Stocks pull back as megacap tech slumps |

Stocks fell on Tuesday as the market's tech titans took a breather after a hot run. The S&P 500 fell 0.6%, the Nasdaq 100 lagged with a 0.7% decline, and the Russell 2000 outperformed, albeit with a 0.2% drop. The Magnificent 7 had their worst day in over a month, down 1.5%, with every constituent falling. Consumer discretionary and tech were the two worst-performing S&P sector ETFs, while energy fared the best. Bright spots on the day were Halliburton and Paramount Skydance, which rose 7.5% and about 6%, respectively. Generac and Vistra were among the biggest decliners, falling more than 10% and 6%, respectively. Elsewhere… |

- Nvidia fell 2.8% even as Wedbush analysts called its recent $100 billion deal with OpenAI a "watershed moment" for the AI revolution. Separately, Bank of America analysts said the chipmaker is poised to generate hundreds of billions in free cash flow.

- Shares of Opendoor sank more than 15% after its third-biggest shareholder, Access Industries, sold 11.36 million shares of the online real estate company through its AI LiquidRE arm.

- Firefly Aerospace also dove more than 15% after the Texas-based space launch startup missed Wall Street's estimates for the company's first quarterly report since its August IPO.

- Plug Power had a wild ride, up double digits in premarket trading before ending down 4.6%, snapping a nine-day winning streak for the hydrogen fuel cell company that was close to becoming longest on record.

- Boeing ticked up another 2% after announcing on Monday Uzbekistan Airways will order up to 22 of its 787 Dreamliner jets.

- IonQ jumped more than 4% after the company announced "a significant technological advancement in its pursuit of scalable quantum networks.

- Shares of Sinclair Inc. rose more than 3% after the self-proclaimed "largest ABC affiliate group" said it will continue to keep "Jimmy Kimmel Live!" off its ABC stations.

- Palantir rose 1.8% after Bank of America analysts hiked their price target on the stock to $215 — the highest among the published price targets tracked by FactSet.

- Kenvue, the company behind Tylenol, gained 1.6% as doctors pushed back against President Trump's claims about a link between the drug and autism, per Reuters.

|

— Luke Kawa, Markets Editor & Nia Warfield, Markets Writer |

|

|

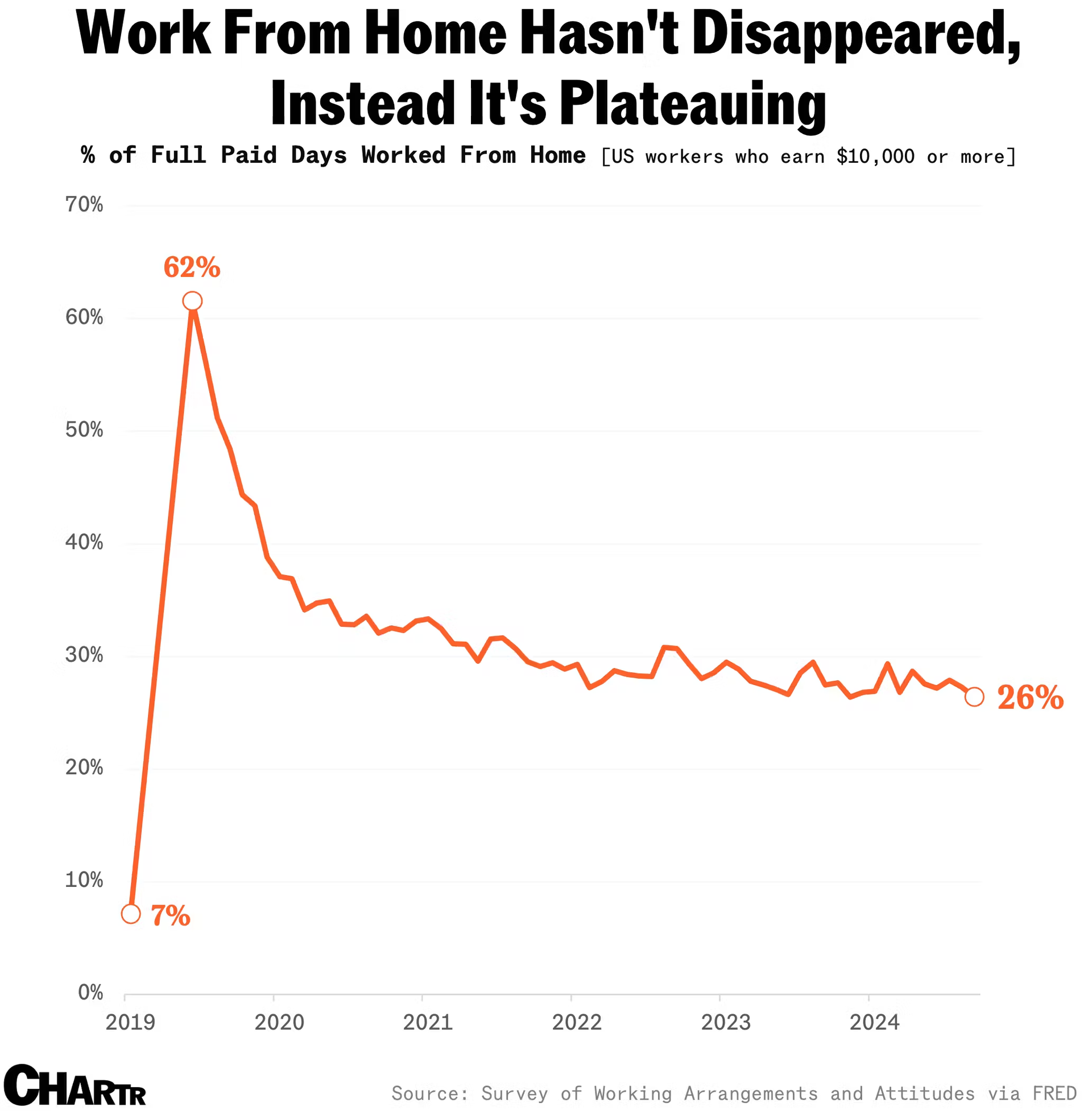

The average worker has been spending about a quarter of their working time from home since 2023, the US Survey of Working Arrangements and Attitudes found. Read more. |

|

|

Hyperion, Colossus, Prometheus, and Stargate. Our guide to the GPUs and gigawatts that make up the largest AI infrastructure projects in the industry. Read more. |

|

|

(Liu Yanan/Xinhua via Getty Images) |

Satellite stocks moon on elevated call options activity Satellite stocks are the latest thematic moonshot — literally — to benefit from a wave of buying appetite. Volumes and call activity in AST SpaceMobile were each more than double their one-month average today Peers Planet Labs and Rocket Lab enjoyed elevated options activity and massive gains, as well. Read more. |

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to The Wrap and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and Snacks for quality reads. We care what you think! If you have any feedback or comments, feel free to reply and let us know your thoughts! |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 | |

|

|

No comments:

Post a Comment