Hi! T.S. I Love You: Taylor Swift and Travis Kelce shocked the world with their engagement announcement on Instagram yesterday — naturally, diamond ring stocks shone in the immediate aftermath. Today we're exploring: |

- New deal: Existing homes, weirdly, are now more expensive than new builds.

- Solar opposites: The US and China are taking different energy tacts.

- Take a gander: Outerwear giant Canada Goose is attracting ~$1.4 billion take-private offers.

|

Have feedback for us? Just hit reply - we'd love to hear from you! |

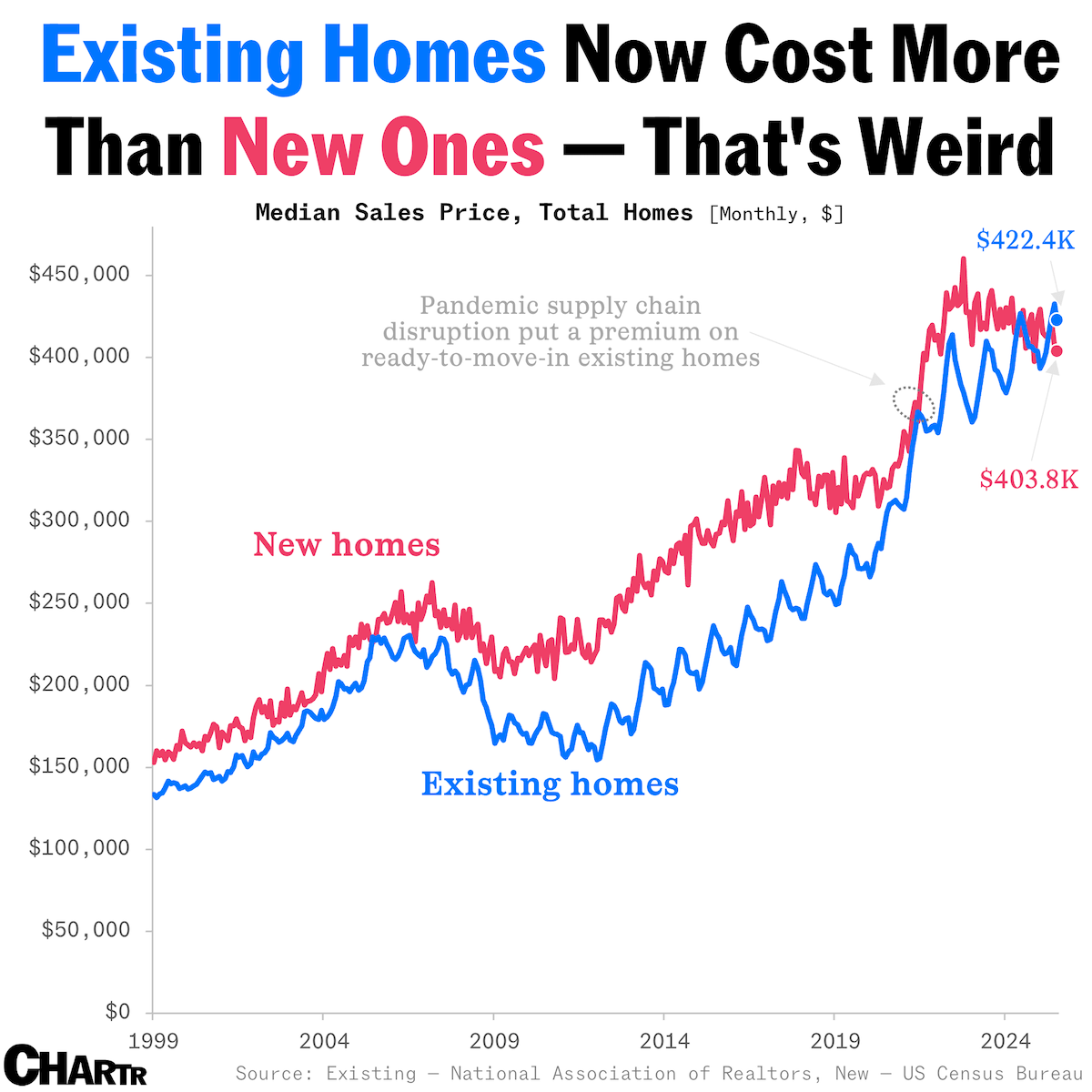

Existing homes are now more expensive than new ones... That's not normal. |

New cars cost more than old ones. And, despite ownership cycles that are decades longer, houses tend to be the same in America, with newly built homes usually 15-20% more expensive than existing ones. But, in a rare reversal of historic trends, that's no longer true. Marrying two datasets from the Census Bureau and the National Association of Realtors reveals that the median $403,800 sales price of new homes was lower than the $422,400 median price of existing homes nationally as of July. |

Harder, better, cheaper, newer? |

Exactly why this is happening is complex. The short answer is that there's simply way too many newly completed homes. As of July, the inventory of unsold new homes on the market would take more than nine months to clear, the highest level in 15 years excluding the pandemic, compared to the 4.6-month supply of existing homes. To attract buyers and trim their overflowing inventories, homebuilders are adding discounts to new home deals, like mortgage rate "buydowns" of about 5% on average — even if it hurts their margins. In fact, a record 38% of builders said they cut home prices in July, per the National Association of Home Builders. Existing homeowners, however, aren't feeling as flexible on price, probably because for most of them, moving would involve reentering the mortgage market and giving up the cushy rate they might have secured during the pandemic. With no incentive to move out, America's existing home sales hit their slowest pace in nearly three decades last year, with homeowners experiencing the strongest mortgage "lock-in effect" since the 1980s. |

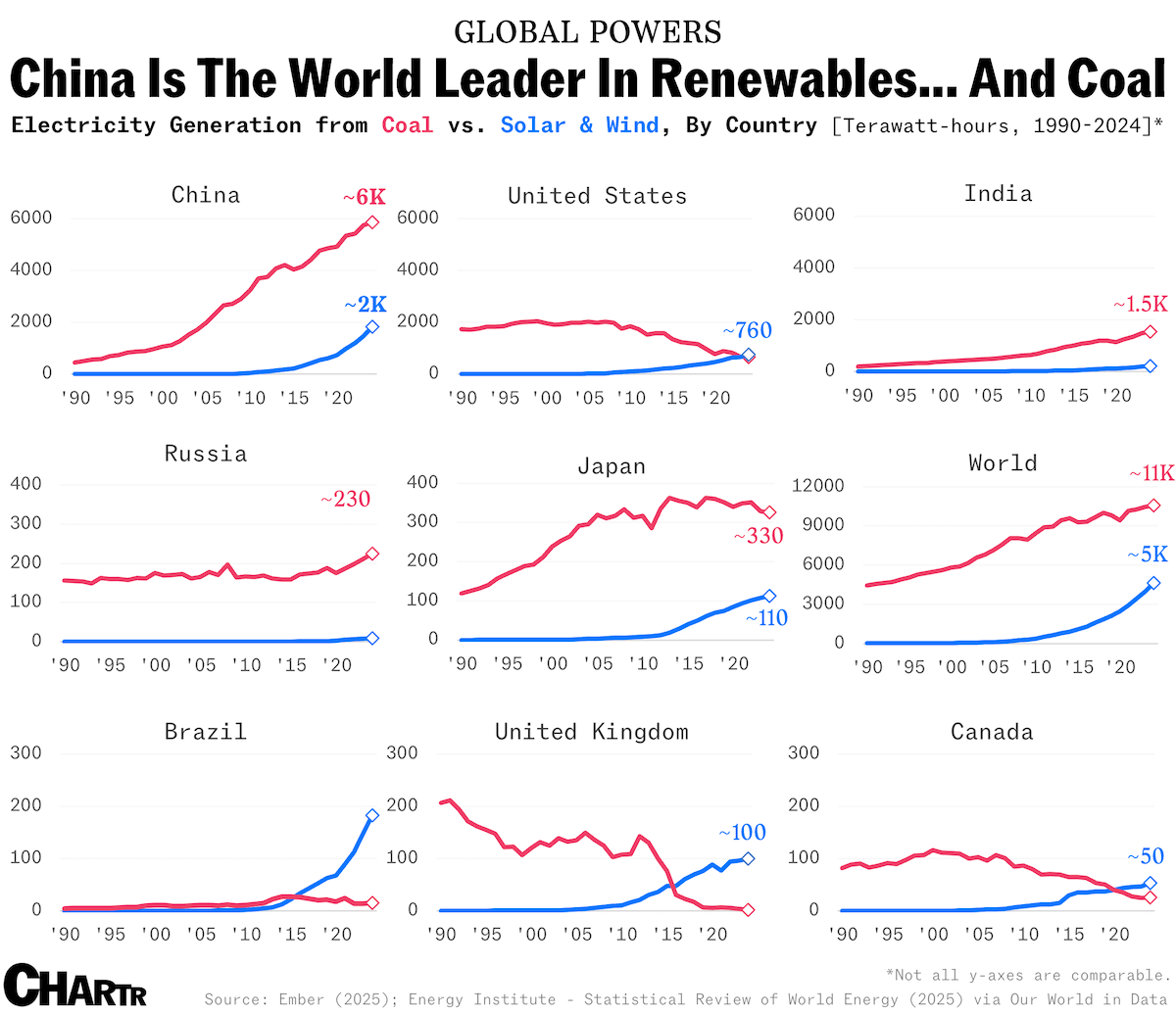

China is driving renewable energy growth globally — it's also the world's biggest coal producer |

The state of renewable energy in 2025 can be described by paraphrasing Charles Dickens: it's the best of times, it's the worst of times. Yesterday, new research from BloombergNEF outlined that while global investments in renewable energy are hitting new highs, reaching a record $386 billion in the first half of 2025, expenditure on renewable projects in America is slumping. Indeed, the US saw the greatest drop in new renewable energy investment of any country in that period, with committed spending down by $20.5 billion (-36%) from the latter half of 2024. |

America's shift from renewables is in line with the Trump administration slashing subsidies. But, at the global level, the future of energy still largely rests on China, the biggest energy consumer, which is continuing to build its renewables capacity despite pressure from lower power prices. Just last month, Chinese officials showed off a new solar farm that they claim will be the world's largest when completed, covering a projected 235 square miles, according to the AP — roughly the size of Chicago. Indeed, even though BloombergNEF found that China's renewables investment contracted in H1 2025, the region still made up 44% of all new investment globally. |

While China currently accounts for a third of global power demand, it's straddling both sides of the energy divide. It's simultaneously the biggest producer of clean energy and the biggest carbon emitter; it's leading the charge in renewable energy investment, and it's approving coal production projects at a rapid clip, starting construction on 94 gigawatts of new coal power capacity last year alone. Whether China edges closer towards its goal of net carbon neutrality by 2060, or leans more on carbon-emitting sources, we will see its giant contradictory energy plights go head-to-head in years to come. |

|

|

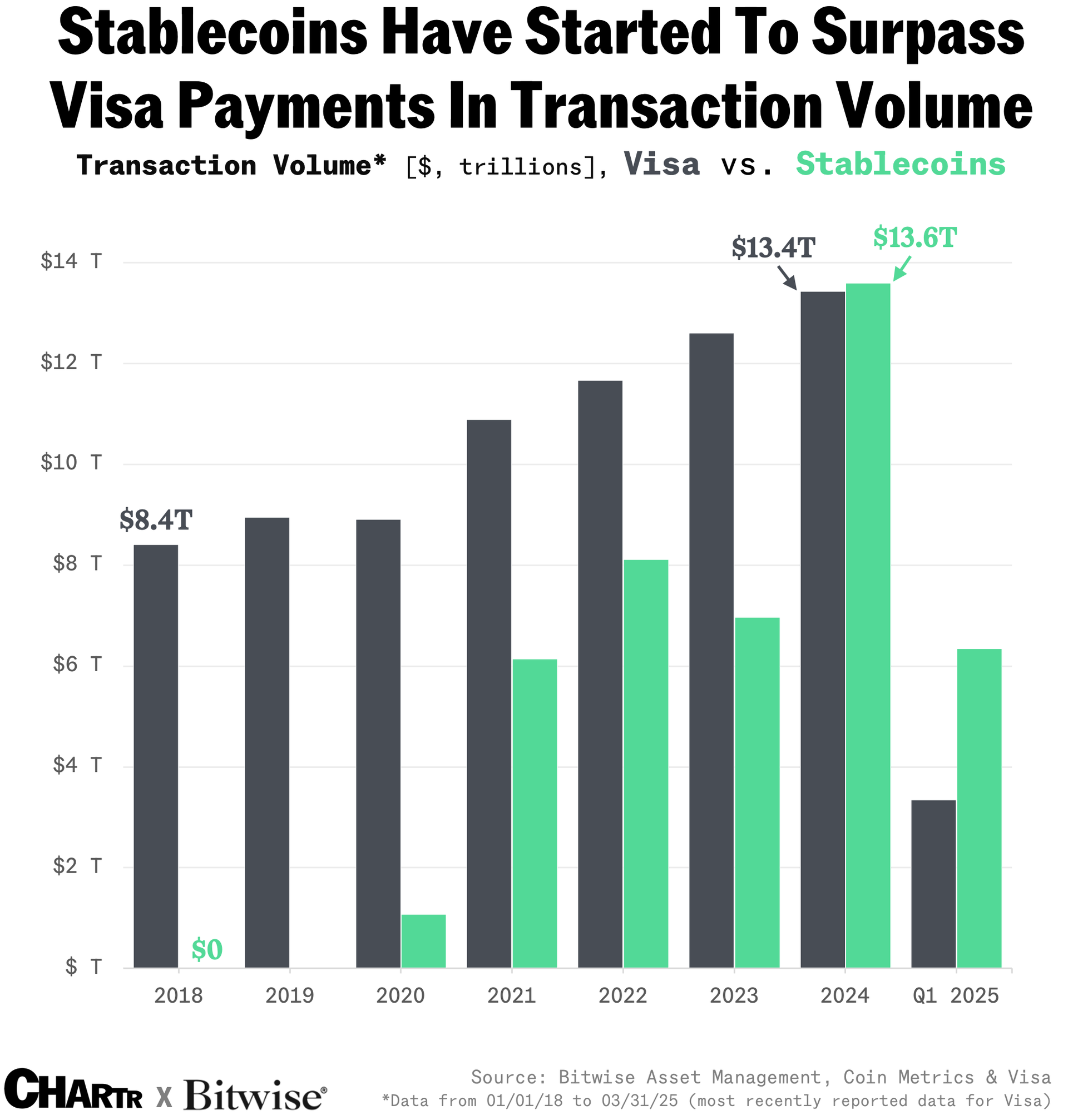

The biggest stories in crypto, charted. |

Stablecoins are one of the killer apps of crypto. They're digital representations of the U.S. dollar that move over blockchains like Ethereum. While bank wires take 24 hours, stablecoins settle in seconds— the same time it takes to send a text. Stablecoins only started getting off the ground in 2019. Last quarter, they were used in more than $6 trillion worth of transactions. And Congress just passed a historic stablecoins bill that aims to make them more secure and trustworthy. |

Expect to see a lot more people and businesses pay for things with stablecoins. For this and more of the biggest stories moving crypto markets, check out the Bitwise Crypto Market Review— 60+ charts and tables created by the specialists at Bitwise. |

|

|

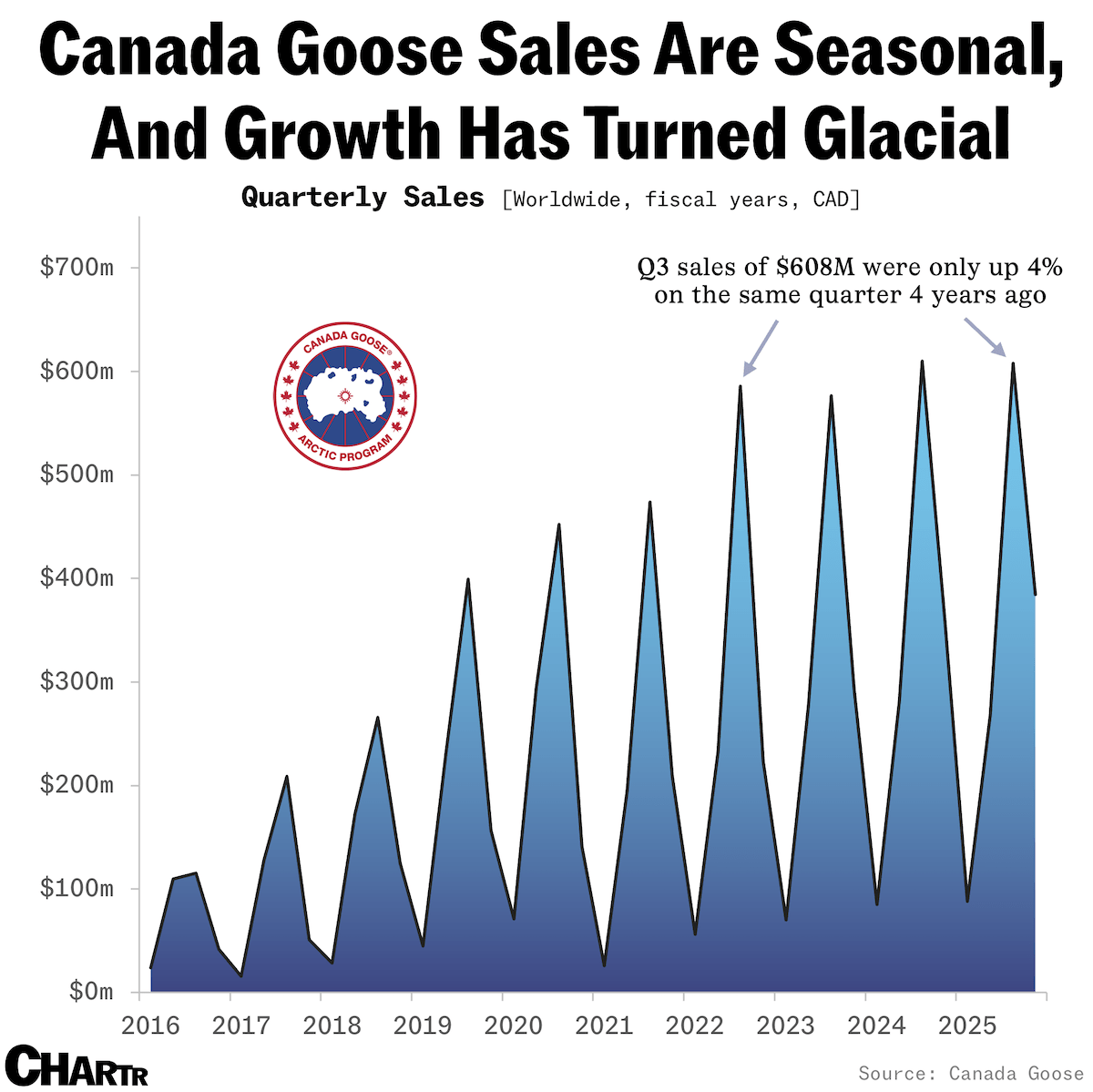

Prospective buyers are flocking to Canada Goose with take-private bids worth almost $1.4 billion |

As summer comes to an end, people are starting to pull cold-weather clothes from the backs of their wardrobes… and now, it looks like several private equity firms are following suit, eyeing up Canada Goose. Following reports that Canada Goose's controlling shareholder, Bain Capital, is trying to offload the luxury parka-maker, a flurry of offers have rolled in from the likes of Boyu Capital and Advent International, per CNBC — with some bids valuing the company at almost $1.4 billion, sending the stock up 13% in early trading on Wednesday. |

Dating back to 1957, Canada Goose is best known for its feather-lined parkas, originally designed for arctic conditions. Now a high-end, heat-keeping staple beloved by celebrities and film set workers alike, the coats retail at just under $1,500 apiece. But only so many people can afford that price tag — which is perhaps why sales growth has recently ground to a halt. |

A top priority for any potential buyer will be to pad out the company's sales again, particularly in struggling markets like China, where revenue dropped ~2% for the year ending in March. That was in stark contrast to the 47% sales jump it saw the year before. Another concern will be diversification. Indeed, as a winterwear specialist, GOOS's sales nosedive in the warmer months — something the company is desperate to change. Per the WSJ, Canada Goose is planning to expand its product line to become a "broader luxury player," hoping that items such as $450 sunglasses and $400+ shoes will help to balance out earnings year-round and draw in new customers with lower price points. Of course, this isn't the first time Canada Goose has attempted to modernize: the brand famously went fur-free back in 2022 after years of criticism from animal rights activists. |

|

|

- A whistleblower claimed that a former DOGE official compromised the Social Security numbers of over 300 million Americans after copying them to a private section of the agency's cloud.

- Cracker Barrel jumped 7% early on Wednesday, as the Southern-themed restaurant chain said it'll be switching back to its old logo.

- Gambling logos and adverts were displayed roughly every 13 seconds during this year's Stanley Cup finals, per a new study.

- For EU Page: TikTok revenues in Europe, the UK and Latin America hit $6.3 billion in 2024, up 38% from the year before.

- YouTube's been the biggest thing on television for half a year straight now, having widened its lead over competitors with a 13.4% share of TV usage in July.

|

|

|

- A great data viz-filled article on global inequality from Our World in Data.

- Corruption, inflation, and political division are the top 3 issues Americans are most likely to categorize as "very serious problems" in the US today, according to a new YouGov survey.

|

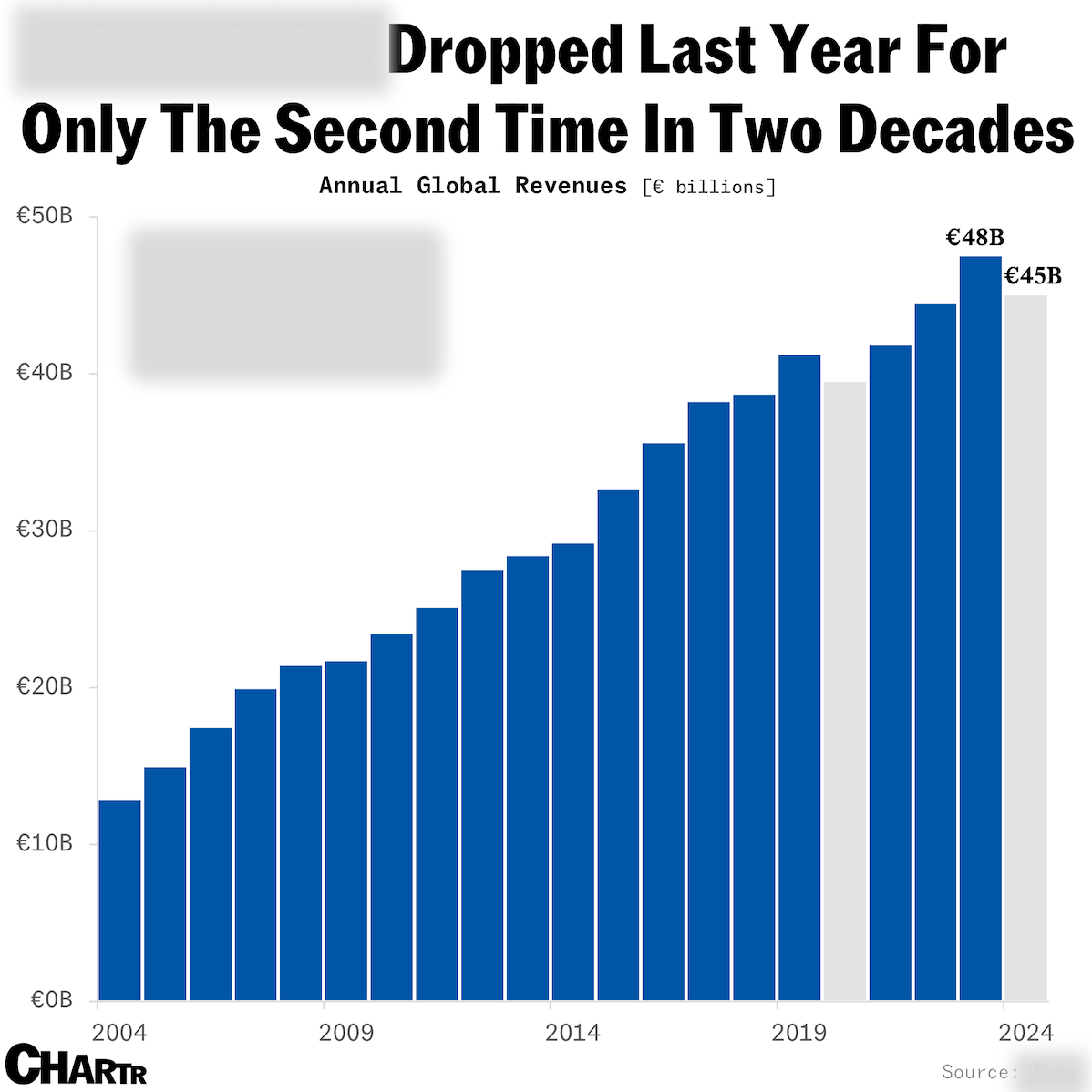

Off the charts: Which company, where sales fell last year for the first time since the pandemic, is bringing out a serving dish specifically designed to fit 11 pieces of its iconic spherical snacks? [Answer below]. |

Not a subscriber? Sign up for free below. |

Advertiser's disclosures: 1 No Advice on Investment; Risk of Loss: Prior to making any investment decision, each investor must undertake its own independent examination and investigation, including the merits and risks involved in an investment, and must base its investment decision – including a determination whether the investment would be a suitable investment for the investor – on such examination and investigation. Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not currently backed nor supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies, stocks, or bonds. Trading in cryptocurrencies comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks and risk of losing principal or all of your investment. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. Cryptocurrency trading requires knowledge of cryptocurrency markets. In attempting to profit through cryptocurrency trading, you must compete with traders worldwide. You should have appropriate knowledge and experience before engaging in substantial cryptocurrency trading. Cryptocurrency trading can lead to large and immediate financial losses. Under certain market conditions, you may find it difficult or impossible to liquidate a position quickly at a reasonable price. The opinions expressed represent an assessment of the market environment at a specific time and are not intended to be a forecast of future events, or a guarantee of future results, and are subject to further discussion, completion and amendment. The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations. You should consult your accounting, legal, tax or other advisors about the matters discussed herein. |

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment