Stocks trade higher as tech rebound continues |

The S&P 500, Nasdaq 100, and Russell 2000 all climbed higher, with the benchmark index trading just below its record closing high. Tech was the best-performing sector for the second-consecutive session. The price of bitcoin stabilized after sinking below $70,000 this morning, but meme coins pepe, shiba inu, bonk, pengu, dogwifhat, and trump continued to slide. Japan's Nikkei 225 soared to a record high after the ruling Liberal Democratic Party won the lower house election in a landslide victory. This week brings delayed economic data, including the January jobs report on Wednesday and January's consumer price index on Friday, both of which could offer clues into the Fed's interest rate plans. Stocks that moved higher: |

- Oracle powered higher as DA Davidson gave the stock a "buy" rating on the belief that OpenAI is increasingly likely to be able to make good on billions of dollars' worth of planned spending on computing power at Oracle.

- AppLovin jumped after CapitalWatch announced "significant revisions" to the report that alleged AppLovin is money-laundering operation for "transnational criminal kingpins. " However, CapitalWatch says that its stance on company "remains unchanged."

- Roblox spiked as Roth Capital upgraded the stock and hiked its price target, citing growth in 18+ users.

- Kroger gained on a report that it plans to name former Walmart US executive Greg Foran as its CEO.

- SoFi Technologies rose after Citizens upgraded its stock to "market outperform" from "perform," with a price target of $30.

|

|

|

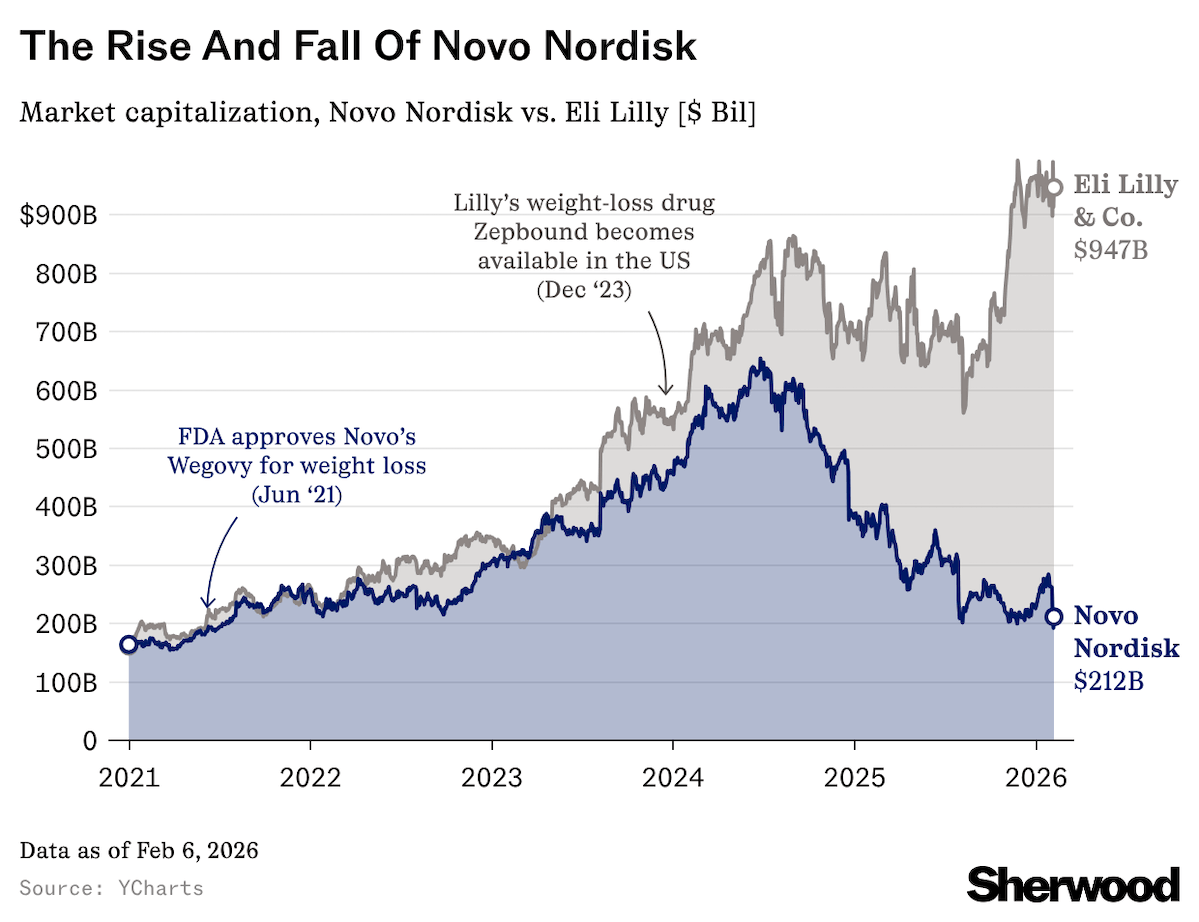

A weak sales outlook and a copycat scare capped a brutal week for Europe's one-time most valuable company. Read more. |

|

|

We remind you that this numbering system was adopted for *clarity.* Read more. |

|

|

Alphabet is preparing a roughly $15 billion US investment-grade bond sale, Bloomberg reports, citing people familiar with the deal. The offering is expected to be split into as many as seven tranches, with initial price talk for the longest maturity — a 2066 bond — at about 120 basis points over Treasurys. JPMorgan is leading the sale alongside Goldman Sachs and Bank of America. Read more. |

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to The Wrap and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and Snacks for quality reads. We care what you think! If you have any feedback or comments, feel free to reply and let us know your thoughts! |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment