You should spend less time on ChatGPT, according to *checks notes* ChatGPT. OpenAI announced that it will start gently encouraging users to take breaks during long sessions. Though this is ostensibly for the benefit of its users' mental health, OpenAI has also said it's losing money even on its most expensive $200 per month subscriptions because people are using it too much and, opposite to all other online behaviors, being too polite. Bad economic news was bad news for stocks, which slumped to their lows of the day after the ISM Services Index reading came in at 50.1 in July, while economists had been looking for 51.5. Major indexes clawed back some of their losses but still ended mostly in the red, with the S&P 500 off 0.5% and the Nasdaq 100 down 0.7%, while the Russell 2000 bucked the trend with a 0.6% advance. |

|

|

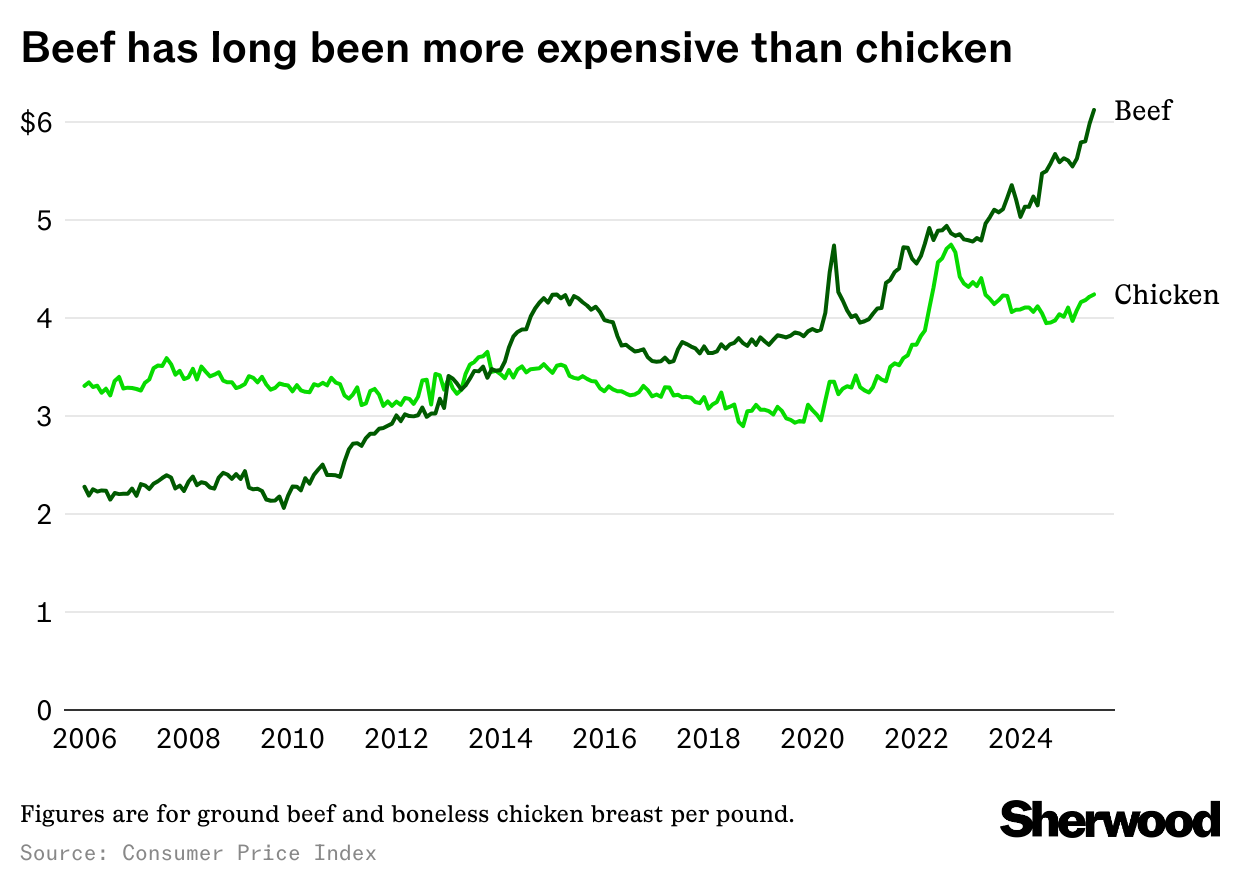

As this email hits your inbox, McDonald's will be reporting its quarterly earnings (the call is scheduled for 8:30 a.m. Wednesday) and investors will be hoping it doesn't suffer the fate of competitor Yum! Brands, the parent company of KFC, Pizza Hut, and Taco Bell. The conglomerate missed expectations yesterday amid a slowdown in consumer spending, especially at KFC, as competition in the chicken arena heats up, with chains like Chick-fil-A and newcomers like Raising Cane's, Dave's Hot Chicken, and Church's Chicken clucking at its heels. Well, McDonald's isn't sitting out the chicken fight, and has brought back the "most requested" discontinued item of all time: the Snack Wrap. While we haven't yet listened to the call to see if the move was a success, days after the item re-hit menus, the wraps were selling so well that McDonald's stores were reportedly running out of lettuce. But the Snack Wrap isn't just about appeasing a rabid fan base; it's a weapon in one battle of the Fast-Food Chicken Wars, the winner of which will feed Americans' insatiable appetite for the bird and make money doing so. |

|

|

In 2025, chicken still rules the roost, but its fixture in the humble wrap and its sheen of somehow being a healthier fast-food option speaks to a consumer culture that's currently obsessed with protein, wary of carbs, and constantly snacking instead of relying on full meals. And with a seemingly unshakable sense of financial anxiety swirling, the allure of a well-priced wrap reflects a consumer base that is nervous, nostalgic, and hungry for a tasty value. |

|

|

Big Opportunities. Micro Size. |

- Compact Exposure: Engage with the NDX® at 1/100th notional size for flexibility.

- Cash Settlement: Simplify transactions by settling in cash at expiration.

- Tax Benefits: Enhance overall returns with potentially favorable tax treatment.

- Versatility: Generate income or manage risk through hedging against market volatility.

|

|

|

After months of strong showings, July's job numbers came in weak, with the US adding just 73,000 jobs last month, far below the 104,000 forecast. But the bigger surprise came after the print, as President Trump fired BLS Commissioner Erika McEntarfer (who was confirmed last year by a bipartisan Senate vote of 86 to 8), asserting that the job data was "rigged" to discredit his administration. It wasn't just the July data that led to this declaration, but also the sharp downward revisions BLS released for May and June, which slashed a combined 258,000 jobs from earlier estimates. That dragged the average job gain over the past three months to just 35,000 — the weakest since the early days of the pandemic and a stark reversal from the solid labor market momentum seen last month. That does seem like a wild drop! But revisions are a routine part of the BLS releases, as the agency updates its numbers as more employer data rolls in and other adjustments are made. Just how unusual are major revisions like the one we just saw? This chart has the answer. While the numbers far exceed the typical monthly average revision, they're not without precedent. And to further assure that the underlying data is good, Ernie Tedeschi, former chief economist at the Council of Economic Advisers, noted that "BLS's first-release estimates of nonfarm payroll employment have gotten more, not less, accurate over time." |

|

|

The revisions were undoubtedly larger than usual, but there is no evidence of any foul play. A Trump-appointed former BLS commissioner, William Beach, told ABC News that it's "impossible" for a BLS commissioner to manipulate the data and that it's more likely it signals a turning point in the economy. The bigger worry for economists is that the firing could erode trust, with JPMorgan's chief economist issuing a stark warning on "the risk of politicizing the data." |

|

|

Yesterday's Big Daily Movers |

- Pfizer rose after reporting earnings results that beat Wall Street's estimates and raising its full-year outlook

- Navitas Semiconductor, a tiny semiconductor company that went parabolic in late May, tumbled after reporting second-quarter results

- Galaxy Digital Holdings slumped following misses on both Q2 revenue and earnings per share

- Strong earnings from Palantir drove the stock to its best day since Trump's first turn away from massive tariffs on April 9

- CRISPR shares fell 7% after the gene-editing company's Q2 results didn't meet expectations

|

|

|

- Earnings expected from McDonald's, Novo Nordisk, Disney, Uber, Lyft, Shopify, DraftKings, AppLovin, DoorDash, Airbnb, IonQ, e.l.f., Jack in the Box, and Joby Aviation

|

Advertiser's disclosures:

1 Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or digital asset or any representation about the financial condition of any company. Additionally, nothing contained herein should be construed as tax advice. Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security, digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or digital asset or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. Investing in options carries unique risks. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. |

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to Snacks and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and The Wrap for quality reads. |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment