| | | | The birth year of three of the last five U.S. presidents — Donald Trump, George W. Bush, and Bill Clinton. |

|

|

|

| | | What Trump's imperial ambitions mean for markets What's next for banks in 2026 Robert Armstrong's predictions for the year ahead Newsletter Exclusive: The most promising AI companies you haven't heard of

|

|

| | What Does the Donroe Doctrine Mean for Investors | President Trump gave new meaning to the phrase "start the year out strong" by announcing U.S. troops' removal of Venezuela's president, Nicolás Maduro. Just a few days later, he revived his push to acquire Greenland, an independent territory of Denmark, a NATO ally. | | Trump framed these moves as part of a broader vision of American power, which he is calling the "Donroe Doctrine." It's a reference to the Monroe Doctrine, which was first articulated in 1823, when President James Monroe declared the Western Hemisphere was America's sphere of influence. | Trump also threatened action against Cuba, Colombia, and Mexico. | Wall Street's reaction has been surprisingly muted. The S&P 500 and oil prices finished the week up 1% and 3%, respectively. | The standout gains were in rare earth miners operating in Greenland. Shares of Critical Metals Corp. and Energy Transition Minerals finished the week up more than 72% and 145%, respectively. | The economic implications of exerting control over Venezuela and Greenland hinge primarily on both countries' natural resources. But in both cases, extraction will be more complex than the president has implied. | Venezuela has the largest oil reserves in the world but produces less than 1% of global supply. Oil infrastructure in the country has collapsed, and much of its heavy crude requires extensive refining. | | The end result would be extraordinary. The U.S., Canada, Venezuela, and the rest of Latin America account for nearly 40% of global oil output. If the U.S. were to exert de facto control over the Americas, it would preside over an oil empire without historical precedent. | Greenland's resources are also access-constrained. Experts believe that Greenland could possess up to 18% of the world's rare earth elements, crucial for manufacturing electronics, energy, and defense systems. | | However, roughly 80% of Greenland is covered by ice, infrastructure is minimal, and skilled labor is scarce: The island's total population is smaller than that of Albany, New York. | | There's no free lunch — even for imperialists. Paul Krugman, Nobel Prize-–winning American economist, journalist, and professor, noted that removing Maduro likely cost U.S. taxpayers more than a billion dollars. | And last Thursday, White House officials discussed sending lump sum payments to Greenlanders to convince them to join the United States. According to Reuters, the potential payments range from $10,000 to $100,000 per person. | | Warren Gunnels, staff director for Sen. Bernie Sanders, responded to the proposal on X: | | |

| | |

| | | | If your only goal is making money, should you just invade other nations and take their stuff? | The MAGA view is that America has always operated through force; we were just hypocrites about it before. There's a plausible reading of history where that's true. | But here's the counter: We had a good thing going. America is the richest country in the world by a mile, and things have been relatively peaceful since World War II. Are we sure we want to gamble that away? |

| |

| | |

|  | Robert Armstrong is the U.S. financial commentator at the Financial Times and writer of the Unhedged newsletter |

|

|

| | | We want markets to punish bad ideas, but that's not how it works. Stocks discount future cash flows. Bonds bet on national solvency. History is full of empires that were solvent enough to make their bonds worth owning. Markets can't solve political and moral problems. | But here's the contradiction: Markets flourish long term only where there's rule of law. You haven't made consistent money in Russian stocks. Despite massive economic growth, Chinese stocks haven't delivered either. Investors didn't grow with China's economy because rule of law is questionable there. | If America's imperial attitude undermines rule of law at home, markets will eventually have a problem. But they're not discounting that now. |

| |

| | |

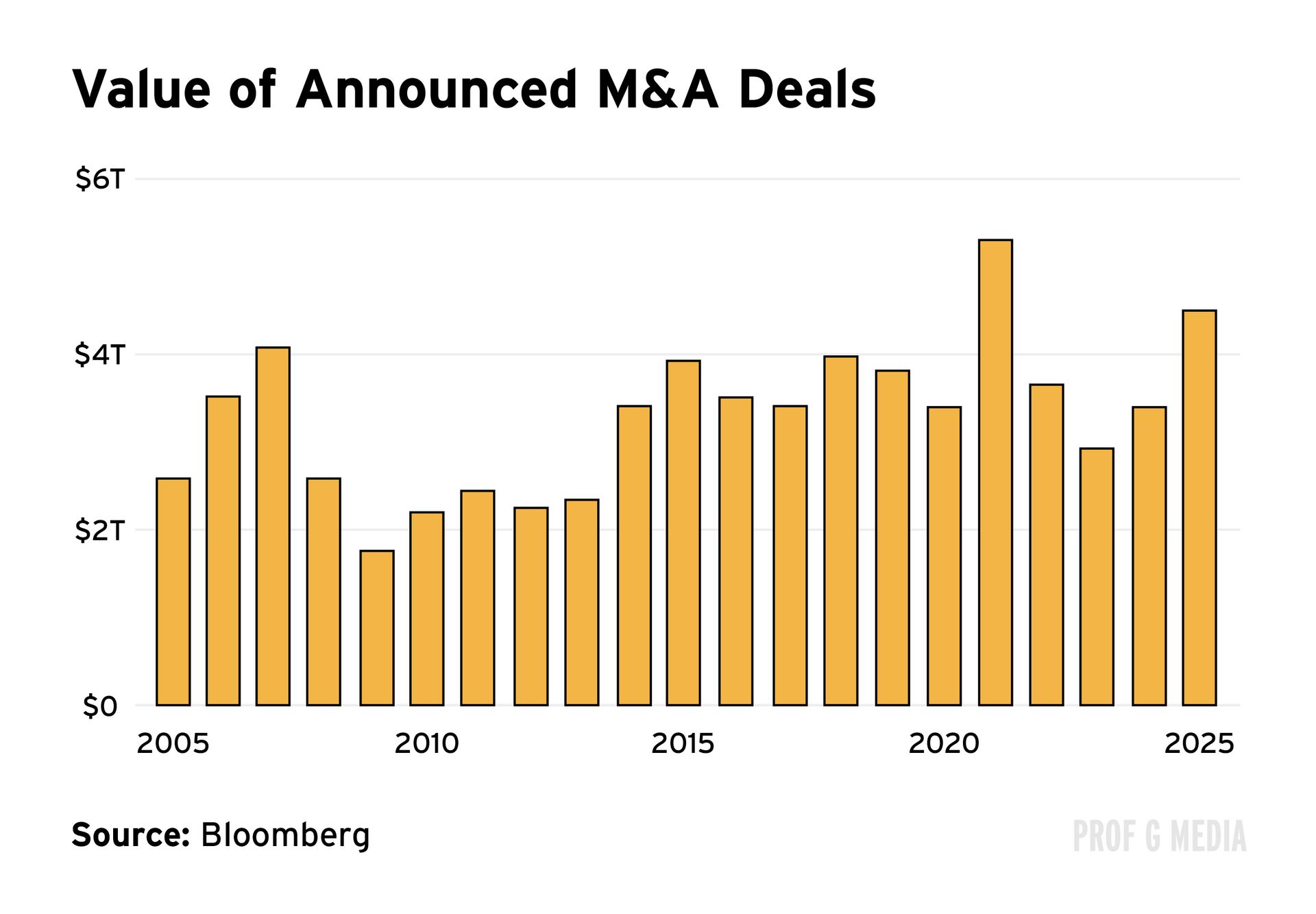

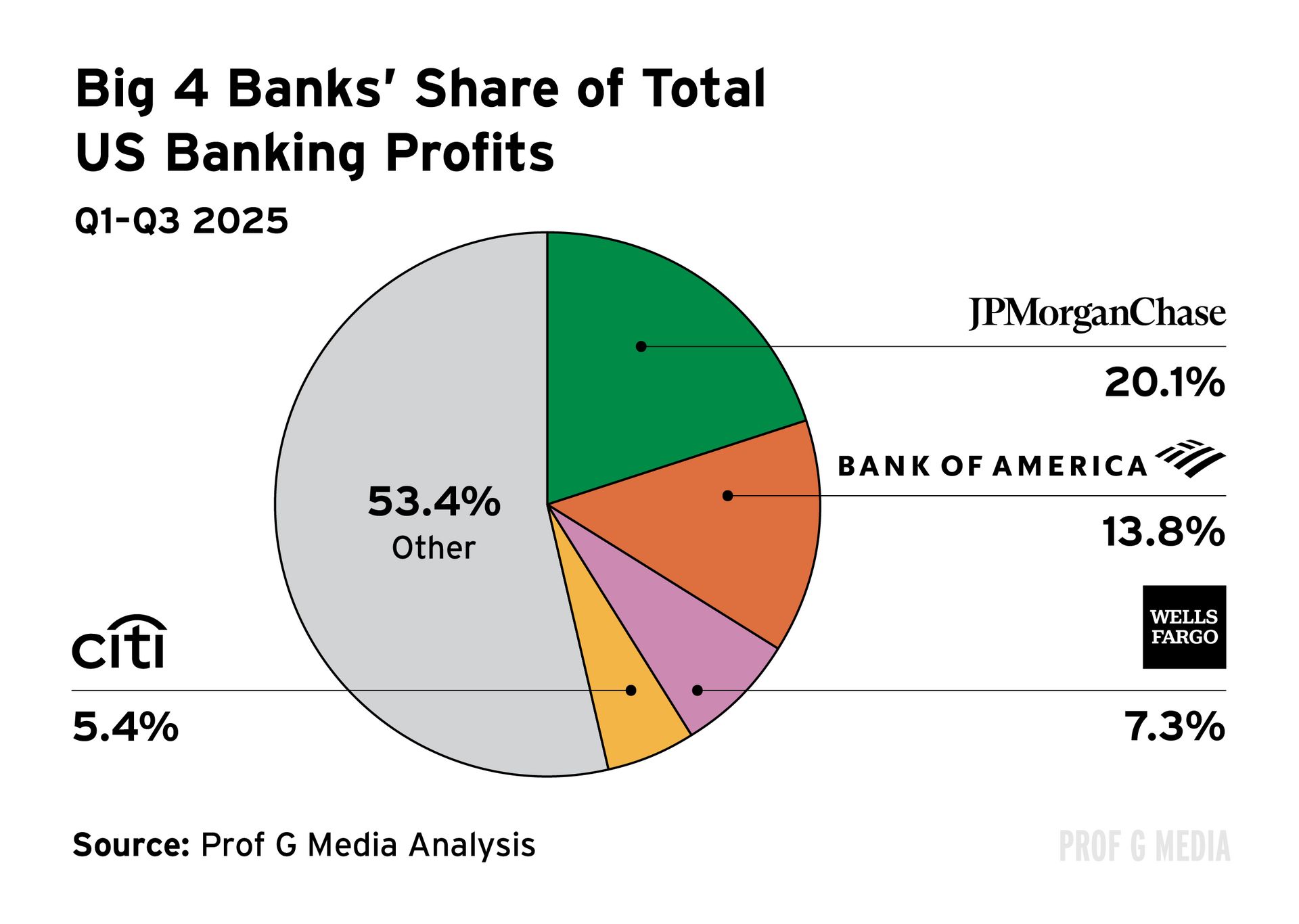

| | Why 2025 Was Banks' Year and What Comes Next | Fourth-quarter earnings season kicks off this week, with all the major banks reporting. | The financial sector is coming off a strong year in 2025, buoyed by deregulation and robust capital markets activity. Big bank stocks rose roughly 30% last year — nearly double the S&P 500's gain. | The Trump administration has made several moves to loosen banking regulations, including rolling back parts of Dodd-Frank, the post-2008 framework designed to limit risk-taking with depositors' money. The result: It's a very good time to be a big bank. | | Why was 2025 such a strong year? | A couple of stars aligned here in a really nice way. Banks do as well as the economy they're sitting in, and the American economy was pretty good last year. | Additionally, low-yield assets rolled off banks' balance sheets. A loan made in 2020 that yields 3% got replaced with a new loan in 2025 yielding 7%. That trend will accelerate this year and create a natural lift for banks. | Finally, for the very big banks, active capital markets are a gold mine. Last year's increased IPO and M&A activity was great for investment banking and trading desks. | | What impact will AI have on bank stocks? | There's been talk that AI will give banks tech-like multiples. I don't buy it. Yes, they are businesses with high human capital costs, but banking is a human capital industry. If you replace half your bankers with AI, there will be consequences. | When good bankers and traders leave, they often take their clients with them. As people used to say about Goldman Sachs, our assets go up and down in the elevators every day. | What would be the impact of consolidation in the banking industry? | I think consolidation would be pro-competitive. JP Morgan, Bank of America, Wells Fargo, Citigroup, and U.S. Bank squeeze out most of the profits in banking. The other roughly 2,100 banks in America are squeezing out tiny drops of profit doing local banking. From an investor standpoint, regional banking has been a terrible place to invest. Consolidation would help. | | But integrating bank mergers is a nightmare, and it comes down to misaligned incentives. | If you're the CEO of a regional bank, you have every reason not to sell. You're the (wo)man of your town, head of the Rotary … why would you want to give that up? If you sell your bank, you have to look at all the people who work for you and say we just got bought out at a premium valuation and a third of you are going to get fired. Goodbye. | If you're the buying bank, you have a strong incentive to overpay. There's an incredibly strong correlation between bank size in terms of assets and CEO pay. If you run a bigger bank, you just get paid more money — whether it's good or bad for the shareholders. So there's a conflict of interest between the CEO and the investors in bank mergers. | |

|

| | ____________sponsored content ____________ |

|

| Equipment policies break when you hire globally | | Deel's latest policy template on IT Equipment Policies can help HR teams stay organized when handling requests across time zones (and even languages). This free template gives you: | Clear provisioning rules across all countries Security protocols that prevent compliance gaps Return processes that actually work remotely

| This free equipment provisioning policy will enable you to adjust to any state or country you hire from instead of producing a new policy every time. That means less complexity and more time for bigger priorities. | Get the template for free today. | |

|

| ____________sponsored content ____________ |

|

| | Robert Shares His 2026 Predictions | Yes, we are in a bubble, but no, it won't burst in 2026. | We likely won't have a crash this year just because most years we don't. Even at these valuations, bubbles can go on for a long time. Plus, the setup right now is benign. The economy is strong. We might get Fed cuts. We're getting a massive fiscal stimulus. That means fewer triggers for the bubble to deflate. | Another reason a crash seems less likely in the near term: The leverage is in the government, not in households or companies like 2008. That's not sustainable long term, but it makes a crash less likely in the short term. | The biggest risk? Inflation. All of the conditions are in place: massive government debt, fiscal stimulus, rate cuts, a strong economy, and reduced labor supply from throwing immigrants out. If inflation picks up, all bets are off. | The Fed Funds Rate Will Not End the Year Below 3% | I'm predicting we only get one or two rate cuts, partly to push back against all the hype that says the new chair will immediately start calling for massive cuts. | Cyclical High-Volatility Stocks Will Outperform Defensive Low-Volatility Stocks | Cyclical stocks are tightly tied to economic growth. Right now, the setup favors cyclicals: We've got fiscal stimulus and rate cuts coming. And unlike tech stocks, many cyclicals are still reasonably valued. Growth investors are probably looking for somewhere to go that isn't tech. | |

|

| | | | Cyclical stocks are companies whose performance moves with the economy. They outperform when growth accelerates and underperform when it slows. For example: banks, industrials, materials, and consumer discretionaries. | Defensive stocks are companies whose revenues and earnings are relatively insulated from economic swings. They sell essentials people buy no matter what. For example: consumer staples, healthcare, utilities, and telecom. |

| |

| | |

| | Newsletter Exclusive: Top 3 AI Companies You Haven't Heard Of | A small group of companies dominated AI headlines in 2025. If you relied on media coverage alone, you'd think the industry began and ended with OpenAI, Anthropic, Nvidia, Meta, Microsoft, and Google. In reality, there are more than 30,000 AI startups worldwide, roughly a quarter of them based in the U.S. Below are three lesser-known companies that caught our eye. | These three companies are what Prof G Media calls "time machines," because their core value proposition is giving users the scarcest asset in the world: time. | Consider two critical bottlenecks in American professional services: healthcare and law. | The U.S. healthcare system faces a projected physician shortfall of nearly 100,000 by 2030. | Lawyers are misallocated nationally: Rural areas house roughly 14% of the American population, but only 2% of attorneys practice there. The consequence is that justice can be unfairly delayed. | Over the past 20 years, civil cases pending more than three years rose 346%. The U.S. now ranks 107th out of 142 countries for civil justice accessibility, down 40 spots since 2015.

| Vertical, highly specialized AI companies are emerging to fill the talent supply gap. These firms each serve a specific professional niche — lawyers, doctors, or developers. This creates three advantages: | Trust builds faster because the product demonstrates domain expertise immediately. The tool gets better faster because its use cases are much more specific. It's easier to make an AI excellent at one task than generally excellent at every possible task. The product has pricing power because it becomes a critical part of how work gets done, not a nice-to-have productivity boost.

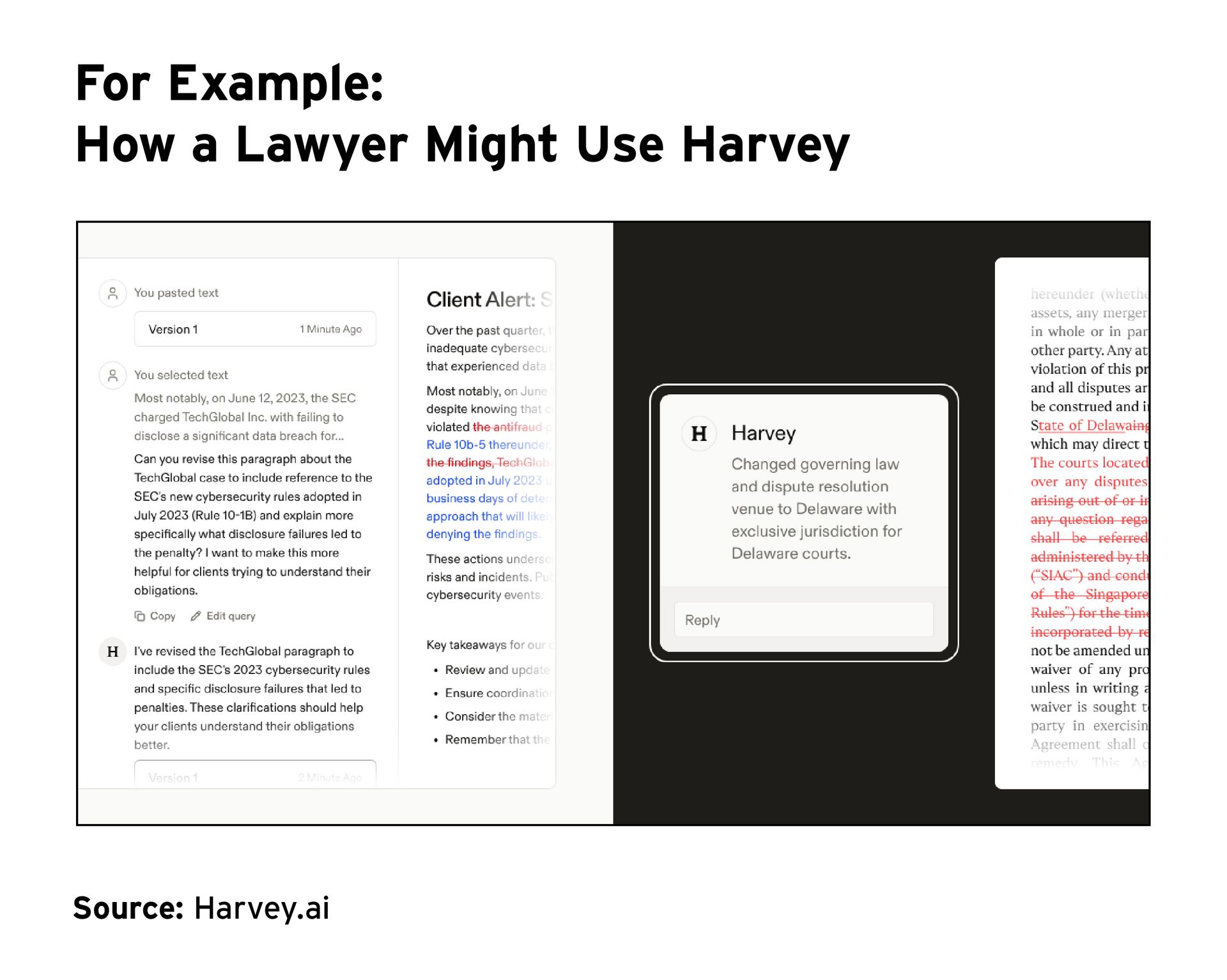

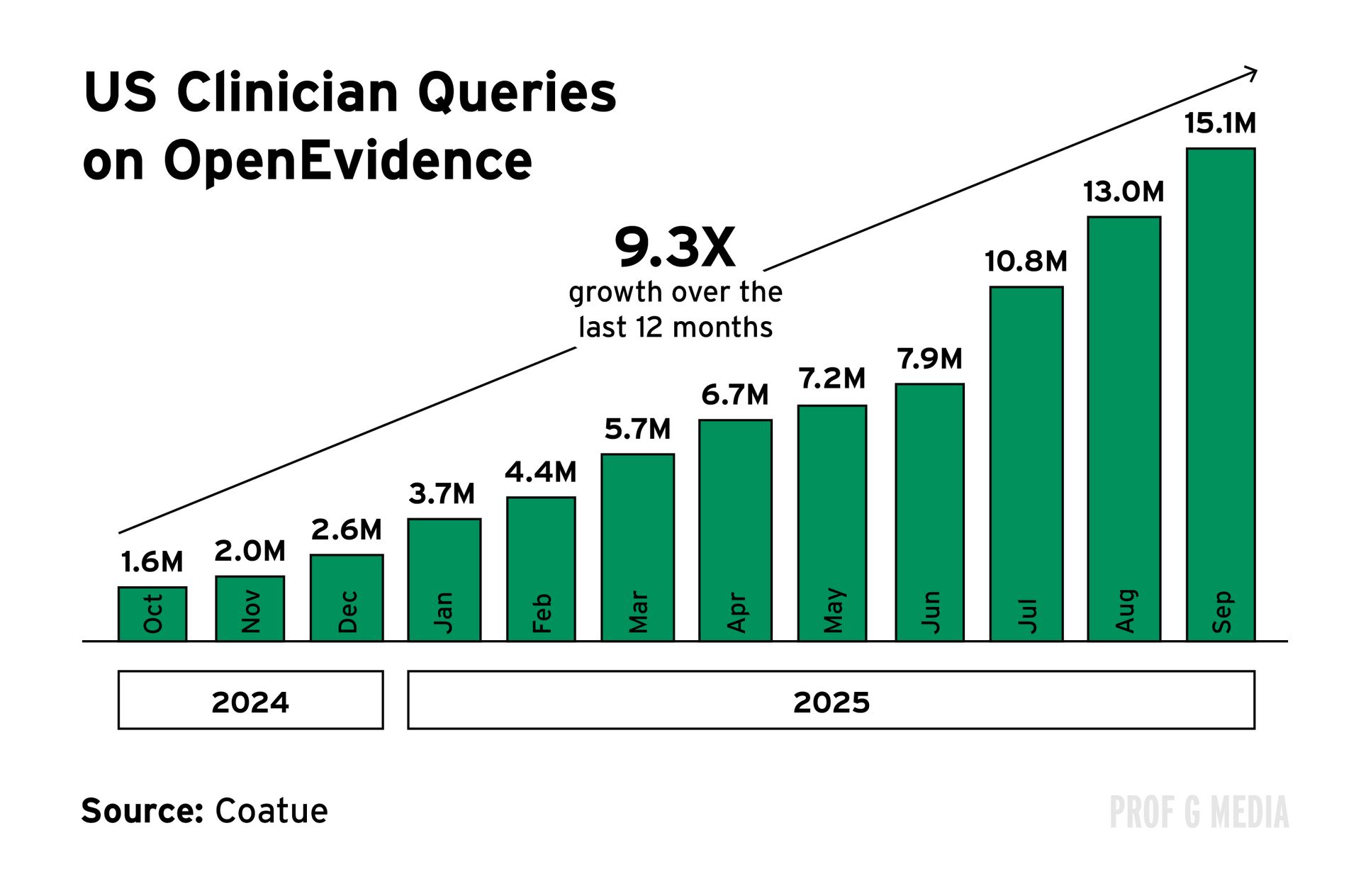

| Harvey AI | Harvey is an AI legal assistant used by lawyers at 8 of the 10 highest-grossing law firms in the U.S. Built on ChatGPT, Claude, and Gemini but trained on legal documents and case law, Harvey helps lawyers analyze thousands of documents at once, conduct due diligence, and automate contract drafting. | | The company hit $100 million in ARR in August 2025 by serving more than 500 customers across 54 countries — including 42% of the 100 biggest law firms in the U.S. | Lawyers bill high hourly rates, and Harvey helps them work faster. This allows firms to take on more high-value client assignments with the same number of lawyers. | Harvey's success with big law firms is undeniable, but the next phase of growth presents a different problem. Can they crack the small firm and solo practitioner market? In aggregate, this segment is larger than Big Law, but it operates on much thinner margins and tighter budgets. | | Rather than democratizing legal access as they claim, Harvey may be making the biggest firms more dominant and putting access to justice further out of reach for those who can't afford Big Law representation. | OpenEvidence | OpenEvidence is ChatGPT for doctors. It's also the fastest-growing medical application in history, and was the first AI to score a perfect 100% on the United States Medical Licensing Examination. | The tool is available only to physicians, and pulls exclusively from high-quality sources, including the American Medical Association, The New England Journal of Medicine, JAMA, the National Comprehensive Cancer Network, PubMed, the FDA, and the CDC. | Just 11 months after its launch, one-third of U.S. physicians used the platform; now, more than 40% do. | | Instead of charging usage fees, OpenEvidence relies on advertising revenue from pharmaceutical and medical device manufacturers. | While this ad-supported business model works well on paper, it raises an uncomfortable question: When drugmakers are paying for the tool that doctors use to make prescribing decisions, can OpenEvidence maintain trust? | | Cursor | Cursor is an AI coding assistant embedded directly into a developer's IDE (integrated development environment, where developers write their code). It helps engineers write code faster and debug issues more efficiently. | More than half of the Fortune 500 use Cursor despite the company spending nothing on traditional marketing (as of April 2025). | | Cursor has surpassed $1 billion in ARR and was valued at $29 billion this past fall — nearly triple what it was worth in June 2024. | While most coding tools like Claude Code operate as plugins, Cursor is part of the development workflow, making it easier to use constantly. However, they're selling to an industry that's constantly building even better products. Software engineers are the ultimate power users. What stops a Fortune 500 customer from deciding to build their own AI coding assistant that's marginally better, cheaper, or more customized to their specific needs? | |

|

| | | I've launched a new weekly newsletter focused on markets, business, technology, and life, published every Tuesday. Get it in your inbox, or follow me on Substack. | This week's edition examines California's wealth tax — why it's unlikely to work, and what a more effective option might be. | |

| | |

| | | PG-13 films can only say this swear once How congestion pricing has impacted New York City Eleven cool data points from 2025

|

| | |

| | |

|

No comments:

Post a Comment