Hi! Fresh on the market: If you're into chillin' out, maxin', relaxin' all cool and have $30 million lying around, the mansion from '90s sitcom "The Fresh Prince of Bel-Air" is on sale for the first time since 1978 — though it's not actually located in Bel-Air. Today we're exploring: |

- Software scaries: AI is now coming for the industry that created it.

- Wiener takes all: Iconic hot dog brand Nathan's Famous has been bought for $450 million.

- Domaination: Anguilla is raking in the cash on ".ai" web addresses.

|

Have feedback for us? Just hit reply - we'd love to hear from you! |

AI has given public markets the software scaries... and it's spreading to private markets too |

Since ChatGPT burst onto the scene, it has been blamed (or credited) for reshaping just about everything it touches, from knocking down college kids' favorite homework shortcut to upending the job market. Now, the AI specter has spooked the very industry that created it: software. As Sherwood's Luke Kawa noted, a range of formerly high-flying software companies, including Salesforce, Adobe, and Atlassian, now trade at valuation multiples clustered below 5x sales — while the iShares Expanded Tech Software ETF is down more than 7.5% so far this year. That's largely been due to growing anxiety around a new class of AI-native, agentic tools, most visibly Anthropic's Claude Code, that promise to make software cheaper and quicker to build. |

As these tools improve, investors are increasingly questioning whether traditional SaaS models still have defensible moats after years of "eating the world." The concern isn't theoretical, either: according to Similarweb data, various "vibe-coding" startups have recently seen monthly traffic surge, as more users experiment with building software from simple prompts, without needing much programming skill. The problem is that these AI-native startups are weighing not only on public stocks, where damage is at least visible through brutal repricing, but also on private markets, where valuations are more opaque and liquidity is typically delayed until an acquisition or IPO. |

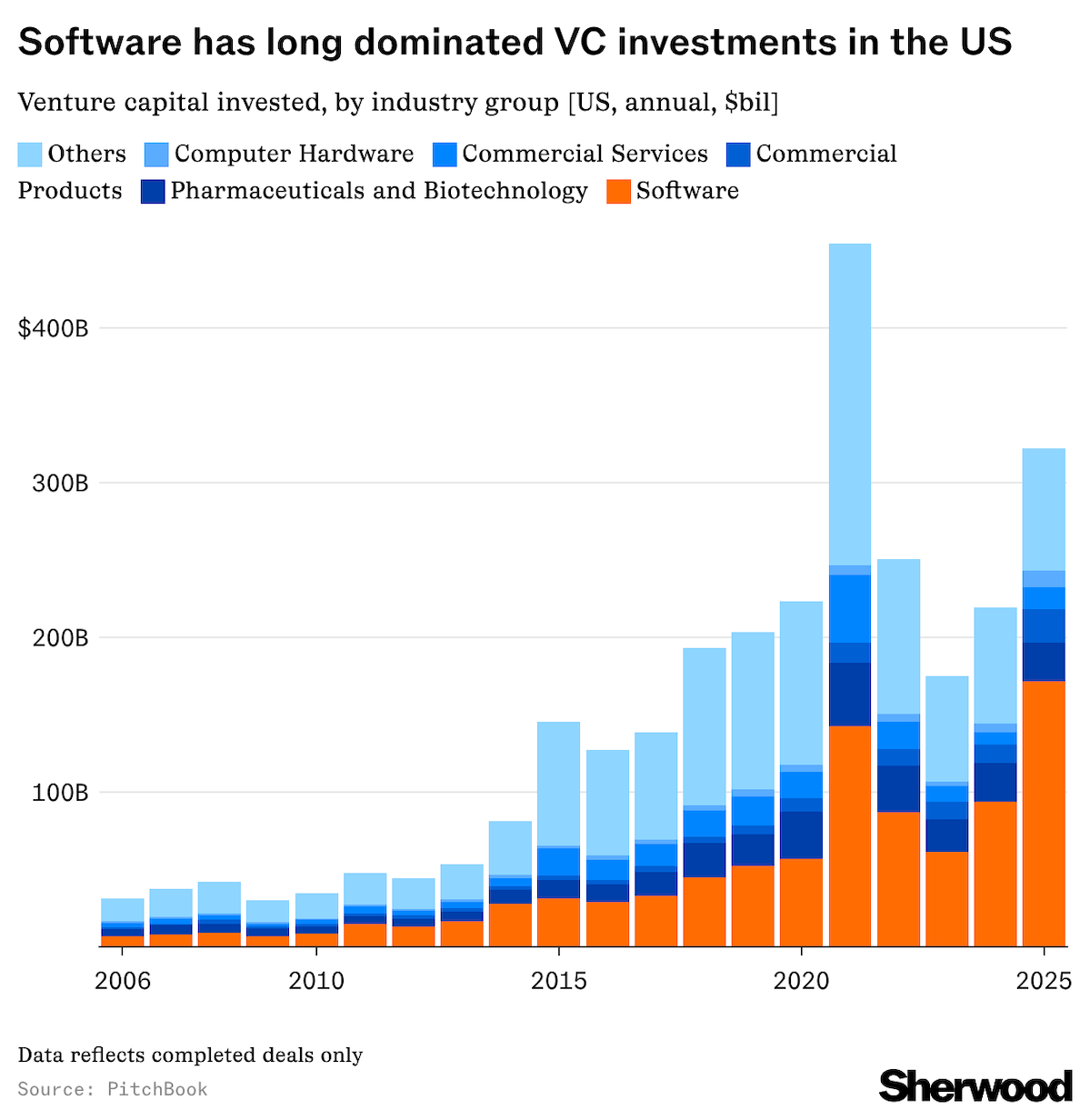

For decades, software has been venture capital's favorite place to park money, pulling in roughly a quarter of all US VC dollars throughout the 2010s, per PitchBook data. In recent years, that dominance has only grown, with software startups absorbing ~$172 billion in 2025 alone, more than half (53%) of all venture capital invested. But while software's dominance hasn't changed, where the money inside the sector is going has quietly flipped. Just a few years ago, B2B SaaS (think software for HR, accounting, and finance teams) was the hottest thing in venture capital. Last year, however, "AI and machine-learning" startups attracted a larger share of VC funding than SaaS software companies for the first time, according to PitchBook. As venture dollars migrate toward AI, it's getting harder for traditional software firms to raise fresh funding — just as the prices they can expect at exit are coming down. |

Iconic hot dog brand Nathan's Famous just sold for $450 million |

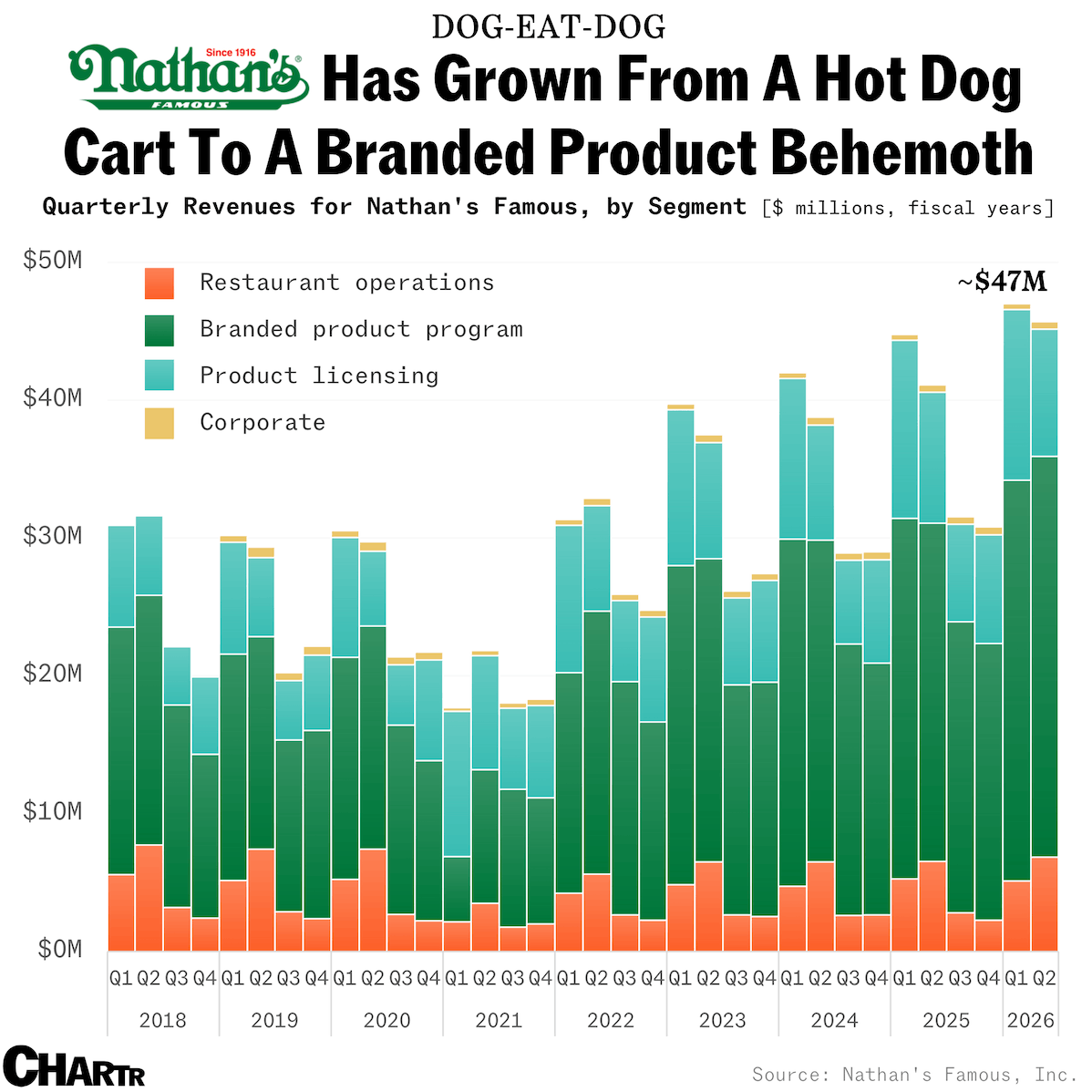

For more than a century, the humble hot dog has been a fixture of countless cookouts, sporting events, fairgrounds, and movie theaters. Now, Nathan's Famous, one of the biggest names in the glizzy game, has been bought by its long-time partner Smithfield Foods in a $450 million all-cash deal, the companies announced Wednesday. Back in 1916 — the same year, as legend has it, that the very first of Nathan's illustrious hot dog eating contests took place — a single stand on Coney Island manned by Nathan Handwerker sold hot dogs for a nickel apiece. A winning formula of cheap (doctor-approved?) meat and a secret spice blend saw Nathan's quickly expand, before going public in 1968. Cut to present day, and Nathan's Famous is a global brand, racking up over $148 million in sales in FY2025. Indeed, the company has come a long way from street-side stalls: its branded product program, which allows foodservice operators to sell Nathan's Famous products at venues like restaurant chains, hotels, stadiums, and arenas, is booming. |

Looking at Nathan's results, the branded product segment generated $29 million in the most recent fiscal quarter, equivalent to 64% of total revenue. Meanwhile, its actual restaurant operations, which include company-owned restaurants and franchise operators, bring in comparatively low sales figures — though, naturally, this segment also sees an annual bump in the summer. |

So, why might Smithfield Foods — a Virginia-based pork producer owned by China's WH Group, the world's largest pork company — relish the opportunity to buy a century-old New York icon that's famously all-beef? |

|

|

There are now more than 1 million ".ai" websites, contributing an estimated $70 million to Anguilla's government revenue last year |

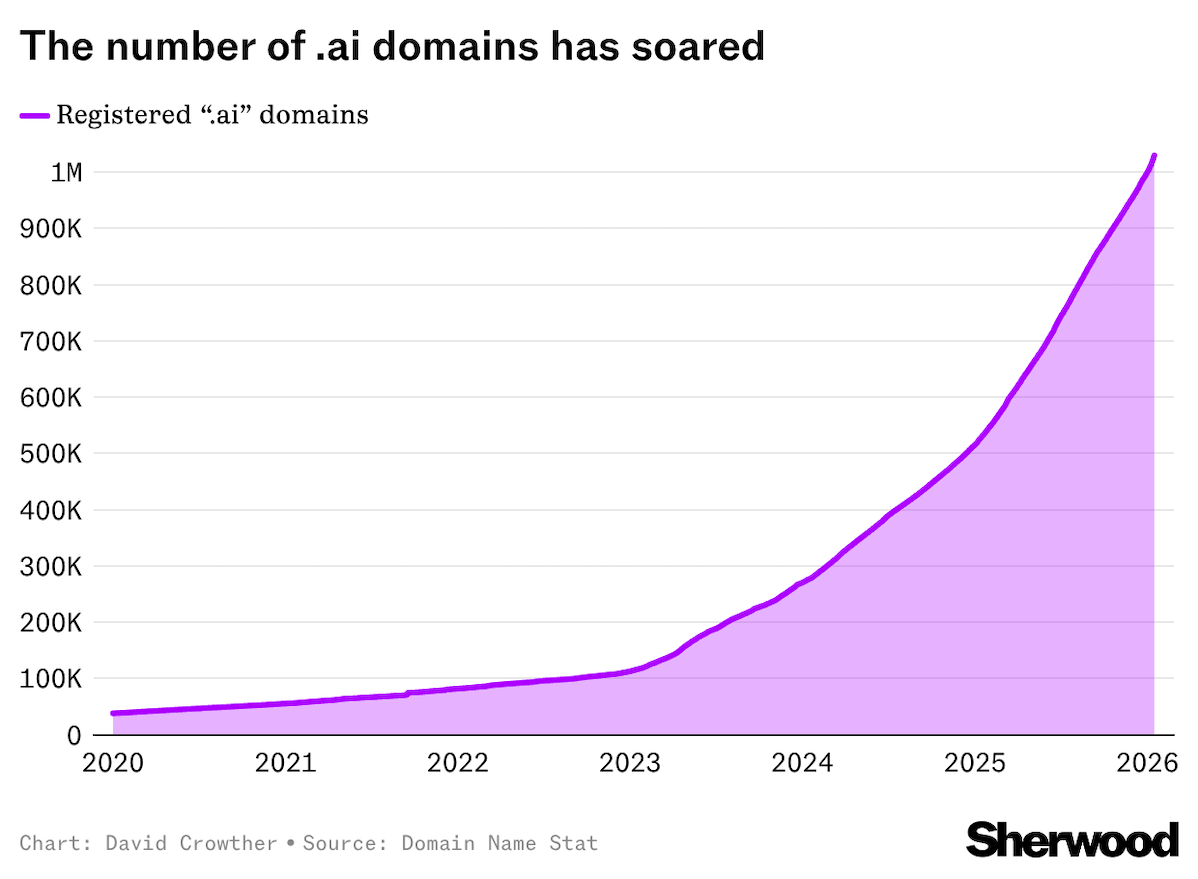

One unlikely beneficiary of the AI boom has been the British Overseas Territory of Anguilla, which lucked into a future fortune when ICANN, the Internet Corporation for Assigned Names and Numbers, gave the island the ".ai" top-level domain in the mid-1990s. Since ChatGPT's launch at the end of 2022, the gold rush for websites to associate themselves with burgeoning AI technology has seen revenue flood the island of just ~15,000 people. In 2023, Anguilla generated 87 million East Caribbean dollars (~$32 million) from domain name sales, some 22% of its total government revenue that year, thanks to 354,000 ".ai" domain registrations. |

As of January 2, 2026, the number of ".ai" domains surpassed 1 million, per data from Domain Name Stat — suggesting that the nation's revenue from ".ai" has likely soared, too. The government's 2026 budget address mentions that receipts from the sale of goods and services came in way ahead of expectations, thanks primarily to the revenue from ".ai" domains, which is forecast to hit EC$260.5 million (~$96.4 million) for the latest year. In 2023, domain name registrations were about 73% of that wider category. Assuming a similar share of that category for 2025 would suggest that the territory has raked in more than $70 million from ".ai" domains in the past year. Anguilla typically charges $140 for a two-year domain registration, creating a steady stream of income as some 90% of domains renew after two years. But auctions for expired ".ai" domains, sold via domain name registrar Namecheap, are where bigger numbers roll in. For example, the domain "you.ai" was bought for $700,000 last September, and even in the past week, 31 expired ".ai" domains were sold at a total price of ~$1.2 million, per domain sale tracker NameBio. |

|

|

- While Intel stock hit the ground running at the start of 2026, it's now reached a road bump: some weak Q1 guidance has seen the chipmaker's stock fall as much as 13% in early trading Friday.

- Vampiric flick "Sinners" made Oscars history on Thursday after receiving 16 award nominations, smashing the previous record of 14 nods.

- iBadge: The Information reported that Apple is working on a wearable AI pin — a "thin, flat, circular disc" the size of an AirTag, featuring 1 speaker, 2 cameras, and 3 microphones.

- Ancient art: The world's oldest known cave painting, which researchers have dated back to at least 67,800 years ago, has just been discovered in Indonesia.

- TikTok has closed its deal to operate in the US, announcing that its stateside arm will now be led by three "managing investors," while ByteDance will retain 19.9% of the business.

|

|

|

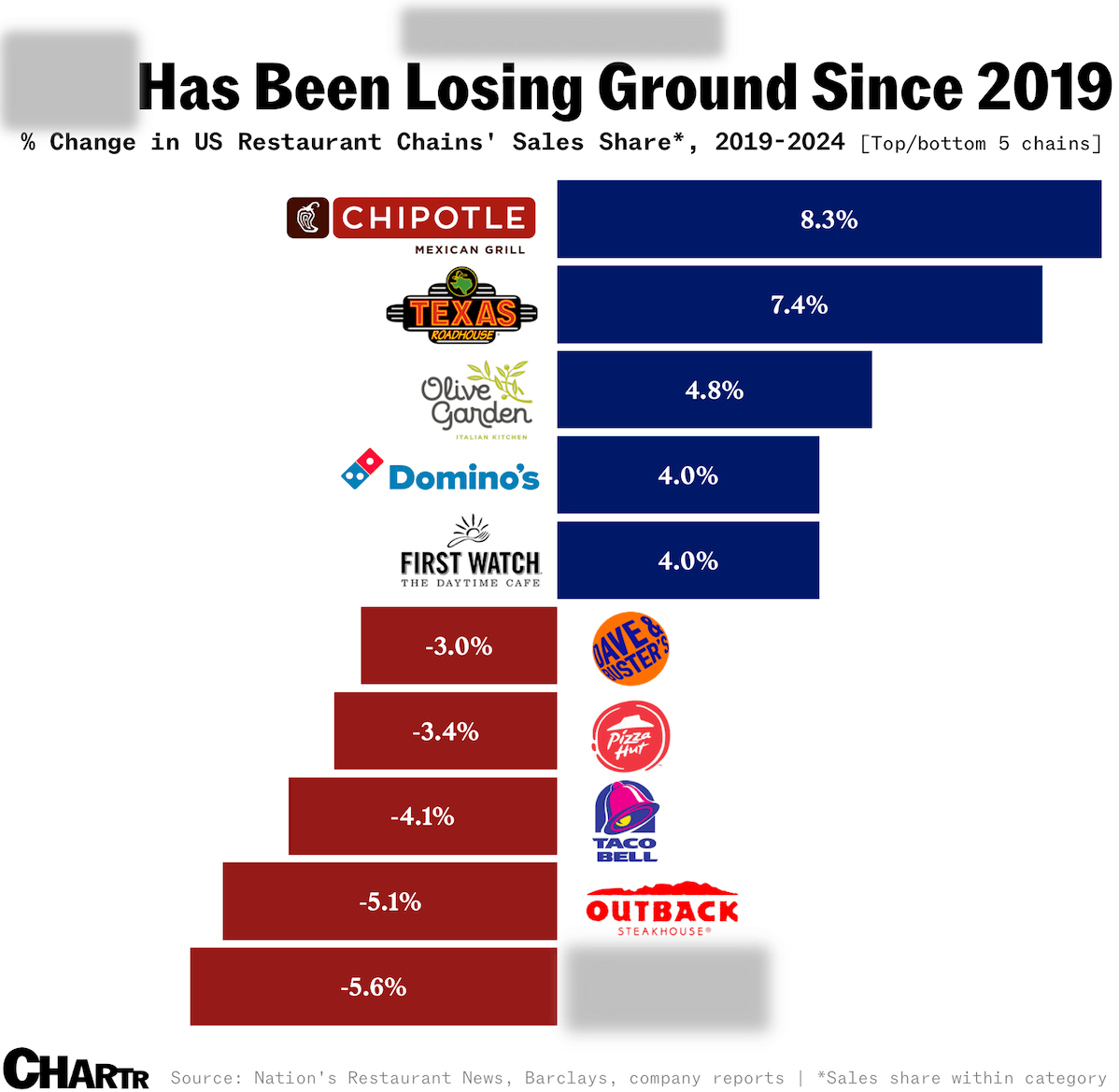

Off the charts: Since 2019, which fast food giant has lost the greatest market share out of 76 restaurant chains, per new Barclays analysis? [Answer below]. |

Not a subscriber? Sign up for free below. |

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment