| | | | of U.S. adults read below a sixth-grade level. |

|

|

|

| | | The real stakes of the Powell investigation Investing for doomsday — without going all-in on gold The AI race continues: Apple and Google ink a new deal, Claude launches Cowork, and OpenAI announces ad test Newsletter Exclusive: What AI gets right — and wrong — about personal finance and investing

|

|

| | Justice Department Opens Criminal Probe Into Fed Chair Jerome Powell | The Justice Department has launched a criminal investigation into Federal Reserve Chair Jerome Powell. The case, which is the first of its kind, centers on whether Powell misled Congress during testimony about renovations to the Fed's headquarters. | In a rare video statement, Powell said the investigation is motivated by his refusal to cut interest rates at the president's command. | The investigation triggered swift pushback across the finance world: JP Morgan CEO Jamie Dimon said that anything that harms Fed independence is "probably not a good idea," and leaders from the European Central Bank, the Bank of England, and others issued a joint statement supporting Powell. Six Republican senators also opposed the move. | | The market's response was muted: the S&P 500 and the Dow initially sold off, but ultimately reversed those losses. By the next day, they hit record highs. |

| | |

| | | | The strongest, most robust economies in the world are the ones that have an independent central bank. Any politician would want to lower interest rates to juice the economy. The problem is you create a scenario where there's more money than goods, which creates inflation. Inflation then spirals into panic buying, and you lose control of your economy. | Here's what happened when a strongman installed a loyalist at the central bank in Turkey: | | When that happens, there's panic. Low, middle, and upper-middle income households don't own assets, and wages never keep pace with inflation, so anything they have in the bank becomes worthless. Overnight they can't make tuition payments, car payments, can't buy food. | Countries don't go out of business because they get invaded. They go out of business because they go broke. And one way to go broke fast is inflation. |

| |

| | |

| | | | The most interesting group supporting Jerome Powell is the Reddit army, the meme stock traders on WallStreetBets. The decision was unanimous. Trump is the villain; Jerome Powell is the hero. | | These are the guys who are supposed to hate institutions, economists, and experts. But something has flipped. Jerome Powell is sticking it to the man, the guy who people used to think was the man. | I'm writing more about Powell and the public's reaction to his address in my newsletter this week. Subscribe here. | But is all of this an attempt to distract from the Epstein files? According to Google Trends, Epstein searches have dropped by 91% since the start of January, right as Trump ramped up attacks on Powell, Venezuela, and Greenland. |

| |

| | |

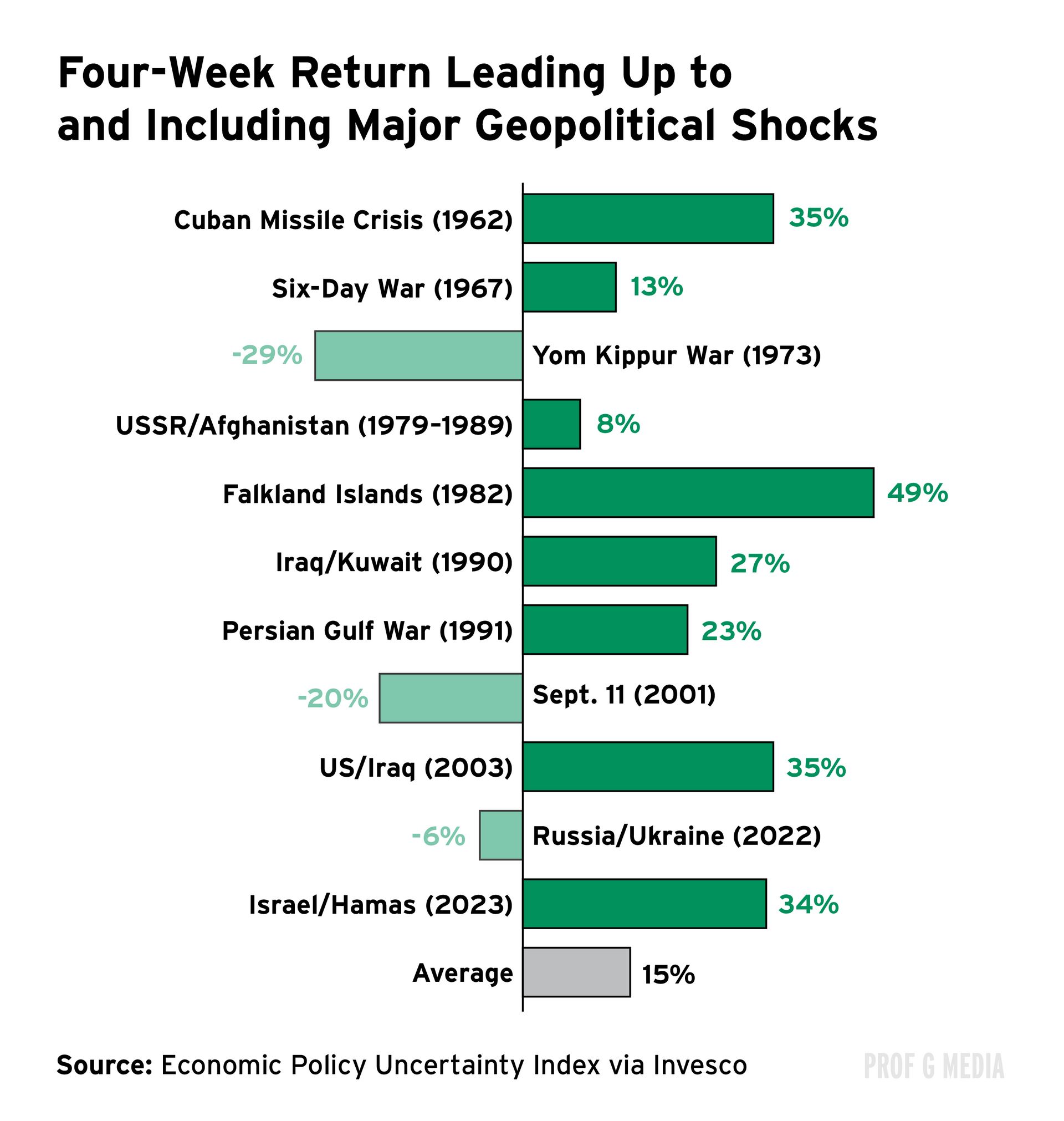

| | Beyond Gold: How Markets React to Geopolitical Stress | Gold, silver, and copper all reached new record-highs last week. Copper is up 36% from a year ago, gold has gained 72%, and silver has risen 187%. | Two factors driving the rally are supply shortages and increasing industrial demand. These metals are critical inputs for data centers, power grids, and electric vehicles, and demand is accelerating across all three sectors simultaneously. | | Geopolitical uncertainty is also spiking prices. Protests in Iran have continued, with reports of significant casualties. Just a few weeks ago, President Trump ordered the capture of Venezuela's president, Nicolás Maduro. Meanwhile, tensions remain high with European allies over Trump's push to acquire Greenland. | Previous periods of geopolitical instability have been good for gold, the hallmark safe-haven asset. Fear and uncertainty typically drag stocks down in the short term. | | But over longer periods, markets are surprisingly resilient. One JP Morgan study of 40 armed conflicts and terrorist attacks found that in the 12 months after the event, S&P 500 returns were not statistically different from peacetime. | A different analysis found that the S&P 500 actually performed better in the 12 months after conflicts, returning 15% on average — higher than the index's average annual return of 10%. | | The bottom line: It may be tempting to sell when conflict breaks out and it looks like the world might end, but — chances are it won't, and you likely shouldn't. |

|

| | | | Bitcoin's doomsday case keeps getting tested, and it flops. Bitcoin is supposed to be digital gold, a hedge against apocalypse in any form. When Russia invaded Ukraine, everyone waited for bitcoin to rally. Didn't happen. | Now we're at what Jamie Dimon calls the most unstable time since World War II. Gold, silver, copper, tin, lithium, and platinum are all ripping to record highs. Bitcoin? Down 1% on the year and 21% over the past six months. |

| |

| | |

| | ____________sponsored content ____________ |

|

| AI-native CRM | | "When I first opened Attio, I instantly got the feeling this was the next generation of CRM."

— Margaret Shen, Head of GTM at Modal | Attio is the AI-native CRM for modern teams. With automatic enrichment, call intelligence, AI agents, flexible workflows and more, Attio works for any business and only takes minutes to set up. | Join industry leaders like Granola, Taskrabbit, Flatfile and more. | 👉Start for free today | |

|

| ____________sponsored content ____________ |

|

| | AI Competition Update: Apple's New Deal with Google, Claude Launches Cowork, and OpenAI Teases Ads | Three major AI headlines broke last week. First, Apple announced it will use Google's Gemini to power an upgraded version of Siri. Rumors suggested Apple will pay Google $1 billion per year for access to the model. | | This transaction signals how competitive dynamics in AI are evolving. Google pays Apple roughly $20 billion annually to be the default search engine on iOS. Now Apple is the one paying — but $19 billion less. That gap suggests that despite all the hype around AI, controlling distribution is still key. | OpenAI, Anthropic, Gemini, and xAI all offer excellent models, but all four have to compete for access to users in just two ecosystems owned by Apple and Alphabet. | Then Anthropic introduced Claude Cowork, a consumer-focused version of its coding agent. It can organize files, create expense reports from pictures of receipts, clean up email inboxes, build spreadsheets, and more. Essentially, it completes tasks that interns and entry-level employees usually handle. | | What's even more impressive is that this product literally produced itself. According to Anthropic executives, Claude Code, the company's AI coding tool, wrote Cowork in a week and a half. | Cowork is still in research preview and available only to Claude Max subscribers, Anthropic's $100/month membership tier. | On Friday of last week, OpenAI announced an $8 per month subscription tier, called ChatGPT Go, and said it would begin testing ads. ChatGPT Go was already available outside of the US and gives users a higher limit on memory, images and uploads. Free and Go subscribers will be subject to the new ads, which will appear under answers and suggest products relevant to user conversations. | | |

|

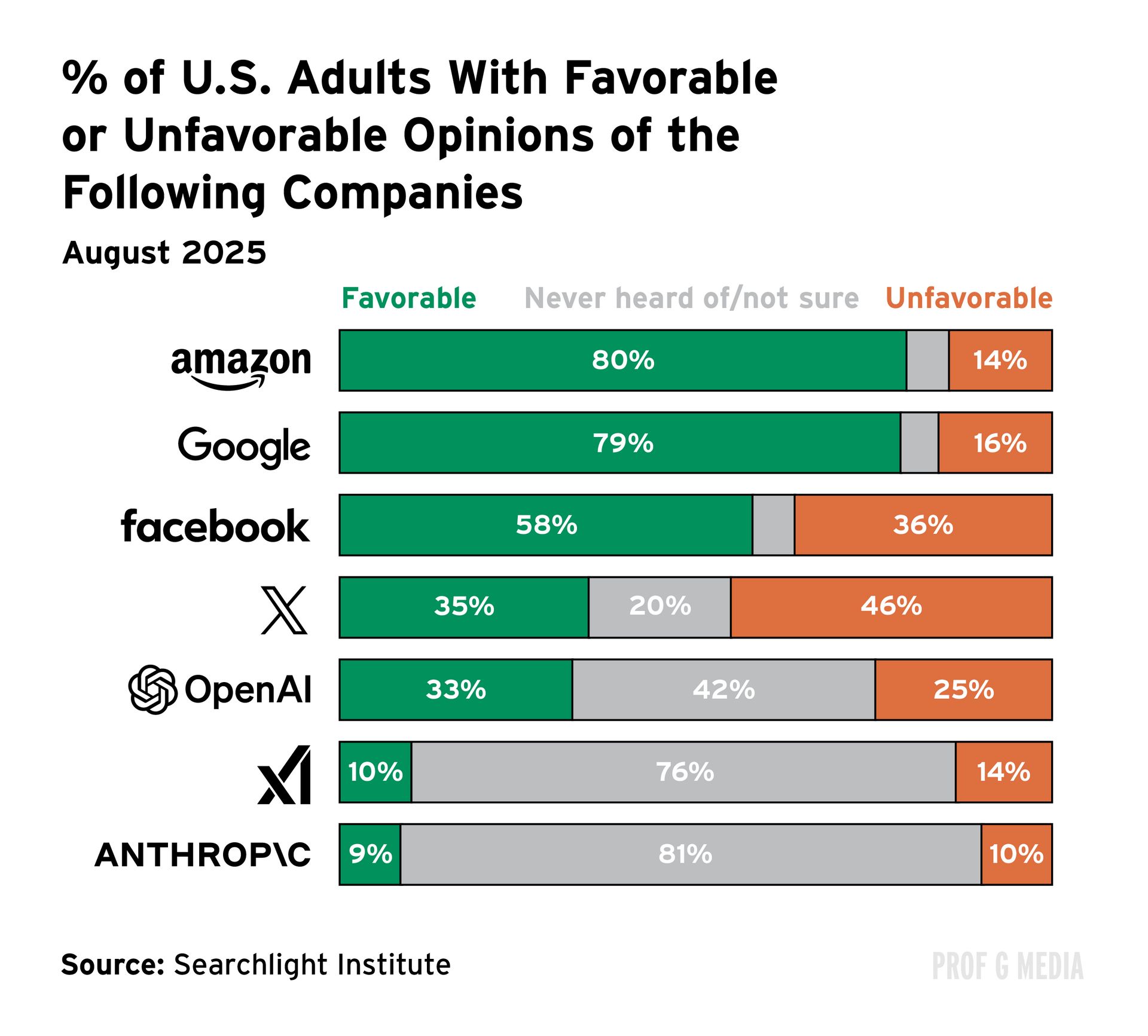

| | | | ChatGPT still dominates on the surface. It has 5.8 billion monthly visits, compared with Gemini at 1 billion and Claude at 183 million. Eighty percent of US adults have heard of ChatGPT. It's achieved what Google and Uber did before it: become a verb. You ChatGPT things, you don't Gemini them. | | But the tide is turning. In December, traffic to ChatGPT went down while Gemini went up. Apple is now using both Google's Gemini and ChatGPT, but Apple is paying Google $1 billion per year while ChatGPT gets nothing. This tells you something about OpenAI's ability to make deals. | Another point that's interesting about ChatGPT's user base: A lot of kids are using it for homework. During the summer and over the weekends usage gets cut in half because kids are out of school. | | OpenAI's real problem is enterprise. 80% of Anthropic's revenue comes from enterprise customers. For ChatGPT, it's 30%. OpenAI has 32x more users than Anthropic but generates less than 2x as much revenue. Everyone's using ChatGPT, but only 5% of users pay for it. What happens when they ramp up monetization? What price are consumers actually willing to pay? |

| |

| | |

| | | Can AI Actually Help Manage Your Money? | I asked ChatGPT to build me a budget. It told me it needed specifics, or else it would be, in its words, "guessy." | Whenever anyone on the internet asks for "specifics," I get nervous. (Too close calls on Facebook Marketplace; if you know, you know.) That left me wondering: What data should I give it for an accurate budget, and what data would expose me to security risks? And, how instructive would it be? Could it tell me which stocks to put in my Roth IRA? | I'm not the only one asking these types of questions. Sixty-six percent of Americans, including over 80% of Gen Z and millennials, have used generative AI for financial advice. But of those who have acted on it, 52% said they made a bad decision because of the information they received. | The question: Is AI a reliable personal finance tool, and if so, what should we use it for? | Advisor.ai | The New York Times profiled a couple people who used AI to create budgeting plans and to find strategies for paying down debt. The advice they received was largely helpful and responsible — essentially a personalized amalgam of information you would find on Investopedia, banks, credit union websites, and excellent personal finance books. | | Using AI for basic financial literacy is much different than using it as an investment guru. There is evidence that AI can improve stock picks but only after it's received extensive data and specific instructions. | | | These studies do not prove that AI on its own is a good stock picker. They prove that very smart people can devise models that can beat the market using AI. | Assuming that you can use AI to beat the market because trained professionals do is like saying you can create Michelin-starred cuisine because you also have a kitchen. | AI can perform better than human analysts likely because it can digest and process massive quantities of information — and because it doesn't suffer from the same biases that humans do. | Humans still beat AI predictors when making forecasts for smaller companies and those with asset-light business models (when there is less data for the AI to ingest). | Most normal people who successfully employ AI in their financial life are using a product that has been around since 2008 — a robo-advisor. A robo-advisor is an algorithm-driven service that asks questions about your financial goals, then uses that information to automatically invest for you. | | Robo advisors offer several concrete advantages. Research shows that investors who use robo-advisors suffer lighter losses during downturns, are more diversified, and pay less in fees. | The latter point is a significant one. Most robo-advisors charge annual flat fees of roughly 0.25%, much less than the typical 1% charged by a human financial planner. That might not sound like a lot, but it could easily add up to thousands of dollars in savings over time. | | The robo-advisory business is expanding quickly: The market is expected to grow from $62 billion in revenues as of 2024 to $470 billion in 2029 — a 600% increase. | | While robo-advisors are good for basic investing guidance, if you need estate-planning services or complicated tax management, you're better off consulting a human. | The Original Sin | So many of us ask AI financial questions because American schools do a terrible job preparing young people for the financial realities of being an adult. | | We were taught that the mitochondrion is the powerhouse of cells, but we never learned how to pay a credit card on time. | Worse, we've maligned talking about money to a point where people are scared to ask questions: Three-quarters of those who asked AI for advice did so because they would be too embarrassed to ask other people. | There is near universal agreement that financial concepts should be taught in high school; yet, only seven states — Alabama, Iowa, Mississippi, Missouri, Tennessee, Utah and Virginia — currently require students to take a semester-long personal finance course. | Professors at the Wharton School and the George Washington School of Business developed three questions that are commonly used to assess financial literacy. In 2021, less than 30% of Americans answered all three questions correctly. See if you can do better (answer key at the end). 1. Suppose you had $100 in a savings account and the interest rate was 2% per year. After five years, how much do you think you would have in the account if you left the money to grow? A) More than $102

B) Exactly $102

C) Less than $102

D) Do not know 2. Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After one year, how much would you be able to buy with the money in this account? A) More than today

B) Exactly the same

C) Less than today

D) Do not know 3. Please tell me whether this statement is true or false. "Buying a single company's stock usually provides a safer return than a stock mutual fund." A) True

B) False

C) Do not know

*Answers below |

|

| Learning personal finance in high school overwhelmingly improves credit scores, reduces the use of risky services like payday lending, and increases debt repayment rates. | Like playing polo, taking frequent ski trips, or saying phrases such as "we're comfortable," understanding money and investing is directionally predictive of your household income. One in five Americans with household incomes less than $47,800 say they don't know much or anything at all about personal finance compared with only 4% of those with incomes greater than $143,000. | |

| This knowledge gap is insidious and partly to blame for growing income inequality. An estimated 30% to 40% of wealth inequality near retirement can be attributed to financial literacy. | This makes sense: Having no foundational understanding of how wealth accumulates makes it very hard to accumulate wealth. | Can AI help? Yes. AI can create low-risk, diversified investment portfolios, and offer advice on basic financial topics like how to make a budget or how to pay a credit card on time. | But AI is a tool – not a magic wand. Unless you are a skilled and lucky professional investor, trying to beat the market remains a statistically doomed undertaking. | | *Answers: 1. A; 2. C; 3. B |

|

| | | Disney is going to be put into play — either through activist pressure or M&A. The stock has gone essentially nowhere over the past decade, while the S&P 500 has quadrupled. Bob Iger will also need to name a successor soon, and leadership transitions are exactly when activists tend to step in. |

| | |

| | | The weak business case for Trump acquiring Greenland How imperfect technologies spread: supermarket self-checkout edition 400,000 items are uploaded daily to Gen Z's new favorite thrifting app

|

| | |

| | |

|

No comments:

Post a Comment