US stocks rally amid hopes of the government shutdown ending soon |

The markets rallied on Monday following the Sunday evening announcement by the US Senate that a tentative compromise bill would advance, potentially ending the US government shutdown this week. The AI trade got an additional boost as Nvidia CEO Jensen Huang "asked for wafers" from TSMC in light of "very strong demand," boosting both stocks. The S&P 500 closed up roughly 1.5%, the tech-heavy Nasdaq 100 soared more than 2% for its best day since May, and the Russell 2000 rose over 1%. Stocks that moved higher: |

- Chips stocks like Micron and AMD benefitted from the Nvidia halo, as traders heard Huang note that there would be shortages of "different things" which those chipmakers could supply.

- Other stocks rallying from renewed optimism in the AI space included Palantir, Western Digital, and Seagate Technology Holdings.

- Tesla shareholders weren't bothered by its Cybertruck program chief stepping down or its lackluster China sales, but seemed to like the move to get more Tesla buyers by first enticing them as Tesla renters.

- Opendoor Technologies skyrocketed after management employed a tactic that's pushing short sellers to think twice about betting against the company.

- Shares of EV maker Rivian revved up in the Monday session, as traders reacted well to a Friday evening announcement that it will award its CEO a pay package of up to $4.6 billion.

- Coinbase rose after The Wall Street Journal confirmed rumors it is launching a new site for "token offerings" reminiscent of the "initial coin offering" craze from a few years back.

|

- After Trump targeted health insurers in his social media posts, the biggest providers of ACA marketplace plans like UnitedHealth, Elevance Health, Oscar Health, and Molina Healthcare fell.

- Shares of airlines such as American Airlines, United Airlines, and Delta rose for a while as investors reacted optimistically to the possible end of the government shutdown before giving up those gains to end in the red.

|

— Luke Kawa, Markets Editor & Toby Bochan, Managing Editor |

|

|

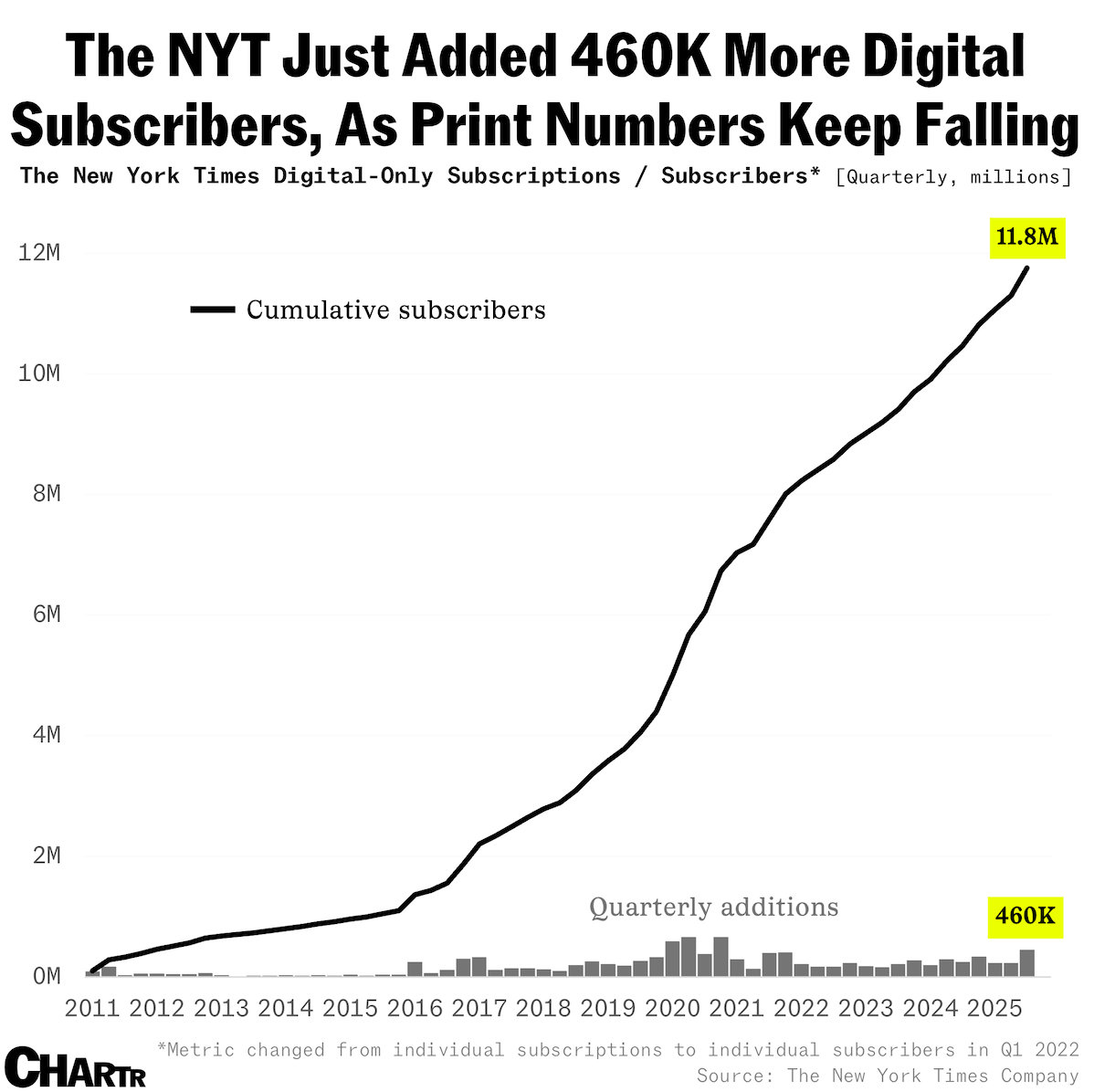

Could paywalling The Mini have made a big difference to the NYT's bottom line last quarter? |

A new wave of bundled and single-product digital subscriptions boosted The New York Times' profits in Q3. Read more. |

|

|

Bank of America: Claiming an AI bubble over OpenAI's money situation is a "lazy/cherry-picked argument" |

The company's $1.4 trillion in spending commitments have boosted a host of tech stocks. Read more. |

|

|

In hopes of teasing out more sales, Tesla is renting cars. After a record sales quarter, the EV company is looking to develop a new sales strea by renting out its cars, starting at $60 a day. Read more. |

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to The Wrap and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and Snacks for quality reads. We care what you think! If you have any feedback or comments, feel free to reply and let us know your thoughts! |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 |

|

|

|

No comments:

Post a Comment