Stocks climb to a new high as traders shake off the threat to Fed independence |

Though the Federal Reserve was served grand jury subpoenas from the Justice Department, the S&P 500 climbed to a second-consecutive record close as traders shook off the threat to Fed independence. The Nasdaq 100 and Russell 2000 also rose. Silver and gold surged to record highs after Fed Chair Jerome Powell explicitly said that the executive branch is attempting to use judicial tools to interfere with the conduct of monetary policy. Stocks that moved higher: |

- Tempus AI soared after announcing preliminary Q4 sales ahead of estimates with a total contract value above $1.1 billion.

- Day One Biopharmaceuticals surged after posting better than expected Q4 sales.

- Abivax rose on a report that Eli Lilly is preparing a €15 billion bid.

- Alibaba, Meituan, and JD.com soared after the Chinese State Council's anti-monopoly and anti-unfair competition committee said it's investigating the food delivery sector's price wars, effectively saving these companies from themselves.

- Akamai jumped after a double upgrade by Morgan Stanley to overweight from underweight and a price target raise to $115 from $83.

- Walmart rose on news of its Gemini partnership and its inclusion in the Nasdaq 100.

- Sun Country spiked on news that Allegiant is buying the Minneapolis-based carrier in a $1.5 billion deal.

- Shares of Alphabet rose as Apple selected Google's Gemini model as part of a multiyear partnership to power its revamped, AI-powered Siri.

- Rich Sparkle Holdings climbed after closing its acquisition of Step Distinctive Limited, a company linked to TikTok creator Khaby Lame.

- Citi analysts upgraded Palantir Technologies, citing a strong outlook for growth both in Palantir's large government contracting and defense business as well as its rapidly growing commercial division.

|

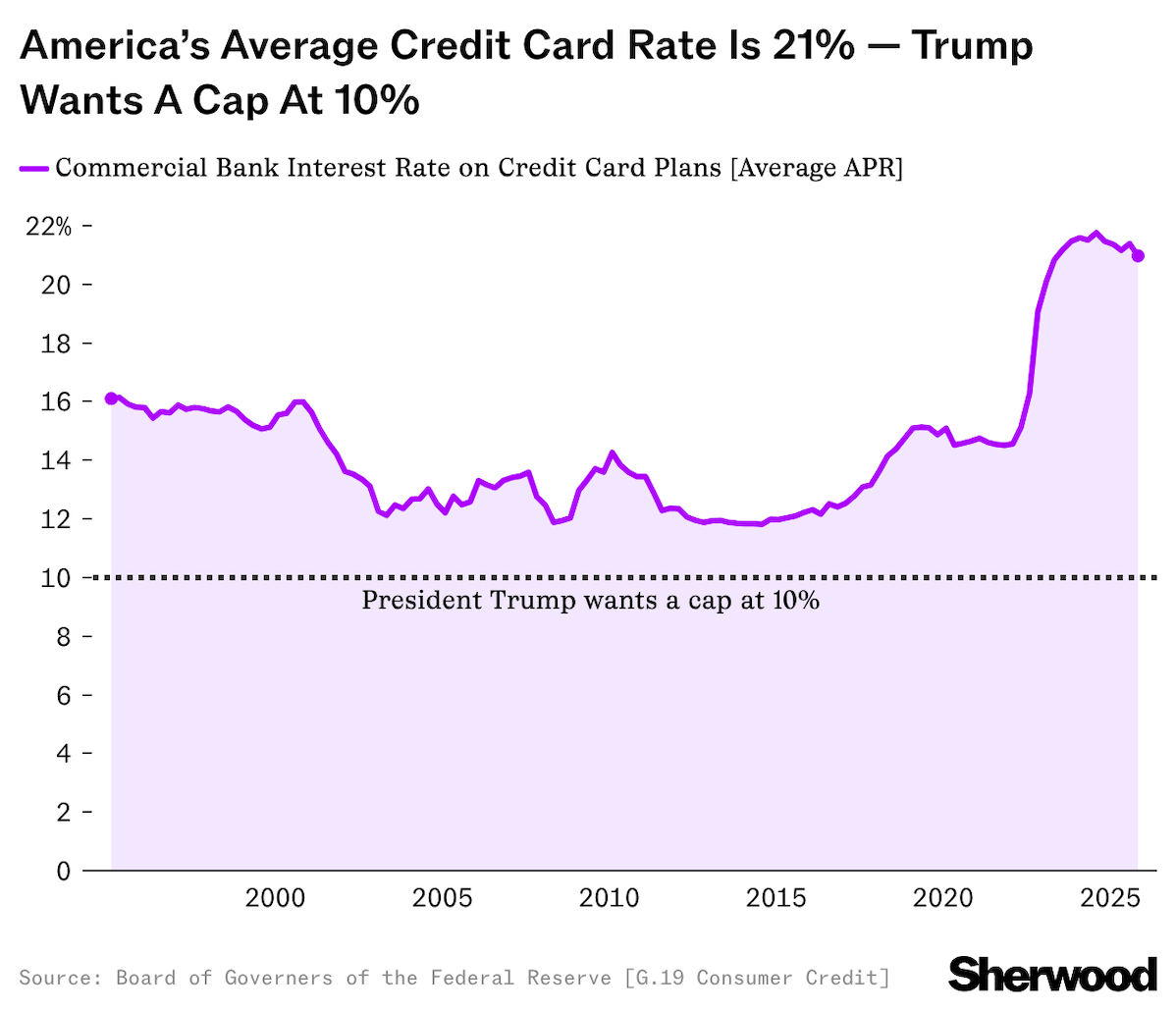

- Banks JPMorgan Chase, Capital One, Bread Financial, Citi, Mastercard, American Express, Synchrony Financial, Wells Fargo, Visa, and Bank of America dropped after President Trump called for a 10% cap on credit card rates.

- Duolingo dropped as its longtime CFO announced he will step down in February.

- Abercrombie cratered after trimming the top end of its Q4 sales and earnings guidance.

- Urban Outfitters tumbled after its holiday sales underwhelmed.

- American Eagle slumped as the midpoint of management's Q4 same-store sales outlook came in short of Wall Street's forecast.

- Warner Bros. Discovery ticked lower as it was sued by Paramount Skydance in a Delaware court in an effort to force the board to disclose "basic information" that will allow shareholders to make an informed decision between Paramount's offer and the one from Netflix.

- Exxon ticked lower as President Trump said that he's inclined to keep it out of Venezuela after its CEO called the country "uninvestable."

|

|

|

America's average interest rate has soared in recent years, as credit card debt has ballooned to more than $1.2 trillion. Read more. |

|

|

With the Academy's nominations voting opening today, the results of the Globes might signal the direction of certain Oscars categories (statistically speaking). Read more. |

|

|

2025 was a great one for Apple, whose global smartphone market share jumped to 20%, besting Samsung and making it the top-selling brand in the world by shipments, new data from Counterpoint Research shows. Read more. |

|

|

- What's the most followed TikToker worth?

A company tied to most-followed TikToker Khaby Lame has been purchased for $975 million, and on paper, the Senegalese-Italian influencer's position is worth way more than that. On paper. - Roku's CEO thinks we'll see a 100% AI-generated hit movie "within the next three years"

Perhaps it could wind up on Howdy, the $3-per-month ad-free streamer the platform's pushing. - Saks Global nears bankruptcy as department stores lose ground in America

On top of its debt-laden luxury merger, the retailer's operating in a sector that's been in retreat for over 20 years. - Apple's App Store reaches 850 million average weekly users

That's up from 813 million this summer and is good news for Apple's Services segment.

- Tesla's Elon Musk says AI deal with Apple gives Google "unreasonable concentration of power"

The richest man in the world has some thoughts on an unreasonable concentration of power. - Moderna says its expects $1.9 billion in 2025 sales amid better-than-expected vaccination rate

Moderna, which has been bleeding money since 2023, said it expects to break even in 2028. - Anthropic rolls out health features, following OpenAI

Healthcare is a key battleground for AI companies in the quest for your dollars and eyeballs.

- Meta appoints former Trump adviser Dina Powell McCormick as first-ever president and vice chairman

Trump congratulated McCormick, calling her appointment a "great choice by Mark Z!!!"

- Standard Chartered still sees bitcoin hitting $150,000 in 2026

The firm expects bitcoin to hit a new all-time high in the first half of the year, and predicts the asset will hit $500,000 in 2030. - Standard Chartered also predicts ethereum will more than double this year

The investment bank thinks the prospects for ethereum have improved citing Bitmine's continued buying, stablecoin adoption, the plan to increase the network's throughput, and the passage of crypto-focused legislation.

|

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to The Wrap and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and Snacks for quality reads. We care what you think! If you have any feedback or comments, feel free to reply and let us know your thoughts! |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment