Hi! If you thought you had a rough Valentine's Day, spare a moment for any couples who'd planned to visit "Lovers' Arch," a romantic beauty spot on Italy's south coast that collapsed on the big day itself. Today we're exploring: |

- Paper trail: Berkshire Hathaway is back in the news business.

- Bean count: January saw a record US-global split in coffee prices.

- Remote control: Younger firms and CEOs allow more work from home, new study finds.

|

Berkshire Hathaway invests in The New York Times, cuts stakes in Amazon and Apple |

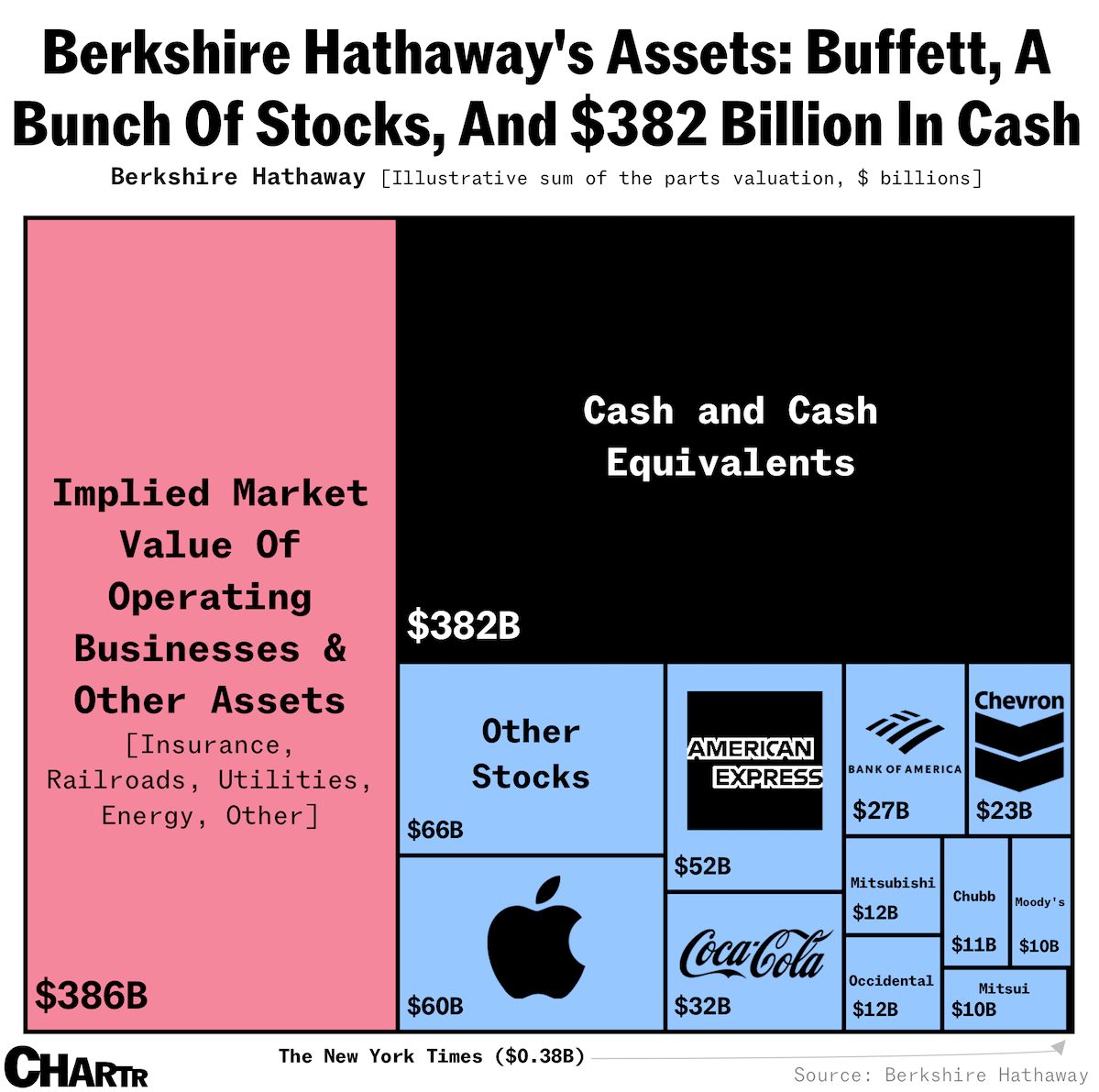

As Warren Buffett wrapped up his 60-year run as CEO of Berkshire Hathaway at the end of last year, the Omaha-based conglomerate made some bets in an industry it hadn't touched in six years, according to its latest 13F filing disclosed Tuesday. In the fourth quarter of 2025, Berkshire Hathaway bought 5.1 million shares (worth $351.7 million) of The New York Times — a legacy newspaper that's arguably transformed itself for the digital age better than any other, becoming a games-cooking-news powerhouse that now boasts nearly 13 million subscribers. |

The move marks Berkshire's return to the news media after selling off its newspaper holdings, including Buffett's hometown daily, the Omaha World-Herald, in 2020. Still, the Times barely registers in the company's overall public portfolio, at just 0.12%. As a share of its total market cap, it's a complete rounding error accounting for an even slimmer 0.03%. At the same time, Berkshire seems to be repositioning toward the old economy while paring back some of its tech exposure. The company trimmed its stake in Amazon by 77%, while reducing its Apple shares by ~4% — though the iPhone maker remains Berkshire's largest holding. Meanwhile, energy and insurance quietly bulked up, with stakes in Chevron and Chubb increasing by 6.5% and 8.7%, respectively. Shares of The New York Times were up as much as 4% in early trading on Wednesday following the report, hitting a 52-week high, though they have since pared much of those gains. |

Coffee prices reached record highs in the US last month |

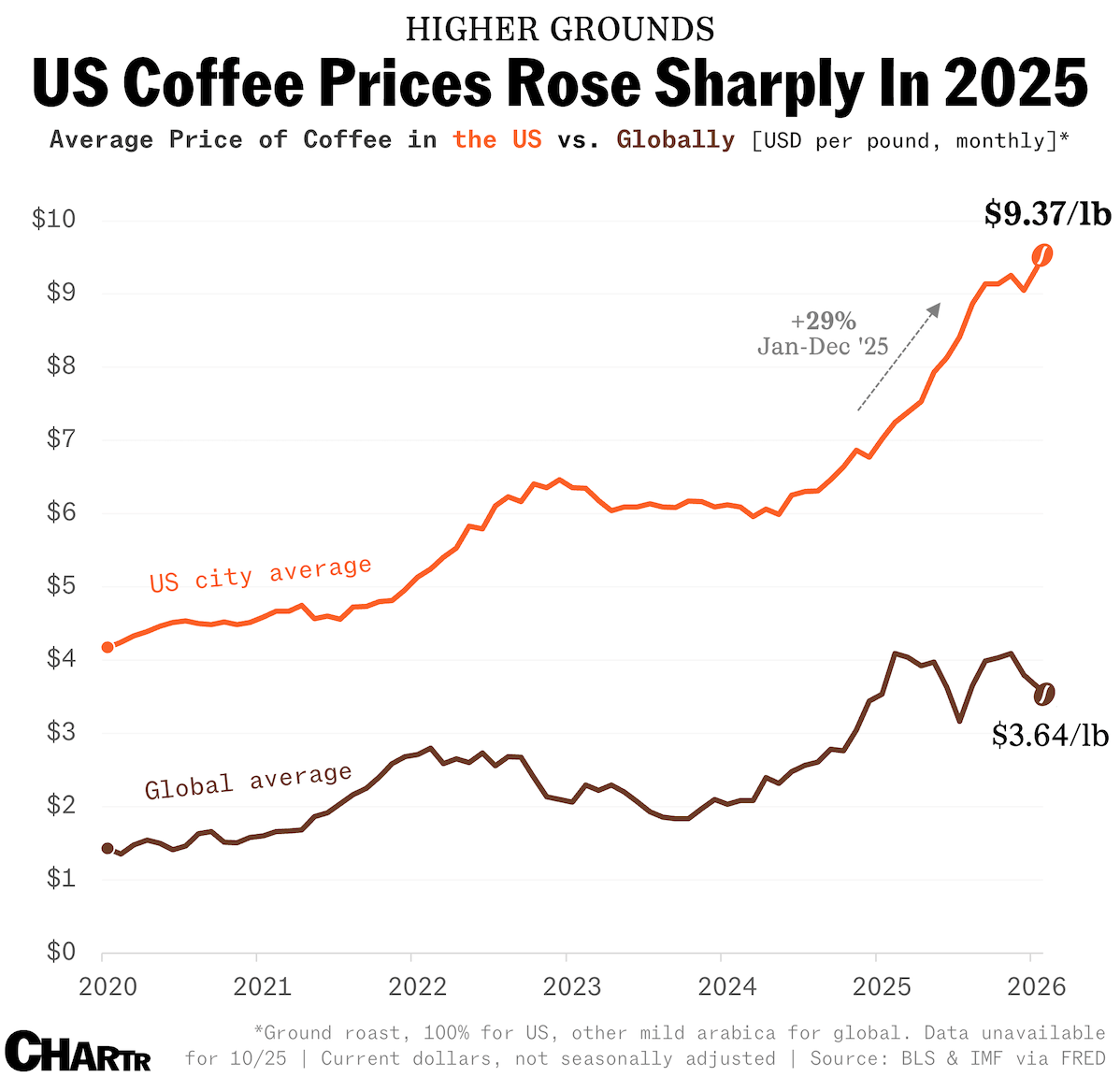

It's been a while since the US first adopted its centuries-old coffee habit, which quickly shifted from being politically revolutionary to, for many, absolutely necessary. Today, America is the world leader in coffee consumption: a total of ~1.6 billion kilograms were consumed domestically last year, per USDA figures, and the National Coffee Association estimated that, as of January 2025, two-thirds (66%) of American adults were drinking coffee every day. But anyone who relies on a first-thing cup of joe might have noticed over the past few months how much their caffeine fixes are costing them. |

According to Friday data from the BLS, the average price of coffee across US cities went up to $9.37 per pound in January — the most expensive since records began in 1980, and up 33% from January 2025. Meanwhile, the global price of coffee dropped to $3.64 per pound last month. |

In case you missed it, the US imposed import taxes on a few countries in 2025. Unsurprisingly, coffee products, 99% of which the US imports from abroad, were hit hard — and raising the tariff on Brazil, the world's biggest coffee producer, to 50% in July didn't help. However, even after these tariffs were rolled back at the end of last year, coffee prices have continued to rise in the US. That's partly because the reversal will take some time to filter through the supply chain, as importers generally order beans months in advance. Mix in last year's production shortfalls from America's top importing countries, and a more positive supply outlook for 2026, and you get a record US-global split in coffee costs. |

|

|

Younger companies and leaders embrace more remote work, new study finds |

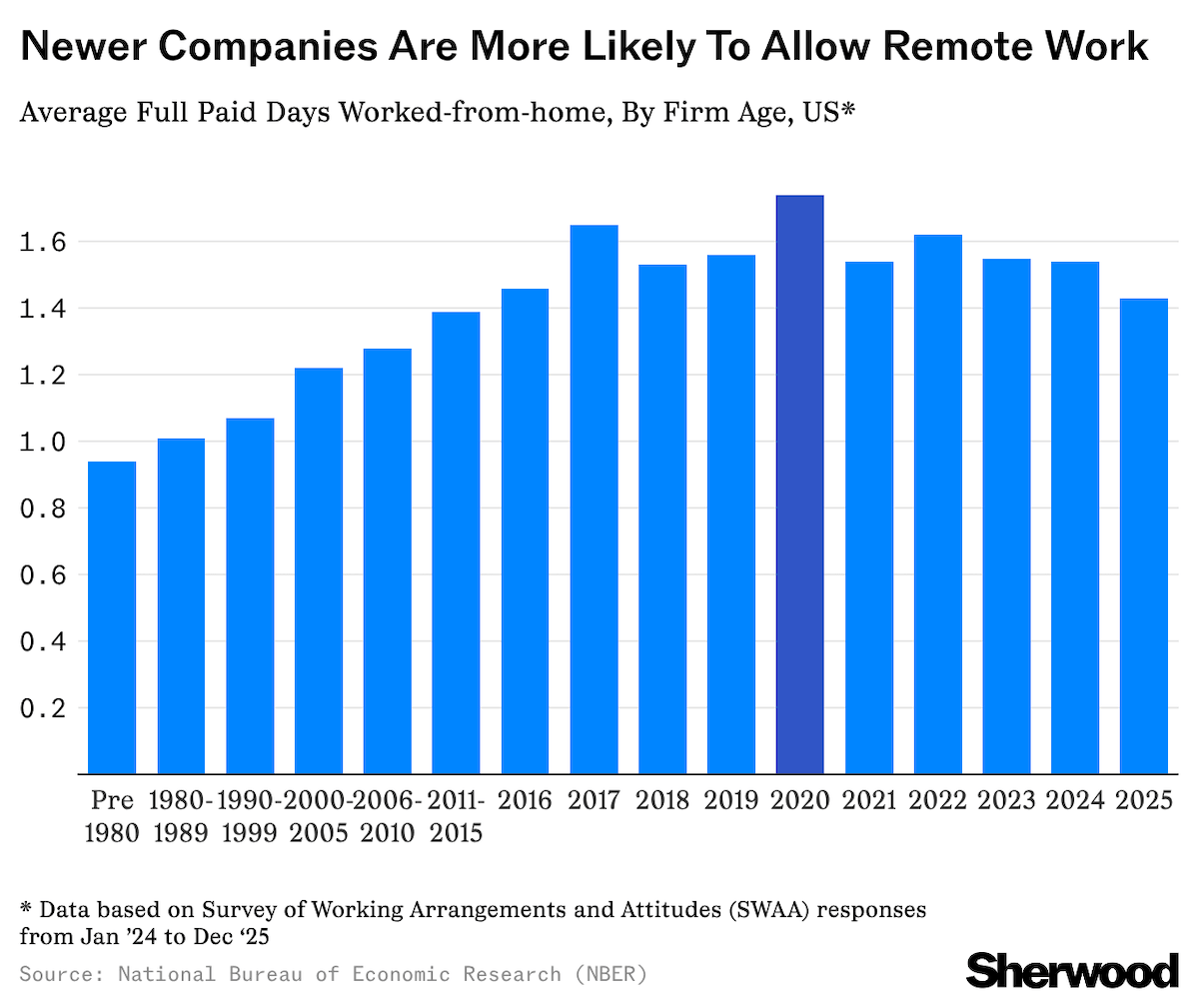

The companies most likely to let you work from home are the newest ones… or at least those helmed by the youngest leaders. According to a National Bureau of Economic Research working paper published last week, employees at companies founded after 2015 are roughly twice more likely to work from home than those at firms that got their start before 1990. |

Companies born in 2020 — the ones that had no choice but to build themselves around WFH from day one — had the highest remote working days on average, at 1.74 per week. While that trend has since softened, post-lockdown cohorts (2021-25) allowed employees to work from home an average of 1.6 days per week over the last two years, well above the ~0.9 days seen for companies founded before 1980. Leadership age tells a similar story, as younger CEOs tend to be more comfortable adopting new technologies and flexible ways of working: firms run by CEOs under 30 saw an average of 1.4 work-from-home days per week, compared to 1.1 days for those with CEOs aged 60 or older. Still, that gap fades once firm age is factored in, suggesting it's the birth year of the company — not its leader — that matters more. And even as big incumbents keep doubling down on returning to the office, the study finds that WFH rates could tick higher over time as older firms cycle out. Indeed, roughly half of US startups don't survive past five years, per the latest Bureau of Labor Statistics data, and the companies that replace them tend to be more remote-friendly from the start. |

|

|

- Pie in the PSKY: Paramount Skydance will have one last chance to convince Warner Bros. board members, after Netflix granted WBD a 7-day waiver to reopen negotiations with its rival.

- What makes 30,000 people in 25 different countries feel national pride? From mateship and multiculturalism, to the ability to "enjoy good wine and cheese."

- Impaulse purchase: Logan Paul sold his ultra-rare Pikachu Illustrator "Pokémon" card for a record $16.5 million to AJ Scaramucci, the son of former White House comms chief Anthony.

- Anthropic's thinly veiled Super Bowl ad trash talk against OpenAI seems to have paid off, with site visits jumping 6.5% and active users rising 11% after the commercial aired, per new data.

- Broadcast (it) yourself: Over 1 million people reported YouTube outage issues on Downdetector yesterday per CNET, disrupting Winter Olympics watchalongs the world over.

|

|

|

- Hyperscalers shaved more than $1 trillion off their market caps post-earnings this quarter — Axios charted the biggest losers.

- No shade: Humans aren't always great at recalling colors, but this game is a great way to test your skills.

|

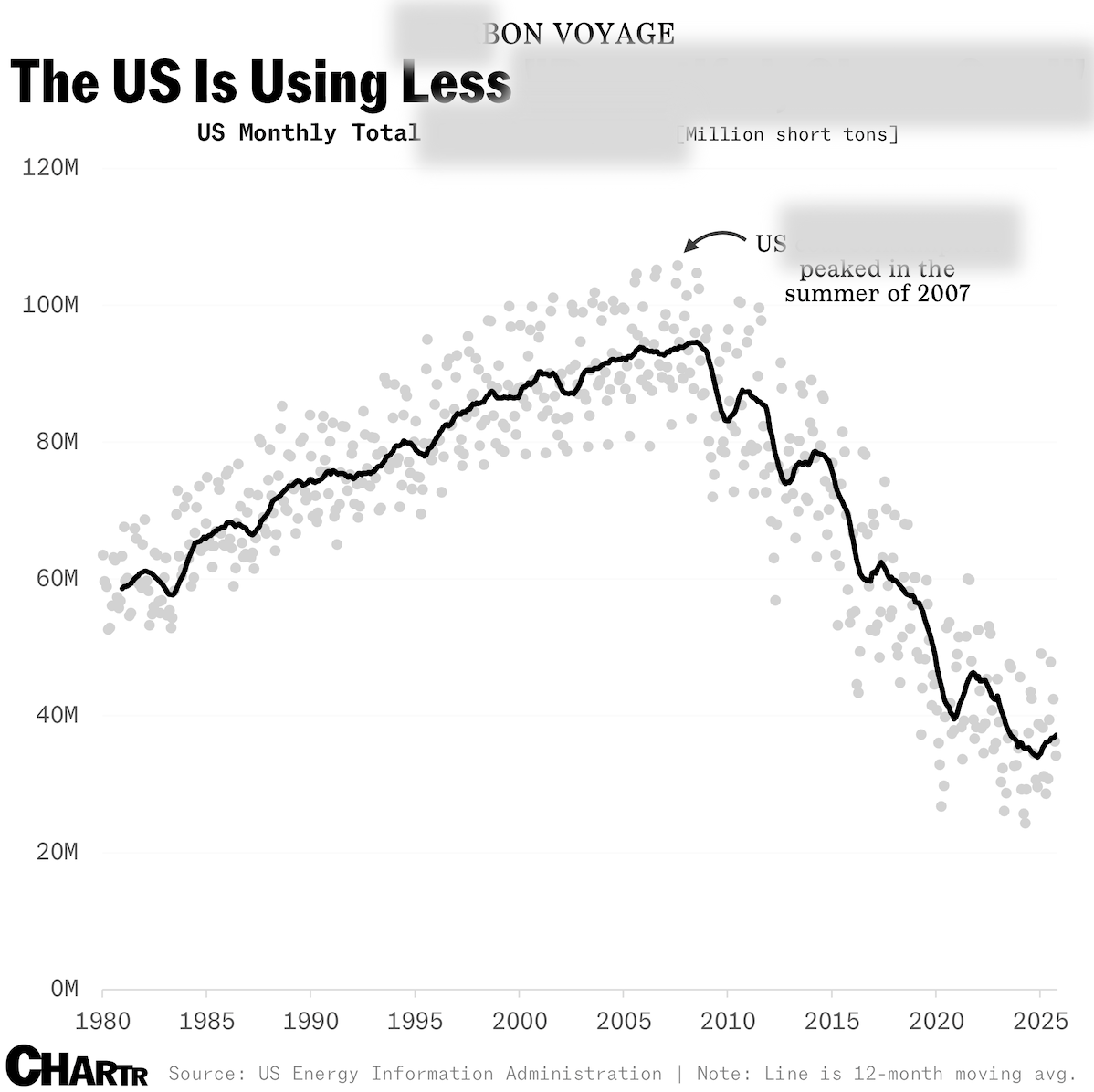

Off the charts: Despite the president's current preoccupation with it, America keeps using less of which once-dominant energy source? [Answer below]. |

Not a subscriber? Sign up for free below. |

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment