US stocks shake off Fed drama with solid gain |

President Donald Trump's push to oust Federal Reserve Governor Lisa Cook from her position may have upset US bonds and the dollar, but it didn't leave any mark on the stock market. The S&P 500 and Nasdaq 100 rose 0.4% while the Russell 2000 outperformed with a 0.8% advance on Tuesday. Industrials were the best-performing S&P 500 sector ETF, up more than 1%, while consumer staples was at the bottom of the leaderboard. Gains on the day were led by Eli Lilly, which popped 5.9% after the pharma giant reported encouraging trial results for its next-generation weight-loss pill, putting it on track to file for regulatory approval by the end of the year. Keurig Dr Pepper fell 6.9% as investors continued to digest the company's recent acquisition and beverage business split-up. Elsewhere... |

- Boeing shares rose 3.5% as President Trump and South Korean President Lee Jae Myung formalized a $50 billion investment by Korean Air in US aviation, including $36.2 billion for 103 Boeing jets.

- Nio shares jumped 10% after JPMorgan upgraded the Chinese EV maker's stock to "overweight" from "neutral" and hiked its price target to $8 — up 67% from its earlier target of $4.80.

- Trump Media shares jumped 5.2% after the company announced a partnership with Crypto.com to build a digital-asset treasury aimed at building a large position in the cryptocurrency Cronos.

- Rocket Lab rose 1.9%, its fourth straight day of gains, as the retail favorite rides a fresh wave of investor enthusiasm for the momentum stocks that have set the pace for the market since April.

- IBM advanced 1.3%, and Advanced Micro Devices jumped 2% after the two companies said they were teaming up to develop "quantum-centric supercomputing."

- Brilliant Earth and Signet Jewelers shares were up 26% and 3%, respectively, after megastar Taylor Swift announced that she and Kansas City Chiefs tight end Travis Kelce had gotten engaged.

- VF Corp and Canada Goose rose 6.1% and 3%, respectively, after Baird analysts upgraded both stocks to "overweight," citing brand refreshes, consumer buzz, and easing headwinds.

- Tilray rose 4.7% amid a continued rally in pot stocks fueled by cannabis reform optimism, including a WSJ report this month saying President Trump was "considering" reclassifying marijuana as a less dangerous drug.

- Interactive Brokers shares were up early Tuesday before closing flat after the options trading platform was tapped to join the S&P 500, replacing Walgreens Boots Alliance. Meanwhile, Talen Energy jumped 6.5% after it was tapped to take the place of Interactive Brokers in the S&P MidCap 400.

- Constellation Brands fell 3.2% after Bank of America analysts downgraded the alcoholic beverage maker to "underperform" from "neutral" and slashed their price target to $150.

- UnitedHealth stock dipped 1.5% near the close, following a report that the Department of Justice's probe against the health care giant will expand beyond the company's Medicare Advantage program.

|

— Luke Kawa, Markets Editor & Nia Warfield, Markets Writer |

|

|

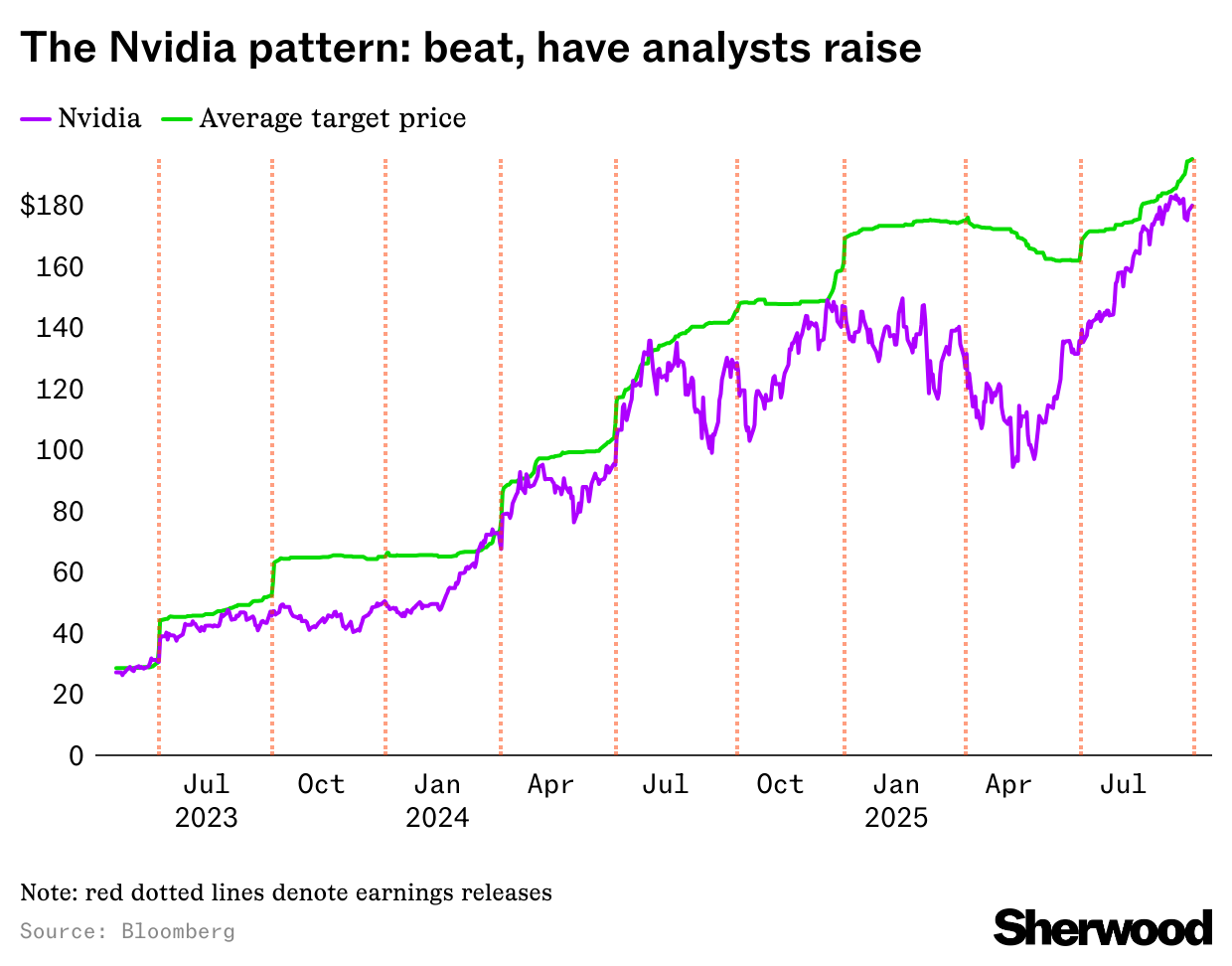

The average price target on Nvidia is up nearly 8% over the past month, its fastest growth this year. Read more. |

|

|

The end of the $7,500 tax credit is a boon for Tesla — for now. Read more. |

|

|

A new study from Stanford University found that employment has declined 13% among entry-level workers in fields most exposed to artificial intelligence, like software development, customer service, and accounting. Meanwhile, employment has held steady or improved for people further along in their careers in those same fields. Read more. |

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to The Wrap and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and Snacks for quality reads. We care what you think! If you have any feedback or comments, feel free to reply and let us know your thoughts! |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment