Sorry to all of those who've grown to love OpenAI's ChatGPT 4o model and its effusive praise of everything and anything you do: the company announced it's permanently shuttering the overly sycophantic model soon. Its unique ability to offer affirmation and support may seem only positive, but the chatbot's behavior has led to real-world harms. Yesterday, stocks dipped as weaker-than-expected December retail sales stoked fears of a slowing economy and Wall Street awaited today's delayed January jobs report and Friday's delayed CPI for clues into the health of the economy. The tech sector's biggest winners and losers swapped places yesterday as investors rotated back into software stocks. |

|

|

- Alphabet spent $91.4 billion on capex last year, and forecasts $175 billion to $185 billion in 2026. Where is that money going? Well, in Alphabet's case, it's mainly looking at AI compute capacity for Google DeepMind.

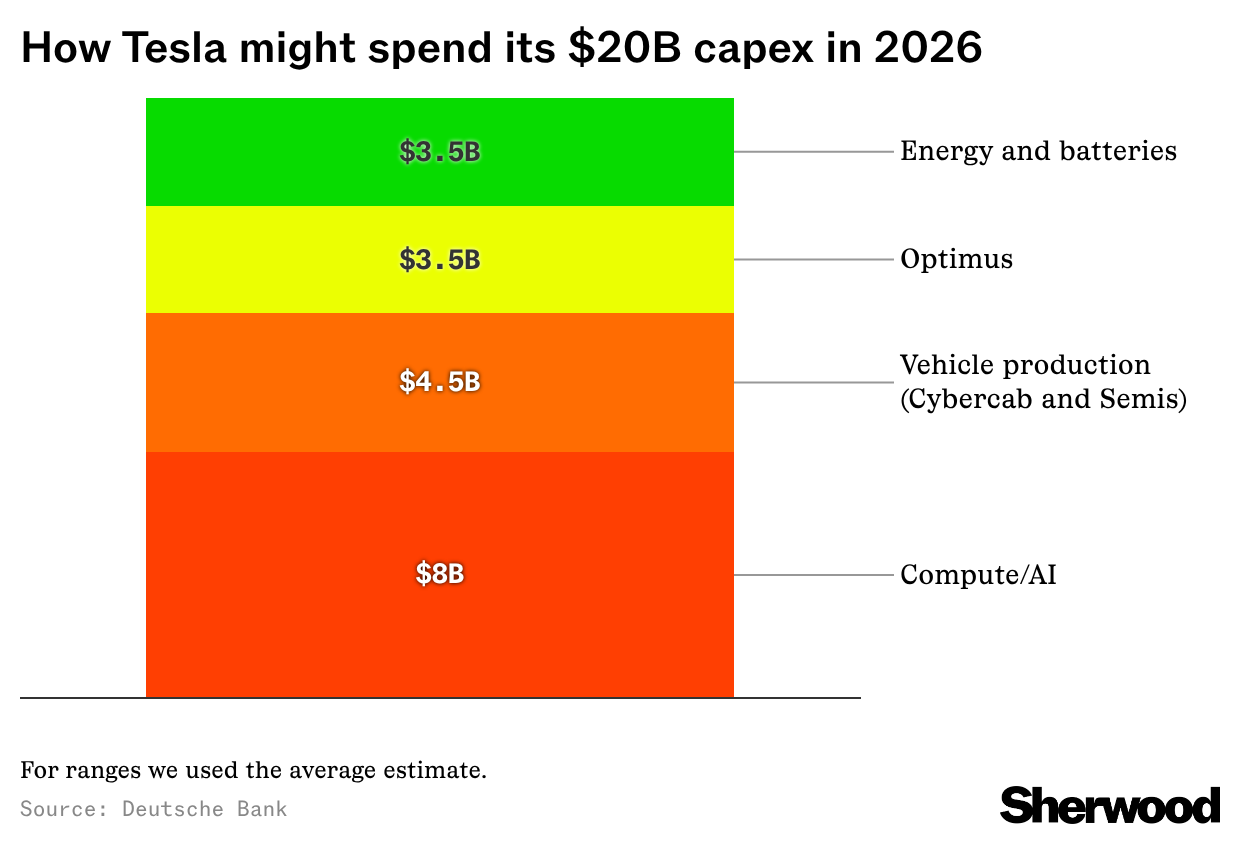

- Tesla's going to outlay over $20 billion, specifically on "six factories, namely the refinery, LFP factories, Cybercab, Semi, a new Megafactory, the Optimus factory." According to Deutsche Bank, about $8 billion is going to compute, $4.5 billion to vehicles, $3.5 billion to Optimus, and $3.5 billion for batteries and energy.

- Meta, which spent $72 billion in 2025, is looking at 2026 capex guidance of $115 billion to $135 billion. That's going toward model training at Meta Compute and all the stuff you need to do it.

- Amazon is going from $131.8 billion to $200 billion, and it's predominantly going to AWS.

|

Microsoft didn't give formal guidance, so it's possible its spending this year, like its peers, will ultimately exceed analysts' expectations. Analysts put it at $116 billion this year, up from $83 billion last year. |

|

|

So, is it possible to be a megacap Magnificent 7 titan of tech without spending a fortune? Apple's certainly trying to find out, for better or for worse. It had capex of $12.8 billion in calendar year 2025, and is looking at a 2026 calendar year capex estimate of merely $13.3 billion, per FactSet's analyst forecast. That's partly because a bunch of the time, its data center is someone else's data center, and so someone else's capex. |

|

|

- The bank currently values the energy business at $140 billion, so an increase of as much as $50 billion isn't anything to sneeze at, though it's also a drop in the bucket of Tesla's gargantuan $1.3 trillion market cap, or the $1 trillion opportunity Wedbush Securities analyst Dan Ives thinks is packed into Tesla's AI and autonomy efforts.

- Reporting on Tesla's solar ambitions knocked First Solar's shares lower last week. But Morgan Stanley writes that Tesla is unlikely to compete directly with the country's leading photovoltaic panel maker, instead pairing it with its fast-growing energy business, with much of that production for internal use.

- Rather than adding solar panels to an already glutted global market, Tesla could use them internally to avoid supply chain bottlenecks and meet its own growing power demands.

|

"We believe the decision to allocate capital to adding solar capacity may be justified by the value creation and growth opportunities that having a vertically integrated solar + energy storage business can yield," the Morgan Stanley note reads. |

|

|

The bank expects Tesla to vertically integrate its solar capacity to meet data center demand, including for data centers in space. (As we've noted, the mission of Elon Musk's SpaceX has been seeming very similar to Tesla's these days.) Notably, Morgan Stanley estimates the solar panel endeavor will cost Tesla $30 billion to $70 billion — a sum that Tesla didn't include as part of its doubled $20 billion-plus capex plan this year. |

|

|

*Event contracts are offered through Robinhood Derivatives, LLC — probabilities referenced or sourced from KalshiEx LLC or ForecastEx LLC. |

|

|

- January jobs report

- Earnings expected from McDonald's, AppLovin, T-Mobile, Shopify, Humana, Cisco, and Kraft Heinz

|

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to Snacks and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and The Wrap for quality reads. |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment