Hi! Goated with the sauce: Heinz is releasing a new "KegChup" ahead of the Super Bowl on Sunday — a beer keg-looking product that dispenses, you guessed it, 114 ounces of ketchup for your big game condiment needs. Today we're exploring: |

- All that glitters: Gold and silver had their worst day in decades after a record rally.

- Tapping out: Users spent more on non-gaming apps than games for the first time last year.

- Elon X Elon: SpaceX is reportedly eyeing a $1.5 trillion valuation for its upcoming IPO.

|

Gold and silver have seen historic wipeouts after Trump's Fed chair pick spooked markets |

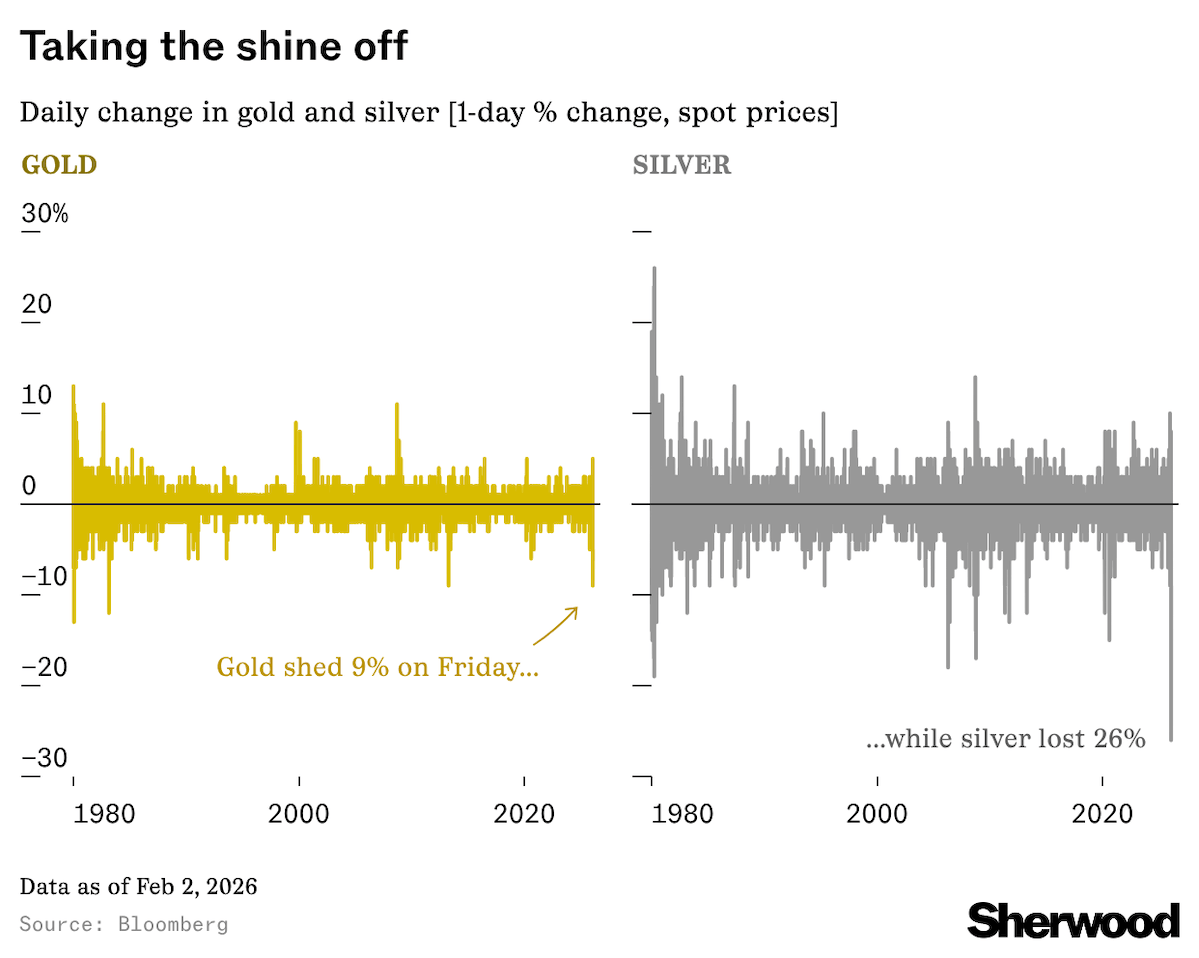

Gold and silver suffered their worst losses in decades on Friday, with silver plunging more than 30% and gold sliding over 10% at their lowest points — the largest intraday declines for the precious metals since the early 1980s. Both recovered marginally into the end of trading, but were down again in early trading on Monday, with spot gold off 2.4% relative to Friday's finish, and silver down 1.4% as of 7:30 a.m. ET. |

The plunge marks a dramatic reversal of a remarkable year-long rally. Earlier last week, gold topped $5,000 per ounce for the first time, while silver also hit fresh all-time highs, fueled by steady central-bank buying and heavy ETF inflows from retail traders, amid geopolitical tensions and bets on dollar weakness. Indeed, per data from SwaggyStocks, the two most discussed tickers on Reddit's r/wallstreetbets forum last week were iShares Silver Trust and SPDR Gold Shares ETF. The silver-based ETF saw a particularly insane amount of discussion, with 15,399 mentions — more than 6x the mentions of TSLA, a usual retail favorite. Goldman Sachs also recently raised its year-end gold price forecast to $5,400 per ounce, underscoring just how bullish sentiment had become. But the metals finally sunk on Friday after President Trump said he plans to nominate former Fed governor Kevin Warsh to succeed Jerome Powell as chair of the Federal Reserve. The news triggered relief around the Fed's independence — as well as skepticism that aggressive rate cuts would actually materialize — sending the US dollar higher and, in turn, weighing on non-interest-paying assets like gold and silver, which tend to struggle when the greenback rises. |

Games weren't the biggest thing on app stores for the first time ever last year |

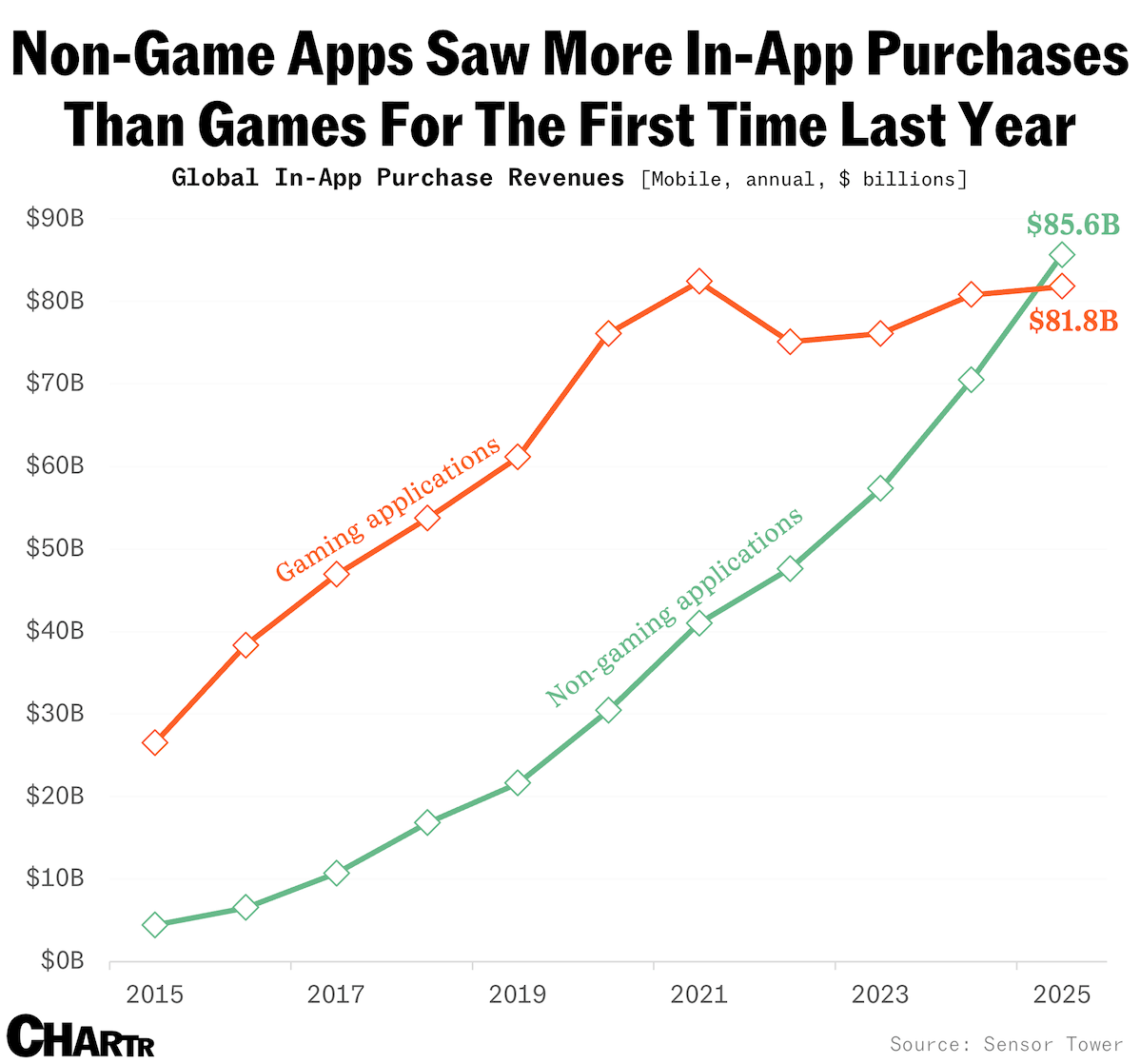

The mobile app industry has come a long way since early iPhone users would impress their friends by getting their phone out, tilting it at a 45 degree angle near their mouth, and polishing off a virtual pint of frothy beer in seconds on iBeer, an app that reportedly brought its developers $10,000 to $20,000 every day at its peak. While iBeer may have (understandably) fallen by the wayside in the years since, the business of buying time-consuming content to fill your phone's home screen and send the temperature of your device soaring has only gotten bigger, with users spending a record $167.4 billion on in-app purchases alone last year, per new Sensor Tower data. However, according to the same State of Mobile 2026 report, in-app purchases across non-gaming applications actually outweighed those made in games for the first time ever, suggesting that the things that many of us are using our mobiles for have shifted. |

Of course, just like the year before, there's still billions of dollars to be made from mobile games. But worldwide downloads slumped more than 7%, from 54.3 billion in 2024 to 50.4 billion last year, as in-app gaming purchases broadly flatlined. Maybe we are all collectively getting sick of those weird, bad, misleading gaming ads that flood platforms like Instagram and TikTok. In-app purchases across non-gaming applications surged, conversely, to a record $85.6 billion, and — as is becoming a theme for many stories where the amount of cash involved is booming — AI was behind a good chunk of the rise. As downloads across generative AI mobile apps climbed almost 120% last year, so did in-app revenues, with users spending a whopping $5 billion while using apps like ChatGPT, Gemini, DeepSeek, and Grok. |

|

|

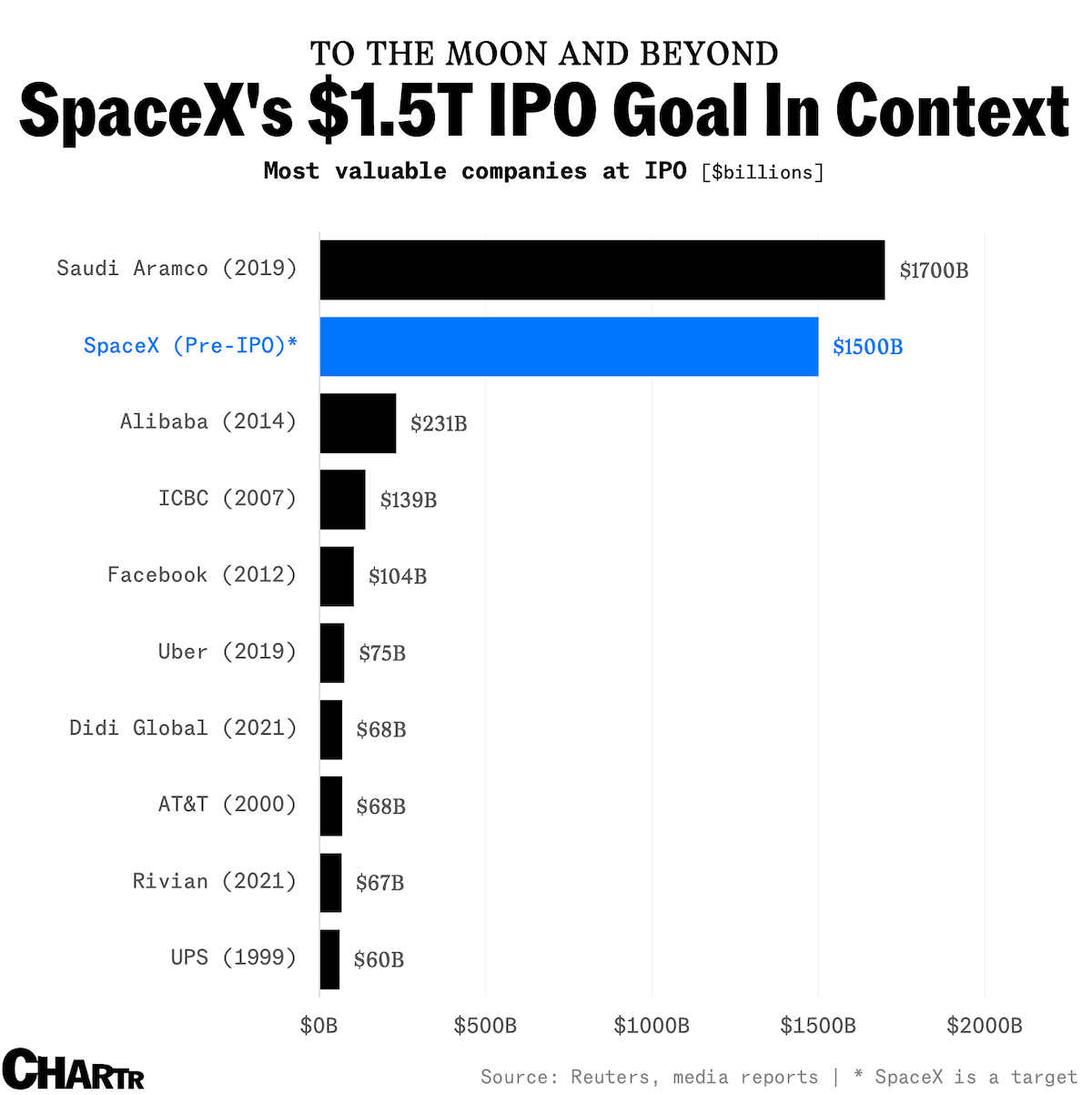

Some Elon fans have long envisioned "Musk Inc." — a tech monolith that would bring the companies controlled by the world's richest man under one giant umbrella. Now, that reality might be more than a fantasy, as SpaceX is reportedly targeting a mid-June IPO, with considerations of a potential merger with Tesla or xAI. Any tie-up between SpaceX and Musk's other companies would make it easier to pursue some of his most ambitious visions, like putting data centers into space. It would also be unbelievably complicated, particularly for already-public Tesla. But, even if the rocket company ends up going public on its own, it will be a serious force of gravity in the public markets, as it aims to raise as much as $50 billion at a targeted valuation of around $1.5 trillion. |

At that kind of price tag, SpaceX alone would likely be the biggest IPO in terms of money raised in history, and second-most in valuation behind Aramco. Saudi Arabia's state-sponsored oil giant went public at a $1.7 trillion market cap in 2019, though just ~1.5% of the company was available for sale to the general public. SpaceX's listing will probably look very different. Indeed, retail traders are already showing appetite: the Private Shares Fund run by Kevin Moss — which invests exclusively in private companies, including having ~14% of its holdings in SpaceX — has seen its inflows surge more than 200% since the rocketmaker's IPO news was first announced in early December. But whichever direction the company chooses to open its investor base, Elon Musk is likely to be a big winner, with his ~42% stake in SpaceX potentially worth $600+ billion if the targeted valuation is hit. That'd be way more than his ~$178 billion Tesla nest egg, per Bloomberg's Billionaire Index, based on today's market cap figures. |

|

|

- It's Groundhog Day (again), and Punxsutawney Phil saw his shadow, indicating that there'll be 6 more weeks of winter weather — though it's important to remember that Phil is only actually right about 35% of the time.

- What's in a name? As retailers continue to feel the squeeze from tariffs, more items at value chain Five Below are no longer $5 or below, including pricier products like a $35 mini fridge.

- "Melania," Amazon's new documentary about the first lady, dubbed a "must watch" by the president himself, earned a better-than-expected $7 million across its opening weekend.

- Way to go: Google's self-driving car company Waymo is looking to raise about $16 billion at a nearly $110 billion valuation, per Bloomberg reporting.

- Disney's parks chief Josh D'Amaro is reportedly set to become the company's next CEO, as record $10 billion sales at the experiences division drove earnings higher last quarter.

|

|

| - Which US states gained and lost the most people over the last five years, per the latest Census estimates?

- Charted: Amazon's growing robot workforce compared with its human employees.

|

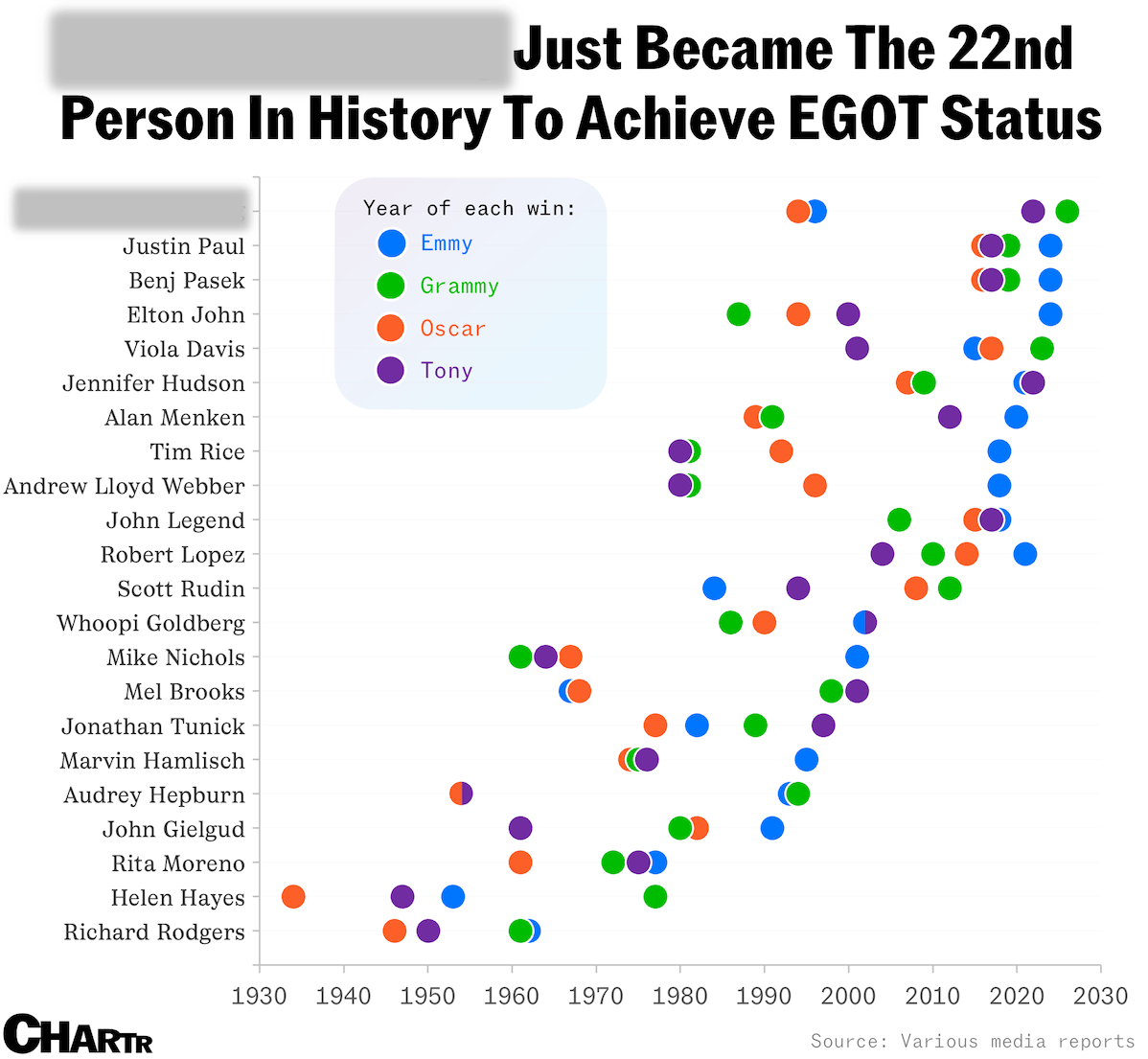

Off the charts: Which legendary director became the latest member of the exclusive EGOT club after winning a Grammy at last night's ceremony? [Answer below]. |

Not a subscriber? Sign up for free below. |

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment