It might actually pay off to spend more time sitting at work: according to the latest wage data from the Bureau of Labor Statistics, how much time you spend seated often lines up with how much you earn. We charted the "chair premium," or median annual wage relative to how sedentary a job is. For example, last year software developers spent 97% of the workday sitting and earned $133,080, and marketing managers sat 93% of the time and pulled a cool $161,030. See how your job ranks. The S&P 500 finished flat, the Nasdaq 100 rose, and the Russell 2000 fell after yesterday morning's blockbuster January jobs report. Employers added 130,000 jobs last month, crushing estimates for 65,000. Bitcoin dipped below $67,000 in the morning, but the jobs report lifted its price back above that level. |

|

|

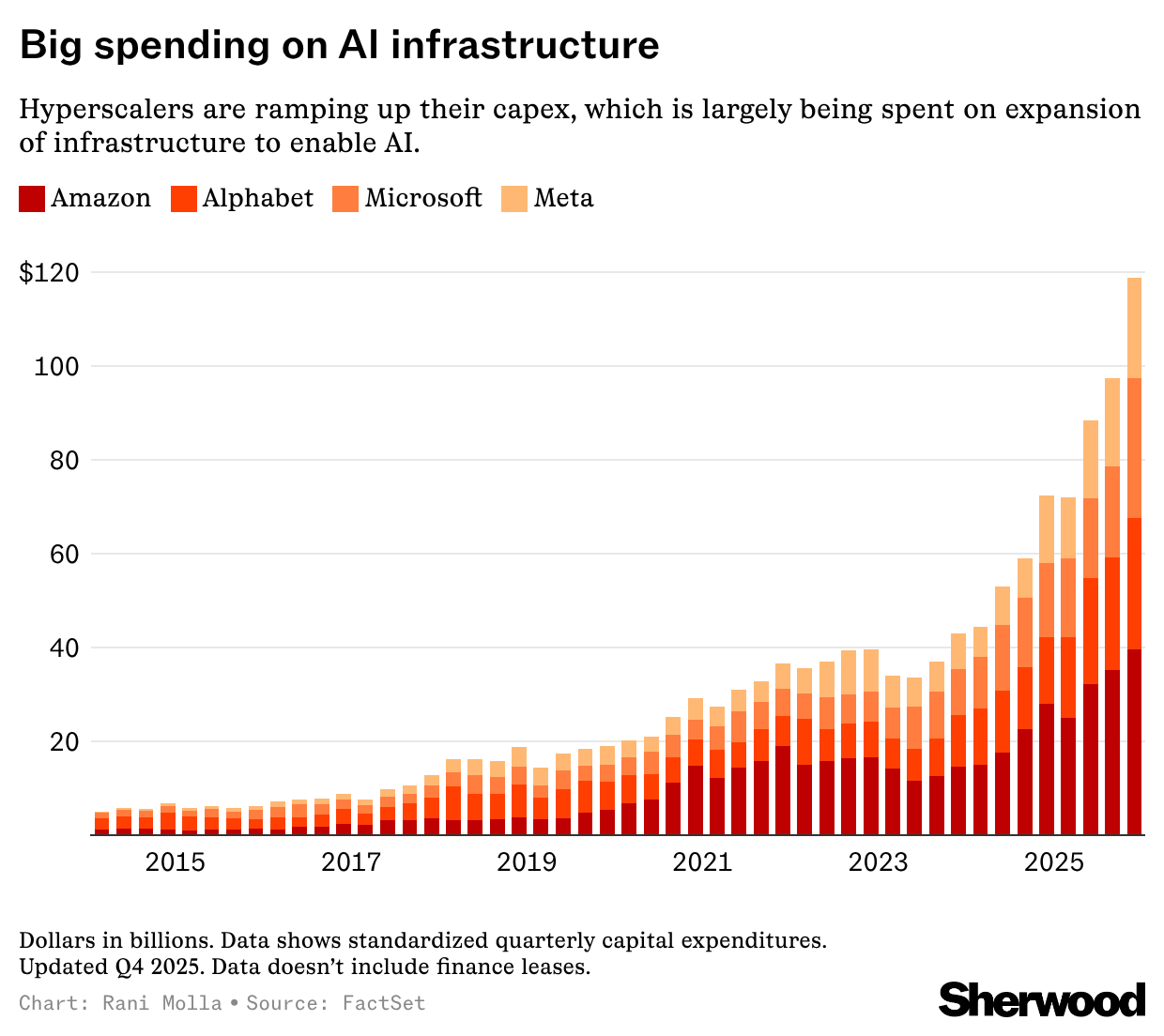

Sprawling gigawatt data center campuses are all the rage. The physical manifestation of the economy's AI frenzy has been gargantuan data center campuses across the rural corners of the nation. Multibillion-dollar developments for Big Tech players like Meta, Amazon, Microsoft, and Alphabet are taking shape in Mississippi, Louisiana, Wyoming, Indiana, and other places with cheap land and available power. More than 4,000 data center projects are currently in the pipeline. But there's a data center shift coming: |

- The next move in AI's expansion is stuffing data centers into urban buildings to get them closer to the action.

- There's a good reason for doing this: placing smaller sites located near users in population centers, on the so-called "edge" of the network, can locally process data requests or process and infer for AI apps, helping apps and programs respond faster and with less delay, or latency.

- Having more inference centers in place will make it easier for ChatGPT to produce and deliver photos more quickly, for example, or help chatbots, often teased for their long pauses, respond more rapidly when asked questions. You've probably already experienced the improvements of edge compute when watching previews instantly auto-play on Netflix.

|

The requirements for data center build-outs are changing too as smaller and more efficient chips, servers, and racks mean that small data centers can be set up in office buildings of 80,000 square feet. There's even an opportunity to create what's called a mesh network of small servers installed in, say, a series of parking garages. Equipment providers like Schneider Electric and Vertiv Holdings have been working for years to design new equipment for these smaller sites. |

|

|

Forecasts by industry analysts at The Proptech Connection predict AI inference traffic will grow 25% between 2024 and 2027, just below the 30% growth in AI training. As soon as the industry figures out the next new thing, it'll require a new build-out. These developments will likely face community pushback, considering the rising power costs attributed to data center demand, and could have significant impacts on downtown real estate value. This could be great for owners with vacant or obsolete office stock, as they could reposition the properties into hybrid tech campuses with inference hubs as anchor tenants, and their presence could attract a cluster of AI companies, life science companies, and other high-value tenants seeking compute and proximity. |

|

|

Go Below The Surface Of The Retail Revolution |

Individual investors now move more than $30 billion daily in trading volume. Nasdaq's Retail Trading Activity Tracker lets you track where that momentum is heading. What Nasdaq's Retail Trading Activity Tracker shows you: |

|

|

- Daily Top 10 traded by retail

- Daily trading patterns across all stocks and ETFs in real time

- Buy/sell ratios by ticker — see which stocks retail investors are accumulating or exiting

- Sector rotations — spot when the crowd shifts from one segment to another

|

- Connect directly via API, Excel plugin, or Python

- Access pre-built analysis templates

|

|

|

This year, France's winemakers may have less reason to pop the corks. Data showed total French wine and spirits exports fell for a third consecutive year by value, and volume has sunk to the lowest level recorded in over two decades. See it charted |

|

|

- 📊 Fed: January's jobs report beat expectations, with nonfarm payrolls growth of 130,000. While stocks finished flat for the day, one market did move: the probability* that the Fed would hike rates in its March decision dropped considerably. The market-implied chance that the Fed simply maintains rates increased from 79% to 92%, while the probability it would cut rates fell from 21% to just 8%.

- 🏅 Olympics: Winter sports powerhouse Norway was already the favorite to win the most gold medals heading into the Olympics, entering the Games with about a 62% chance of having the most golds. That has now jumped to 92%, as the Norwegians are indeed performing strong while the other possible threats — Germany and the United States — have not managed to pick up enough gold to pose a serious threat to Norway.

|

*Event contracts are offered through Robinhood Derivatives, LLC — probabilities referenced or sourced from KalshiEx LLC or ForecastEx LLC. |

|

|

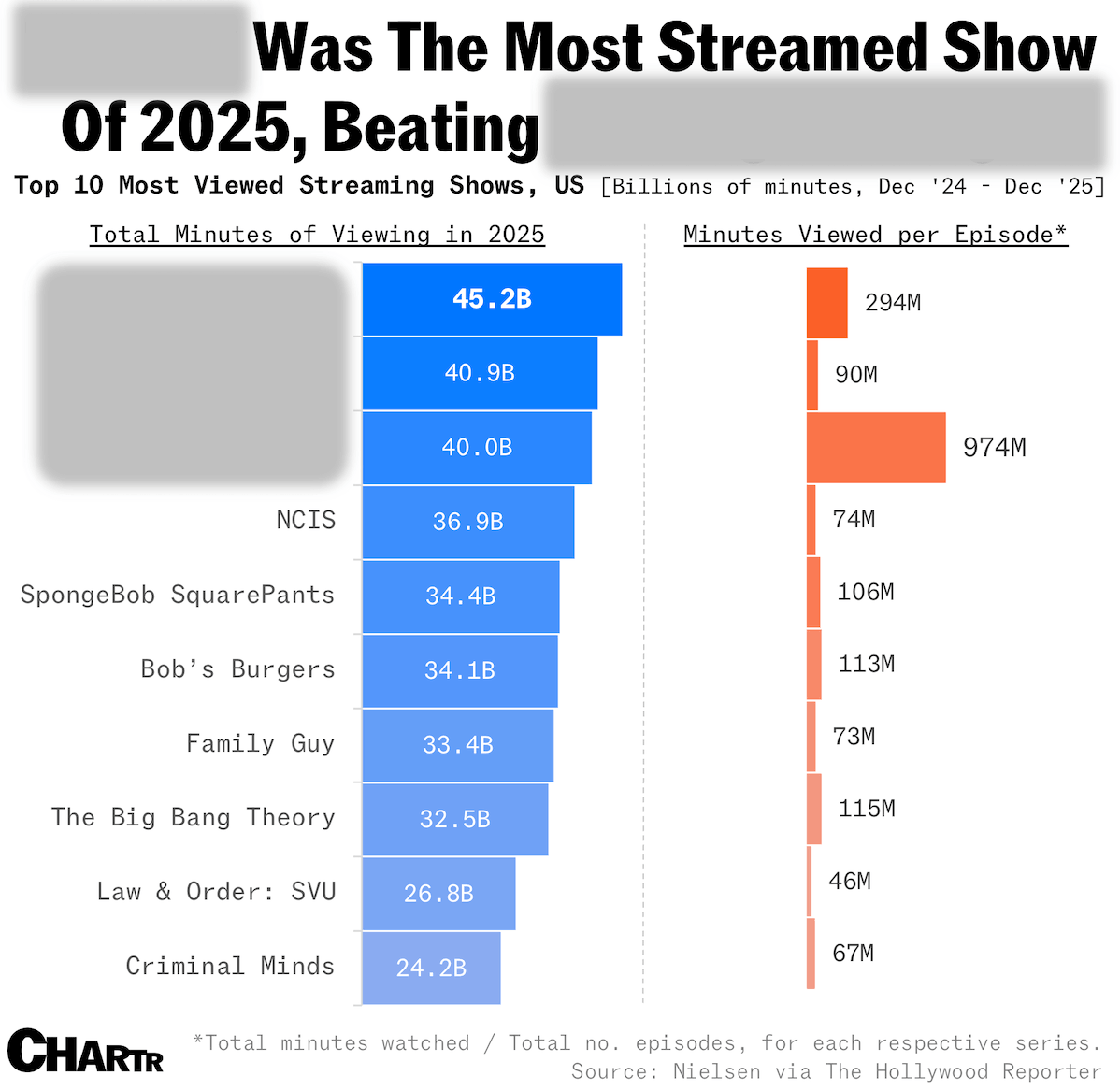

Which animated hit was named America's most streamed series for a second straight year — and which two shows did it beat to secure the top spot? |

|

|

- Wedbush Securities analyst Dan Ives explains why Microsoft and Google's giant capex plans are worth it

- Ethereum ETF holders are still "diamond-handing" despite hurting more than their bitcoin counterparts

- The slump in software stocks resumed after high-profile companies issued underwhelming outlooks

|

|

|

- Earnings expected from Dutch Bros, Rivian, Anheuser-Busch, Applied Materials, DraftKings, Pinterest, Arista Networks, Vertex Pharmaceuticals, Airbnb, Coinbase, Expedia, and Crocs

|

|

|

Advertiser's disclosures:

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security, digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or digital asset or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to Snacks and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and The Wrap for quality reads. |

| |

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment