Sherwood Media/Datawrapper |

|

|

Since the dawn of Furby nearly three decades ago, one rule in toy making has proved itself true time and time again: there's always money in weird little guys. The latest case in point: Labubu, the wildly hyped little monster toys by Chinese toy maker Pop Mart. Sales of the Monsters franchise, fueled by the zoomorphic creatures, grew to $670 million in the first half of the year. To put that in perspective, that's nearly twice the sales of Barbies in the same period. The nascent pullback across high-flying, AI-linked names picked up steam on Tuesday, sending major indexes down even as most stocks went up. The S&P 500 fell 0.6% despite having far more gainers than losers, the Nasdaq 100 tumbled 1.4%, and the Russell 2000 gave back 0.8%. |

|

|

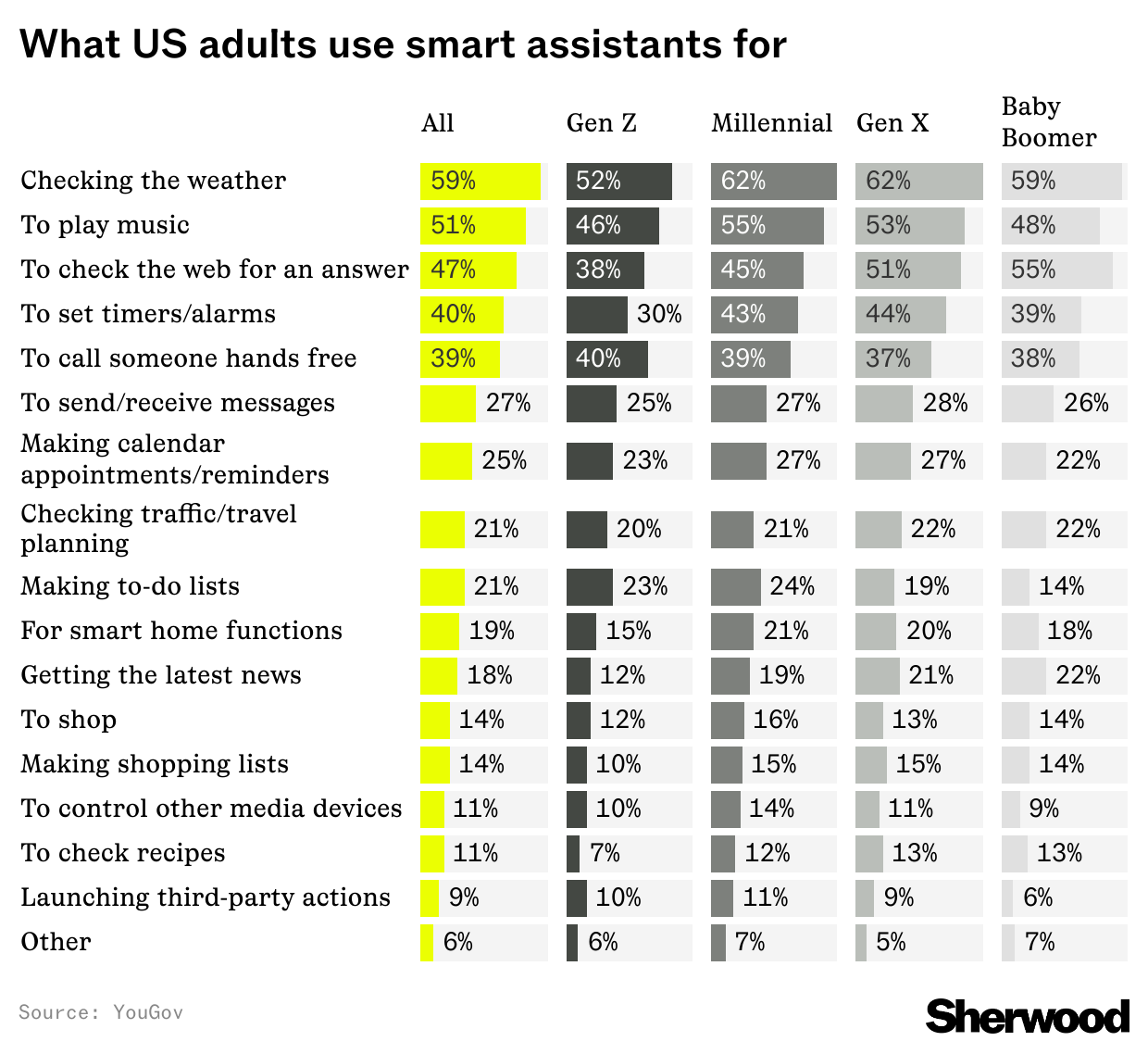

Google, Amazon, and Apple have all touted improvements to their digital assistants — Assistant, Alexa, and Siri, respectively — to use more advanced generative-AI technology. The problem has been that even as they promise new and better capabilities, these tools have lost some of their initial functionality, and companies are struggling to make everything work as advertised. A new survey from YouGov shed a little light on what exactly people want out of their digital assistants. The surprising thing? It's all boring stuff that you can do with normal computers and don't really need AI for. |

- The three most popular uses for digital assistants were checking the weather (59%), playing music (51%), and searching the web for an answer (47%).

- Lots of the other top uses were just sending basic telecommunications: 39% of respondents use them to call hands-free, 27% to send or receive messages, and 11% to control other media devices.

- These digital assistants are not exactly doing rocket science — 40% of people use them to set a timer, while half that number uses them for smart home functions.

|

|

|

Where can AI help? Some 27% of smart assistant users said their main problem with the technology is that it doesn't understand their requests, while another 12% cited a lack of accuracy and the final complaint was that digital assistants aren't as smart as expected. Maybe generative AI and LLMs can sand those edges a bit. |

|

|

Creating the life you're envisioning starts today |

Get a head start on investing for the future and turn today's money into tomorrow's wealth. Every day, millions of investors are building towards their goals with ETFs like DIA - the only ETF that tracks the Dow. With DIA, you get 30 US blue-chip stocks in a single trade. The mega-caps that comprise the Dow Jones Index offer exposure to 172 countries and 160 different industries. Whatever the goal, find out how getting there starts here.1 |

|

|

Demand for blockbuster GLP-1 drugs has never been higher, creating opportunity for both the drugmakers that developed them and telehealth companies that sell compounded versions. But for investors in those companies — Novo Nordisk, Eli Lilly, and Hims & Hers being the ones that stand to benefit the most — the plate is half empty. In fact, shares of each dropped the day they last reported earnings because Wall Street was unimpressed with their sales or, in Lilly's case, progress on its next weight-loss product. What gives? |

- Total sales of the four major brand-name GLP-1s eclipsed $15 billion in the latest quarter for the first time ever, continuing a sharp climb.

- A recent RAND survey showed that a whopping 11.8% of all Americans have used GLP-1 drugs for weight loss.

- The drugs have become ubiquitous in America, but you wouldn't know it by looking at the recent stock price moves of the companies that sell them. Over the past six months, Lilly's, Novo's, and Hims' stocks are down 18%, 34%, and 37%, respectively.

|

So, what's holding them back? Uncertainty of the future, mainly. "The blowout in revenue and earnings per share, that's great, but that's all stuff that happened in the last quarter," Brian Mulberry, an analyst at Zacks Investment Management, said of Lilly's results. "We want to know where growth is headed." |

|

|

With SPACs back on the menu, Chamath Palihapitiya, the former Facebook exec, SoFi founder, and "All-In" podcaster, is raising at least $250 million for a new special purpose acquisition vehicle called the American Exceptionalism Acquisition Corp. But his previous merger projects haven't all led to great stock performance, as this chart shows. One winner out of six |

|

|

Step into the Future with Nasdaq-100 Micro Index Options (XND®) |

- Compact Exposure: Engage with the NDX® at 1/100th notional size, offering flexibility without large commitments.

- Cash Settlement: Simplify transactions by settling in cash at expiration.

- Tax Benefits: Enhance overall returns with potentially favorable tax treatment.

|

|

|

Yesterday's Big Daily Movers |

- Viking Therapeutics plummeted over 40% after its weight-loss pill trial disappointed

- Palo Alto Networks surged after posting better sales, earnings, and guidance than anticipated

- Fabrinet sank double digits after warning of supply chain issues in its Nvidia-linked business

- Intel spiked 7% after SoftBank invested $2 billion in the chipmaker and Commerce Secretary Howard Lutnick confirmed the US was in discussions for an equity stake

- Palantir led the way down with a 9% drop as momentum stocks cratered

|

|

|

- Fed meeting minutes

- Earnings expected from Baidu, Lowe's, Target, Estée Lauder, Viking, XpengTJX, Nordson Corporation, and Analog Devices

|

Advertiser's disclosures:

1 Before investing, consider the funds' investment objectives, risks, charges, and expenses. To obtain a prospectus or summary prospectus, which contains this and other information, call 1-866-787-2257 or visit www.ssga.com. Read it carefully. Investing involves risk. ALPS Distributors, Inc. (fund distributor); State Street Investment Management Funds Distributors, LLC (marketing agent). State Street Global Advisors (SSGA) is now State Street Investment Management. Please click here for more information. 2 Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or digital asset or any representation about the financial condition of any company. Additionally, nothing contained herein should be construed as tax advice. Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security, digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or digital asset or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. Investing in options carries unique risks. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. |

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to Snacks and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and The Wrap for quality reads. |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment