Hi! While the eye-watering $1.8 billion Powerball jackpot was split between two lucky winners a few weeks ago, another large lottery prize was spread a little further… turning 10% of a small Quebec town's population into multimillionaires. Today we're exploring |

- Build-A-Bull market: One toy company's stock is soaring, as the "kidulting" economy keeps growing.

- Ride or dine: Uber wants customers to bulk buy rides, restaurants to batch cook value meals.

- National anthems: American music artists dominate both US and international charts.

|

Have feedback for us? Just hit reply - we'd love to hear from you! |

The "kidulting" economy is still booming

|

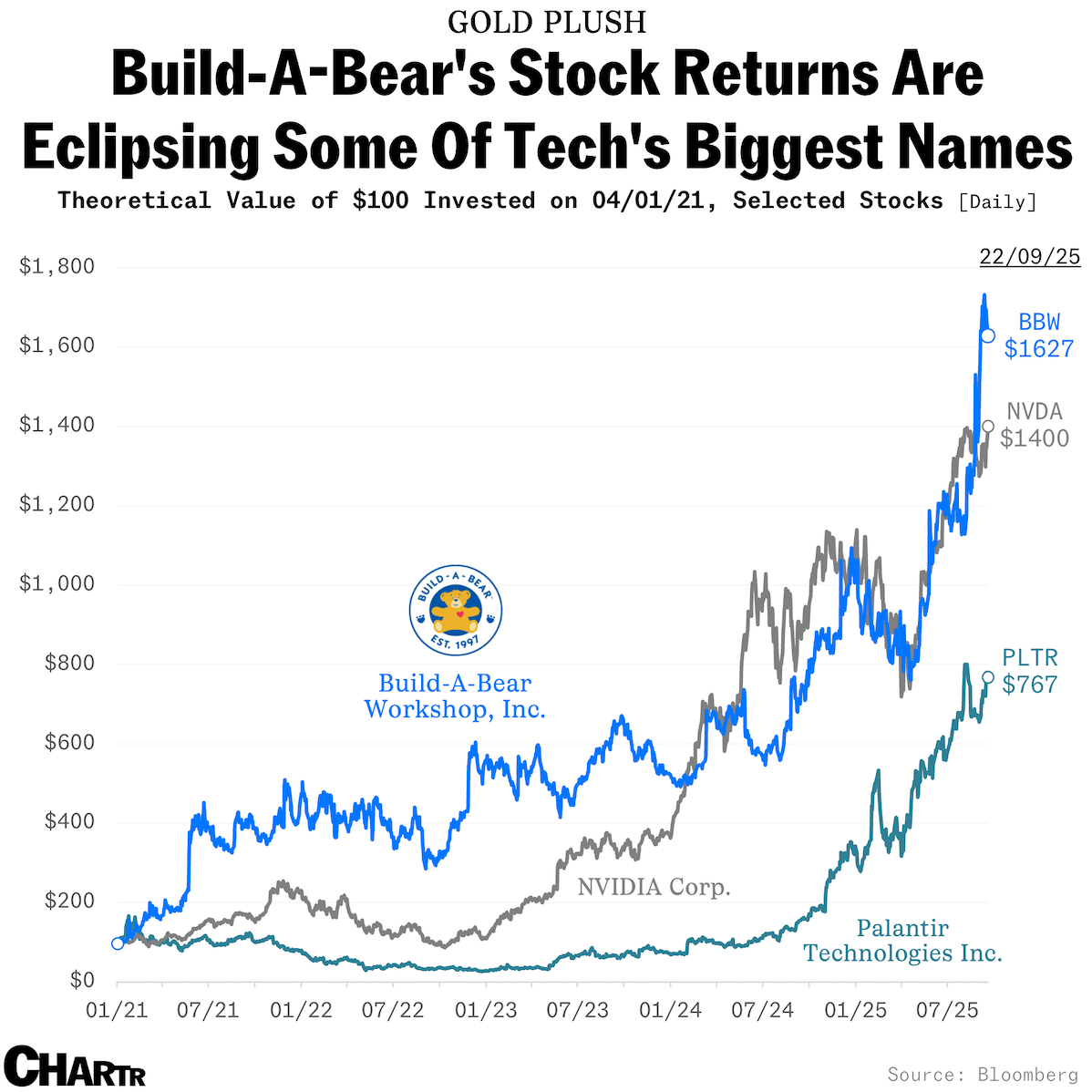

What's fluffy, has big ears, and has seen its stock outpace the likes of Nvidia, Palantir, and Microsoft? It's Build-A-Bear Workshop, of course. The almost 28-year-old mall staple where one can stuff, name, dress, and accessorize a cuddly toy has seen its stock price soar more than 2,000% over the last five years, as reported by the Washington Post on Monday, outperforming some of the hottest names in AI and technology. |

Indeed, a theoretical $100 invested into BBW stock at the start of 2021 would be worth ~$1,600 today — about $200 more than the theoretical value of the same amount of Nvidia stock. Since its sales plunged in 2020, Build-A-Bear has only gone from strength to strength. The company reported its best Q1 results ever in May, with revenue rising 11% to $128.4 million, having emerged as a post-pandemic winner after tapping into a lucrative market: grown adults. |

Today, analysts estimate that about 40% of the company's business is from adults. And it's not just Build-A-Bear: several toy companies that have pivoted to regression are showing some serious progression. Lego, the world's biggest toymaker, recently reported record sales of 34.6 billion Danish kroner (~$5.4 billion) for the first half of the year, driven by the overwhelming success of its adult-focused sets. Other plushie brands like Jellycat and Squishmallows have seen plumped-up sales since taking off with older consumers — and you'd have been hard pressed to have missed the Labubu craze. Classic childhood toys like Barbie and Hot Wheels are similarly flying off shelves, increasingly by way of those tall enough to reach. Beyond the trend for nostalgic collectibles, it also seems that adults, bogged down by responsibilities, are just craving some lighthearted playtime. Whether it be through theme parks, ball pits, or building bears in workshops, the latest form of grown-up self-care is some carefree growing down. |

Uber wants customers to bulk buy rides, restaurants to batch cook value meals |

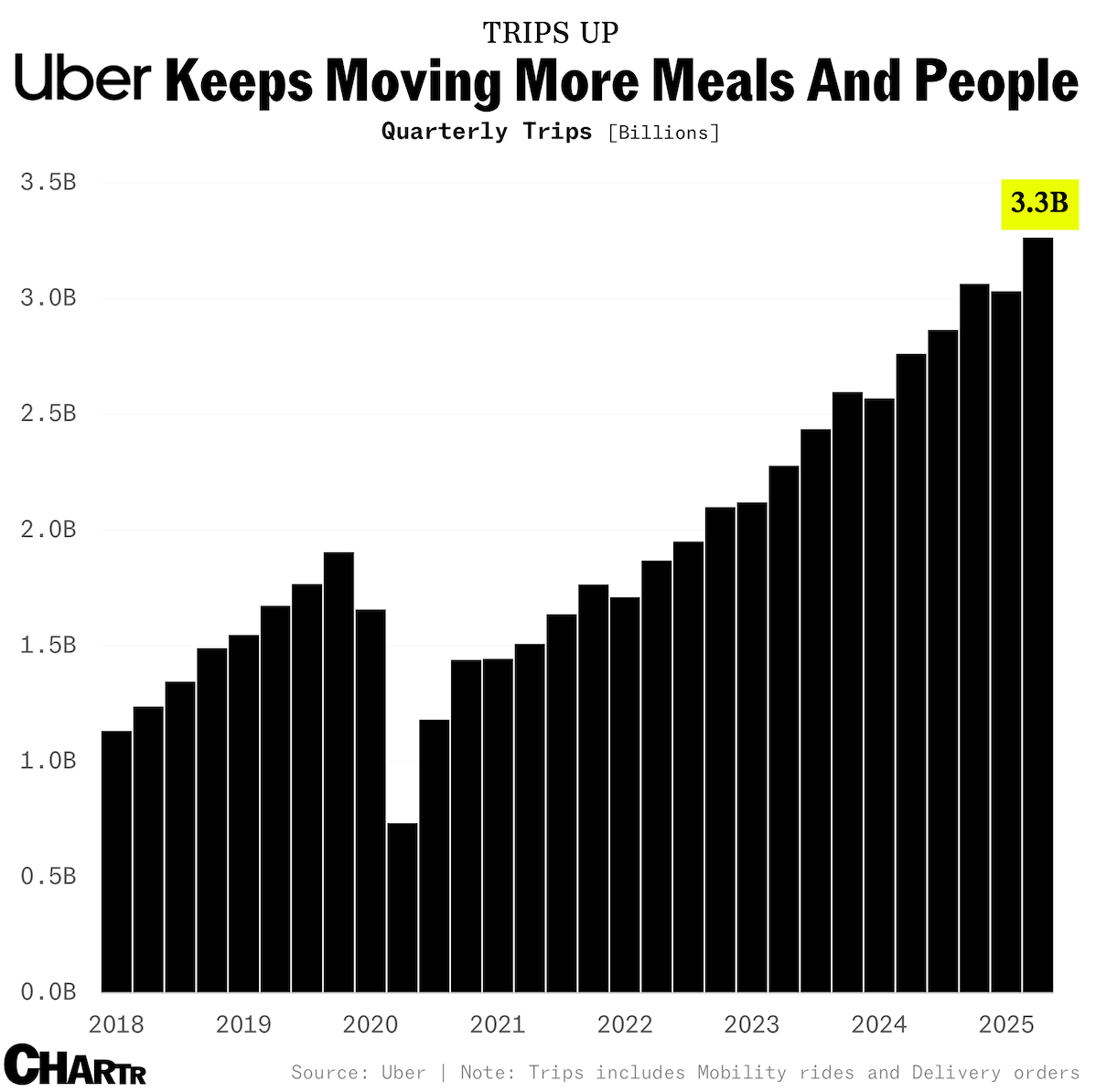

Whether you're a delivery fiend with a penchant for a popular dish from a local spot, or someone who makes the same monotonous cab ride multiple times a month, Uber wants to make your routine a little cheaper. Yesterday, the company announced a raft of changes across its services, with The Verge presenting one new feature — where riders can bulk buy 5, 10, 15, or 20 passes for the same route at a discounted rate — as an attempt to "chip away at the perception that its ride-hailing service is too expensive." Similarly, "Meal Deals," a new Uber Eats offering, is also designed to save users a bit of cash, with a range of popular dishes prepped in batches at local restaurants priced at $15 or less, including fees. With a renewed focus on its power customers, Uber's latest initiatives might help the company secure a few extra trips. However, its riders and drivers are already busier than ever, with the number of deliveries and taxi rides booked through Uber already hitting record highs as it is. |

In 2018, Uber was clocking just over 1.1 billion "trips" (a composite measure of the number of rides and food delivery orders completed on the platform) in the first three months of its fiscal year. In the last quarter, it notched almost 3x more than that, as users hopped into cabs and ordered private burrito taxis a staggering 3.27 billion times on the platform across Q2. |

|

|

ETF Investors, There's A New Way To Bitcoin |

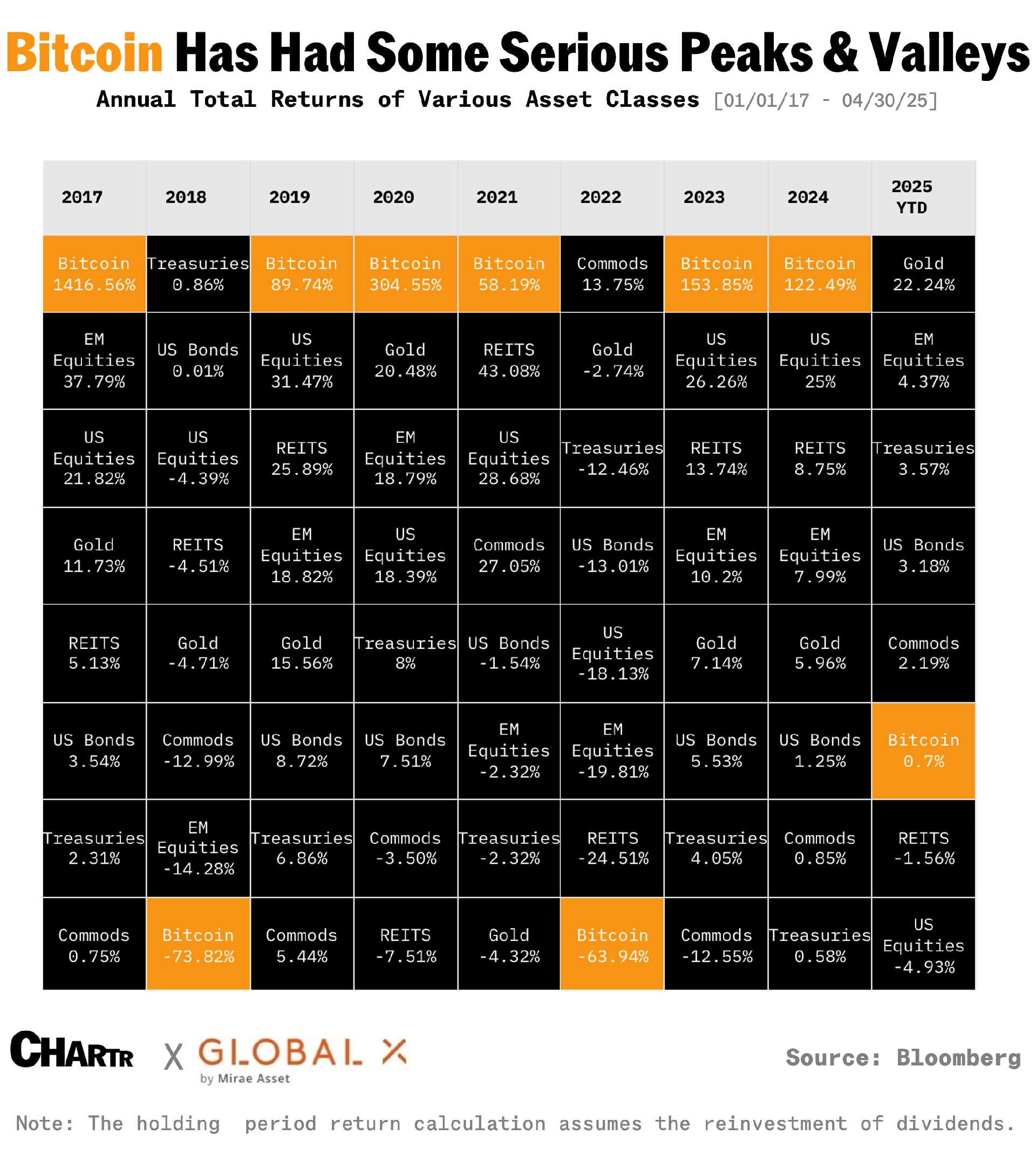

Bitcoin's rollercoaster returns have sent rumbles through the investment community for years. The world's largest cryptocurrency outperformed US equities by nearly 5x last year. But wide measures of periodic outperformance have come back-to-back with intermittent drawdowns, leaving many investors looking for a way to manage volatility and capture upside potential. |

Past performance is not a guarantee of future results. Index returns are for illustrative purposes and do not reflect any fees or expenses. Asset classes represented as follows: Bitcoin, Bloomberg Bitcoin Index; U.S. Equities, S&P 500; EM Equities, MSCI Emerging Markets Index; REITs, MSCI US REIT Index; US Bonds, Bloomberg US Agg Total Return Index; Treasuries, Bloomberg US Treasury Total Return Index; Commods, Bloomberg Commodity Index; Gold, S&P GSCI Gold Index. |

Bitcoin Covered Call ETF (BCCC) from Global X seeks to turn Bitcoin's volatility into an asset. It's a new, actively-managed fund that provides exposure to Bitcoin exchange-traded products (ETPs) while employing a partial covered call strategy. This may help to: |

- Capture a portion of Bitcoin's capital appreciation1 while seeking to manage its inherent volatility through the pursuit of options premiums and distributions.

- Get synthetic exposure to Bitcoin's ETP price movements in an efficient ETF wrapper, without owning the coin.

- Receive potential distributions from collection of options premiums, which the fund aims to distribute on a weekly basis.

|

|

|

1 The Fund does not invest directly in Bitcoin. |

American music artists dominate both US and international charts |

Although there was no real definitive song of the summer this year (bar an advert jingle that took social media by storm), one thing's remained clear: American pop stars aren't going anywhere.

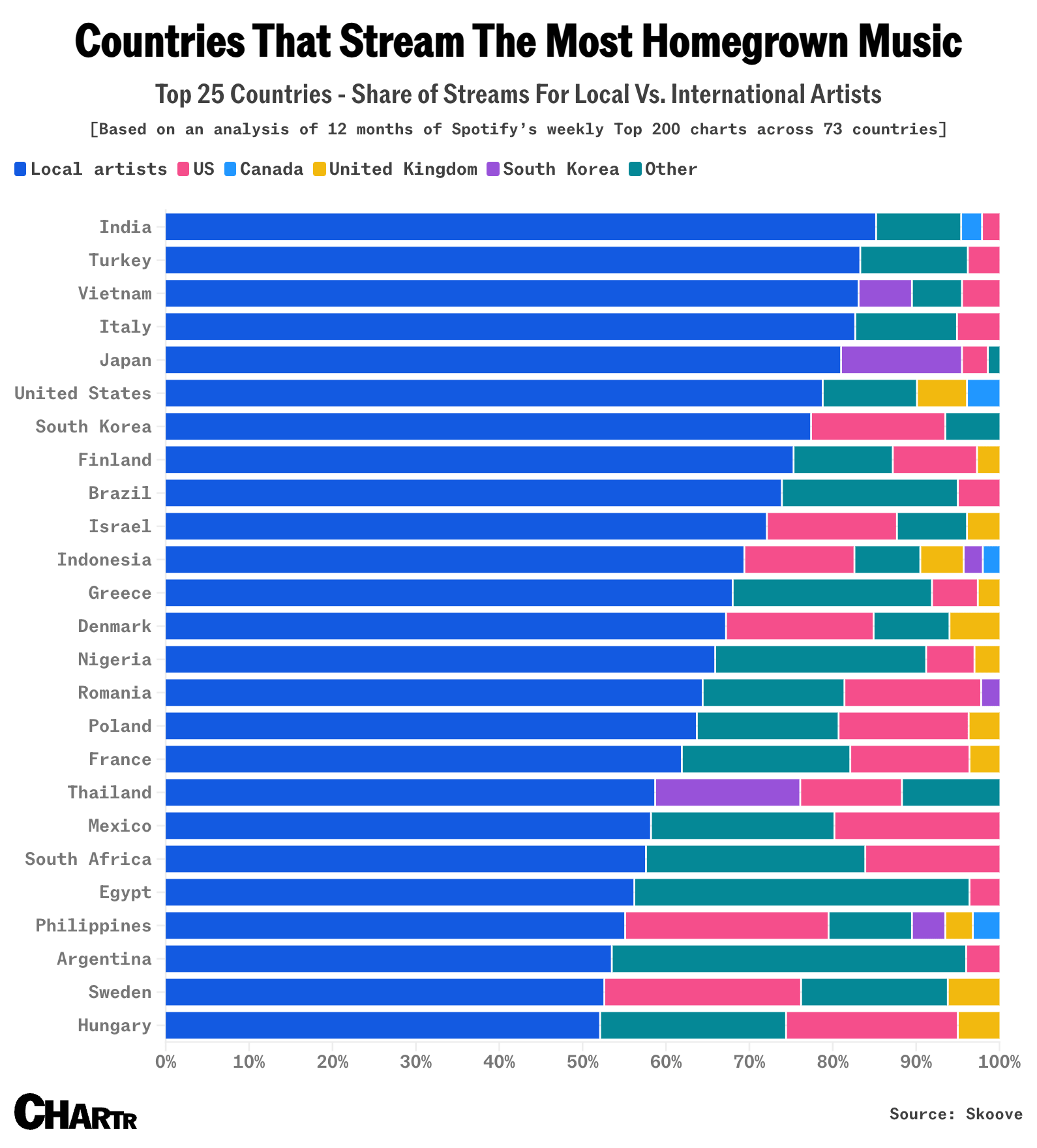

While many international artists are enjoying meteoric rises — reaching new audiences all over the world thanks to global platforms like Spotify, YouTube, and even TikTok — most of the world's biggest music acts are still born in the USA. Indeed, looking at Spotify's top artists and songs globally for 2024, the majority are American artists; zooming out further, the platform's most-streamed artists of all time chart tells a similar story. |

Using 12 months' worth of data from Spotify's weekly Top 200 chart, piano learning app Skoove assessed where the music that different nations listen to actually comes from. Of the 73 nations analyzed, 70 had the US in the top five list of where their most-streamed songs originate. However, some nations still have a lot of homegrown talent on repeat. |

Topping the list for home-nation artist fandom is India: with a music industry largely ruled by Bollywood soundtracks, 85% of the country's streams came from Indian artists. In fact, Turkey, Vietnam, Italy, and Japan — each with their own thriving national music scene — all saw more than 80% of their streams made up by local artists. The popularity of K-pop music, originating from South Korea, was also more evident in Asian countries like Thailand, though its influence on Western culture is mounting. Despite international success, no country loves American artists more than America itself, where they take a 79% share of Spotify streams. Even with a massive entertainment industry of its own, UK listeners still look to the US for most of their music, with American artists commanding a 55% share of British plays — considerably more than British artists' 29%. |

|

|

- OpenAI, Oracle, and SoftBank have announced five new AI data center sites — two in Texas, and one each in New Mexico, Ohio, and the Midwest — expanding the Stargate initiative.

- Better late-night than never… Jimmy Kimmel made an emotional return to his ABC show yesterday evening following a six-day suspension.

- Meanwhile, Disney+ subscribers might feel like their streaming costs are going to infinity and beyond, as the company just unveiled a fourth price hike in as many years.

- Shares of Lithium Americas soared over 100% earlier today on news that the Trump Administration is seeking an equity stake in the Canadian mining company.

- Sip-fil-A: Fast food spot Chick-fil-A is planning a new beverage-focused concept… with none of its beloved chicken on the menu.

|

|

|

Compared to equities, gold, and bonds, Bitcoin has historically shown a lot more volatility. If you're looking to get indirect exposure to the coin's movements while aiming to manage that volatility, Global X's Bitcoin Covered Call ETF (BCCC) could be the place to start.2 |

|

|

- I'm not a robot… am I? This interactive reCAPTCHA test from Neal.fun might make you question your own humanity.

- Hold on to your bucket hats: Stat Significant unpacks whether iconic British rock band Oasis is overrated or not.

|

Off the charts: Which occupational area has been piquing Americans' interest this year, after a pretty heavy social media push over the summer? [Answer below]. |

Not a subscriber? Sign up for free below. |

Advertiser's disclosures: 2 Bitcoin and bitcoin futures are a relatively new asset class. They are subject to unique and substantial risks, and historically, have been subject to significant price volatility. The value of an investment in the Fund could decline significantly and without warning, including to zero. You should be prepared to lose your entire investment. Investing involves risk, including the possible loss of principal. BCCC is actively managed and invests in options contracts on one or more bitcoin exchange-traded product (ETP) that invests principally in bitcoin futures contracts or invests directly in bitcoin. BCCC does not invest directly in or hold bitcoin. The price and performance of bitcoin futures should be expected to differ from the current "spot" price of bitcoin. These differences could be significant. Bitcoin futures are subject to margin requirements, collateral requirements and other limits that may prevent the ETF from achieving its objective. Margin requirements for futures and costs associated with rolling (buying and selling) futures may have a negative impact on the fund's performance and its ability to achieve its investment objective. Bitcoin is largely unregulated and bitcoin investments may be more susceptible to fraud and manipulation than more regulated investments. Bitcoin and bitcoin futures are subject to rapid price swings, including as a result of actions and statements by influencers and the media, changes in the supply of and demand for bitcoin and bitcoin futures contracts and other factors. BCCC's concentration will subject it to loss due to adverse occurrences that may affect that sector. Investors in BCCC should be willing to accept a high degree of volatility in the price of the fund's shares and the possibility of significant losses. BCCC engages in options trading. An option is a contract sold by one party to another that gives the buyer the right, but not the obligation, to buy (call) or sell (put) a stock at an agreed upon price within a certain period or on a specific date. A covered call option involves holding a long position in a particular asset and writing a call option on that same asset with the goal of realizing additional income from the option premium. BCCC establishes its "long" position through the combination of purchasing call options and selling put options on the Bitcoin ETPs. As a buyer of call options, the Fund pays a premium to the seller of the options. The fund then also sells call options to establish the "covered call". By selling covered call options, the fund limits its opportunity to profit from an increase in the price of the underlying asset above the exercise price, but continues to bear the risk of a decline in the asset. A liquid market may not exist for options held by the fund. While the fund receives premiums for writing the call options, the price it realizes from the exercise of an option could be substantially below the asset's current market price. BCCC is non-diversified. Carefully consider the Fund's investment objectives, risks, and charges and expenses before investing. This and other information can be found in the Fund's summary or full prospectuses,which may be obtained at globalxetfs.com . Please read the prospectus carefully before investing. Global X Management Company LLC serves as an advisor to Global X Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC or Mirae Asset Global Investments. |

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

SHERWOOD MEDIA, LLC, 85 Willow Road, Menlo Park, CA 94025 | |

|

|

No comments:

Post a Comment