Consumers are buying now and returning later: product returns cost the retail industry an estimated $890 billion last year, as return rates have more than doubled since 2019 and the associated costs have risen even more. As for the demographics primarily responsible, higher-income shoppers are returning items at nearly twice the rate of lower-income households, but one generation has the lowest return rate — unless it's for electronics. After stocks ended last week with their best day in months, they took a breather Monday, ending near session lows. The S&P 500 fell 0.4%, the Nasdaq 100 gave back 0.3%, and the Russell 2000 was at the bottom of the pack with a decline of about 1%. Within the S&P 500, there were 299 more losers than gainers, the most broadly negative day in over a month. The US dollar dropped and S&P 500 futures dipped after US President Donald Trump posted a letter to Truth Social saying he had fired Fed Governor Lisa Cook effective immediately. Both pared much of their losses, but it remains to be seen how traders will fully react to the president's most pointed attempt yet to reshape the upper echelon of US monetary policy decision-makers. |

|

|

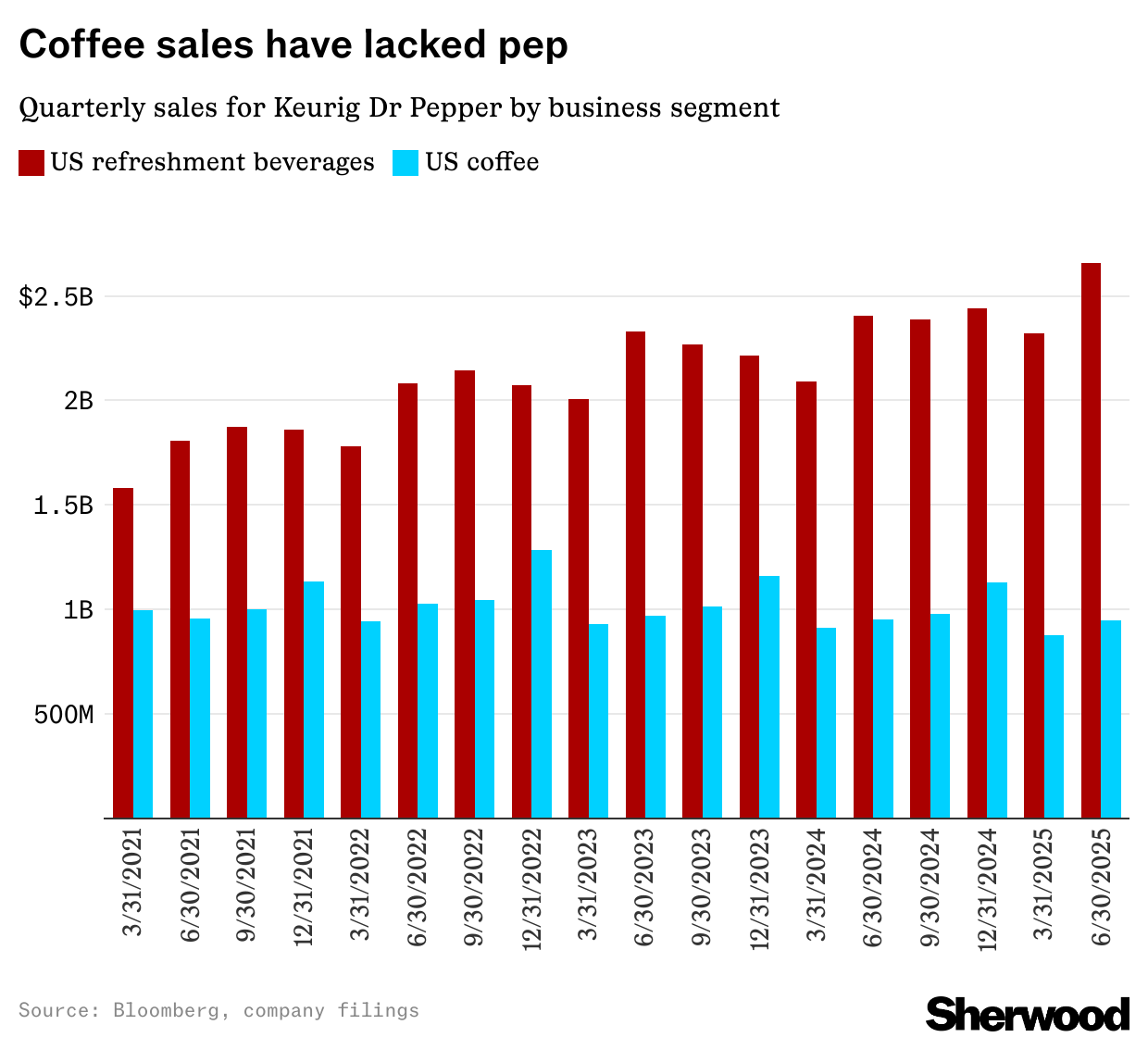

Seven years ago, a deal was made, and Dr Pepper Snapple Group merged with Keurig Green Mountain to become the diversified beverage giant Keurig Dr Pepper. Sure, the city fathers clucked their tongues and stroked their beards and wondered, "Are you really sure that it makes sense to be both a coffee company and a soft drink company," or perhaps, "Those really don't seem like similar products is all I'm saying," and naturally, "I don't see a lot of supply chain efficiencies across those two product lines," but the companies defied the haters and merged. Well, you really do have to hand it to the haters — they nailed it. They were totally right on this one. |

- Keurig Dr Pepper has announced a plan to buy Dutch-based JDE Peet's NV for 15.7 billion euros (or roughly $18.4 billion) in an all-stock deal.

- It will then cleave itself in two, separating the newly combined company's coffee and other refreshment drinks into stand-alone entities. One company will sell coffee; another will sell soft drinks. You know, just like seven years ago.

- "Upon separation, Global Coffee Co., with approximately $16 billion in combined annual net sales, will be the world's largest pure-play coffee company," Keurig said in a press release.

|

Investors appear to dislike this development, with the stock at the bottom of the S&P 500 and finishing the day down 11.5%. |

|

|

If there's one persistent trend of the past few decades, it's that markets abhor a conglomerate. Companies that try to have a diversified portfolio are often judged not by the strongest business in that portfolio but rather the weakest card in their hand. Keurig Dr Pepper is a strong fizzy beverage company with a struggling coffee business, and by splitting apart, presumably it hopes that investors will more appropriately value its cold bev biz. |

|

|

Osteoarthritis + Cancer: One Drug May Treat Two Diseases, You Can Invest |

The minimum investment is $501. |

|

|

PDD Holdings — the parent company of Temu, best known for offering low-cost consumer goods through the mail — reported earnings, with revenues of nearly 104 billion yuan ($14.5 billion) modestly exceeding expectations and adjusted diluted earnings per share of 22.07 yuan ($3.08) crushing estimates for 15.50 yuan. Unfortunately for them, "low-cost consumer goods" is more of a pre-tariff phenomenon, and even the "through the mail" bit is getting dicey. |

- During the conference call, co-CEO Jiazhen Zhao cautioned that this was more of a bumper quarter for the bottom line.

- "We do not believe this quarter's profit levels are sustainable," he warned, with other executives citing positive e-commerce seasonality as a factor juicing these results.

- Over the course of the quarter, PDD Holdings had to grapple with the end of the "de minimis" exemption that allowed inexpensive shipments to come into the US duty-free. Moving forward, packages of any value are going to get hit with tariffs, which is a problem when your American business was built on cheap packages avoiding that.

|

|

|

So, how bad is the death of de minimis going to be? "While margins are unlikely to return to prior highs, early signs suggest profitability may prove more resilient even as the company sustains investment and prioritizes long-term growth over short-term gains," Bloomberg Intelligence senior industry analyst Catherine Lim wrote. |

|

|

Rumors regarding changes to marijuana regulation have been some of the largest catalysts for price movement in cannabis companies' stocks. Recently, a report that President Trump was "considering" reclassifying marijuana as a less dangerous drug boosted shares of Tilray, Canopy, and SNDL. Now even analysts are growing bullish on the future, upgrading price targets for two of those companies. |

|

|

Jumpstart your options journey |

The most powerful tool in any trader's toolbox is education. For the options-curious, we've created a beginner-friendly guide that helps dispel common options myths, explains options basics, and helps you understand how to turn your market opinions into options trades. Trade options with confidence. |

|

|

Yesterday's Big Daily Movers |

|

|

- Tesla's robots get the same treatment as its cars: cameras and video, forgoing expensive sensors like lidar and radar

- American Eagle's Sydney Sweeney boost isn't enough to offset tariffs

- Skinny, curved: the iPhone is finally getting a glow-up

- Elon Musk is suing Apple and OpenAI, accusing the iPhone maker of unfairly favoring ChatGPT in its App Store

- The Hustle is a must-read for innovators. Its daily newsletter delivers the latest stories in business and tech — what to learn from them, and how to capitalize. Join the more than 1.5 million innovators who start their day with The Hustle. Sign up today.

|

|

|

- July durable goods

- August consumer confidence

- Earnings expected from MongoDB and Box

|

Advertiser's disclosures:

1 The estimated global osteoarthritis (OA) market = TNF-alpha global sales x [ratio of OA prevalence to rheumatoid arthritis (RA) prevalence]. OA is 9x more common than RA. OA estimated market = $43B x 9 = $393B. 2 The minimum investment is $501 (167 units). This is a paid advertisement for Cytonics Regulation A+ Offering. Please read the offering circular and related risks on the Cytonics StartEngine page. Investing in private company securities is not suitable for all investors because it is highly speculative and involves a high degree of risk. It should only be considered a long-term investment. You must be prepared to withstand a total loss of your investment. Private company securities are also highly illiquid, and there is no guarantee that a market will develop for such securities. |

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to Snacks and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and The Wrap for quality reads. |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment