Hi! Dizzying heights: The Kelce brothers' "New Heights" podcast saw its daily YouTube viewership increase more than 147x week-over-week on Thursday, per Social Blade data. Now, to figure out why… Today we're exploring: |

- At a loose end: Clothing subscription service Stitch Fix is doubling down on AI.

- Tipple over: Americans' self-reported drinking falls to a record low as health concerns mount.

- Line to gain: Which NFL team is the most valuable franchise in the league?

|

Have feedback for us? Just hit reply - we'd love to hear from you! |

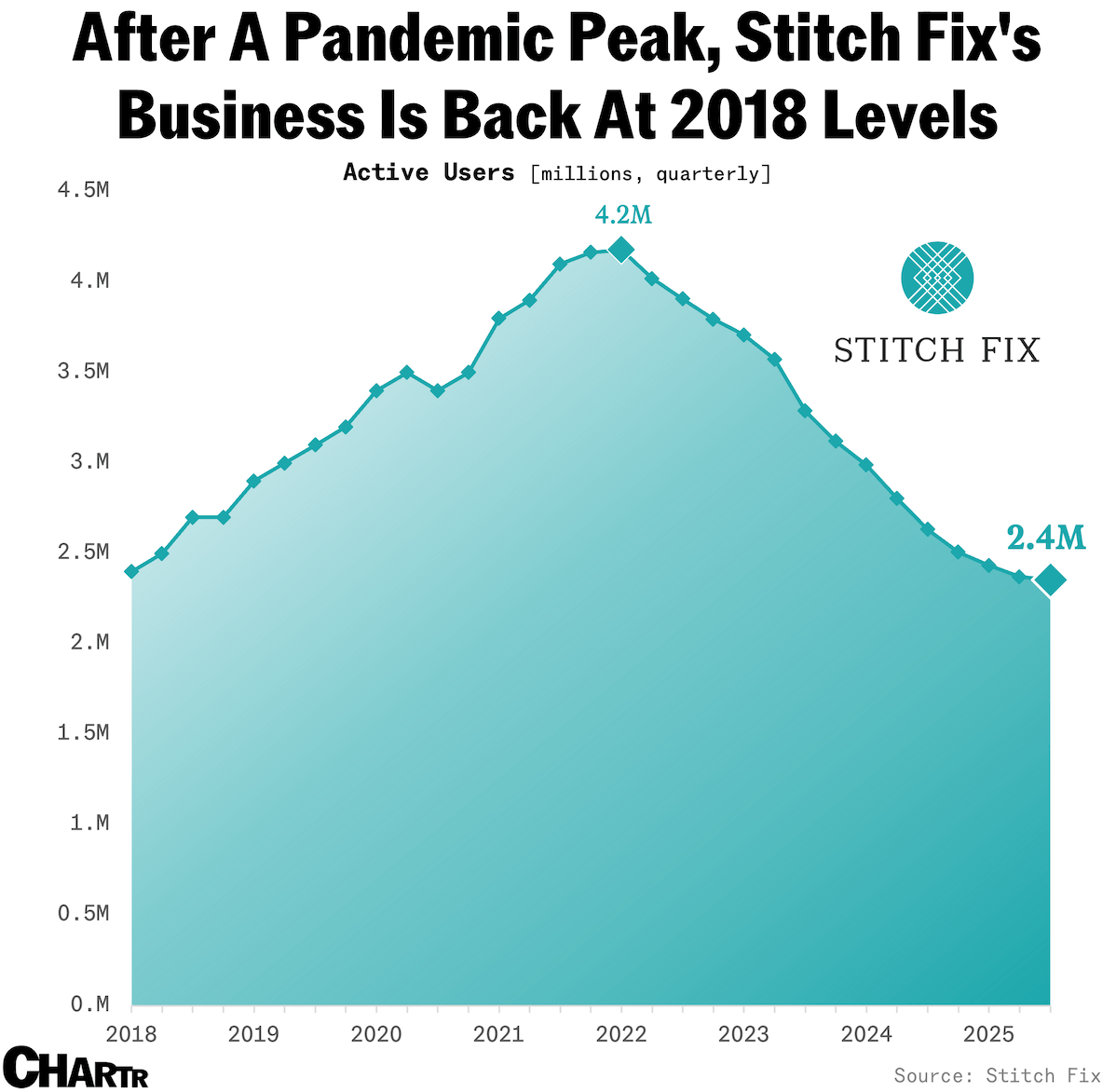

Stitch Fix, the online personal styling service that sends handpicked outfits to your door, has had a rough few years. Founded in 2011, the company's relatively narrow appeal — to those who didn't like clothes shopping and didn't want to choose what they wore — widened massively during the pandemic, as shops shuttered and fashion went online. But as quickly as the hype came, it disappeared: SFIX stock dropped more than 90% between January 2021 and the summer of 2022, as customers ditched the platform for rival subscriptions, or just went back to shopping in real life again. There are some positive signs, however, as the company posted its first top-line growth in three years, with net revenues climbing 0.7% year over year in its latest quarter. Unfortunately, though, its key active user figure is still falling. From a pandemic-era peak of 4.3 million users, the company now counts a threadbare 2.4 million as of the end of May. |

Now the company — which makes money by charging a $20 styling fee for all "fixes" alongside the clothes themselves — is hoping AI can help drive growth. This week the company announced a new AI "Style Assistant" for clients, as well as new AI-powered visual tools to help you see what you might look like wearing that new scarf, sweater, or T-shirt. Will millions of people rush out to ask a bot's opinion of how they look in their new clothes? Considering that many already use AI as a therapist, a romantic partner, or a career counselor, it doesn't feel like much of a stretch to think they'd also ask it for fashion advice. The problem SFIX might run into is: what if ChatGPT, DeepSeek, or Claude can also do this — will people open a separate AI app just for fashion? Stitch Fix's new boss, Matt Baer, who was tasked with fixing the company when he became CEO in June 2023, is betting the answer is yes. |

Americans' self-reported drinking is at the lowest level since 1939 |

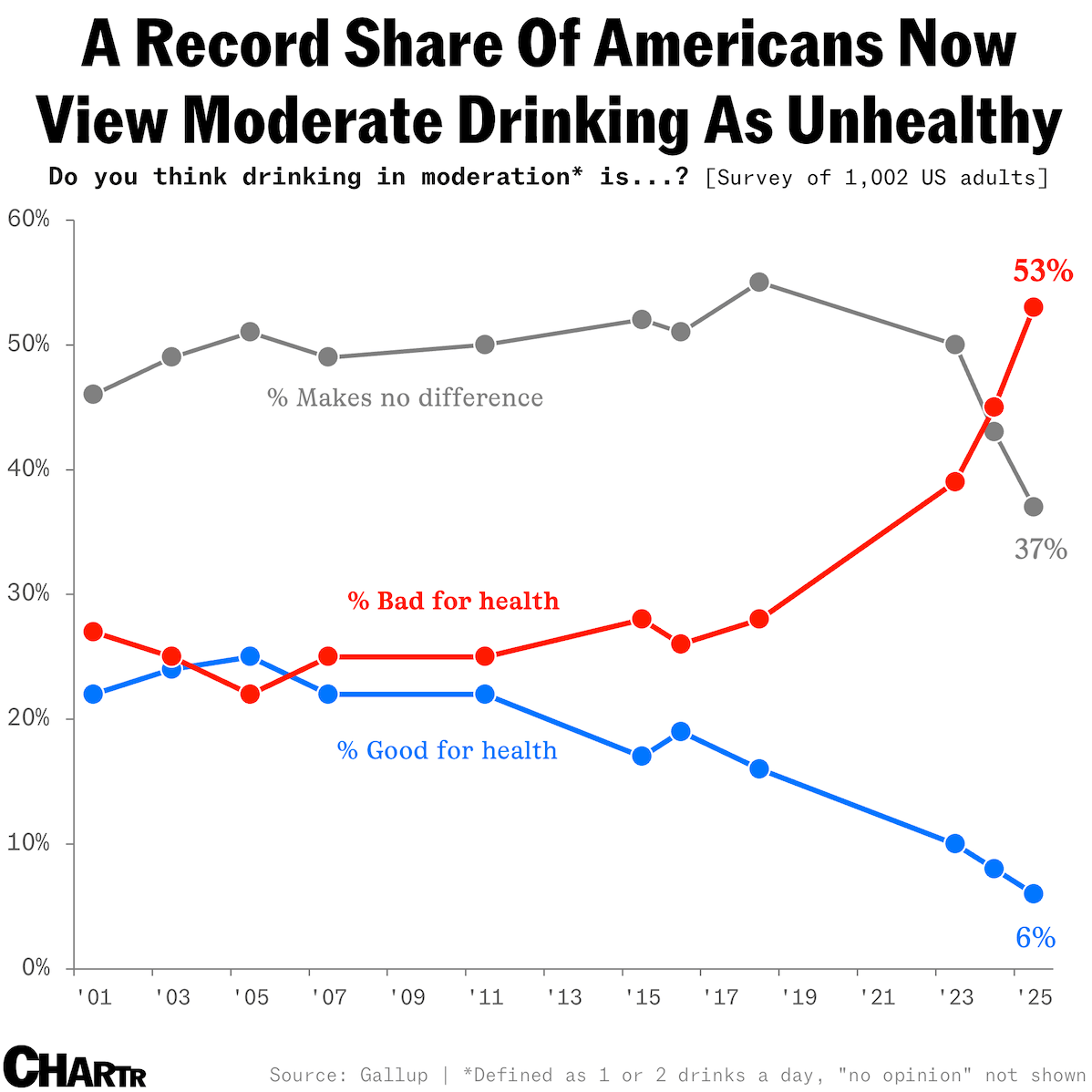

As the state of US healthcare morphs at a rapid clip, more Americans are wrestling with the physical risks of one of the nation's most storied pastimes: drinking. The share of adults in the US that report consuming alcohol has fallen to 54% in 2025, according to a new Gallup survey released Wednesday. That marks the lowest share the survey has ever recorded, with at least 60% of respondents from 1997 to 2023 reporting drinking.

One factor driving the trend of alcohol abstinence is that attitudes toward the health effects of drinking have shifted dramatically. For the first time in the survey's history, a majority of Americans (53%) now view drinking in moderation as unhealthy, while the share of those who considered it good for one's health is at a record low of 6%. |

Though alcohol may be a notable gap in the "Make America Healthy Again" agenda, new research outlining the risks associated with both excessive and moderate alcohol use — including a landmark report from the US surgeon general in January — has helped turn the tide on casual drinking for many in recent times. |

The same survey also found that young adults were more likely to consider moderate drinking as harmful, with two-thirds of 18- to 34-year-olds now agreeing that it's bad for health. While this is consistent with a broad decline in alcohol use among young people, there's still evidence to suggest that Gen Z might indulge in a drink or two despite the detrimental effects. |

|

|

Step into the Future with Nasdaq-100 Micro Index Options (XND®) |

- Compact Exposure: Engage with the NDX® at 1/100th notional size, offering flexibility without large commitments.

- Cash Settlement: Simplify transactions by settling in cash at expiration, eliminating the need for physical delivery of underlying assets.

- European Style Options: Exercise only at expiration, thereby eliminating early assignment risk.

- Tax Benefits: Enhance overall returns with potentially favorable tax treatment.

- Versatile Use: Generate income or manage risk through hedging against market volatility.

|

Explore how XND® index options can elevate your investment strategy. |

|

|

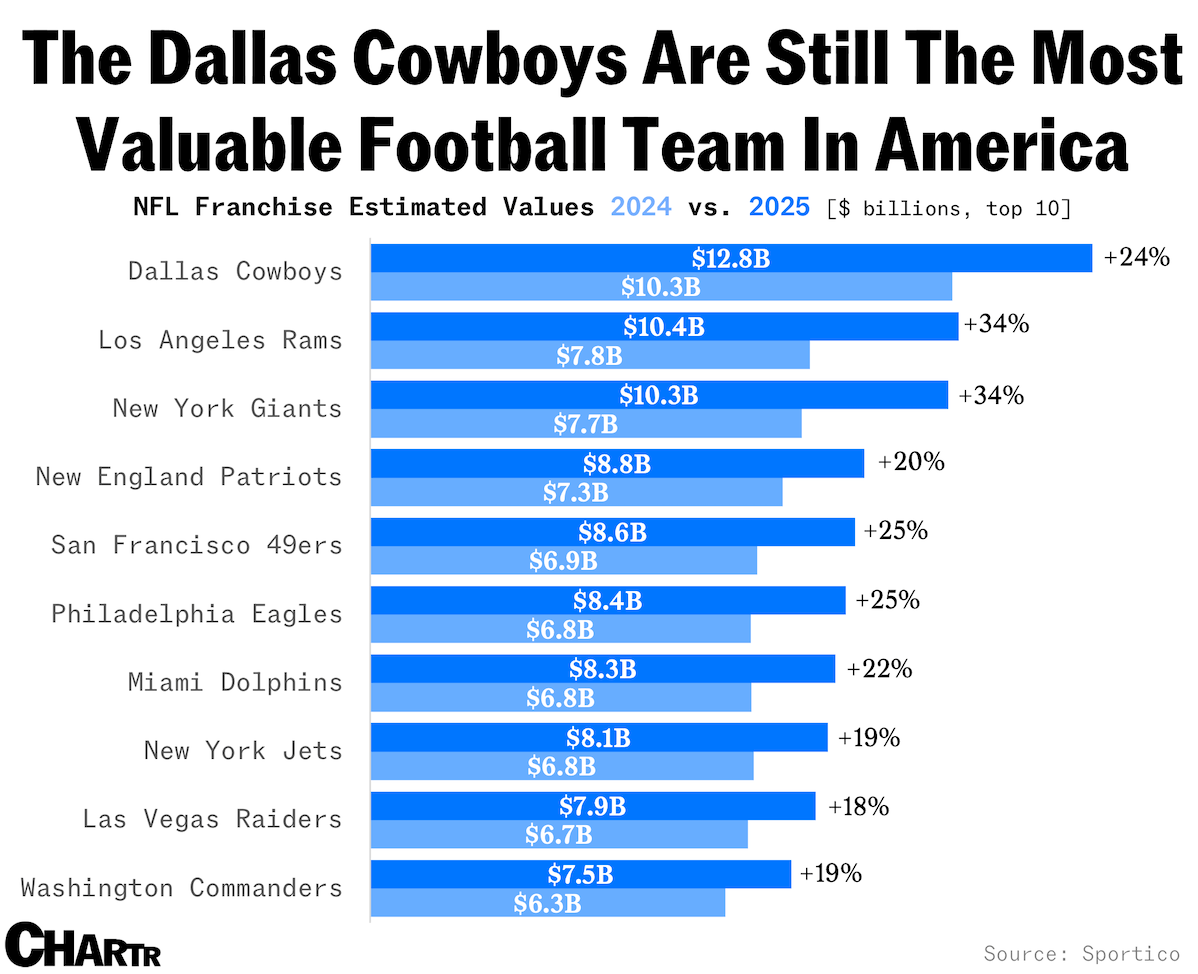

NFL franchise valuations have risen 20% in the last year |

We're now less than three weeks away from the opening game of the 2025-26 NFL season, when Super Bowl LIX champions, the Philadelphia Eagles, will take on the Dallas Cowboys to get this year's action underway. Though the Eagles will be going into the game as the odds-on favorite, there's no competition between the two when it comes to the size of the franchises off the field. Per the latest annual NFL franchise valuation figures from Sportico released earlier this week, the Dallas Cowboys are (again) the league's most valuable team by far — worth a staggering $12.8 billion, according to the publication's estimates. That's more than steak chain Texas Roadhouse ($11.5 billion), but some way off Texas Instruments ($176 billion). It's not just the Cowboys that have bloomed to become a huge, $10 billion+ business, though; the NFL's decision last August to open up the league to private equity dealmakers has seen two other sides join the 11-digit club and helped bump franchise valuation estimates by 20% on average over the past 12 months. | Sportico put the value of the Los Angeles Rams and the New York Giants at $10.4 billion and $10.3 billion, respectively, having both risen 34% each over the last year based on local and national revenues, wider transaction metrics, and team-specific multipliers. Climbing valuations across the board mean that the average NFL side is now worth $7.13 billion, compared to the estimated $4.6 billion average in the NBA — calculated before the approved $6.1 billion sale of the Boston Celtics made it the most expensive franchise in US sports history on Wednesday — and $2.82 billion in the MLB, from Sportico's figures. Read this on the web instead |

|

|

- UnitedHealth stock is soaring after Berkshire Hathaway disclosed that it purchased 5 million shares of the group, and Buffett wasn't the only high-profile billionaire buying up UNH.

- Makeup break-up: Target and Ulta Beauty have announced that their years-long deal, which has seen Ulta shops incorporated into nearly a third of Target's 1,981 US stores, will end next August.

- Shares of Bumble sank on Thursday on news that large shareholder Blackstone and the dating app's founder-and-CEO filed to sell more than 17% of the company.

- Retail giant Amazon is deepening its push into the grocery game, announcing Wednesday that Prime members can now get free same-day grocery delivery.

- Meanwhile, in Florida… A local woman claimed the $10,000 grand prize at the Florida Python Challenge after catching 60 invasive Burmese pythons.

|

|

| XND® index options offer a streamlined way to engage with the dynamic Nasdaq-100 Index (NDX®) at 1/100th notional size, offering flexibility without large commitments. Explore XND® index options.. |

|

|

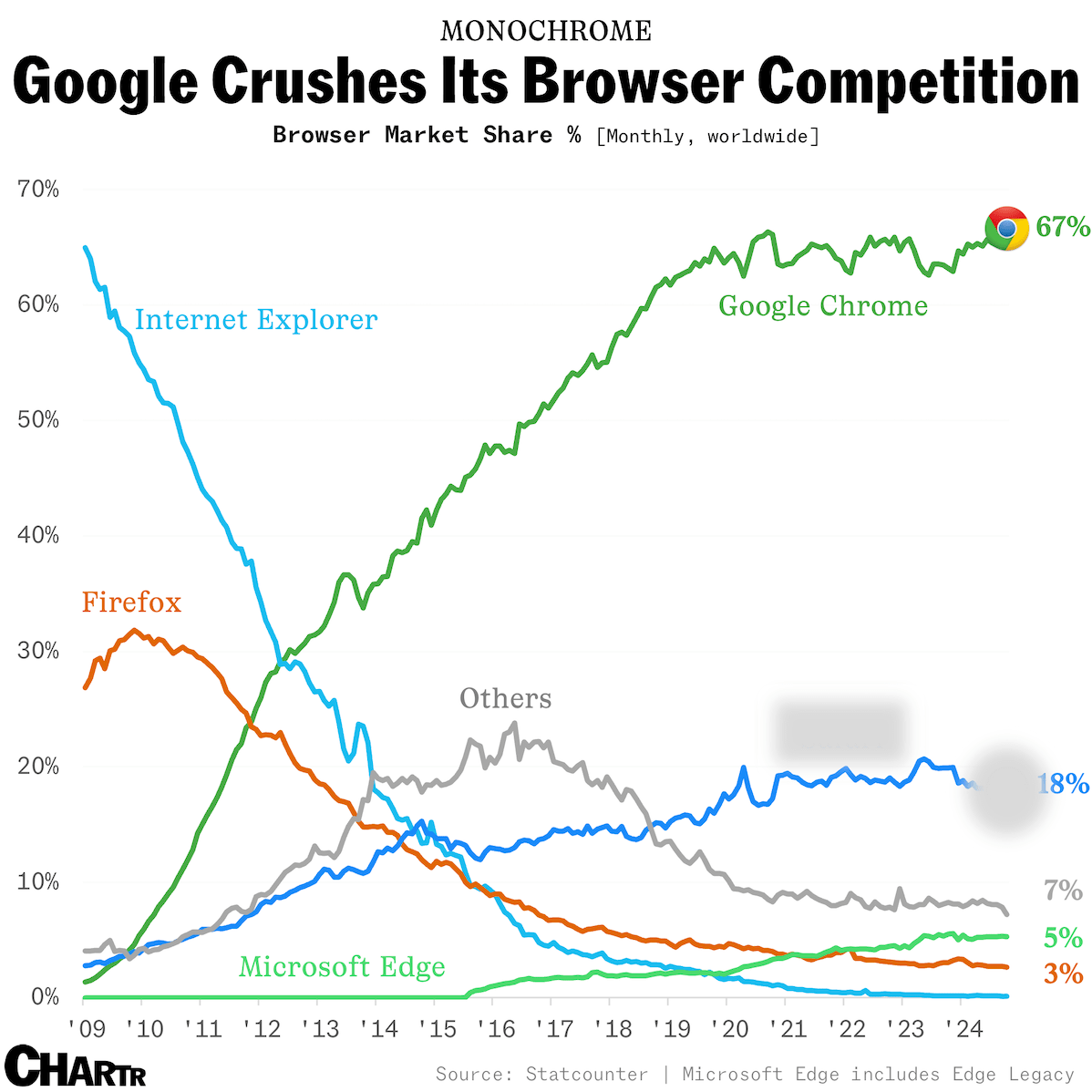

Off the charts: Perplexity made an unsolicited $34.5 billion bid for Google Chrome, the biggest browser by market share, this week — but which web browser comes at a distant second? [Answer below]. |

Not a subscriber? Sign up for free below. |

Advertiser's disclosures: Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or digital asset or any representation about the financial condition of any company. Additionally, nothing contained herein should be construed as tax advice. Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security, digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or digital asset or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. Investing in options carries unique risks. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. |

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment