S&P 500 closes at another record high, but everyone's watching the meme stocks |

The S&P 500 inched up less than 0.1% to close at a fresh record, the Nasdaq 100 fell 0.5%, and the Russell 2000 led the way with a 0.8% advance. Tech was the source of weakness on Tuesday, the only S&P 500 sector ETF to decline. Health care, real estate, materials, industrials, and consumer discretionary all rose more than 1%. But much of the intriguing stories of the day were in the names outside the benchmark US stock index. |

- Kohl's doubled in the first few minutes of trading in a seeming meme-stock, r/wallstreetbets-inspired short squeeze before being halted for volatility and finishing up 37%.

- Opendoor was up more than 20% early in the session but finished down 10% as the bullish flows that have fueled the stock's surge became more balanced.

- Lucid rose double digits after announcing that owners of its Air sedan would be able to access Tesla's charging network before the month is out.

- Health care company IQVIA was the best performer in the S&P 500 after posting stronger than expected earnings along with better than anticipated guidance.

- Another company that specializes in clinical trials, Medpace, rocketed higher on an earnings beat and improved guidance.

- Lockheed Martin, on the other hand, slumped double digits on a Q2 earnings miss.

- Philip Morris International also tumbled despite raising its profit guidance and reporting better than anticipated earnings, as this news also came along with the first quarterly decline in Zyn shipments.

- Another earnings-linked selloff came from General Motors, which reiterated guidance for a tariff hit of up to $5 billion this year.

- Coca-Cola dipped despite beating on earnings and adjusted operating profits as the beverage seller suffered a decline in volumes sold. Oh, and cane sugar Coke is coming this fall as an extra offering.

- Oscar Health rose 8% despite shifting its guidance to an operating loss of $250 million this year versus its prior expectation of a $250 million profit, as the company suffers from the same challenges to the ACA marketplace as Centene.

- Chatter about another potential railway merger influenced stocks, even as Warren Buffett himself threw cold water on the reports, sending CSX and Norfolk Southern up more than 1%.

|

— Luke Kawa, Markets Editor |

|

|

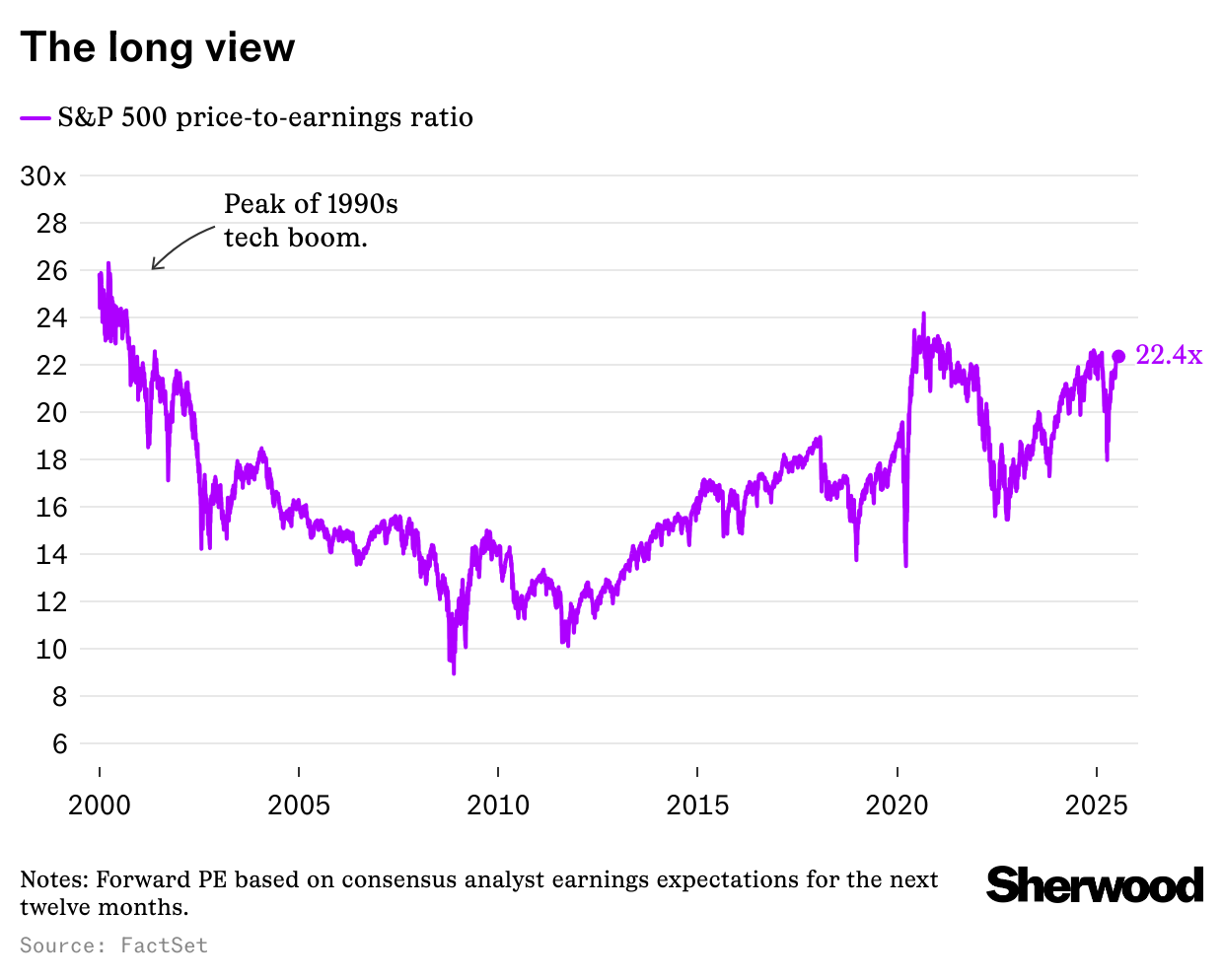

Wall Street is starting to warn about the stock market |

|

|

The most insane trading day for Opendoor yet, charted |

Opendoor traded more than Meta in furious, frenzied trading yesterday that echoed the peak GameStop era. Read more. |

|

|

General Motors said it took a whopping $1.1 billion hit from tariffs in the last quarter, as the true cost of the trade war comes into view across the industry. Read more. |

|

|

- Here's how much traders think Google and Tesla are poised to move after earnings

The state of play before the Mag 7 start reporting quarterly results.

- Morgan Stanley touts a $70 billion boost for megacap tech companies from the One Big Beautiful Bill Act

Tax tweaks are poised to give a huge lift to five of the Magnificent 7's free cash flows (and they just might send that extra money to another member of the cohort!) - Citadel Securities: "The current level of retail bullishness is something to keep a close eye on"

"Retail clients on our platform have been net buyers for the past 18 trading sessions in a row! This bullish streak hasn't been seen on our platform in over 3 years," per Citadel Securities.

- Report: Weeks after raising $10 billion, Musk seeking another $12 billion for xAI to buy Nvidia GPUs

Musk's xAI is burning through cash, as it races to keep up with AI competition.

- Happy first birthday, ethereum ETFs

As the funds celebrate their first anniversary, they have finally started to pick up momentum. - From God to Gordon Gekko: New book tracks how greed became good

Paul Vigna's new book, "The Almightier," follows the transformation of avarice from a mortal sin in medieval Europe to a broadly fetishized force that drives the modern world. - Cathie Wood's Ark Invest picks up BitMine shares and trims Coinbase

A trade filing shows the investment firm picked up $177 million of BitMine, boosting its stock price. - A tiny Canadian biotech company bought 2,000 shares of GameStop as part of its "commitment to combating market corruption"

"The Quantum team and I see the extreme value in GameStop going forward and the deep value the company has with 90% cash and marketable securities on their balance sheet," board adviser Kevin Malone said.

- OpenAI and SoftBank's $500 billion AI data center "Stargate" stumbles

The Wall Street Journal reports that Stargate has "yet to complete a single deal for a data center."

| |

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to The Wrap and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and Snacks for quality reads. We care what you think! If you have any feedback or comments, feel free to reply and let us know your thoughts! |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment