Greenland escalations send stocks into the red |

The S&P 500, Nasdaq 100, and Russell 2000 sold off in reaction to President Trump's various escalations over Greenland, with the S&P 500 and Nasdaq 100 erasing all year-to-date gains. In a Truth Social post on Saturday, Trump warned that the US would impose tariffs on European countries — Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland — unless a deal is reached for the "Complete and Total purchase of Greenland." The touted 10% tariffs on "any and all goods" shipped to the US from the eight countries would take effect February 1, rising to 25% by the start of June if an agreement isn't reached. Investors retreated to precious metals, sending gold and silver higher. All Magnificent 7 stocks traded lower, as did bitcoin and ethereum. Consumer staples was the only sector ETF to end the day in the green as investors pivoted to a defensive posture. The bright spots: |

- ImmunityBio continued to surge after announcing that its ANKTIVA drug may be approved to treat a broader range of bladder cancers.

- Corvus Pharmaceuticals skyrocketed after reporting encouraging early-stage data on its eczema drug.

- RAPT Therapeutics soared on news that GSK will acquire the biotech in a $2.2 billion deal.

- Intel was one of the few tech stocks in the green as the American chipmaker received a pair of upgrades from HSBC and Seaport Global.

|

- Nvidia fell on news that suppliers for its H200 chips have halted production amid reports that Beijing has banned these processors from entering the country.

- Roblox sank as Deutsche Bank cut its price target to $115 from $140.

- 3M tumbled after softer than expected 2026 earnings guidance, with its CEO warning of a possible $30 million to $40 million impact from potential tariffs on Europe.

- AppLovin ticked lower after a report from CapitalWatch alleged that it's a money-laundering operation for "transnational criminal kingpins."

|

|

|

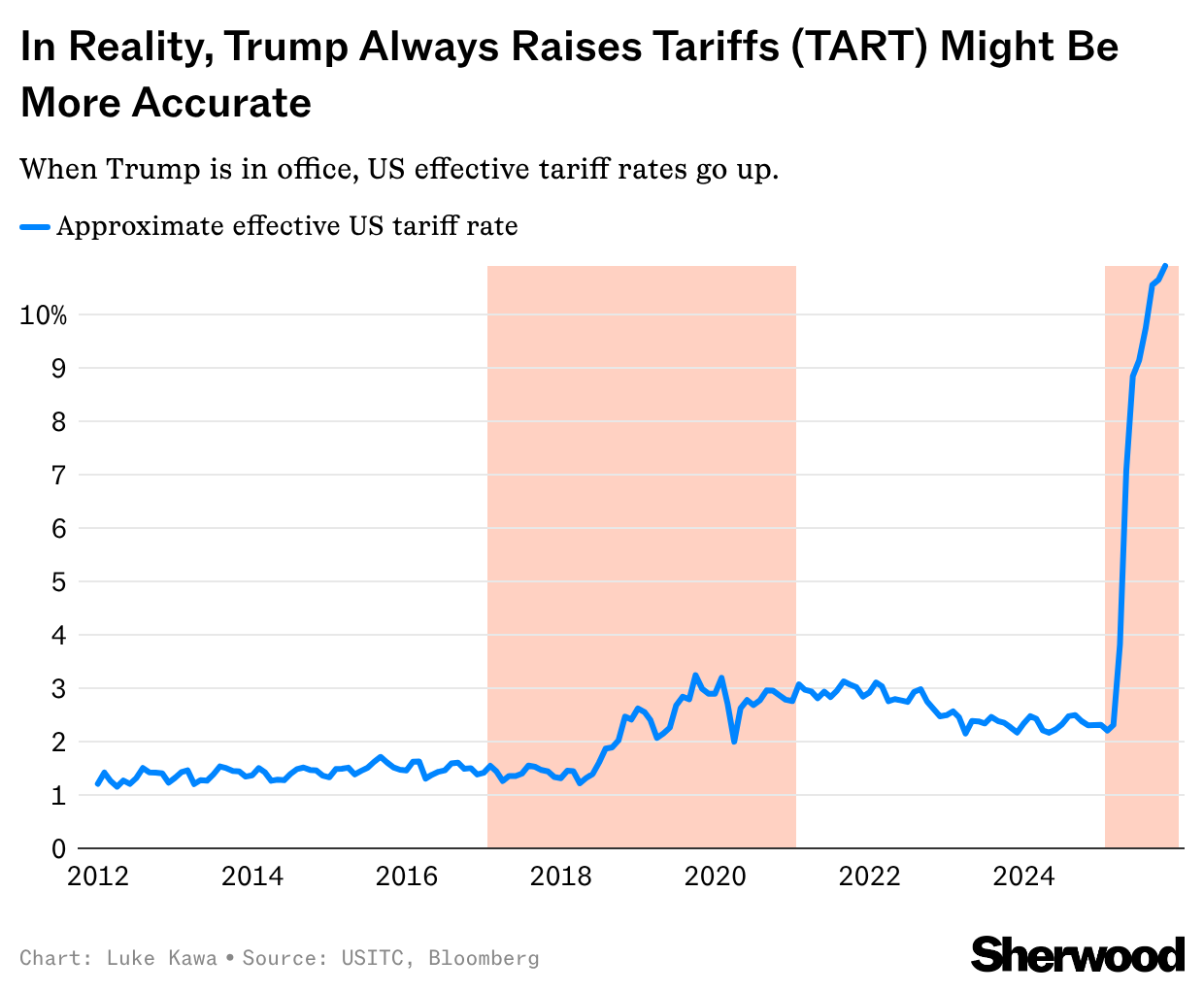

A popular market narrative over the last year has been that Trump often employs tariffs as threat, using them as a bargaining tool for other goals. But the "Trump Always Chickens Out" argument isn't really borne out by the data. As Luke Kawa pointed out last year, the reality is that the US has raised its levies rate on both occasions that Trump has been in the White House, suggesting that the more accurate acronym is really: "Trump Always Raises Tariffs." Read more. |

|

|

"Tech stocks will be hit as the 'risk off dynamic' hits AI names front and center but ultimately we view this as an opportunity to own the tech winners for 2026 and beyond," he concluded. Read more. | |

| Sam Altman's $500 billion artificial intelligence behemoth hit a major financial milestone last year, according to a new blog post over the weekend from OpenAI CFO Sarah Friar, as the company confirmed it had hit a more than $20 billion annual revenue run rate at the end of 2025. Read more. |

|

|

- Traders will soon have three times as many opportunities to punt short-term options on the biggest US stocks

And that means three times the opportunities for gamma/pin risk in the largest US stocks (and the biggest bitcoin ETF). - Pharma largely unfazed as Greenland tariffs roil markets

Drugmakers, which have spent the past six months reaching tariff deals with Trump, seem to expect some immunity from a new batch of tariffs on European countries. - Why people are flirting on LinkedIn — and job hunting on Tinder

The job market is tough, and so is dating. Americans are starting to mix the two. - Bitcoin, one year after Trump's second inauguration

"If 2025 has taught us anything, it's that apparently political favor is rarely a guarantee of future returns." - Washington, DC, looks set to get America's second Sphere

Revenue for the Las Vegas version of the big orb has soared, but the Sphere is still a money pit. - Netflix goes all-cash in bid for Warner Bros.

Netflix now offers $27.75 per share in cash for Warner Bros., not including the company's cable business.

- Nurses are still America's most trusted workers

While healthcare professionals continue to lead Gallup's ranking of ethics ratings, Americans' trust in many occupations has slumped to record lows. - Despite the government's best efforts, China's birth rate just hit a new low

Deaths in the nation, meanwhile, have never been higher in the 21st century. - Micron announces deal to buy fabrication plant for $1.8 billion as AI demand drives memory chip supply crunch

Management expects this purchase to begin to add to DRAM output in the second half of 2027. - Musk: Tesla restarting Dojo supercomputer effort as "AI5 chip design is in good shape"

Tesla paused work on the supercomputer this summer as it worked on AI5 and other AI chips.

- Google's YouTube maintains its top spot as streaming accounts for nearly half of all TV-watching time

A record 47.5% of US TV watching in December was through streaming services.

- Amazon CEO says tariffs are inflating prices and buyers are looking for bargains

Consumers are looking for bargains.

|

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to The Wrap and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and Snacks for quality reads. We care what you think! If you have any feedback or comments, feel free to reply and let us know your thoughts! |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment