Hi! Window pain: Delta and United Airlines have been sued by passengers who were charged extra for "window seats" that turned out to face blank walls. Today we're exploring: |

- Speed bumps: Amazon's new deal with Hertz is bad news for used car seller Carvana.

- Identity crisis: A lot of people hate the new Cracker Barrel logo.

- Sides of the aisles: Walmart keeps its retail dominance as Target continues to slide.

|

Have feedback for us? Just hit reply - we'd love to hear from you! |

After an insane ride, Carvana is finally back on top. Now, Amazon is muscling further into its territory |

Whatever industry you're in, whether it's beauty or electronics, toys or groceries, there's one phrase you never want to hear: Amazon is getting into your line of business. So, on Wednesday, when car rental company Hertz announced that it will be selling its cars through Amazon's automotive retail platform Amazon Autos in selected cities, it's no surprise that investors touched the brakes on online used car retailer Carvana, which dipped ~2% the day after the news broke. For Hertz, which changes some 80% of its core rental fleet in the US within a year, the deal is a way to find extra buyers for its 500,000-plus fleet of used vehicles. Now, sites like Carvana will have to compete against the Amazon network for Hertz's supply. |

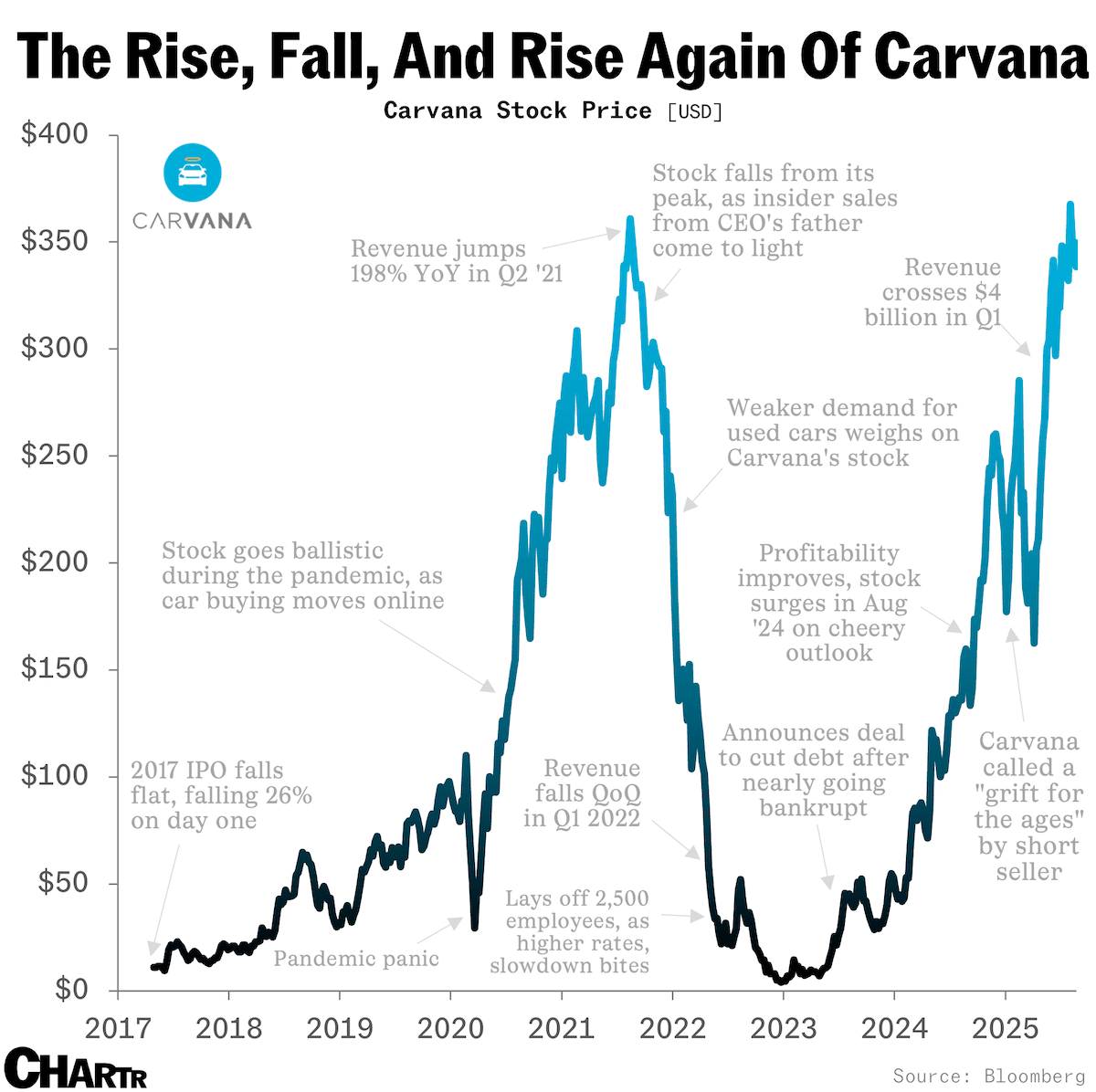

Known for its car vending machines, Carvana has more than a few scars from its time as a public company. Technically, anyone who backed Carvana since its IPO has been rewarded handsomely — but the journey's been anything but smooth. |

From a pandemic boom — when everyone wanted to invest in the "Amazon of cars" — to nearly going bankrupt, to raking in a better-than-expected record $4.8 billion in revenue in the latest quarter, Carvana is keeping the roller-coaster stock analogy alive. After an ill-timed, debt-heavy acquisition in 2022, the company nearly buckled under the pressure of higher interest rates, as sales started to go backward and costs mounted. Since then, CVNA has rebounded a whopping 9,000% as it trimmed costs and slowly returned to growth, finally clawing its way to a fresh stock market high... Enter Amazon. |

Cracker Barrel sinks after unveiling new logo, which some people — including Donald Trump Jr. — really hate |

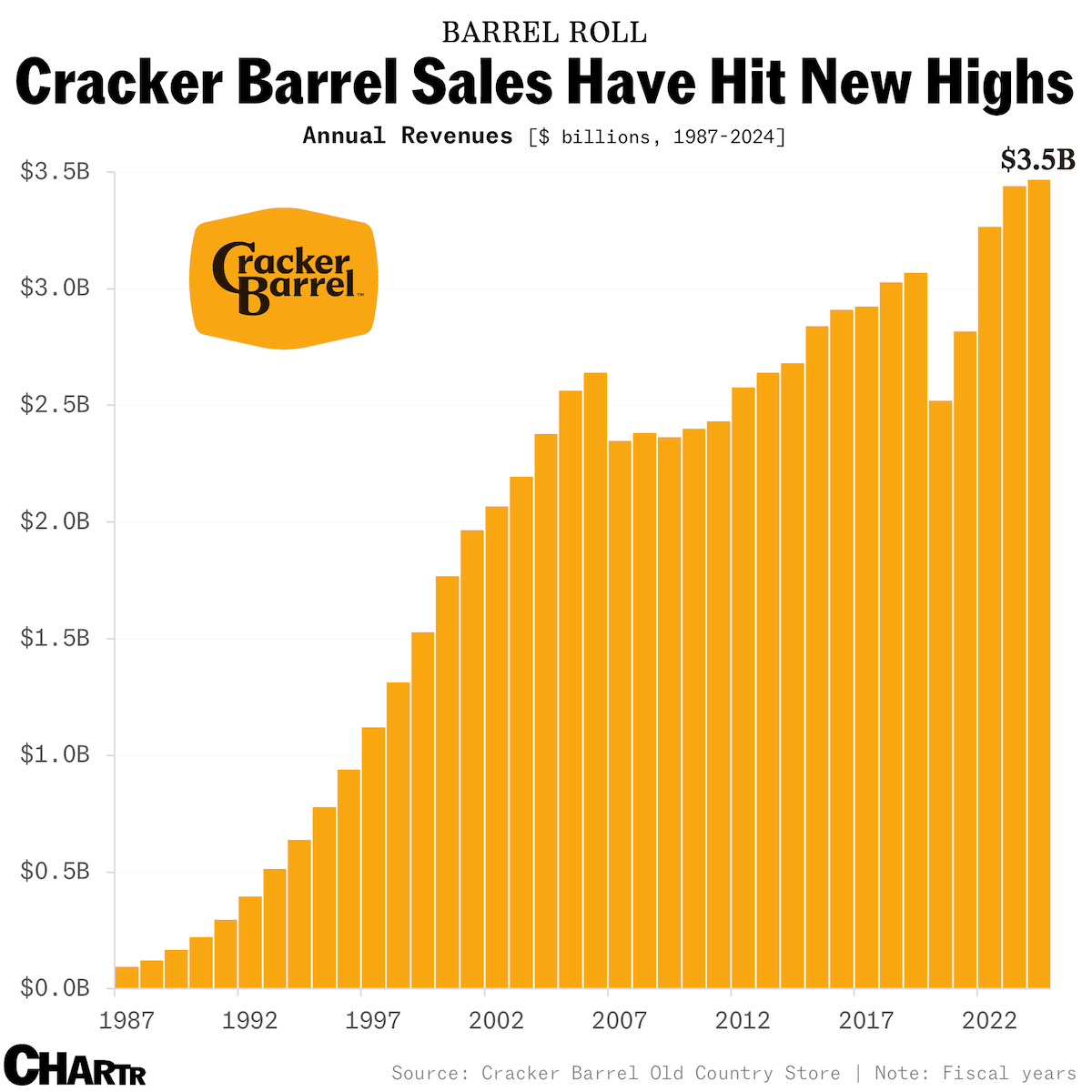

On Wednesday, Southern-themed restaurant chain Cracker Barrel revealed a new, stripped-back logo, as the company presses on with its biggest branding overhaul since it shook things up in 1977. So far, people online have reacted as well as they did to British carmaker Jaguar's rebrand late last year — that is, not very. The new, minimalist design leaves the brand name on a plain orange background, chopping out the cartoon barrel that previously sat there, the man leaning against it, and the "Old Country Store" written beneath them. Though a press release from the restaurant says the new logo roots it "even more closely to the iconic barrel shape and wordmark that started it all," critics aren't convinced. One X user lamented, "Noooooo they private equity'd Cracker Barrel," and the US Graphics Company responded, "Each sunrise, farther from God." Others have taken issue politically as well as aesthetically — Donald Trump Jr. is not a fan. The market's view was similarly dim, with CBRL trading down 12% on Thursday. The logo refresh builds on revamped restaurant and store interiors announced last year, in addition to a new fall menu and free side promotion this weekend. It also comes amid a bit of a moment for the casual dining industry more widely, with Americans increasingly viewing casual chains as the value option — though how well positioned Cracker Barrel is to make the most of that appetite is another question. |

Though annual revenues reached a record $3.47 billion last year, sales haven't grown quite so healthily as they had for the company serving up "Hashbrown Casserole Shepherd's Pies" and "Uncle Herschel's Favorites." From 1994 to 2004, Cracker Barrel's revenues grew more than 270%; in the 20 years since then, they're up just 46%. Will a new logo reinvigorate sales? So far, it's not looking good. |

|

|

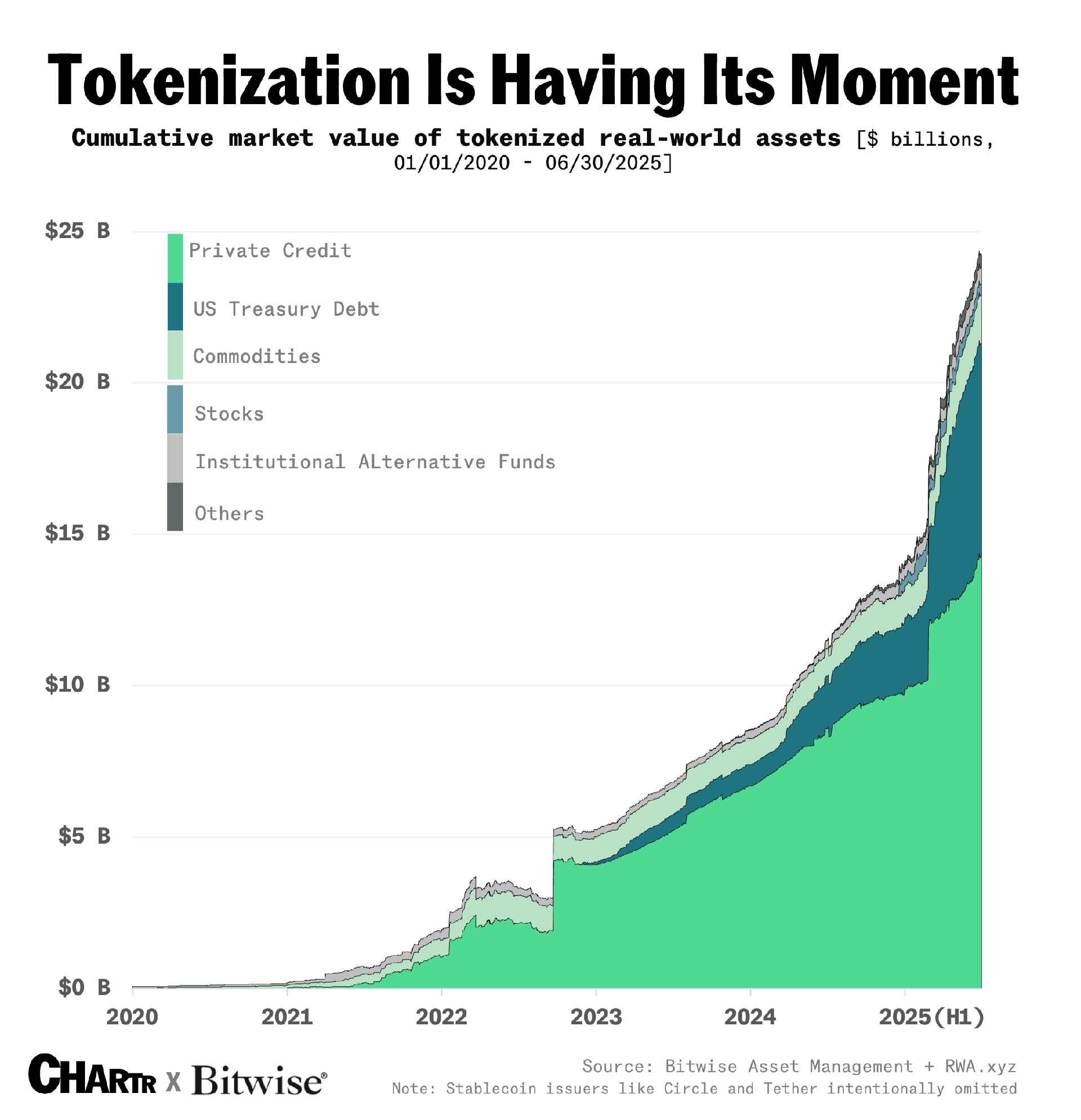

One to watch: The trailblazing trajectory of tokenization |

Not only has it catapulted from $0 to a $25 billion market in four years, but suddenly some of the biggest players in finance are talking about it. One of the biggest stories today is tokenization: the idea of moving stocks, bonds, and other real-world assets over blockchains instead of traditional networks. |

|

|

Walmart is still king of Retail America as Target sales continue to slide |

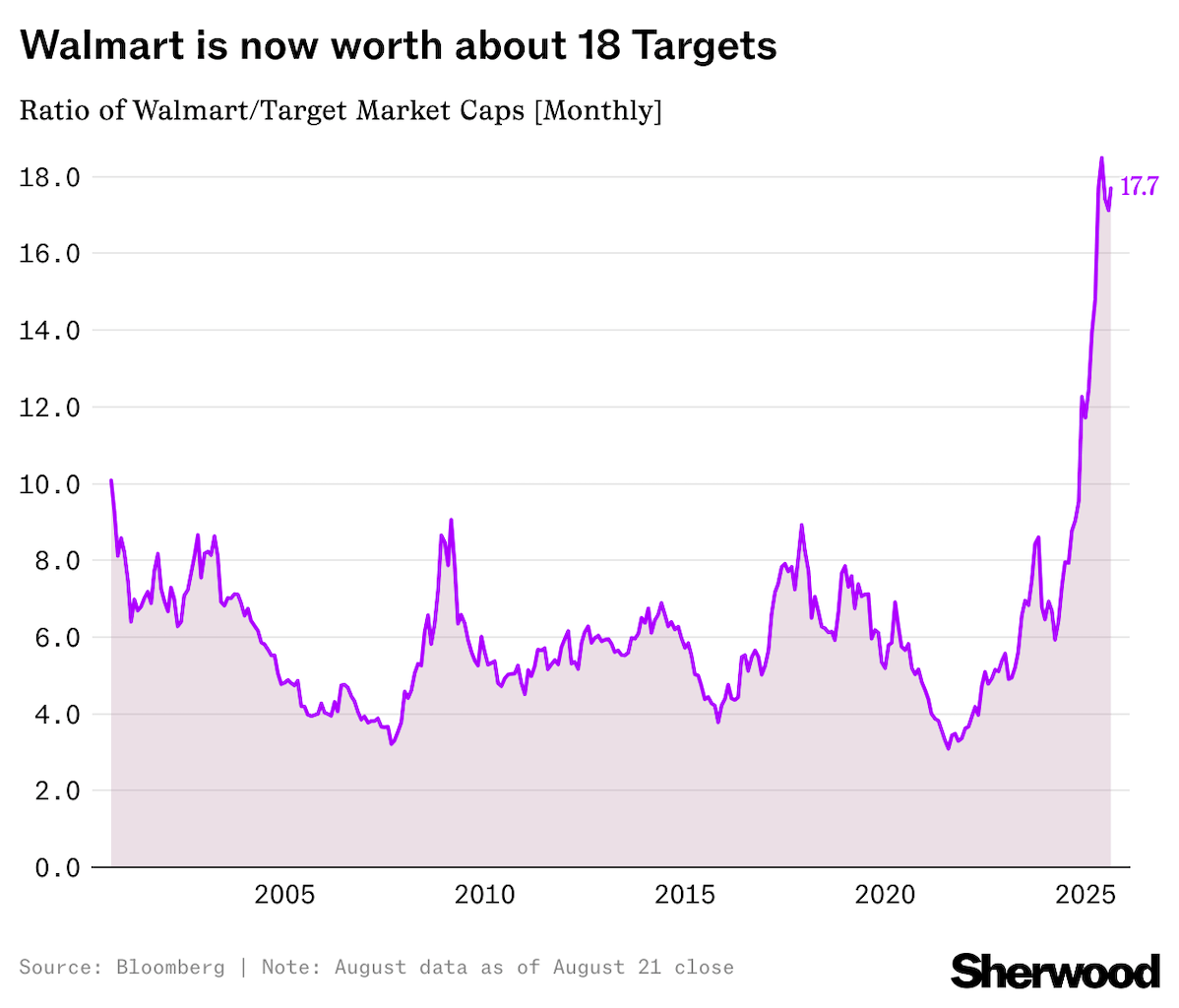

It's been a big week for retail, with the effects of tariffs fully setting in for some of America's best-known store chains as they report results for the second quarter. On Thursday, Walmart shares fell more than 4% after the company posted its first quarterly profit miss since May 2022, with adjusted earnings per share falling below expectations — despite US same-store sales growing almost 5%, topping forecasts and bringing in more than $177 billion in revenue. While there were aspects of Walmart's results that investors were less than enthusiastic about, including hints at further price hikes, there was also plenty to like: the company cited its massive supply chain and dominant market position as reasons it can keep its price rises below the national average. However, in the face of tariffs and slumping consumer spending, not all retailers are faring so well. |

Just a day before, Target, one of Walmart's biggest competitors, reported pretty much the exact opposite situation. Though earnings came in above expectations, same-store sales fell 1.9% and profit dropped by almost 20% — marking the retailer's 11th consecutive quarter of flat or falling sales. Target stock sank ~6% in Wednesday trading, seeing its market cap get dragged even further behind its rival. |

With Target's model reliant on international goods — it imports roughly half of its merchandise, compared with ~33% at Walmart, per CNN — the retailer needs to raise prices even further to mitigate the impact of tariffs. But even before that, Target was struggling to draw customers from discount chains and e-commerce giants like Amazon. Now, Target is hoping that a leadership shake-up might help to get sales out of the red. Around its quarterly results, the company announced that CEO Brian Cornell will step down in February after more than a decade, with current Chief Operating Officer Michael Fiddelke, who's been at the company for 22 years, set to take the helm. |

|

|

- Labubu-boom: Pop Mart's revenue from the Americas jumped 1,142% in the first six months of 2025 compared with the same period last year.

- McDonald's is lowering the cost of its combo meals to 15% less than the sum of their individual menu items in a bid to win over cost-conscious consumers.

- Private drone for my burrito… Chipotle is partnering with Zipline to test out drone food delivery in the greater Dallas area, beginning Thursday.

- Meta will reportedly spend at least $10 billion to use Google's cloud service over the next six years, per The Information.

- Rapper Kanye West launched a meme coin named "$YZY" on Thursday, which briefly reached an eye-popping $3 billion market cap in its first 40 minutes… before plummeting to ~$1 billion.

|

|

|

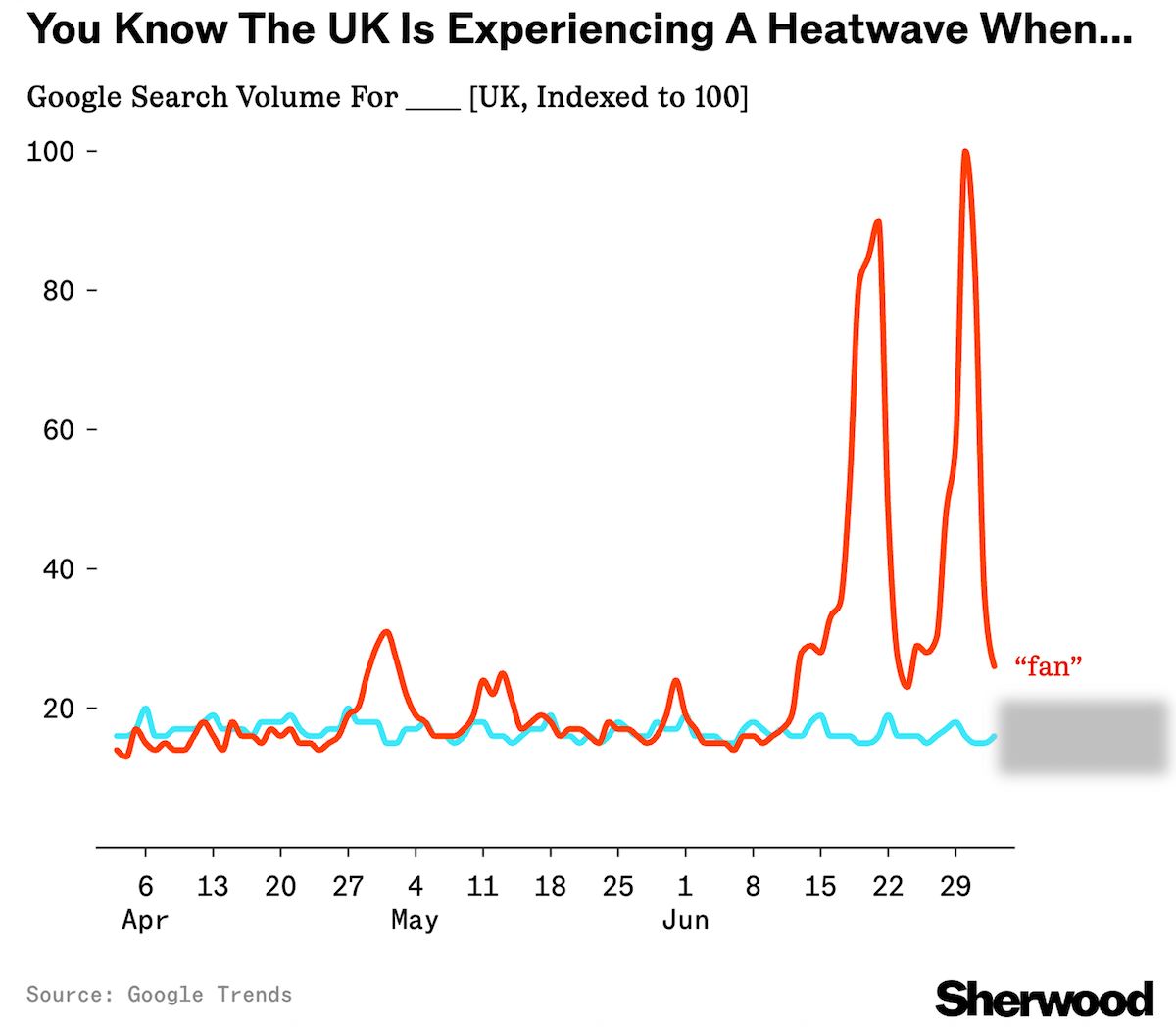

Off the charts: Searches for which platform, whose owner just received a record $701 million in dividends ahead of a potential sale, were no match for "fans" during the last heatwave in the UK? [Answer below]. |

Not a subscriber? Sign up for free below. |

Advertiser's disclosures: 1 No Advice on Investment; Risk of Loss: Prior to making any investment decision, each investor must undertake its own independent examination and investigation, including the merits and risks involved in an investment, and must base its investment decision—including a determination whether the investment would be a suitable investment for the investor—on such examination and investigation. Crypto assets are digital representations of value that function as a medium of exchange, a unit of account, or a store of value, but they do not have legal tender status. Crypto assets are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not currently backed nor supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies, stocks, or bonds. Trading in crypto assets comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks and risk of losing principal or all of your investment. In addition, crypto asset markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. Crypto asset trading requires knowledge of crypto asset markets. In attempting to profit through crypto asset trading, you must compete with traders worldwide. You should have appropriate knowledge and experience before engaging in substantial crypto asset trading. Crypto asset trading can lead to large and immediate financial losses. Under certain market conditions, you may find it difficult or impossible to liquidate a position quickly at a reasonable price. The opinions expressed represent an assessment of the market environment at a specific time and are not intended to be a forecast of future events, or a guarantee of future results, and are subject to further discussion, completion and amendment. The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations. You should consult your accounting, legal, tax or other advisors about the matters discussed herein. |

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

| |

|

No comments:

Post a Comment