Stocks climb higher as investors shake off hawkish Fed commentary |

The S&P 500, Nasdaq 100, and Russell 2000 all moved higher as investors did not seem to be spooked by the Fed's hawkish commentary and instead focused on yesterday's blowout earnings from Amazon . The S&P 500 closed up 0.3%, and the Nasdaq 100 rose 0.5% as did the Russell 2000.

The S&P 500 is on a six-month winning streak, its longest since 2021 and the Nasdaq 100 notched its seventh-consecutive monthly gain, a hot streak not seen since 2017, primarily due to the fact the Mag 7 Index has also had seven straight months of gains. Stocks that moved higher: |

- Amazon notched a new all-time high after a monster quarter, with AWS revenue growing 20% year on year.

- Investors upvoted Reddit after it posted generally strong Q3 financials yesterday.

- Netflix rose after the streamer announced it'll perform a 10-for-1 forward stock split in yesterday's earnings call.

- Hims & Hers rose after JPMorgan disclosed that it substantially increased its position in the telehealth company.

- Cryptocurrency exchange Coinbase reported better-than-expected Q3 sales, profit, and transaction numbers than Wall Street analysts had expected yesterday, sending shares higher.

- Strategy jumped following yesterday's report of third-quarter earnings today that beat analysts' estimates.

- Gene-editing stocks Intellia, Beam Therapeutics Inc, Crispr Therapeutics, Editas Medicine, and Prime Medicine rose after the industry's top regulator told Bloomberg News that the Food and Drug Administration plans to publish a paper in early November outlining the agency's new, faster approach to approving those treatments.

- Western Digital, a maker of the decades-old data storage devices known as hard disk drives that's become a top stock this year due to the AI boom, rose after it had nothing but good news in yesterday's Q1 earnings report. The company has received a bevy of target price hikes since reporting results.

|

- AbbVie slipped after it reported earnings results that beat Wall Street estimates, but also showed a slowdown in its oncology and aesthetics business.

- Getty Images initially climbed higher after announcing a multiyear licensing deal with AI search company Perplexity AI before closing slightly lower.

|

|

|

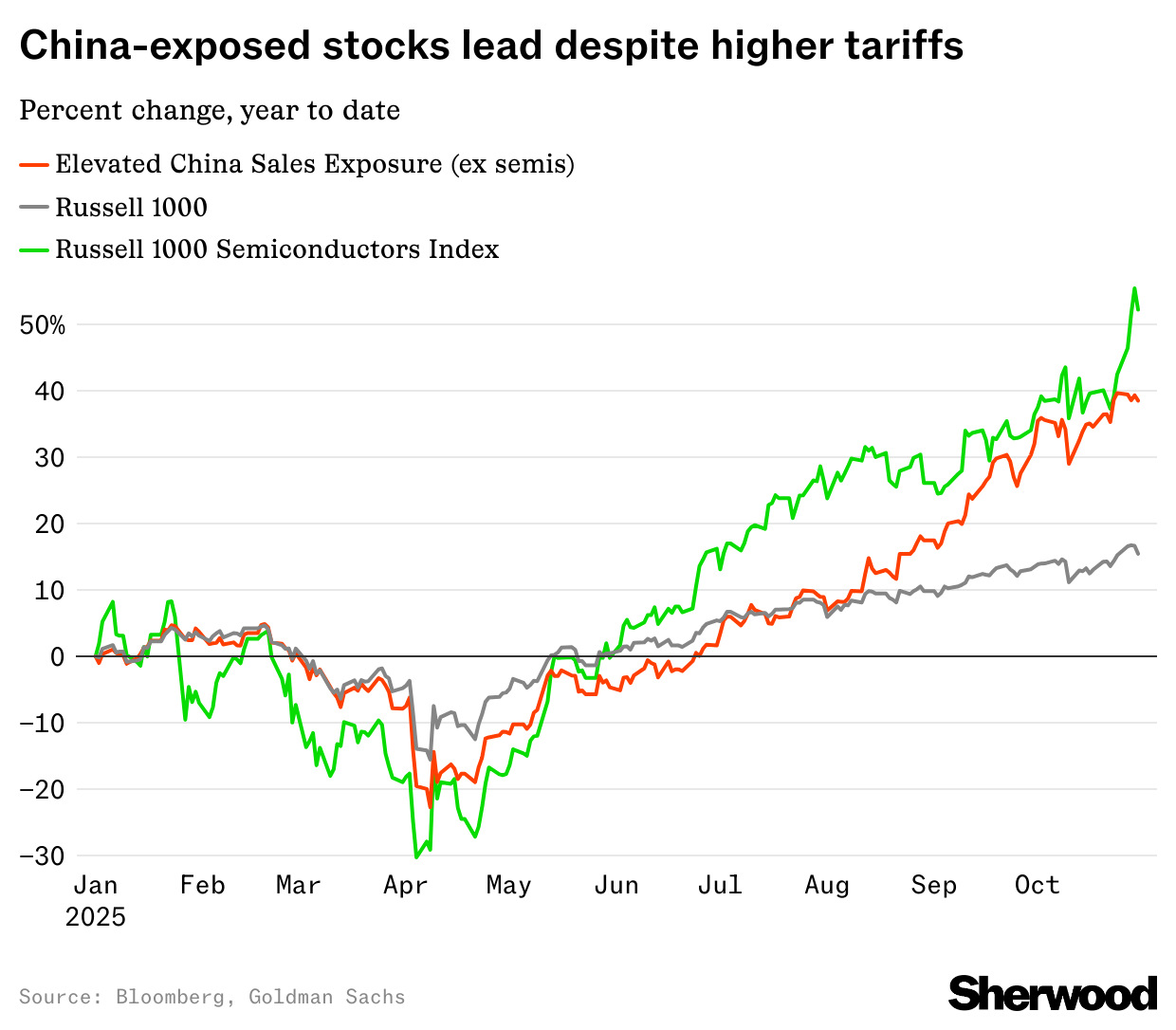

China-exposed companies are crushing the S&P 500 this year. That's because "China-exposed company" is just another term for "high-growth company." Read more. |

|

|

Chipotle dropped 18% yesterday, and its woes weighed on the wider slop bowl complex, dragging Cava and Sweetgreen down, too. Read more. |

|

|

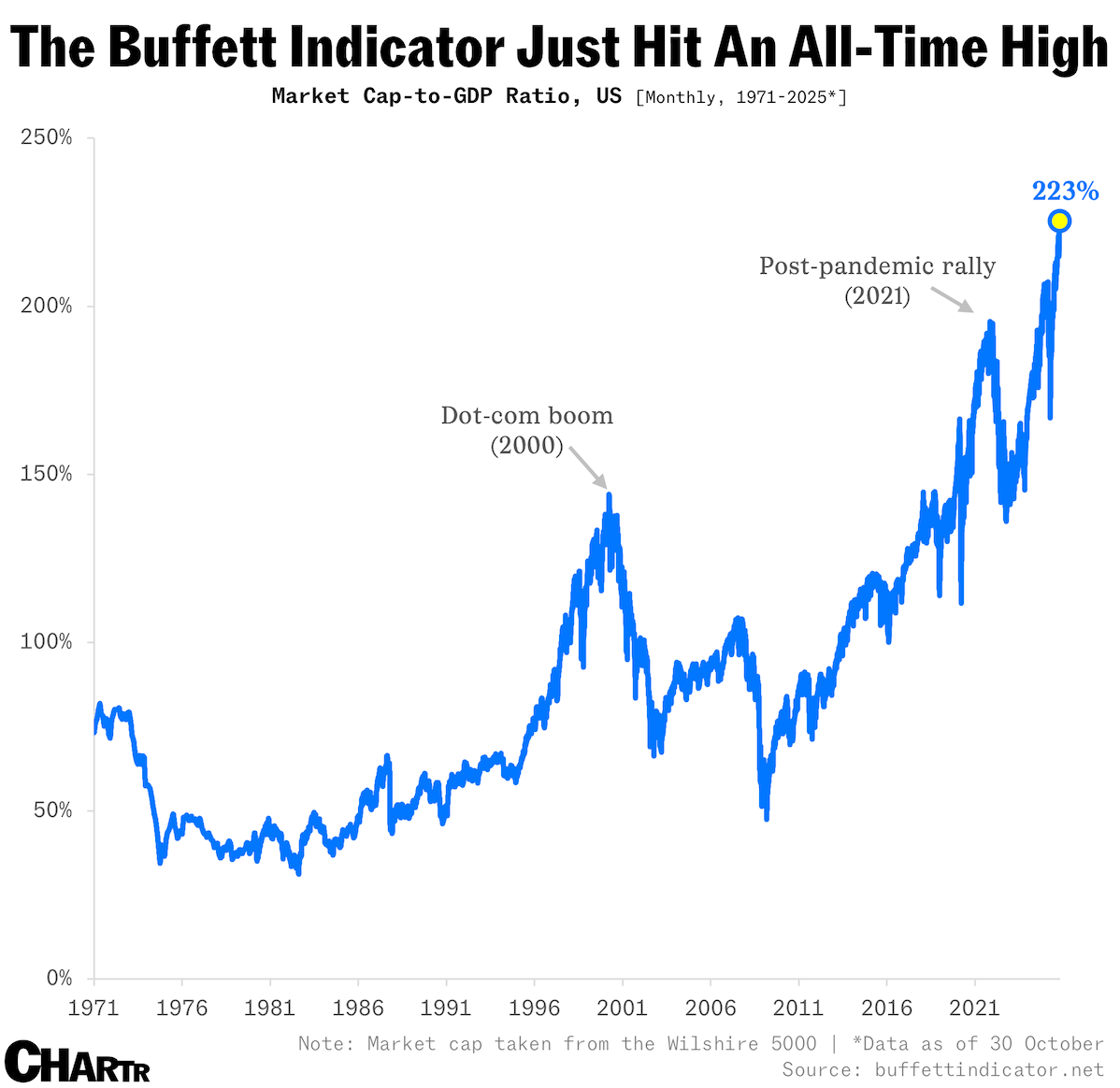

The Buffett Indicator just hit an all-time high Once hailed by its namesake investor as "probably the best single measure of where valuations stand," that indicator just hit an alarm-ringing 225% — its highest level on record, adding to the growing chorus of market commentators who think we might be in for a correction. Read more |

|

|

- The best analyst questions from Apple's earnings call

Apple even answered some of them! - "KPop Demon Hunters" costumes will probably be everywhere this Halloween

Again, Google Trends data shows one of the year's buzziest movies is inspiring Halloween heads across the country. - Microsoft, Amazon, and Google all have cumulonimbus-sized cloud backlogs

Amid searing demand for AI computing, the top cloud companies can't keep up with demand. - Amazon, Alphabet, Meta, and Microsoft combined spent nearly $100 billion on capex last quarter

That's nearly double what it was a year earlier, as AI infrastructure costs continue to balloon and show no sign of stopping.

- Google uses an AI-generated ad to sell AI search

Of course it did, but the company chose not to label it as such.

- RIP bitcoin "Uptober" as price disappoints, breaking 6-year trend

On October 2025's final day, bitcoin is trading 8% lower than where it was on the first day of the month.

| |

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to The Wrap and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and Snacks for quality reads. We care what you think! If you have any feedback or comments, feel free to reply and let us know your thoughts! |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 | |

|

|

No comments:

Post a Comment