cheap to ignore, but right now, they're gathering dust while the momentum carousel continues. |

|

|

America's tip economy, visualized |

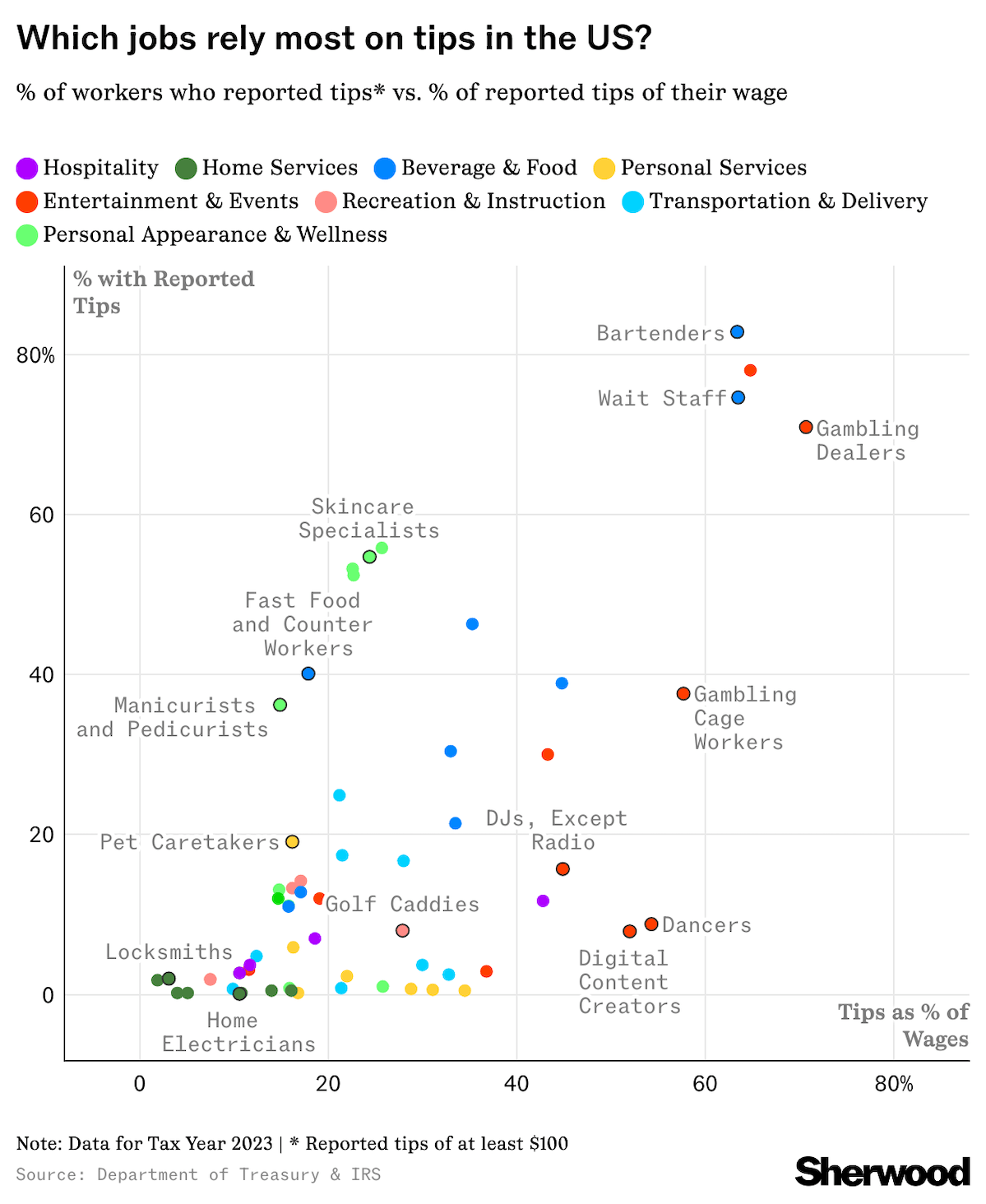

In January, President Trump said at a rally in Las Vegas: "If you're a restaurant worker, a server, a valet, a bellhop, a bartender, or one of my caddies… or any other worker who relies on tipped income, your tips will be 100% yours." That line became the "No Tax on Tips" provision in July — as part of Trump's One Big Beautiful Bill Act — letting workers earning under $150,000 a year deduct up to $25,000 in tips from their federal taxable income, from 2025 through 2028. Last Friday, the Treasury and IRS revealed a draft rule, giving a clearer picture of who might benefit — and who won't. The proposal includes a list of 68 jobs where tipping is common, from bartenders and fast food workers to makeup artists and locksmiths, alongside IRS data on how often tips are reported. |

Roughly 70–80% of wait staff, bartenders, and gambling dealers report tips that account for 60–70% of their wages. For musicians, dancers, and digital creators, it's a different story: only about 3–9% report tips, yet for those who do, tips can account for up to half of their income. In contrast, home maintenance and repair crews rarely report tips, and when they do, it's mostly pocket change. Of course, these figures are likely understated in general, assuming some workers underreport or misreport tips on their tax forms. |

Like, comment, subscribe… and tip! |

Not every job on the list makes the cut. The law excludes those tied to "specified service trades or businesses," such as health, law, finance, athletics, and performing arts — meaning actors, musicians, and dancers won't qualify. Meanwhile, digital creators like Twitch streamers and podcasters are in, but with one big asterisk: tips tied to illegal activity, as well as sex-related work, won't be allowed, carving out adult content platforms like OnlyFans. The Treasury has scheduled a public hearing for October 23 before finalizing the rules. |

|

|

- Shares of Pfizer rose in premarket trading today after the pharma giant announced that it's buying weight-loss drugmaker Metsera for up to $7.3 billion.

- Full pantry: Sales of cupboard staple Hamburger Helper are up 14.5% through August of this year, the NYTimes reported, with sales of tinned fish and boxed mac and cheese also surging.

- SNAP streak: Five-day average volumes in social media company Snap hit a record high as of Friday, after some r/wallstreetbets users speculated about a potential acquisition.

- Microsoft is raising the price of Xbox consoles in the US by up to $70 — the second price hike in five months — starting October 3.

- Run Direction: 31-year-old singer and former band member Harry Styles completed the Berlin Marathon in under three hours on Sunday.

|

|

|

- Gallup explores why a record share of adults now feel safer walking alone at night.

- Between a rock and a harder rock… Ranking over 100 minerals and gems by hardness.

|

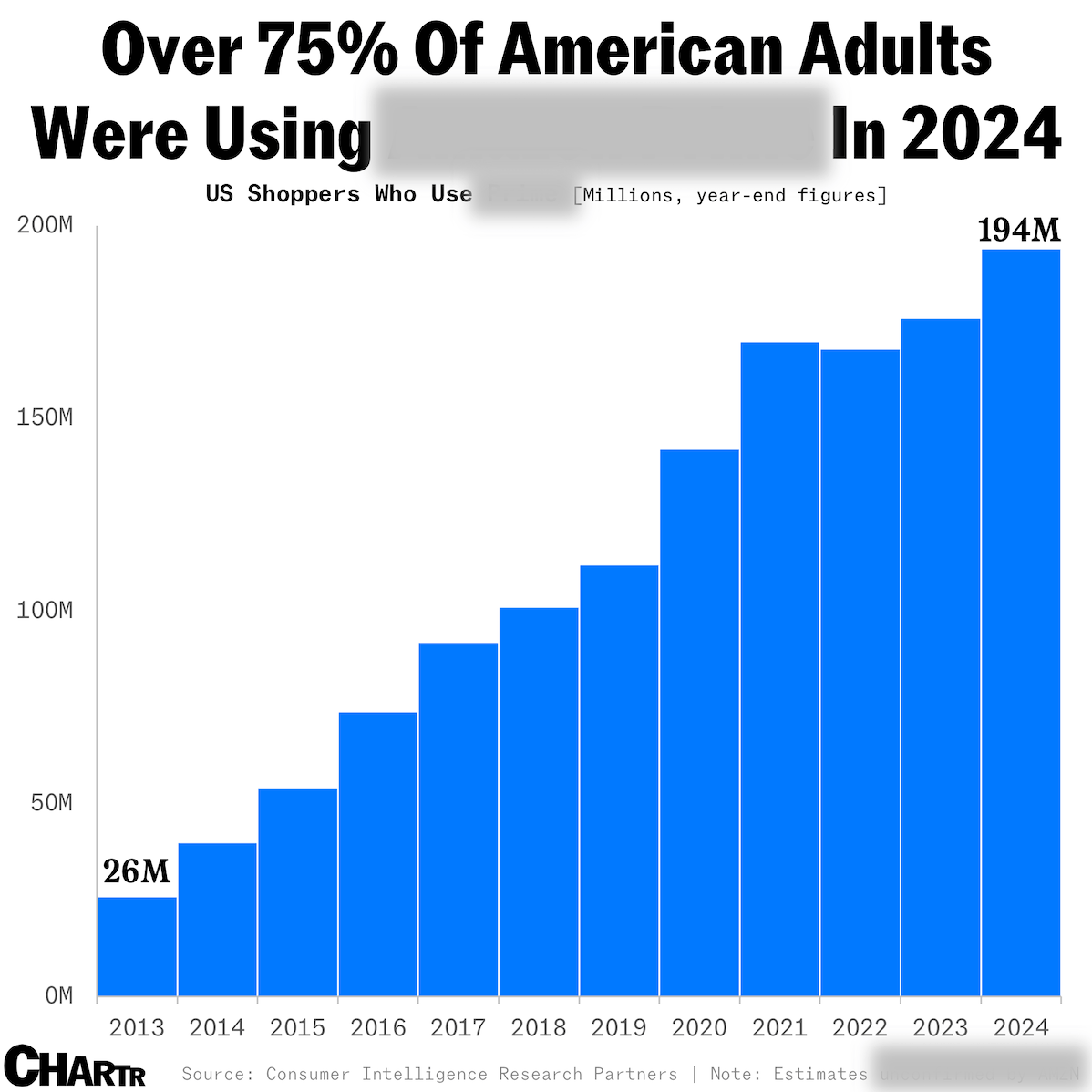

Off the charts: Which subscription service, used by more than three-quarters of US adults last year, is about to be scrutinized in a month-long trial against the Federal Trade Commission? [Answer below]. |

Not a subscriber? Sign up for free below. |

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 | |

|

|

No comments:

Post a Comment