S&P 500 snaps losing streak, buoyed by chip stocks |

After a bit of whipsawing, the S&P 500 broke its four-day losing streak. The Nasdaq 100, however, posted a loss, while the Russell 2000 outperformed, climbing over 1%. Energy was the best-performing sector, continuing its rise. Cryptocurrencies rose as bitcoin rallied and memecoins pepe, dogecoin, and shiba inu jumped. Stocks that moved higher: |

- The AI trade was back on as traders dove headlong into a "new year, same AI-fueled rally" thesis. AI stocks that gained include AI chip stocks Nvidia and Advanced Micro Devices; foundry giant TSMC; memory stocks Micron, Western Digital, Seagate Technology Holdings, and Sandisk; neoclouds CoreWeave, Nebius, IREN, and Cipher Mining; AI-adjacent energy plays like Bloom Energy, Oklo, and Plug Power; ASML, the Dutch business whose gigantic photolithography machines imprint circuits on the chips that enable the AI boom; and finally, AI server company Super Micro Computer.

- Baidu soared on plans for a Hong Kong IPO for its AI chip unit.

|

- While the AI picks and shovels stocks enjoyed a strong start to 2026, the same wasn't true for the companies more downstream in this theme — even most of the hyperscalers. The AI downstream stocks that tumbled include AppLovin, which is beloved by the Street for its heavy use of LLMs to deploy code as well as its AI ad-targeting engine; cybersecurity companies CrowdStrike and Palo Alto Networks; AI-linked software companies like Palantir, Adobe, ServiceNow, and Salesforce; hyperscalers Meta, Amazon, and Microsoft.

- Tesla fell for the seventh-consecutive trading session as its Q4 deliveries slid 16%, falling short of estimates. The last time Tesla slipped for seven straight sessions, its longest losing streak on record, was April 2024.

|

|

|

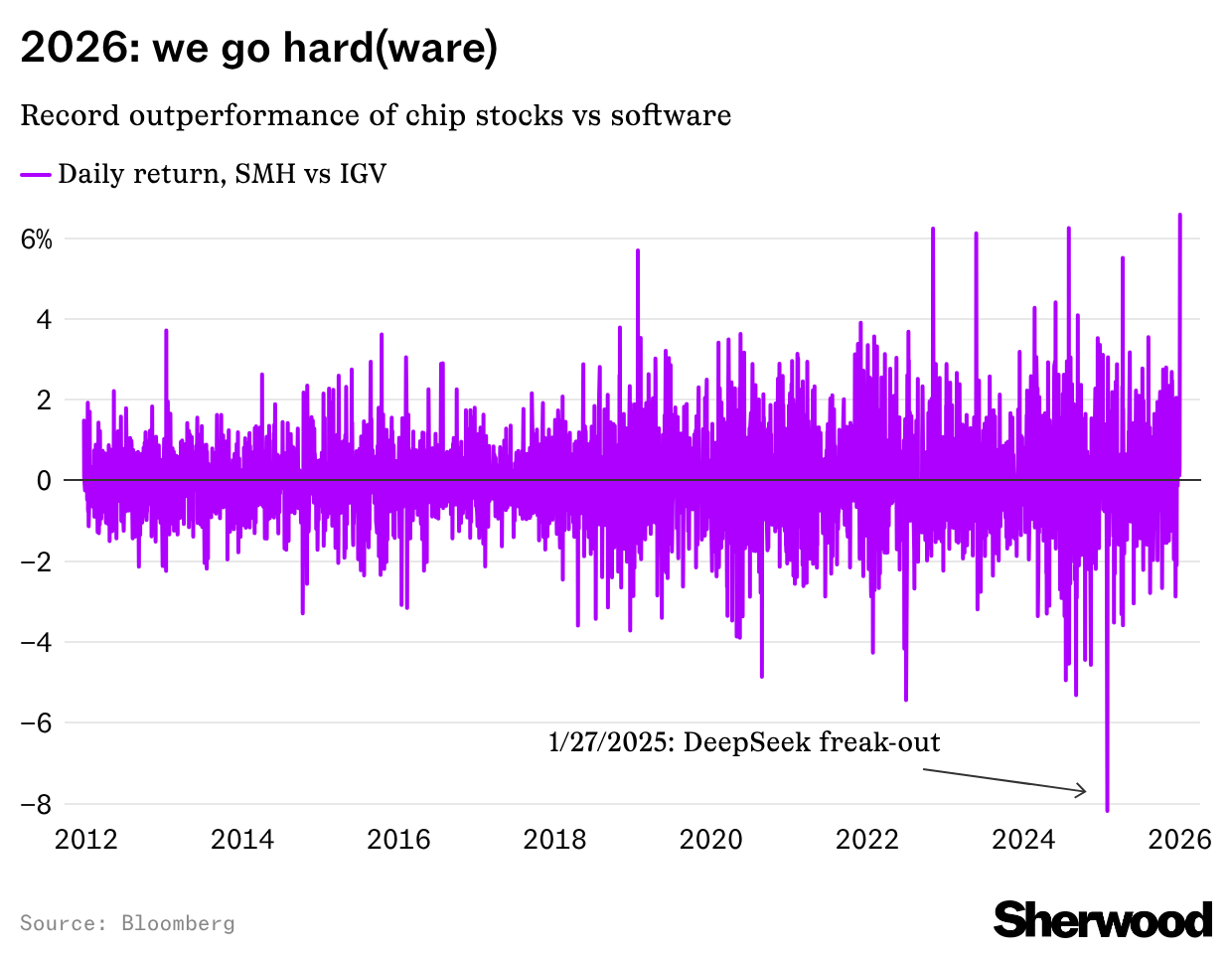

The VanEck Semiconductor ETF absolutely trounced the iShares Expanded Tech Software ETF today, with the former gaining 3.7% while the latter dropped 2.9%. Read more. |

|

|

Andrew Ross Sorkin's new book, "1929," follows the foremost financiers of the era through the market's darkest days and the aftermath that created Wall Street as we know it. Read more. |

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to The Wrap and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and Snacks for quality reads. We care what you think! If you have any feedback or comments, feel free to reply and let us know your thoughts! |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment