Stocks climb higher, led by energy |

Investors shrugged off geopolitical risk as the S&P 500, Nasdaq 100, and Russell 2000 all rallied. The energy sector led gains as US-Venezuela tensions sent crude oil prices higher. Stocks that moved higher: |

- US oil producers Chevron, Exxon Mobil, and ConocoPhillips gained after President Trump said the US plans to "run" Venezuela after Saturday's military operation. Oil field service firms Halliburton and Schlumberger; equipment providers NOV Inc and Weatherford International; and refineries Valero, Phillips 66, and Marathon Petroleum gained as well.

- Global defense stocks, including Lockheed Martin, German manufacturer Rheinmetall AG, and Palantir, were trading higher as well as investors priced in heightened geopolitical risk.

- President Trump's intervention in Venezuela also sent shares tied to nuclear fuel and experimental forms of nuclear energy higher, including nuclear fuel companies Lightbridge, Critical Metals, Centrus Energy, and Energy Fuels. Nuscale, Oklo, and Nano Nuclear — all makers of unproven, not-yet-fully approved smaller nuclear reactors (SMRs) that the industry is pushing as the next generation of atomic power — also surged.

- While US-Venezuela tensions sent crude oil prices higher, the market appears to be pricing in some medium-term relief due to the possibility of Venezuela's reserves getting more developed as Delta Air Lines notched a new all-time high and Frontier Airlines, JetBlue, American Airlines, Southwest Airlines, and United Airlines climbed higher.

- A rise in bitcoin sent crypto-adjacent stocks Riot, MARA Holdings, Strategy, Cipher Mining, IREN, Coinbase, Trump Media & Technology Group, Hut 8, Strive Inc., and Robinhood* higher.

- Amazon rose amid the launch of Alexa+ on web. Jeffries analyst Brent Thill also raised his price target on the stock.

- Novo Nordisk jumped as it launched the first GLP-1 pill for obesity in the US.

- Duolingo rose after Bank of America upgraded the stock to "buy" from "neutral" and slapped a $250 target on the stock.

- Tesla climbed as Elon Musk and President Trump started 2026 as they began 2025 — hanging out and being buddies, with Tesla's CEO writing about his "lovely dinner" with Donald and Melania Trump over the weekend.

- Lucid rose as the EV maker met its lowered full-year production target, delivering 55% more EVs in 2025.

- Qualcomm moved higher on news that it is expanding work with Google on automotive initiatives and AI mobility projects.

|

*Robinhood Markets Inc. is the parent company of Sherwood Media, an independently operated media company. |

|

|

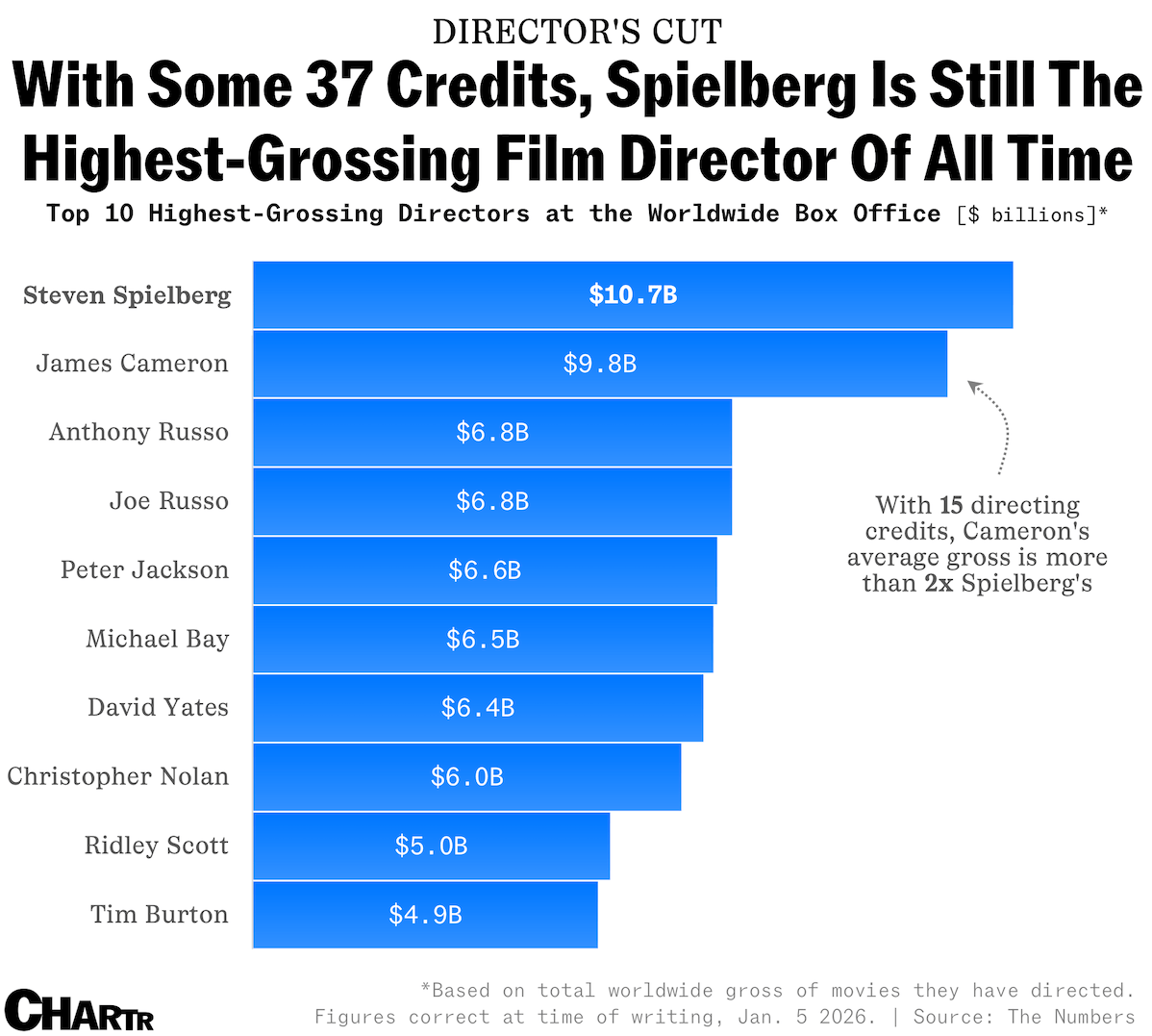

James Cameron is now the first director in history to have four consecutive movies gross over a billion dollars. Read more. |

|

|

Tesla missed its own deadline to remove safety drivers from Robotaxis, but it looks like it's moving forward with Cybercab testing. Read more. |

|

|

According to the latest numbers from the Norwegian Road Federation, or OFV, electric vehicles took a 96% share of new vehicle registrations last year. Read more. |

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to The Wrap and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and Snacks for quality reads. We care what you think! If you have any feedback or comments, feel free to reply and let us know your thoughts! |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment