Hi! Whether this email finds you looking firmly ahead to 2026 with tunnel vision, or if you still have one foot in 2025 and an urge to look across some of the best charts of last year, we're just happy to be back in your inbox. Today we're exploring: |

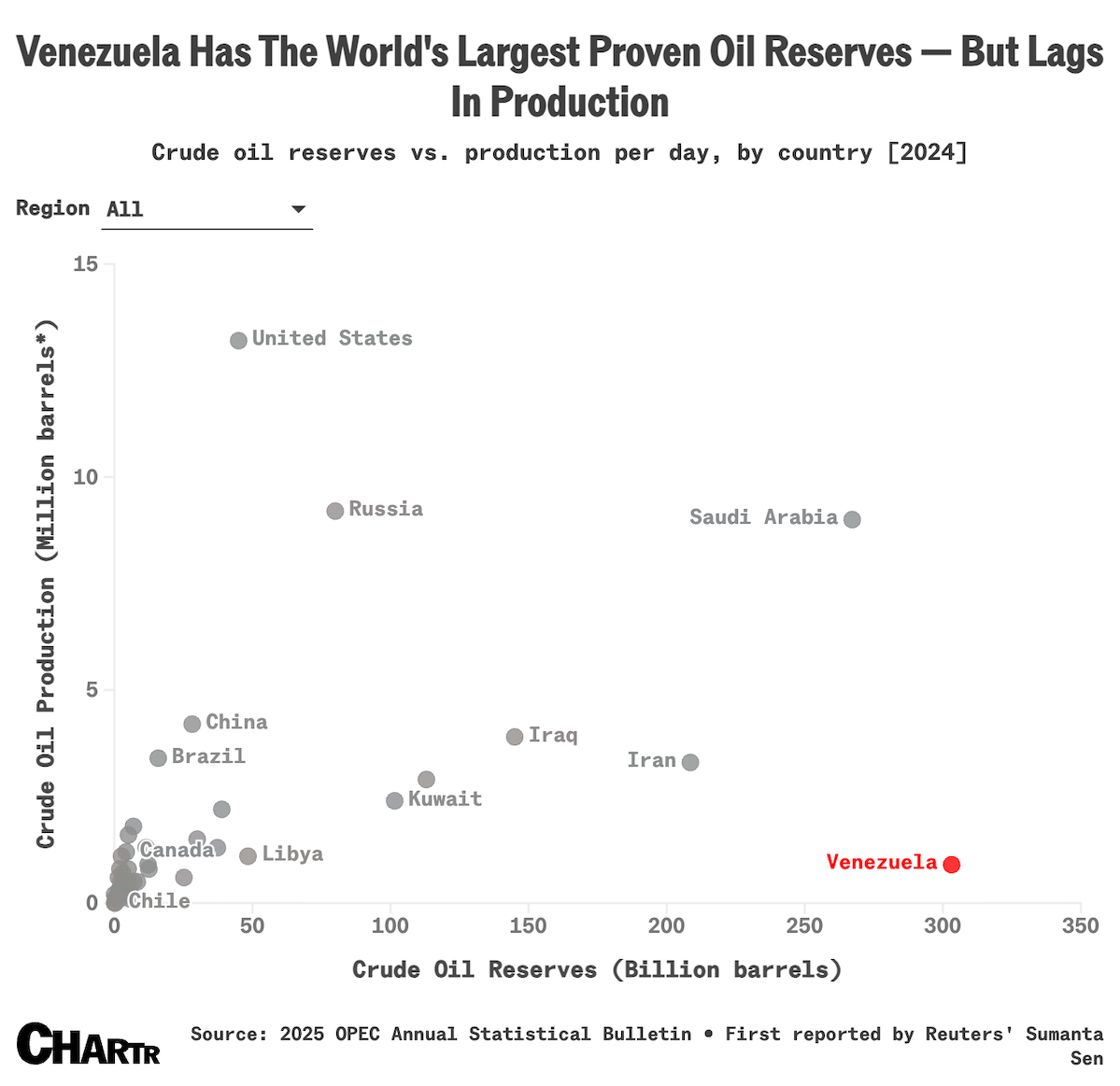

- Put crudely: Venezuela holds the world's largest known oil reserves, but pumps just a fraction of the stuff.

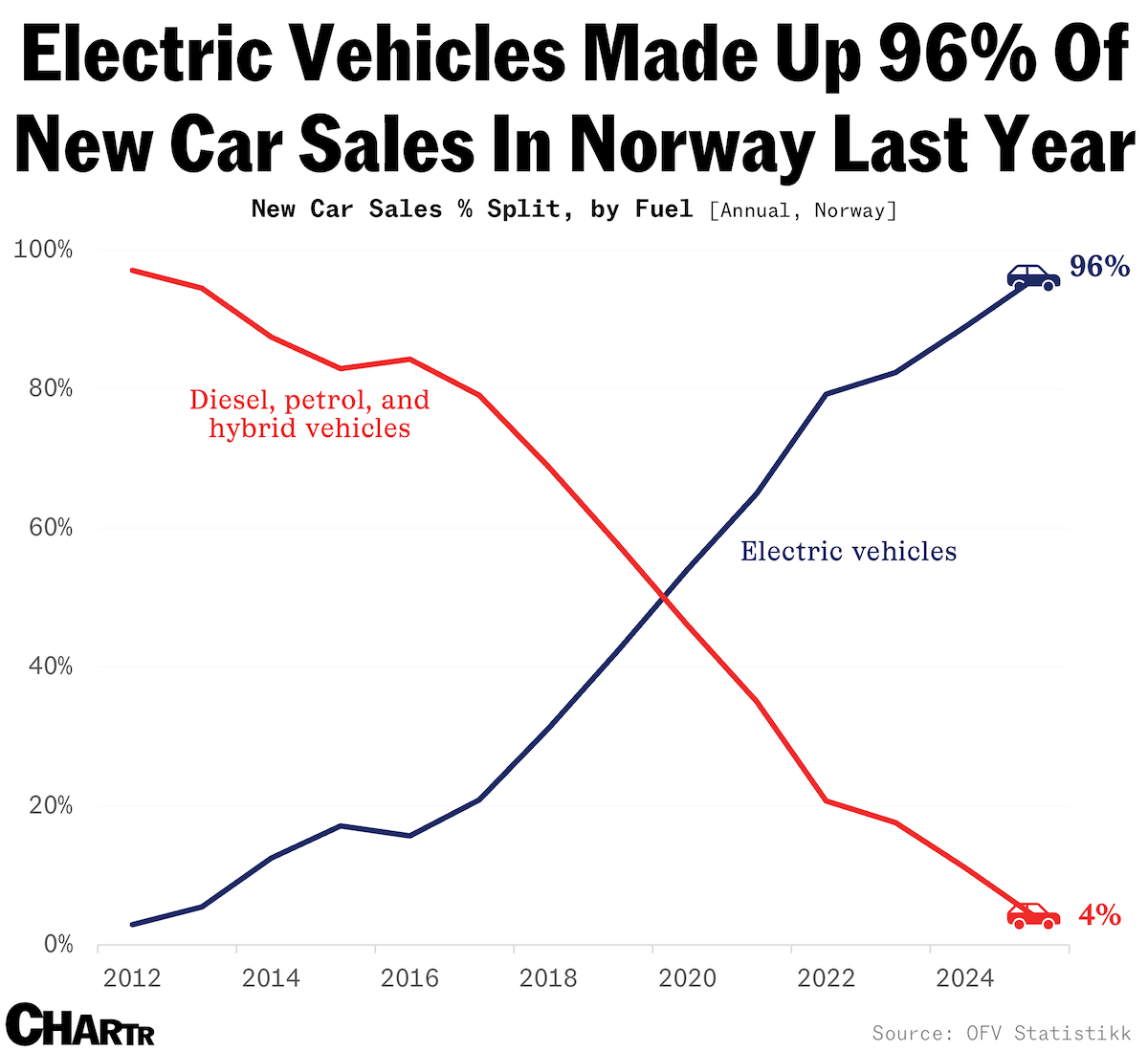

- Gone elektrisk: EVs made up 96% of all new car sales in Norway last year.

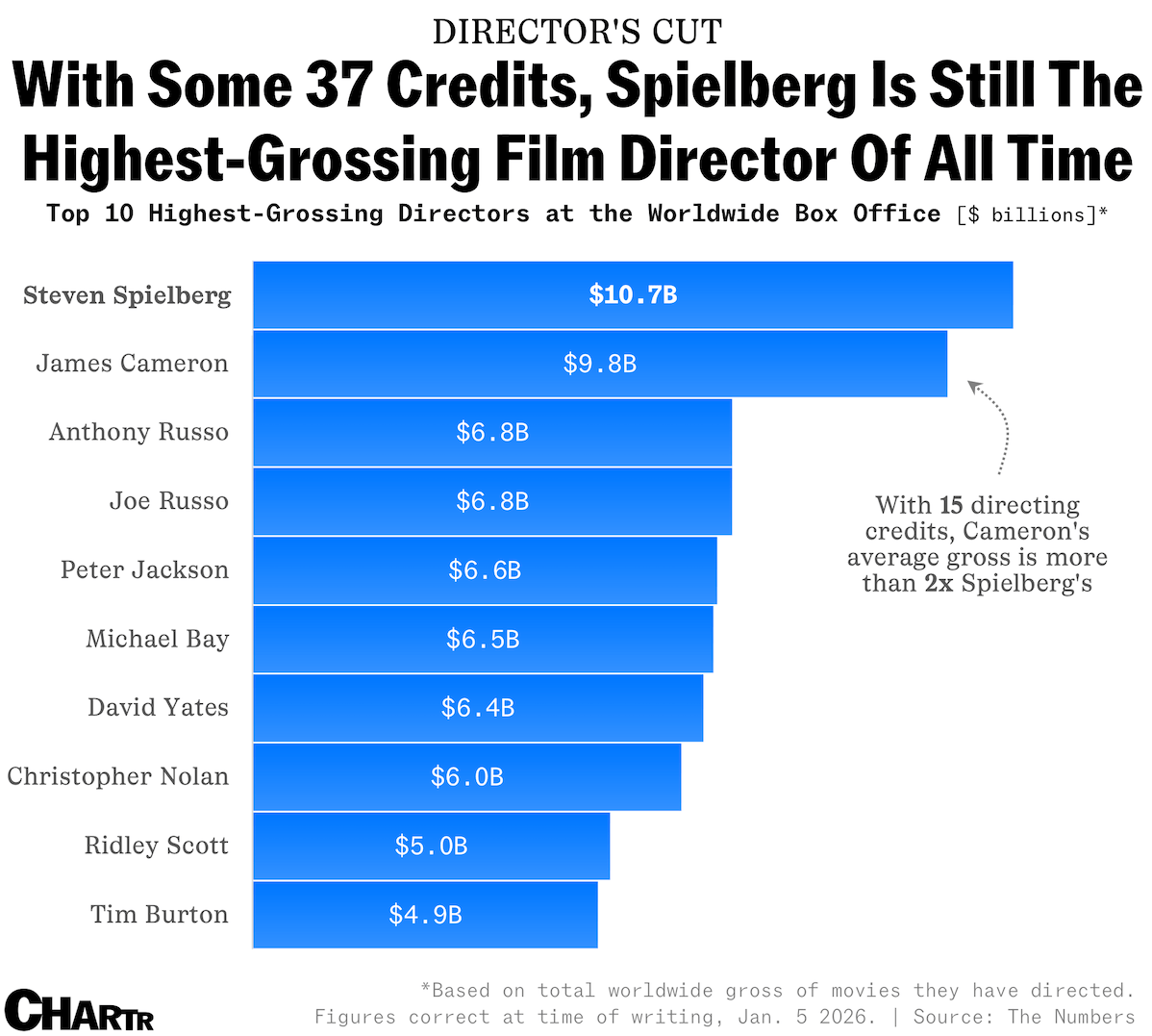

- Out of the blue: The new "Avatar" has cemented James Cameron as one of the top-grossing directors ever.

|

Have feedback for us? Just hit reply - we'd love to hear from you! |

Oil and defense stocks rose this morning as markets got their chance to react to the US military's stunning operation in Venezuela on Saturday, which resulted in the capture of President Nicolás Maduro. The energy rally follows weekend statements from President Trump, who said the US will temporarily "run" Venezuela throughout the transition, and that US oil companies are prepared to "spend billions of dollars, fix the badly broken infrastructure," and "start making money for the country." Indeed, Venezuela does have more than enough to be an oil powerhouse. According to OPEC's annual statistical bulletin, the country holds the world's largest proven oil reserves, estimated at 303 billion barrels, or about 19% of global reserves, as of 2024. However, years of underinvestment, US sanctions, and mismanagement have left production at a fraction of that potential. |

As Reuters explained, Venezuela's ample assets account for just 1% of global output, which suggests that any short-term disruption to its exports is unlikely to be globally significant, with analysts expecting "little immediate impact" on prices. US-listed oil stocks, meanwhile, are telling a different story: investors are betting on the possibility of a multi-year rebuilding effort in Venezuela's oil industry, pushing up the share prices of those that could potentially take part. Oil majors such as Chevron, the only US oil producer still operating in Venezuela, as well as Exxon and ConocoPhillips, moved higher in early trading on Monday. Shares of oilfield services firms like Halliburton also rose, as did refineries like Valero, Phillips, and Marathon Petroleum, which own US Gulf Coast facilities designed to process heavy, high-sulfur Venezuelan crude. Outside of stocks, the reactions have been more mixed, sparking protests in the US and abroad. Among international reactions, arguably the most notable came from China — the top destination for Venezuela's crude oil exports, per CNBC — with officials in Beijing calling on the US to release Maduro and his wife "at once." |

Almost every new car sold in Norway last year was an EV |

There's no swerving it: 2025 was a tough year for Tesla the business — even if it wasn't so bad for Tesla the stock — as the electric vehicle pioneer ceded its crown to Chinese upstart BYD for the first time ever, after sales dropped for the second year in a row. Elon Musk's EV giant saw deliveries fall in key regions over the year, not least in Europe, its "weakest market," per the CEO. However, there was one major bright spot on the continent for the company, with Tesla selling more cars in Norway last year than any other automaker in history. The Scandi nation being a standout for the car company will come as little surprise to anyone who's kept an eye on the global electrification movement, given that Norway has raced ahead on EV adoption for years now and hit a staggering new record in 2025, per new national data released on Friday. |

According to the latest numbers from the Norwegian Road Federation, or OFV, electric vehicles took a 97.6% share of new vehicle registrations in the last month of 2025, taking their share to a whopping 95.9% for the year all told. Plug-in and gas hybrids, meanwhile, took a collective share of around 3%, while diesel vehicles made up just 1% of the market. Most of the late-year surge is likely linked to the government's announcement that it would pull back on some of the major tax benefits it's used to incentivize EV uptake, before cutting them entirely by 2027. So, is Norway now an EV utopia? Interestingly, despite electric cars dominating new car sales, the stock of cars on the road is still predominantly gas-guzzling due to the life cycle of vehicles, with figures compiled by Our World In Data estimating that only about one-third of Norway's vehicles were electric in 2024. Naturally, that figure will continue to move higher, but it's a good reminder of just how long a full electric transition could take. |

|

|

"Avatar: Fire and Ash" surpasses $1 billion globally after 18 days |

Just over two weeks after its release, the third movie in James Cameron's blockbuster "Avatar" franchise has officially reached $1 billion at the global box office. In its first 18 days, "Avatar: Fire and Ash" notched ticket sales of $306 million domestically and over $777 million internationally, Variety reported on Sunday. However, while only a few films manage to reach this milestone in their lifetime, the first two installments in the sci-fi saga did it in slightly shorter periods (17 days and 14 days, respectively). |

Cameron's latest flick had some big box office shoes to fill: 2009's "Avatar" remains the highest-grossing movie of all time, with a worldwide total of $2.9 billion, per movie financial analysis site The Numbers, and 2022's "Avatar: The Way of Water" stands in third place at $2.3 billion. Along with his 1997 epic "Titanic" — the first movie ever to break the nominal $1 billion at the global box office — James Cameron is now the first director in history to have four consecutive films cross the billion-dollar mark. (Granted, they span almost three decades.) But even with another smash hit Na'vi movie, Cameron still isn't the world's highest-grossing director. |

According to The Numbers, Steven Spielberg, the legendary filmmaker behind "Jurassic Park" and "Indiana Jones," is the highest-grossing director of all time, accruing ~$10.7 billion across an astounding 37 directing credits, not inclusive of the many producer credits to his name (and not adjusted for inflation). With "Avatar: Fire and Ash," Cameron has now pulled in a total of ~$9.8 billion over 15 directing credits, bringing his average gross to ~$653 million. While this is still slightly less than the average reported for the Marvel-directing Russo brothers, among others, if the latest "Avatar" keeps momentum to exceed $2 billion like its predecessors, Cameron could rise up both rankings. |

|

|

- The co-founders behind Twitter and Pinterest have raised $29 million to launch a social media app to fix the "terrible devastation" that has been caused by… social media.

- America might have reached peak pizza, as there are now more coffee shops and Mexican restaurants than pizzerias in the US, per market-research firm Datassential.

- A new Gallup poll reveals that most US adults expect unemployment, taxes, prices, and general economic difficulties to worsen in the new year — though 55% believe that the stock market will rise.

- Rome, sweet Rome: Italy's capital city welcomed a record 33.5 million pilgrims for the Catholic Holy Year in 2025.

- While tech stocks were busy setting records last year, the companies' founders and execs cashed out more than $16 billion in 2025, according to a Bloomberg analysis of insider selling filings.

|

|

|

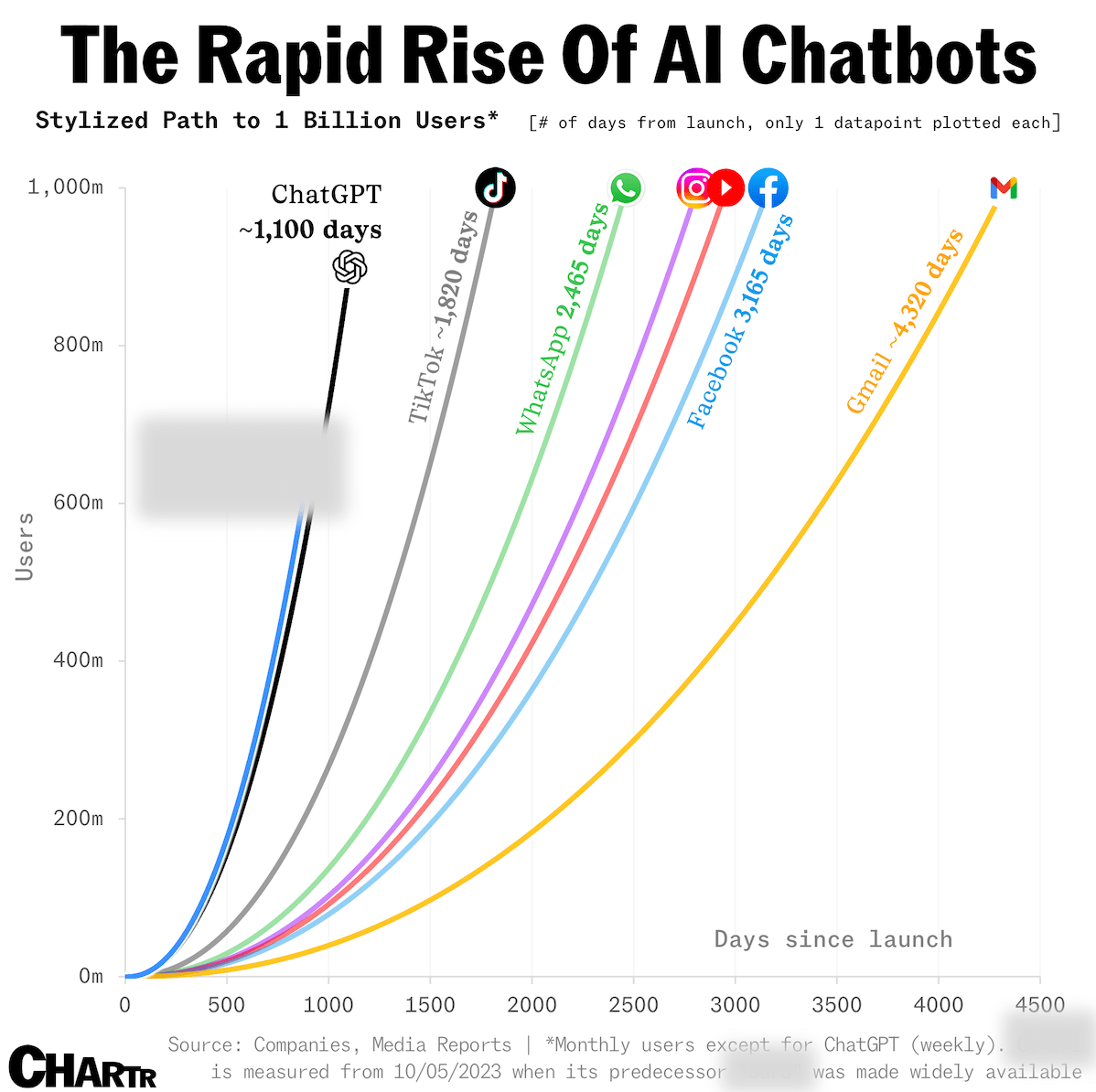

Off the charts: Which fast-growing AI chatbot could see usage soar, as Samsung reportedly prepares to double the number of devices equipped with "Galaxy AI" — largely powered by the assistant — this year? [Answer below]. |

Not a subscriber? Sign up for free below. |

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment