Hello! Tesla CEO Elon Musk has been granted $29 billion worth of shares as part of an interim compensation package. The company cited the "ever-intensifying AI talent war" amongst reasons for the massive payout, which is roughly equivalent to the cost of 290,000 Cybertrucks. Today we're exploring: |

- Grande plan: Starbucks was America's fastest growing fast food chain in 2024.

- Patently unfair: The 235-year-old US patent system may be getting a price hike.

- Big money: Amazon, Google, Microsoft, and Meta spent a record amount on capex last quarter.

|

Have feedback for us? Just hit reply - we'd love to hear from you! |

Starbucks was America's fastest-growing fast food chain last year, while Subway keeps shedding stores |

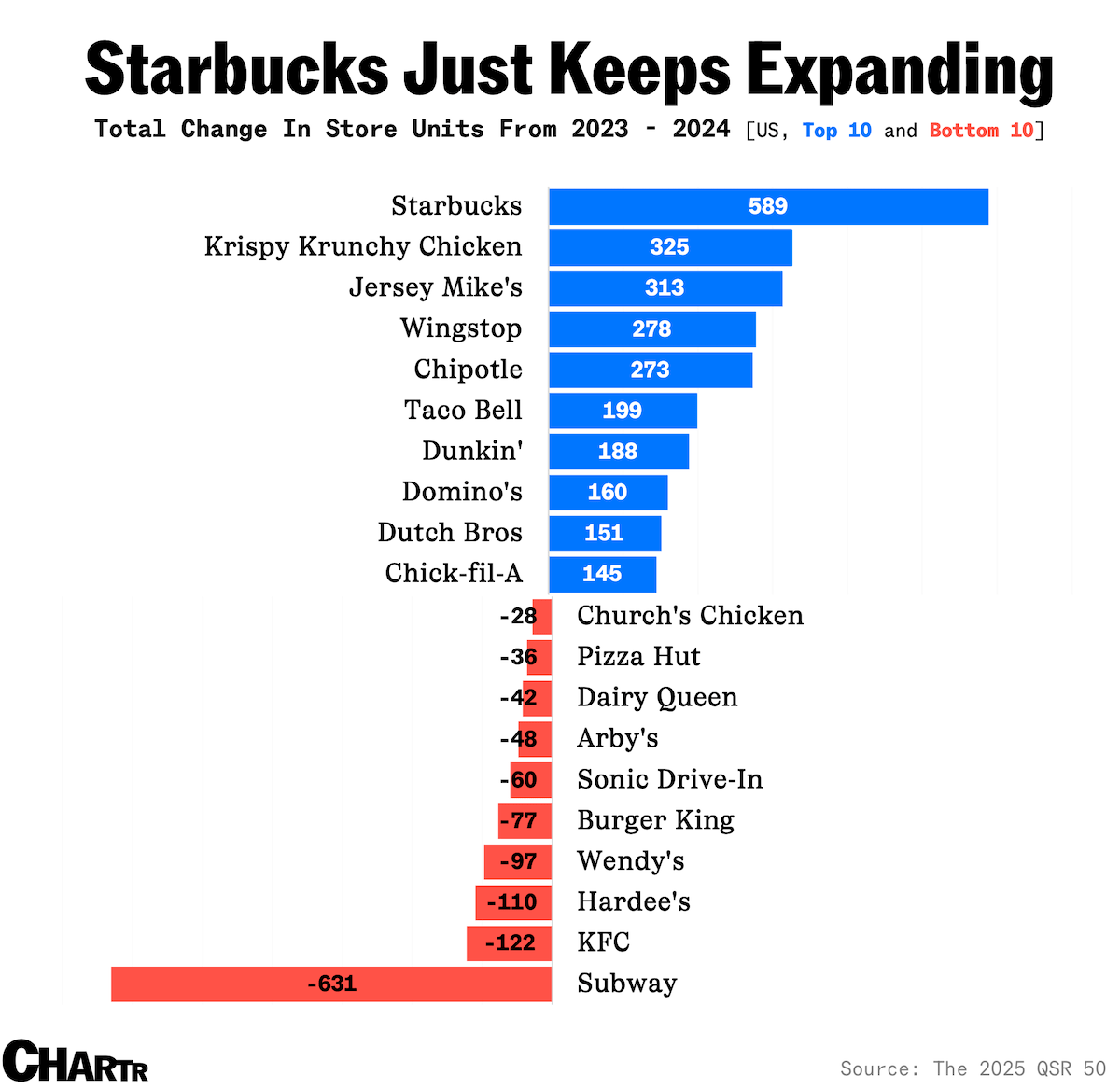

QSR Magazine's annual ranking of America's 50 largest fast food chains is out, and Starbucks has once again topped the list of fastest-growing chains, adding a whopping 589 stores in the US in the from 2023 to 2024 — more than any other restaurant in the ranking. Even so, those new Starbucks outposts might not be as busy as they would have been in the past. The coffee house reported last week that same-store sales and foot traffic fell once again despite its ambitious turnaround plans to continue expanding while also trying to improve the customer experience. |

On the other end of the spectrum, Subway lost another 631 units over the same period, continuing the years-long drop in store count that has seen the sandwich chain trim 7,600 locations in the US since 2016. Some of that ground is being made up internationally, where the sandwich-maker remains in growth mode, signing 25 master franchise agreements in the past three and a half years. |

A close runner-up in the rankings was the relatively unknown fried chicken chain Krispy Krunchy Chicken, which has added 325 units since the last report, with another chicken outlet, Wingstop, not far behind. Considering how much competition there is in the space — with heavyweights like KFC and Chick-fil-A, as well as a flood of hot names like Raising Cane's, Dave's Hot Chicken, Church's Chicken, and others — Krispy Krunchy's rapid growth is not only testament to its food and operations, but to just how insatiable America's appetite for chicken is right now. Still, no chain is more efficient than the chicken giant Chick-fil-A, which racked up average sales per store of $7.5 million in 2024, ahead of another bird-based eatery, Raising Cane's, which averaged $6.6 million. Subway's per-store average? Just $495,000. |

The US patent system could be getting a price hike — tech giants could be hit the hardest |

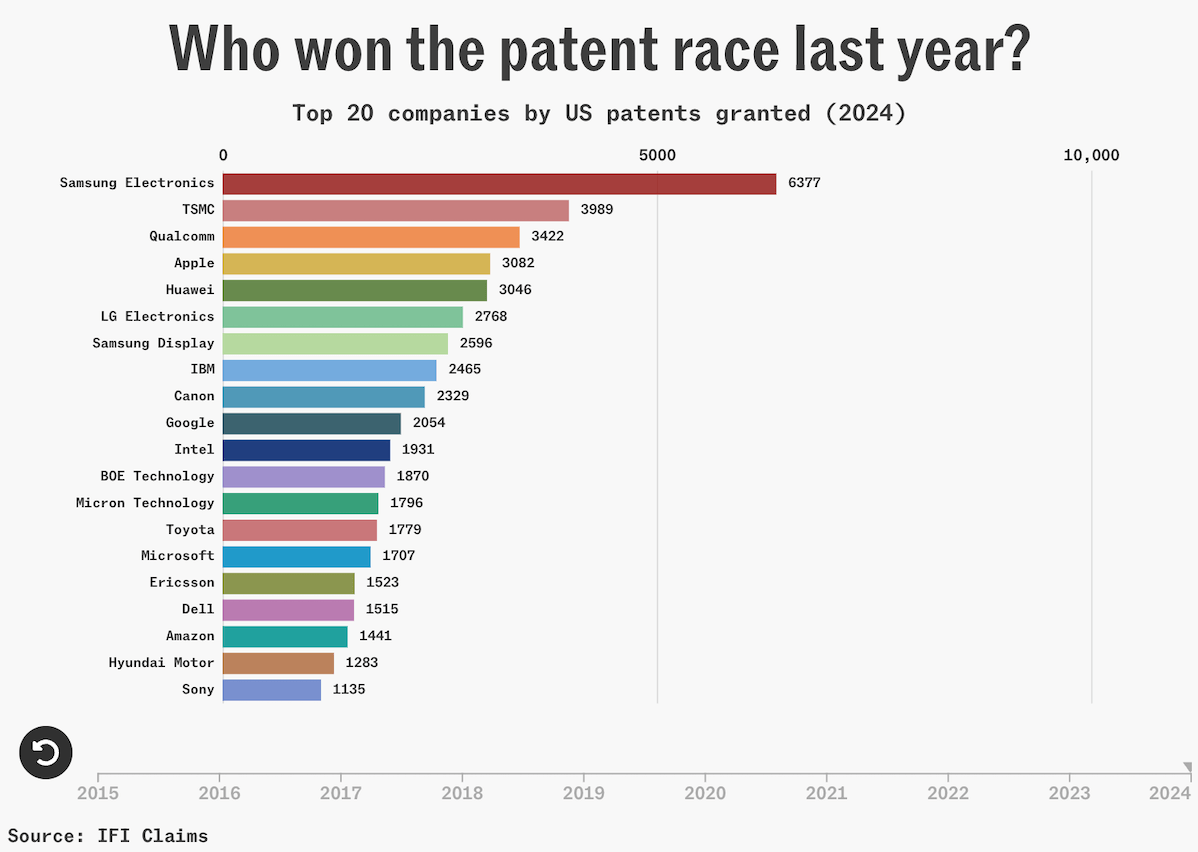

Last week, the Trump administration teased an idea that could rewrite how America charges for patents — a move that would significantly boost federal revenue. According to The Wall Street Journal, Commerce Department officials are weighing a new model that would charge patent holders 1% to 5% of a patent's overall value each year. The goal? Raise billions of dollars to help reduce the nearly $2 trillion annual national deficit. If enacted, it would mark a sharp break from the 235-year-old system, where inventors pay a series of fixed fees (typically around a few thousand dollars) regardless of the patent's "worth." Under the proposed model, annual fees could balloon for companies with large portfolios of high-value patents, like those in sectors such as semiconductors, AI, or biotech. Indeed, the largest patent holders are already getting thousands of patents granted every single year. |

Over the past decade, America's patent landscape has been dominated by tech and chip giants like Samsung, TSMC, and Apple. IBM — once the perennial leader, with more than 71,000 patents granted since 2015 — has recently slipped in the ranks after deliberately scaling back its filings to focus on "high-quality" innovation. A move toward value-based fees could dampen patent filings from these behemoths, as costs would scale with their market potential, while hitting smaller firms even harder, especially those unable to absorb the extra burden. Meanwhile, the proposal comes as intellectual property revenues are already booming. Last year, the US Patent and Trademark Office (USPTO) collected $4.1 billion in patent and trademark fees — more than 4x what it brought in back in 2000. Unlike most federal agencies, the USPTO is self-funded, running on those fees rather than taxpayer dollars. The potential new model, however, could turn it into a broader revenue source for the government. But the main challenge would be the math: namely, how do you exactly calculate what a patent is actually worth? Considering that no other country currently ties patent fees to market value, we can't just borrow someone else's formula. |

|

|

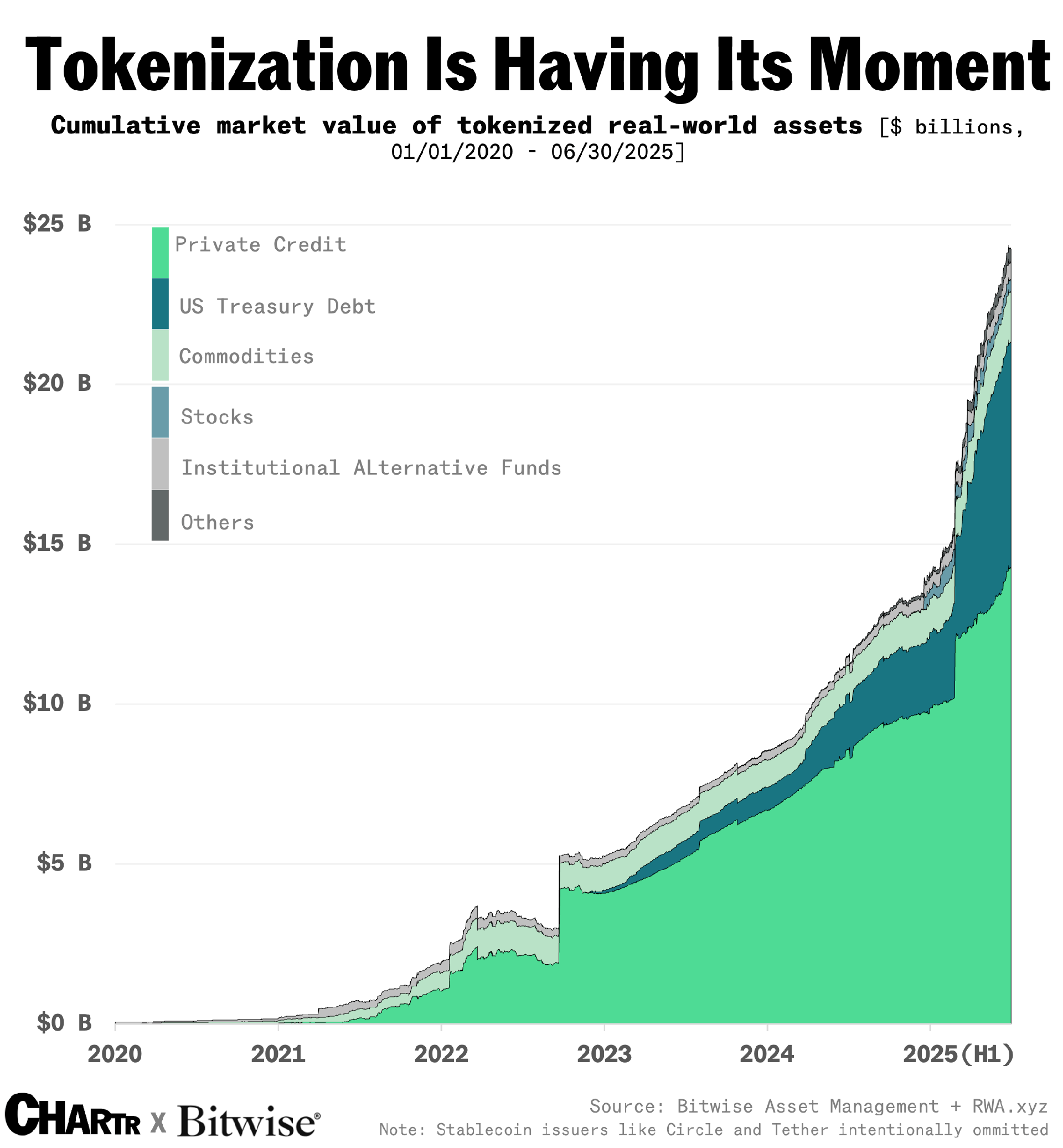

Charts tell stories. Hockey-stick charts tell big stories. |

One of the biggest stories today is that tokenization — the idea of moving stocks, bonds, and other real-world assets over blockchains instead of traditional networks — is having a moment. Not only has it catapulted from zero to a $25 billion market in four years. But suddenly some of the biggest players in finance are talking about it. Think about that for a second. Stocks are a $117 trillion market. Bonds are a $140 trillion market. That's $257 trillion up for grabs in the tokenization wars. This is one chart you'll want to keep your eye on. |

|

|

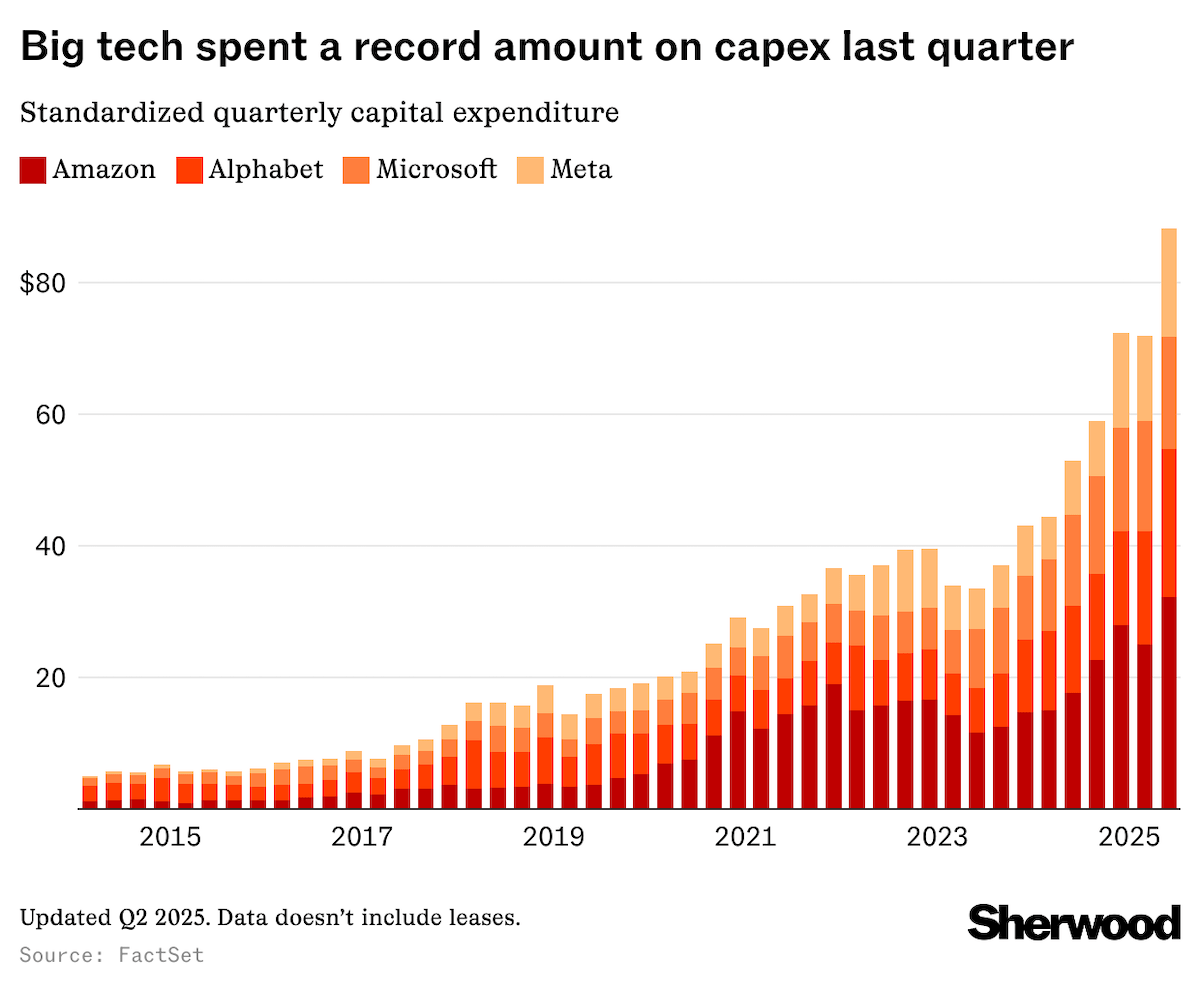

Amazon, Google, Microsoft, and Meta spent a record $88 billion on capex last quarter |

Big Tech companies including Amazon, Google, Microsoft, and Meta continue to spend big on capital expenditures to furnish their AI goals — a strategy that, judging by their earnings last quarter, seems to be paying off. Combined, those four companies spent $88 billion on purchases of property and equipment last quarter — a record, according to FactSet — much of which went toward AI projects like data centers. In case you're trying to wrap your brain around just how much money that is, it's roughly the equivalent of the market cap of Starbucks... in one quarter. |

|

|

- Spotify is raising subscription prices for users pretty much everywhere except the US, after the platform missed revenue expectations in earnings last week.

- Iran has proposed cutting four zeros from the rial after decades of economic decline, which would see it join the likes of Turkey and Romania in re-denominating its currency.

- Hot right now: US restaurant chains launched 76 new spicy menu items in total from March to June, per Datassential, as part of a push to attract younger diners with buzzy new flavors.

- Nintendo officially upped the price of the Switch 1 console — which has cost ~$299 in the US since its release 8 years ago — to ~$339 yesterday.

- Downward dogs: A truckload of hot dogs spilled onto Interstate 83 in Pennsylvania on Friday, causing traffic congestion and taking crews (without the help of Joey Chestnut) hours to clean up.

|

|

|

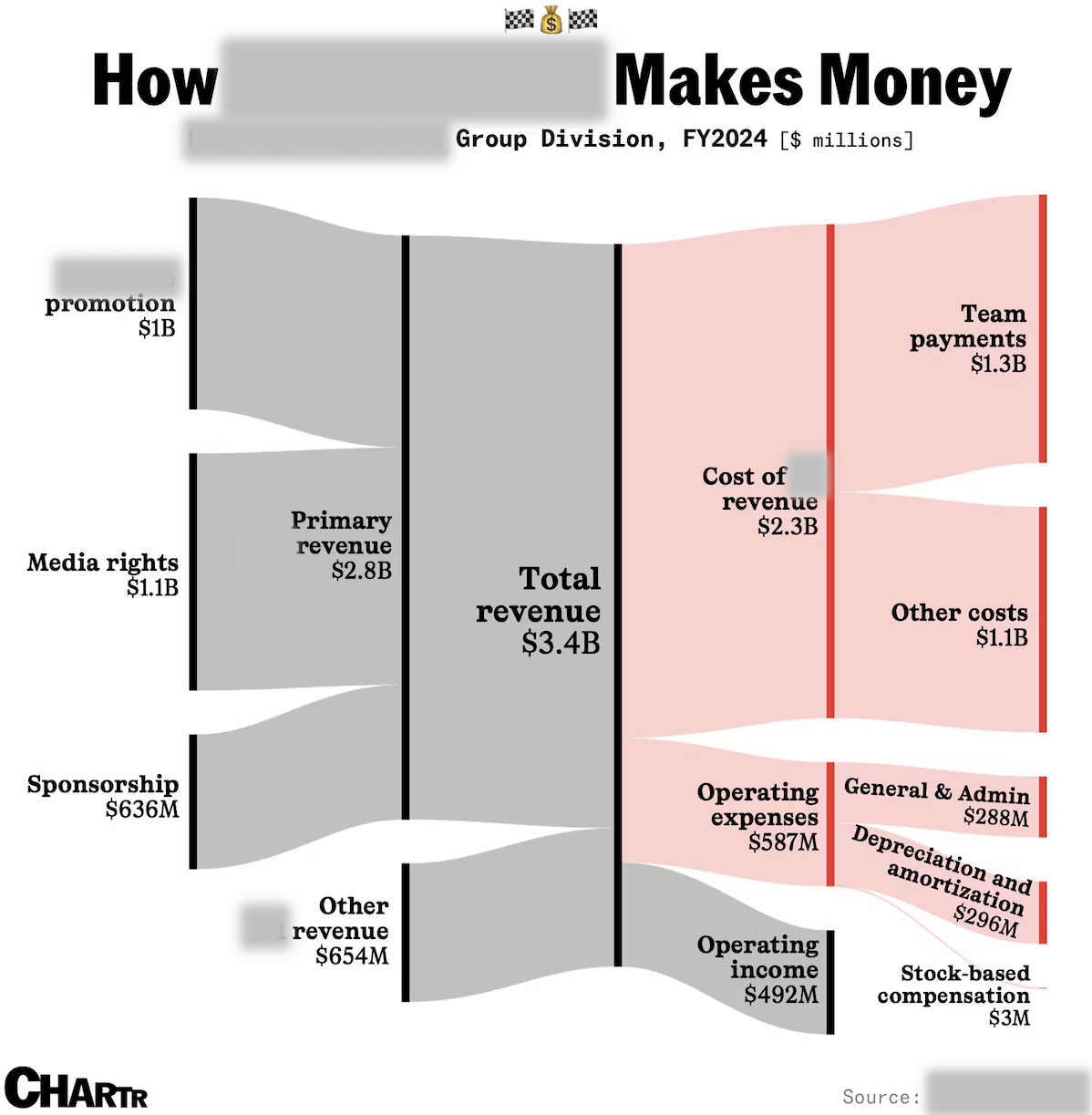

Off the charts: The 2024 financials of the owner of which sport are visualized below? [Answer below]. |

Not a subscriber? Sign up for free below. |

Advertiser's disclosures: 1 No Advice on Investment; Risk of Loss: Prior to making any investment decision, each investor must undertake its own independent examination and investigation, including the merits and risks involved in an investment, and must base its investment decision – including a determination whether the investment would be a suitable investment for the investor – on such examination and investigation. Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not currently backed nor supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies, stocks, or bonds. Trading in cryptocurrencies comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks and risk of losing principal or all of your investment. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. Cryptocurrency trading requires knowledge of cryptocurrency markets. In attempting to profit through cryptocurrency trading, you must compete with traders worldwide. You should have appropriate knowledge and experience before engaging in substantial cryptocurrency trading. Cryptocurrency trading can lead to large and immediate financial losses. Under certain market conditions, you may find it difficult or impossible to liquidate a position quickly at a reasonable price. The opinions expressed represent an assessment of the market environment at a specific time and are not intended to be a forecast of future events, or a guarantee of future results, and are subject to further discussion, completion and amendment. The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations. You should consult your accounting, legal, tax or other advisors about the matters discussed herein. |

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

| |

|

No comments:

Post a Comment