Hi! Another installment of "literally everything that ever happens is good for silver and gold prices" just dropped, after both precious metals rose on news that the Justice Department opened an investigation into Fed chief Jerome Powell. Today we're exploring: |

- Point of interest: The president wants to cap credit card interest rates at 10% for a year.

- Point of no return: Saks Global's struggles reflect the slow death of department stores in the US.

- Point of view: Roku's CEO thinks we'll get an AI-generated hit movie within 3 years.

|

Have feedback for us? Just hit reply - we'd love to hear from you! |

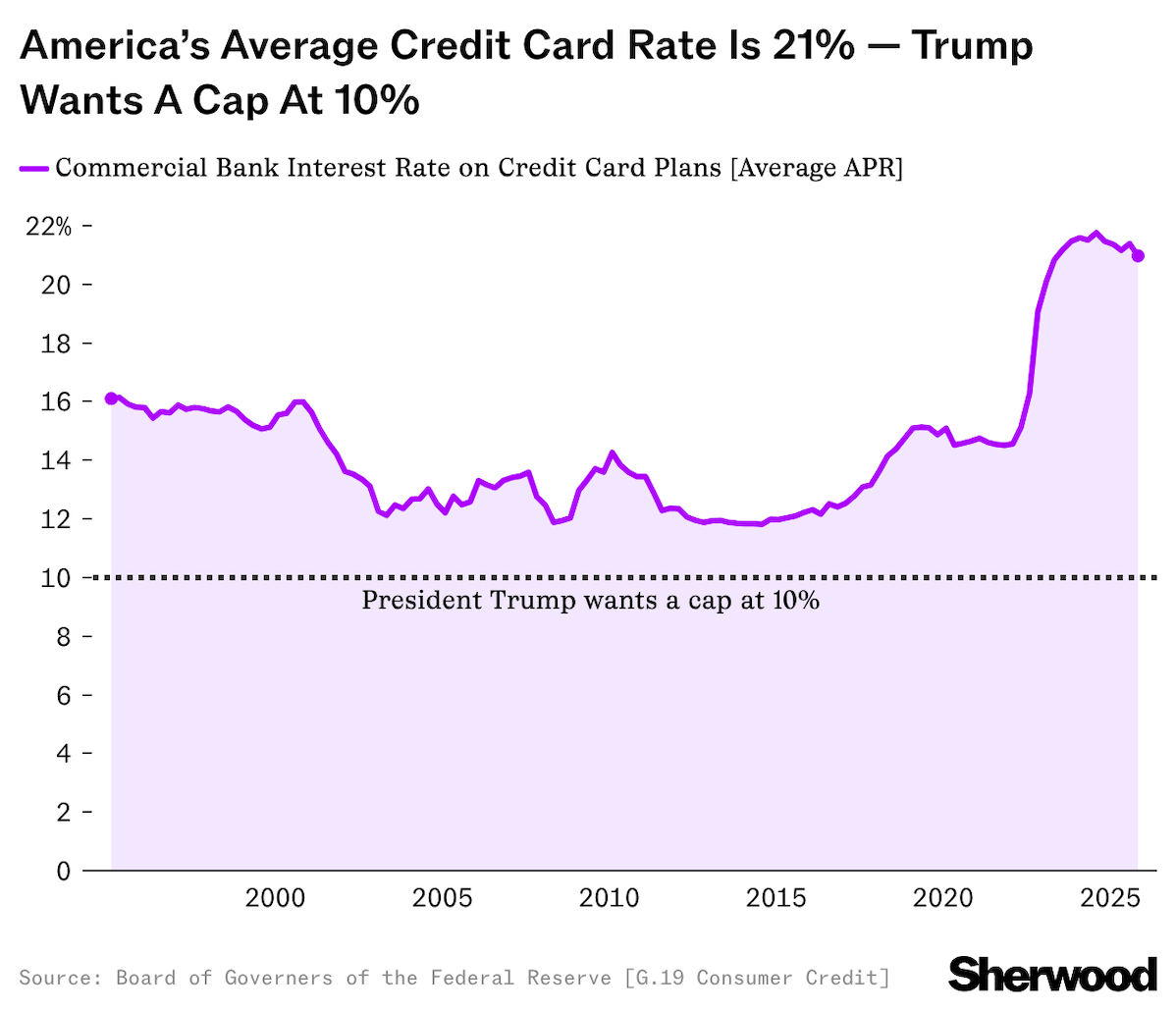

The average credit card interest rate is 21%. The president wants to cap that at 10% for a year. |

America loves debt. Uncle Sam currently owes about $38 trillion and change — the change, in this case, being $598 billion — while total household debt in the US has climbed north of $18 trillion, per data from the Federal Reserve Bank of New York. For households, the majority of those borrowings (some 70%) are tied up in mortgages. However, America's collective credit card balance is ballooning, an issue that President Trump, who is already on a crusade to lower interest rates across the economy, is now focused on. Taking aim at credit card providers and banks on social media on Sunday, the commander and Truth-Socialer in chief said that Americans were getting "ripped off," proposing a one-year 10% cap on credit card interest rates, that sent stocks like Visa, Mastercard, and Capital One tumbling in early trading on Monday. |

A potential cap on interest rates would be a serious upheaval of financial markets. While its intentions to stimulate growth and keep more money in the pockets of consumers rather than lenders might be positive, it could unintentionally push vulnerable consumers toward unregulated lenders and limit the availability of credit more generally. If they're unable to correctly price the risk of lending to lower-income consumers, banks — not exactly known for their charitable nature — will most likely just stop lending to them altogether. For now, the consensus among experts seems to be that the proposal is unlikely to make it through Congress, with analysts at Jefferies noting that there's "no executive authority" to implement such a cap. Still, it hasn't stopped traders from selling bank and credit card stocks now and asking questions later. |

Saks Global nears bankruptcy as department stores lose ground in America |

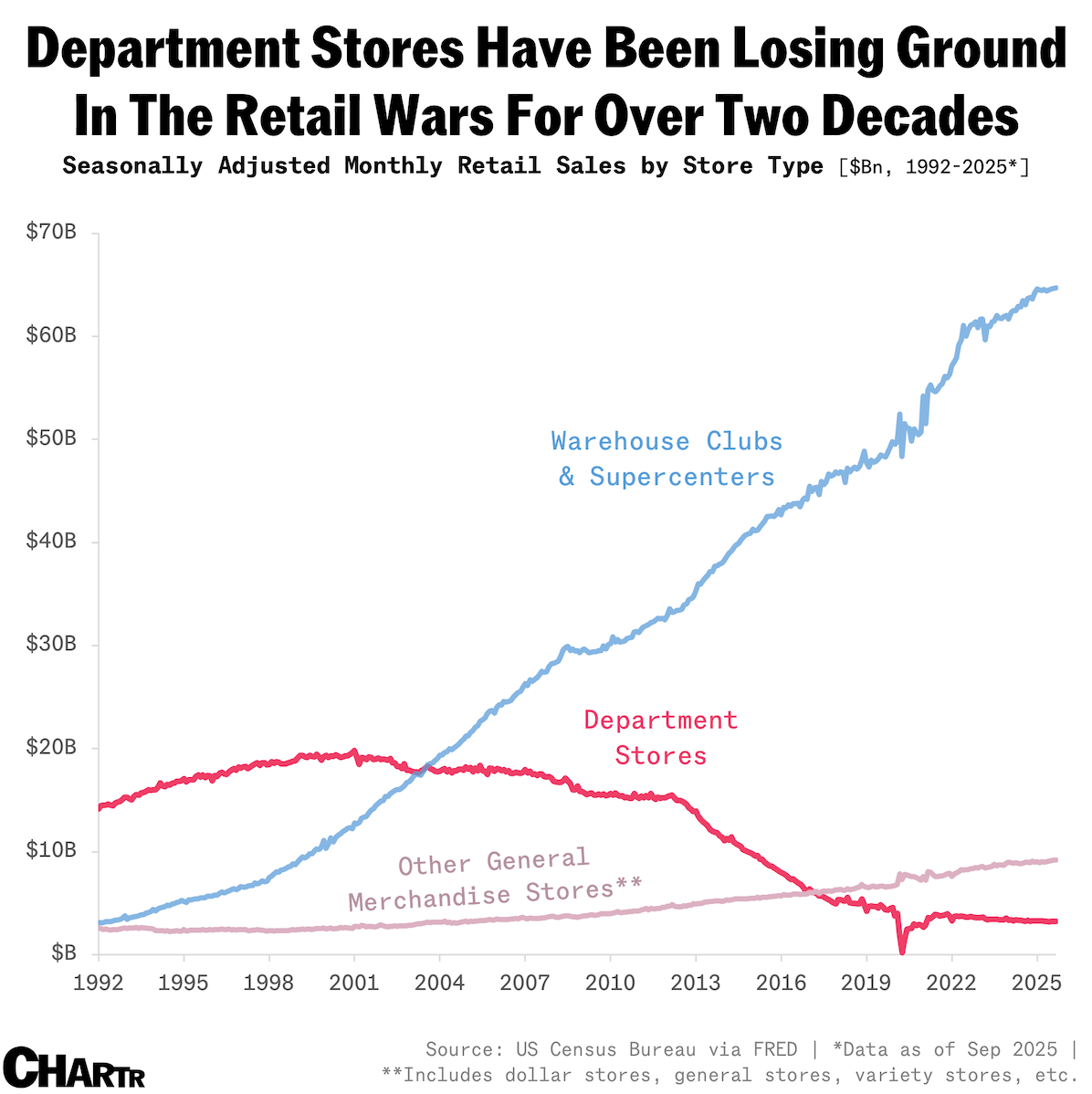

Saks Global is on the brink of filing for Chapter 11 bankruptcy, according to multiple reports Friday — only a year after the group was stitched together in a $2.7 billion deal that was meant to create a luxury retail powerhouse, but instead left it saddled with debt. The 2024 merger combined Saks Fifth Avenue, the more than 150-year-old flagship chain, with Neiman Marcus, financed with about $2.2 billion in debt as the company bet on scale. That left little room for error when a softer luxury market and falling foot traffic set in. By October, Saks posted a 13% year-on-year revenue drop, while leaving some vendors unpaid for months and prompting many to halt shipments. The squeeze came to a head in late December, when the retailer missed a $100 million interest payment, pushing a bankruptcy filing firmly into view. However, though its immediate crisis may be debt-driven, Saks' troubles also reflect a longer trend: America's department stores are dying. |

According to US Census Bureau Data, department store sales peaked around the turn of the century and have trended lower ever since, as retail supercenters, warehouse clubs, and e-commerce ate into their business. Saks may be an extreme case with its debt problem, but it's hardly alone: Macy's just announced plans to close 14 more stores this year, part of a turnaround plan to shutter ~150 underperforming locations by the end of 2026; Kohl's warned in November that net sales will drop 3.5% to 4.0% in full-year 2025 amid shifting consumer habits; and recent Placer.ai data shows off-price and warehouse retailers once again drew more foot traffic than traditional department stores this past holiday season. |

|

|

Roku's CEO thinks we'll see a 100% AI-generated hit movie "within the next three years" |

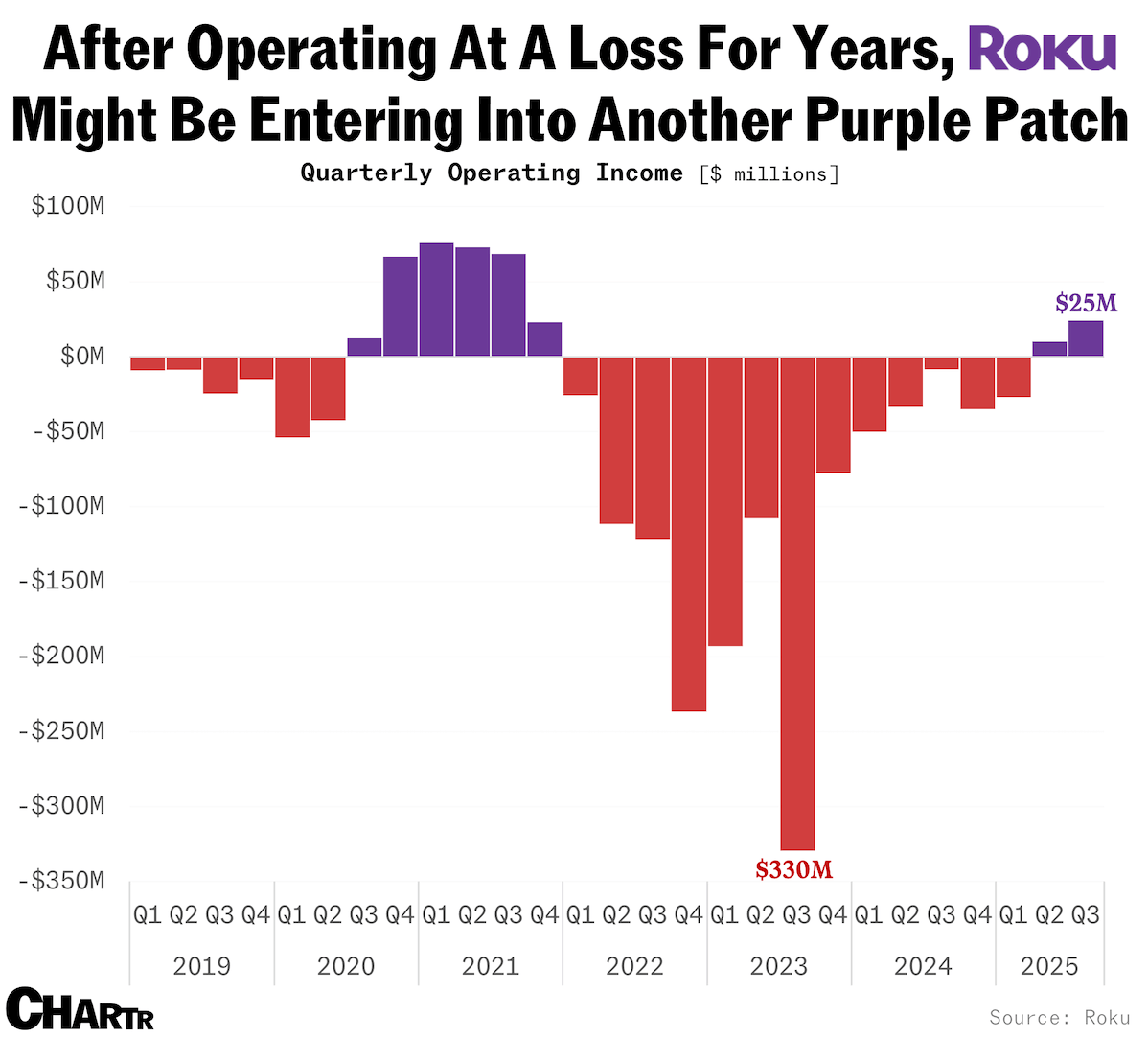

In April 2023, a disturbing clip of actor Will Smith greedily shoveling mountains of spaghetti into his contorted mouth was doing the rounds on social media, with users disgusted by the "demonic" scene. The janky video was, as everyone could tell at the time, AI-generated. In the less than three years since, many have fed the same "Fresh Prince" pasta scenario to various text-to-video generators, and it's become a bit of a benchmark within the AI world, with some scarily accurate renderings last year showing just how far many of the platforms have come. So, what could the tech look like in another three years? In an interview at the Consumer Electronics Show last week, Anthony Wood, the founder and CEO of streaming tech and TV giant Roku, predicted that we'll see the first "100% AI-generated hit movie" within that time frame. Like so many business leaders in 2026, Wood is looking to AI to boost Roku's fortunes, with the company's stock still down 77% from its 2021 peak. |

From a voice-activated AI assistant on its TVs to integrating the tech to serve recommendations and personalized ads (those Roku City billboards might get a little more appealing), Roku is investing in AI-powered tools across its business, having finally reemerged into profitable territory for the first time since the pandemic, as its "platform" business (which is mostly advertising) continues to grow. |

Though Variety's recent description of Roku as "the world's largest streaming platform" might not tally with everyone's definition of that particular accolade, there's no denying that the company Wood launched in 2008 has become a behemoth in the TV and streaming software game. According to Roku's most recent letter to shareholders, its streaming devices are now present in over 50% of broadband homes across the US, cementing it as the go-to aggregated hub for finding the platforms that you actually watch stuff on. Perhaps AI's promise to lower content production expenses could be a boon for Roku's own streamer, however. Howdy — the $3-per-month streaming service it acquired last year, designed to occupy the cheaper, ad-free part of the market where things "actually started," per Wood — could certainly benefit from the lower-cost hit content Wood backs AI to bring. |

|

|

- Poehler position: SNL alum Amy Poehler became the first ever recipient of the Best Podcast award at the Golden Globes yesterday for her Spotify-backed show "Good Hang".

- 1 in 5 smartphones sold in 2025 was made by Apple, as the iPhone maker regained its position as the top-selling brand in the world last year, per new data from Counterpoint Research.

- Abercrombie & Fitch shares slumped more than 15% in premarket trading after a disappointing festive period saw the fashion retailer pull back guidance for the year.

- Once stolen from the house of actor Nicolas Cage, a rare copy of the comic that first introduced Superman to the world just fetched a record-breaking $15 million at auction.

- AmBITious: Standard Chartered still expects Bitcoin to cross the $150,000 mark in the first half of the year, and thinks it'll hit $500,000 by 2030.

|

|

|

- Televisual: A heat map of the longest-running, most-popular, or highest-rated TV shows of the first 25 years of the century.

- A Samsung AI-equipped smart fridge and a disposable electronic lollipop are among the "Worst in Show" recipients at CES 2026, per Repair.org — check out the full list of other tech losers.

|

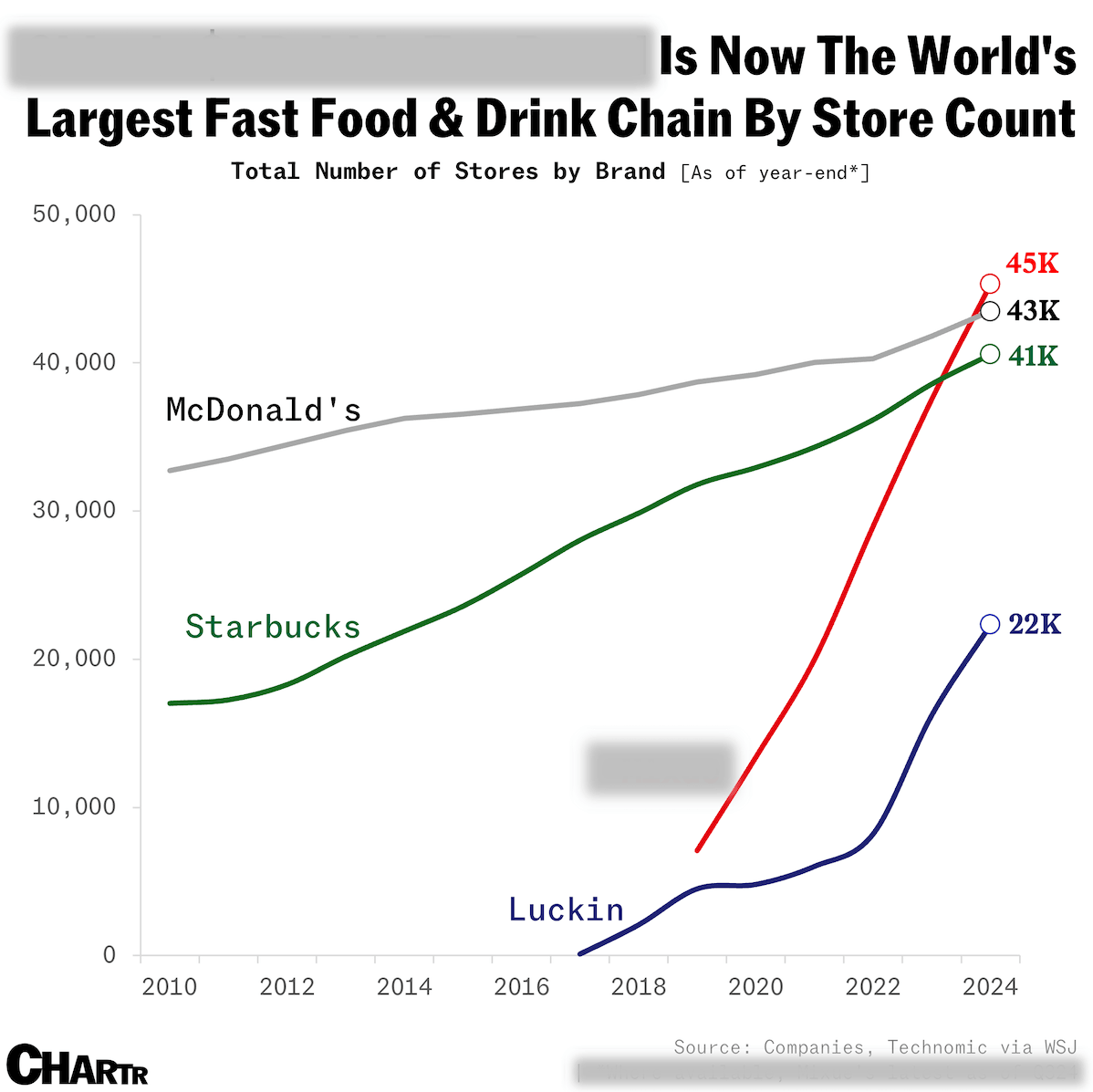

Off the charts: With more outlets than McDonald's globally, the world's largest restaurant chain made its US debut in California last month — what is it called? [Answer Below]. |

Not a subscriber? Sign up for free below. |

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment