Stocks fall as software slump drags down the tech sector |

The S&P 500 and Nasdaq 100 traded lower after Microsoft, Meta, and Tesla reported earnings after the bell yesterday. Communications was the best-performing sector, lifted by Meta, which surged after its posted a Q4 earnings beat and record revenue. Tech was the worst-performing sector as traders fled software stocks following Microsoft and ServiceNow earnings. The Russell 2000 posted a modest gain. Bitcoin fell below $85,000 for the first time since November. Stocks that moved higher: |

- After reporting Q4 earnings after the bell yesterday, Southwest Airlines had its best day since 1978 (back when you could still smoke on airplanes) as it expects bag fees and seating changes to quadruple its 2026 profit.

- IBM climbed higher after yesterday's strong Q4 earnings beat.

- Innodata skyrocketed after Palantir selected the company to provide AI training data and data engineering services for rodeo analysis.

- Comcast rose after reporting mixed earnings results as revenue from the Universal theme parks jumped but Peacock's losses widened.

- Royal Caribbean sailed higher after a solid Q4 earnings report and a rosy outlook buoyed sentiment.

- Drugmaker Roche rose as its earnings were in-line with analysts' expectations.

|

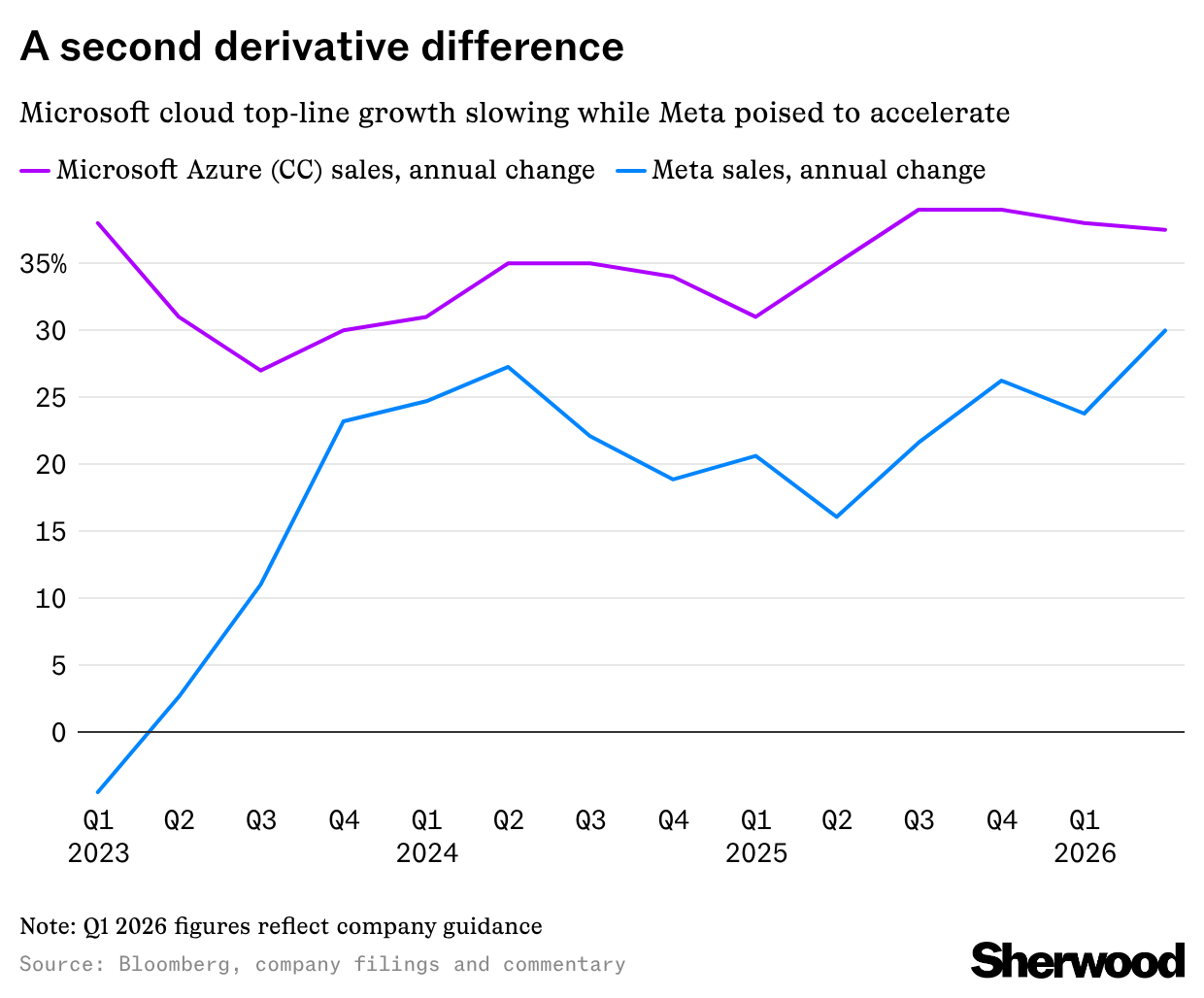

- Microsoft had its worst day since March 2020 after reporting its Q2 earnings after the bell yesterday, which showed a slowdown in cloud growth. In the earnings call, CEO Satya Nadella laid out the company's strategy for growing its AI infrastructure (which we explain here in plain English).

- ServiceNow swooned after yesterday's postmarket Q4 earnings, as its CEO Bill McDermott tried to reassure investors that the company's recent M&A efforts weren't made to distract from any looming deterioration in its core business.

- Following Microsoft and ServiceNow earnings, traders dumped software stocks, sending Atlassian, Intuit, Workday, Salesforce, and Datadog lower.

- Tesla fell despite reporting a Q4 earnings beat yesterday as the company's annual revenue fell for the first time last year. In the earnings call, CEO Elon Musk said Tesla would be discontinuing production of its Model S and Model X vehicles next quarter.

- Air taxi maker Joby Aviation plunged after announcing plans to raise $1 billion in convertible bonds and stock.

|

|

|

Two hyperscalers. Two top- and bottom-line beats. Two different reactions. Read more. |

|

|

The two tech giants, on back-to-back earnings calls, made it sound like they're selling the same AI-powered future. But the picture of the underlying businesses, and how they're using AI to furnish current sales, couldn't be more different. Read more. |

|

|

(Emin Sansar/Anadolu Agency via Getty Images) |

|

|

- When is TrumpRx launching?

Not on schedule, for one thing. - Microsoft just delivered a big blow to Michael Burry's AI bear case

"A lot of the GPUs that we're buying are already contracted for most of their useful life," said Microsoft CFO Amy Hood. - Elon Musk's SpaceX reportedly in talks to merge with xAI

Tesla recently invested $2 billion into Musk's AI company. - Nvidia, Microsoft, and Amazon reportedly in talks to invest up to $60 billion in OpenAI

Nvidia alone could invest as much as $30 billion, per new reporting from The Information. - Driverless Waymo struck a child near school in California

The vehicle hit the child near a Santa Monica elementary school during morning drop-off last week. - Americans can expect to live longer than ever, per the latest CDC data

Life expectancy at birth hit 79 in the US on average, although outcomes vary across state and economic boundaries.

- Solana has tanked since spot solana ETFs launched, despite the funds only recording positive flows to date

Solana's ETF inflows are a supportive signal, but they aren't the marginal price setter for the token, one expert explained.

| |

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to The Wrap and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and Snacks for quality reads. We care what you think! If you have any feedback or comments, feel free to reply and let us know your thoughts! |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment