The customers may have complained when Southwest changed course and started charging fees for bags and premium seats, but its shareholders should be over the moon after the stock had its best day since (double-checks notes) 1978 on Thursday. Not only did the carrier rake in beaucoup bucks for bags, but a knock-on effect of fewer bags checked overall meant the airline spent less on fuel. The S&P 500 and Nasdaq 100 traded lower on Thursday while the Russell 2000 posted a modest gain. Communications was the best-performing sector while tech was the worst-performing sector. Crypto suffered a broad sell-off, with bitcoin falling below $85,000 for the first time since November. The biggest thing on traders' minds this morning? The report that dropped after market close that SpaceX is considering a merger with Tesla. 🧠 Test your knowledge of recent business trivia with our Snacks Seven Quiz: |

- Which more than century-old company is a buzzy candidate for a 2026 IPO?

Check your answer.

|

|

|

For software stocks, the past few quarters have required acts of gymnastics to assuage investors. Yes, of course there is an AI revolution happening that will fundamentally change the technology industry. No, don't be ridiculous, it will not affect us or our balance sheets — we're going to be one of the winners here. Sure, you are right that they've created code that can write code, but that code certainly can't code new code that would render our code obsolete. Anyway, have some earnings, go away, we'll see you in three months. Well, the party's over: |

Put it all together and the iShares Expanded Tech Software ETF had its worst day since the Friday following the Rose Garden reciprocal tariff announcements in April 2025. |

|

|

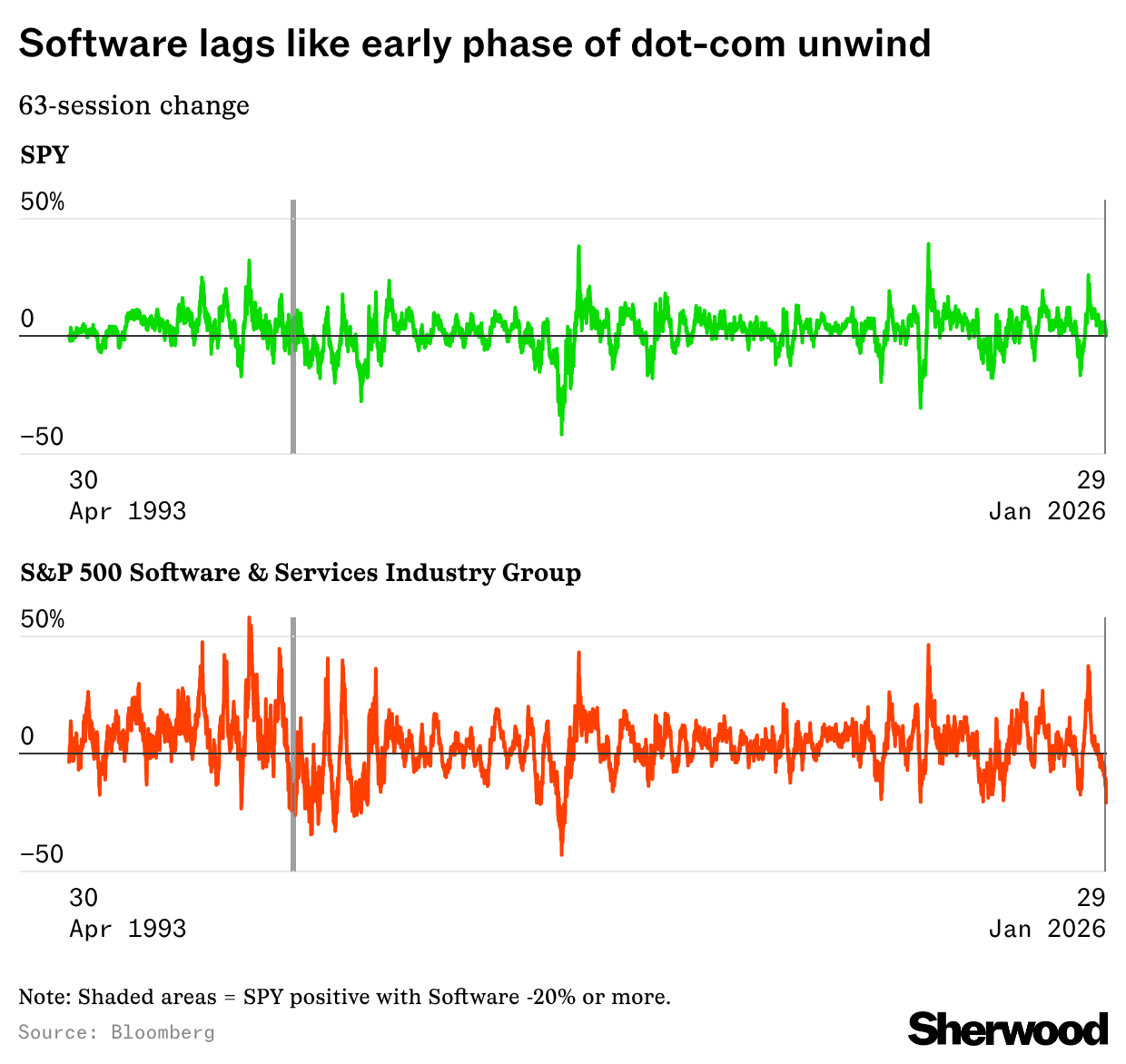

Are there babies being thrown out with the bathwater here? Maybe. Probably, even! But it likely won't inspire too much confidence to learn that the last time the S&P 500 Software & Services industry group was down at least 20% over a 63-session stretch while the S&P 500 was positive, as was the case midday on Thursday, happened to be June 12, 2000. |

|

|

The crowd moves markets. Individual investors now drive more than $30B in daily trading volume, creating ripples that markets can't ignore. Nasdaq's Retail Trading Activity Tracker transforms this collective force into actionable intelligence — revealing which stocks are seeing retail momentum.

Track daily retail trading patterns across stocks and ETFs, including precise buy/sell ratios by ticker. Whether retail investors are accumulating tech stocks or rotating into value plays, you'll see the movement as it happens. And you can connect the data directly into Excel through Nasdaq's plugin, or jumpstart your analysis with three pre-built templates (exclusive to Nasdaq Data Link users – free to sign up!). Unlock retail trading intelligence with Nasdaq Retail Trading Activity Tracker. |

|

|

On Apple's earnings call a quarter ago, CEO Tim Cook said, "We expect the December quarter's revenue to be the best ever for the company and the best ever for iPhone." He was right. |

- For its all-important holiday quarter, Apple posted revenue that grew 16% to $143.76 billion, above analysts' expectation of $138.4 billion. (Q1 2025 was $124.3 billion.)

- Sales of the company's flagship product, the iPhone, hit a record $85.27 billion amid "unprecedented demand" — beating out the first fiscal quarter in 2022, when iPhone revenue hit $71.6 billion.

- The iPhone maker posted earnings per share of $2.84, compared with analysts' expectation of $2.67. Shares were up 2.1% in after-hours trading.

- The company also posted a significant beat in Greater China, with $25.5 billion in revenue versus analysts' $20.8 billion estimate.

|

Apple has been a bit of a laggard among the Magnificent 7 lately, perhaps to the point that Cupertino really needs to start justifying why a company that missed its shot on AI ought to be among the most scrutinized companies at the vaunted heights of the S&P 500. Companies that revert to the mean don't get to call themselves "magnificent" on reputation alone. |

|

|

The earnings call was, to that point, a bit of an affirmation of what precisely Apple is doing here. Senior Vice President Kevan Parekh talked up how the iPhone had all-time records in the US, Greater China, Latin America, Western Europe, South Asia, the Middle East, and Australia. Apple's got products in a lot of pockets, which is perhaps more than the companies on the cutting edge of the AI revolution can say. That said, the thing about revolutions is that they tend to involve dislodging a lot of things that prior to them had reigned on top. |

|

|

- 🎵 Grammys: This weekend is the Grammy Awards. Album of the Year is a tight race, with Bad Bunny's "DeBÍ TiRAR MáS FOToS" seen as having the best shot with a 56% chance of winning, based on prediction market* prices. Kendrick Lamar's "GNX" and Lady Gaga's "Mayhem" each have a little more than a one-in-five chance of pulling off the win, though.

- 🏛️ Shutdown: Without a funding package, the government will shut down on January 31, and Democrats have threatened to withdraw their support from the funding package over the actions of DHS personnel. A bipartisan mix of Senators voted to block the funding package, but later on Thursday news broke that a deal had been reached. On the news, the market swung from pricing in a 63% chance of at least a partial shutdown to 42%.

|

*Event contracts are offered through Robinhood Derivatives, LLC — probabilities referenced or sourced from KalshiEx LLC or ForecastEx LLC. |

|

|

- Earnings expected from SoFi, Exxon Mobil, Chevron, American Express, and Verizon

|

|

|

Advertiser's disclosures:

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security, digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or digital asset or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. |

Was this email forwarded to you? Don't miss out on future stories — subscribe to Snacks and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and The Wrap for quality reads. |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment