Hi! "Rage bait" has been named word of the year by the Oxford University Press, beating contenders like "aura farming" and "biohack." OUP staff obviously know what they're doing because that is, of course, two words. Today we're exploring: |

- Buy, buy, buy: Online holiday spending hits new heights, even with Gen Z's plans to pull back.

- Wild, actually: "Zootopia 2" grossed over $500 million worldwide, thanks to a great start in China.

|

Have feedback for us? Just hit reply - we'd love to hear from you! |

Online holiday spending hits new heights, even with Gen Z's plans to pull back |

US shoppers aren't feeling too much economic pain if the weekend's retail figures are anything to go by, with Americans spending a record $11.8 billion online on Black Friday alone, up 9% on last year. That haul could help push this year's holiday e-commerce spending toward the projected all-time high of ~$253 billion, Adobe Analytics data shows. Part of that rise simply reflects that this year's stuff was more expensive than last year's stuff, with Salesforce finding that average selling prices were up 7% year over year in the 2025 early holiday season. However, the blowout e-commerce spending so far also underscores just how much our holiday shopping habits have changed, from busting down the doors of a local big-box retailer to silently scrolling through sales. |

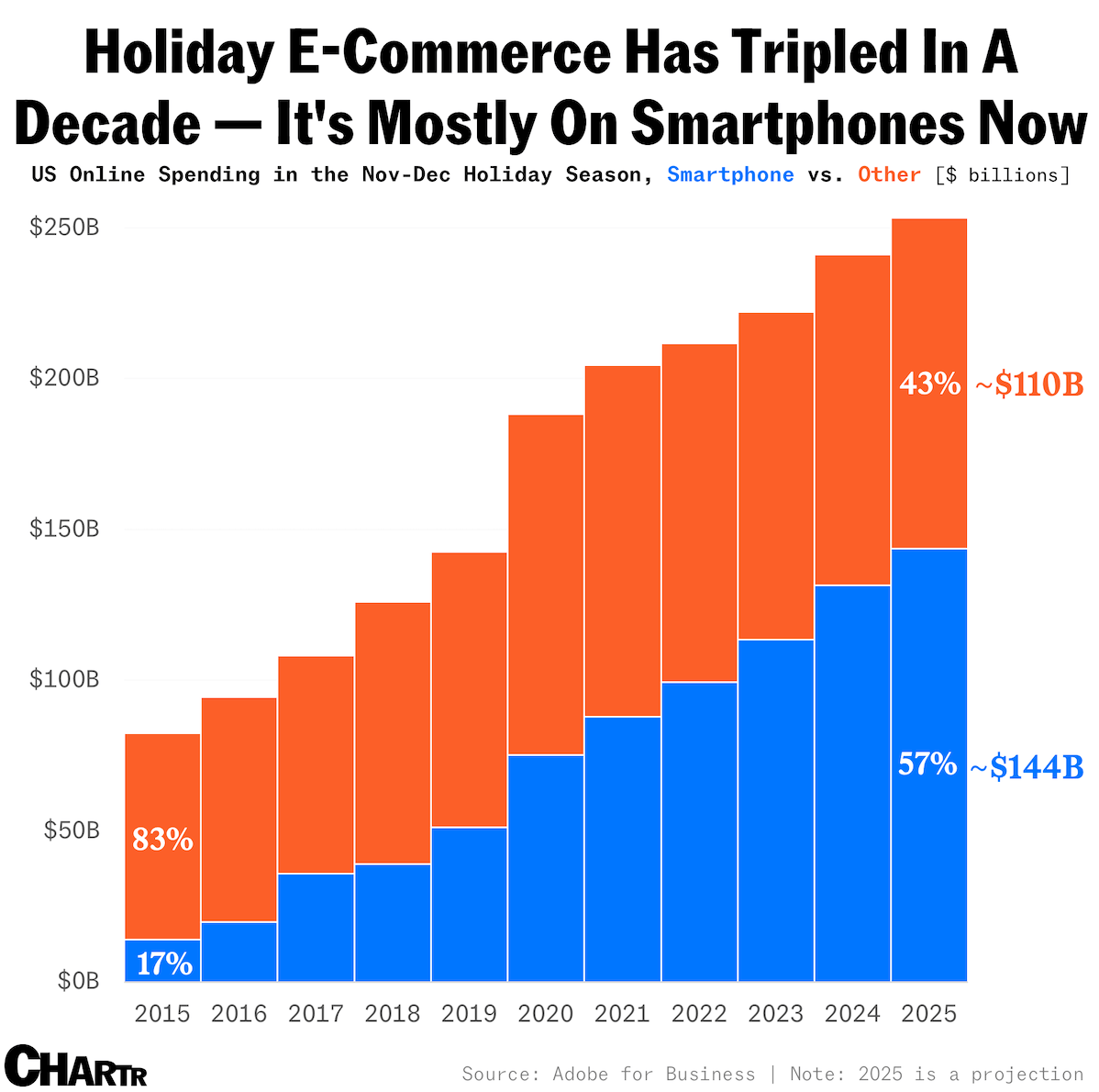

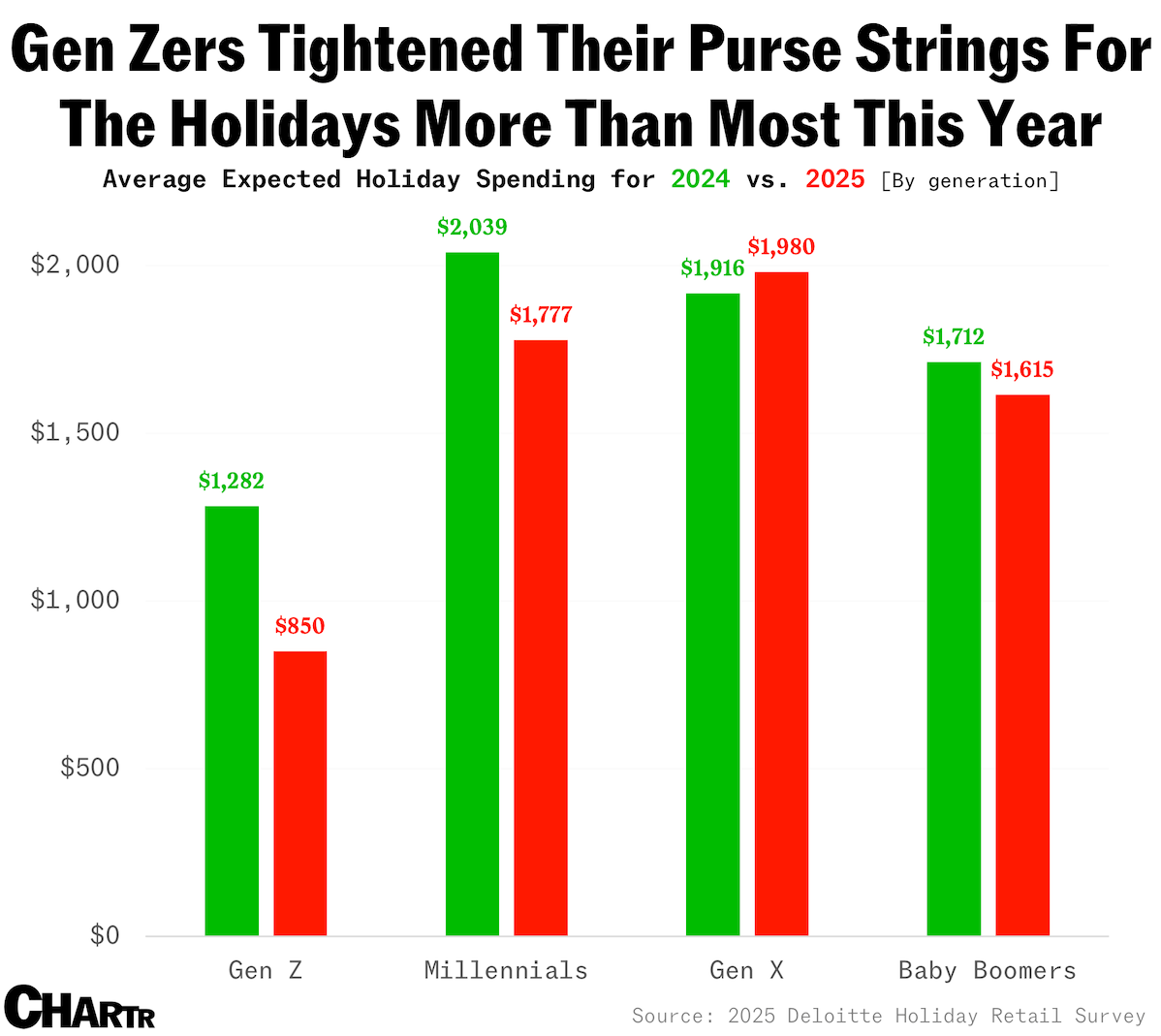

In 2015, just 17% of American online holiday shopping took place on smartphones — a share that's expected to hit 57% this year, per Adobe estimates. Total online spending has surged more than 3x over the same period and now, with some shoppers turning to AI for product discovery and recommendations, that growth seems likely to continue. Indeed, from November 1 through 28, AI-referred traffic to retail sites was up 805% from the same period last year. More than 4 in 10 consumers already use AI to shop, a survey from Mastercard found — led by 61% of Gen Z, who rely on it for deal-checking and filtering out bogus reviews. Still, even if they're using AI to help them bargain hunt this Thanksgiving period, America's youngest adult generation has planned to pull back pretty decidedly on holiday spending in 2025, per Deloitte's Holiday Retail Survey for this year. |

According to the expected spending figures, millennials are looking to splash about 13% less cash than they did during last year's holiday period, while Gen Z said in late summer that they were expecting their seasonal spending to drop by more than one-third. According to a separate part of Deloitte's report, 62% of America's Zoomers are anxious about higher prices this festive period. Obviously, all of this is potentially concerning for America's retailers. As The Wall Street Journal pointed out, though the youngest generation of US adults accounts for only about 8% of retail dollars in 2025, that's expected to rise to around 20% by the end of the decade. Getting the next generation hooked on shopping is what the season now has to be all about if you're a big brand. Right? |

|

|

AI Starts With Semiconductors. Here's Why Investors Are Tracking The Sector |

Chips are essential to artificial intelligence, cloud services, and digital transformation. Hyperscalers and enterprises now treat AI computing as core infrastructure, driving consistent demand for GPUs, memory, and networking across the semiconductor value chain. To keep pace, the semiconductor industry has shifted toward stronger supply management and pricing discipline, supported by a more concentrated group of major players. For investors seeking semiconductor exposure through ETFs, VanEck has options: |

- VanEck Semiconductor ETF (SMH) offers exposure to the world's largest semiconductor companies. It includes leaders across the stack, from chip designers to manufacturing and equipment companies — providing diversified exposure across the ecosystem.

- VanEck Fabless Semiconductor ETF (SMHX) focuses on fabless semiconductor companies, the designers solving today's biggest chip bottlenecks. These firms drive innovation in areas like GPU architecture and AI acceleration as the brains behind global compute growth.

|

|

|

"Zootopia 2" is a rare smash hit for Hollywood at the Chinese box office |

Following the success of "Moana 2" last year, Disney's latest Thanksgiving offering had all the hallmarks of a modern-day blockbuster: a PG-rated animated sequel, ripe for cute, animal-inspired merchandise. As box office takings for the five-day weekend roll in, it seems that "Zootopia 2" is following the script, notching a mammoth ~$560 million worldwide — the highest-grossing global debut for 2025, per Deadline, and the fourth highest of any film ever. One slightly surprising place it's finding an audience, though, is China. While "Zootopia 2" has beat out China's own smash hit "Ne Zha 2" for the best ever opening for an animated movie worldwide, it's also managed to take the domestic-dominated Chinese box office by storm with a ~$275 million haul, trailing only "Avengers: Endgame" for foreign debuts in the country. |

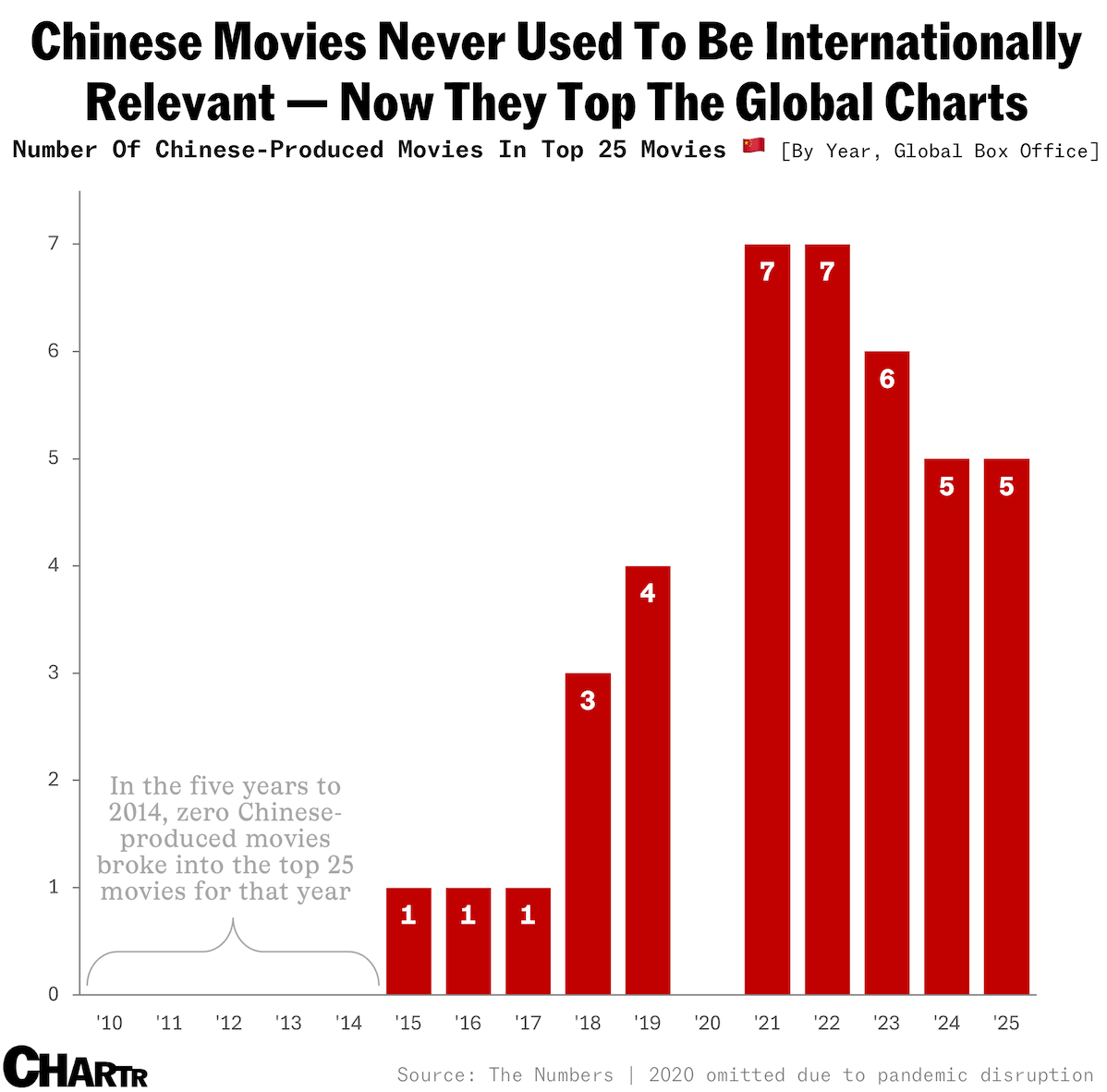

This marks a rare win for a US-made movie in China. Per Bloomberg, as America's share of the global box office has shrunk from 92% to just 66% in the last two decades, Chinese-produced movies have soared in popularity, bumping them up international charts. |

Looking at the top 25 global movies each year compiled by The Numbers, Chinese-produced flicks barely made the ranking until 2015. However, since a pandemic lull, China's film industry has been booming, with domestic hits now routinely rivaling Hollywood tentpoles. Although America is still first overall, with 19 of the top global box office hits of the year so far (vs. China's 5), US movies have struggled to break into China — even before they got caught up in the trade war. While China has commanded 20% of the global box office on average over the last five years, only a 2% share of the country's box office in that period came from overseas movies. So, Hollywood might have to stick with anthropomorphic action if it's to win over a growing Chinese audience as it has with "Zootopia" — and bring the US industry back to its glory days. |

|

|

- Rounding problem: After the US Mint stopped making pennies in November to save $56 million annually, American retailers are already struggling with math headaches at cash registers.

- Norway's becoming a rare bright spot for Tesla in Europe, a region Elon Musk once called the company's "weakest market," as the EV maker's sales in the country jumped 175% last month year-on-year.

- Eli Lilly is cutting the cost for lower-dose Zepbound vials by ~$50 a month for those who pay cash starting Monday, as competition with rival Novo Nordisk heats up.

- Silver lining: Prices for the precious metal climbed to a record high on Monday, marking a 99% jump this year so far and outpacing both gold and platinum.

- ChatGPT officially turned 3 years old yesterday — why not celebrate with our idiot's guide to AI jargon.

|

|

| For investors seeking semiconductor exposure through ETFs, VanEck has options. Learn more about SMH and SMHX from VanEck. |

|

|

- Friends, family, personal finances? What Americans were most grateful for going into this Thanksgiving, per YouGov.

- The 15-minute city: Mapping walkable cities across the world and the average time to travel to key services.

|

Off the charts: What was America's biggest agricultural export in 2024, more than half of which was bought by China? [Answer below]. |

Not a subscriber? Sign up for free below. |

VanEck's Disclosure: This is not an offer or recommendation to buy or sell any security or digital asset, nor personalized investment, financial, legal, or tax advice. Forward-looking statements are illustrative, subject to change, and not predictive. Third-party data is believed reliable but not verified or guaranteed. Views are those of the author(s), not necessarily VanEck or its other employees. Investing involves substantial risk and high volatility, including possible loss of principal. Sector ETF products are also subject to sector risk and non-diversification risk, which will result in greater price fluctuations than the overall market. Visit vaneck.com/etfs to read and consider the prospectus, containing the investment objectives, risks, and fees of the funds, carefully before investing. Past performance is no guarantee of future results. Fund holdings may vary. Visit vaneck.com/smh or vaneck.com/smhx for a complete list of holdings. VanEck mutual funds and ETFs are distributed by VanEck Securities Corporation, Distributor, a wholly owned subsidiary of VanEck Associates Corporation. |

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment