S&P 500's losing streak extends to three |

The S&P 500 fell 0.5% on Thursday, marking its third straight day in the red for the first time in over a month. The Nasdaq 100 gave back 0.4% and the Russell 2000 fell 1%. Every S&P 500 sector ETF finished in the red aside from energy, with consumer discretionary and healthcare faring the worst. Bright spots on the day were led by Intel, which rose 8.8% following a Bloomberg report that the chipmaker approached Apple about a possible investment as it seeks to revive its business. Declines were led by CarMax, which sank 20% after the used vehicle retailer missed Wall Street's estimates for the second quarter. Elsewhere… |

- Amazon ticked 0.9% lower after agreeing to pay $2.5 billion to settle a case by the Federal Trade Commission that alleged the retailer tricked people into signing up for Prime and made it hard to cancel.

- Quantum stocks including IonQ, D-Wave Quantum, and Quantum Computing sputtered after nearly doubling thanks to the US government calling the technology an R&D priority for fiscal 2026.

- Stitch Fix sank nearly 17% after the personal styling platform topped the Street's Q4 expectations but tepid guidance and declining customer numbers disappointed investors.

- Oklo dove 9.2% after an SEC filing showed company director Michael Klein sold some $6.7 million in stock.

- Cipher Mining fell nearly 18% after initially popping, following news that Google was taking a 5.4% equity stake in the data center company.

- Shares of retail darling Opendoor Technologies jumped over 10% after proprietary trading firm Jane Street revealed a 5.9% stake in the company in a new filing.

- BYD leapt 2.5% after the Chinese EV maker outsold Tesla in the EU again in August. Tesla fell 4.4%.

- Duolingo popped 4.2% after the language-learning app regained some attention among options-trading retail investors.

- Hertz ticked up 0.9% after the company announced an upsized $375 million exchangeable senior notes offering, an increase from the previously announced offering size of $250 million.

|

— Luke Kawa, Markets Editor & Nia Warfield, Markets Writer |

|

|

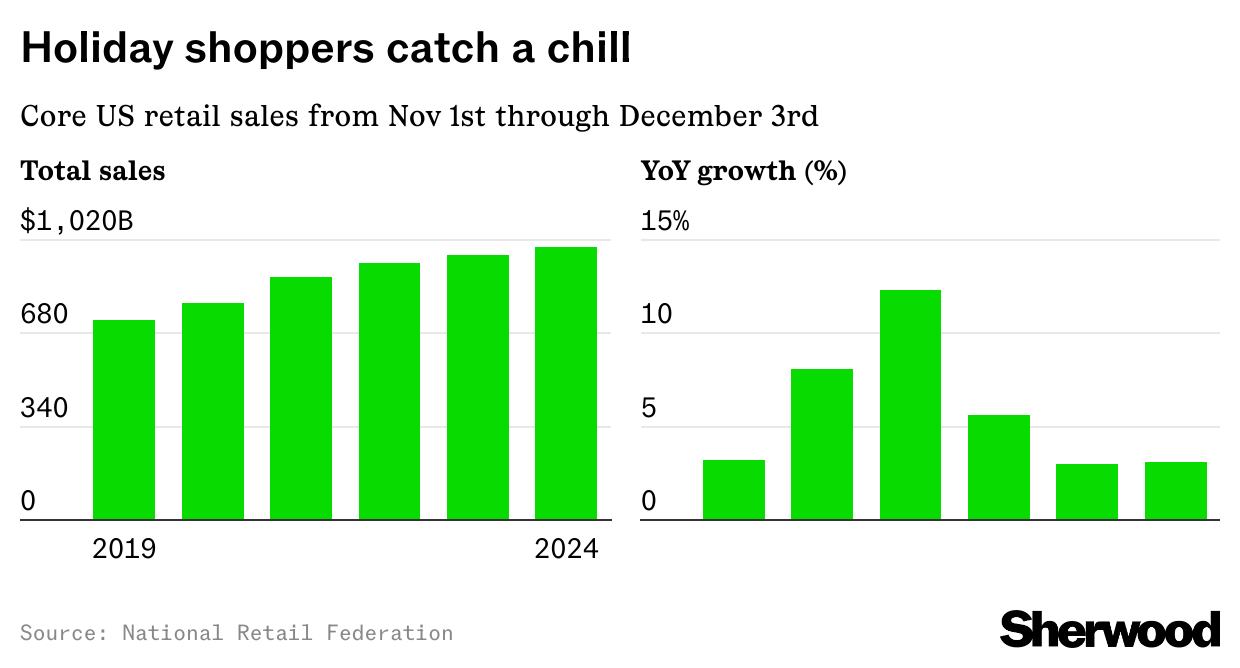

Walmart, Amazon, and Target are leaning on early deal events, faster delivery, and price cuts to win over cash-strapped consumers. Read more. |

|

|

We spoke to ATB Capital Markets analyst Frederico Gomes about why institutional investors are growing bullish on cannabis. Read more. |

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to The Wrap and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and Snacks for quality reads. We care what you think! If you have any feedback or comments, feel free to reply and let us know your thoughts! |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 | |

|

|

No comments:

Post a Comment