US stocks power higher on Apple's US investment plans, solid corporate earnings |

Tuesday's drop was just another opportunity to buy the dip. The S&P 500 rose 0.7% and the Nasdaq 100 outperformed with a 1.3% advance, while the Russell 2000 once again bucked the trend, dropping 0.2%. The day got off to a strong start when the White House touted an additional $100 billion in domestic investment from Apple ahead of the market open, which fueled the iPhone maker's 5% rise on Wednesday. The S&P sector ETFs for consumer discretionary, consumer staples, and tech all rose at least 1%. On the other side of the spectrum, materials and health care were down more than 1%. Gains were led by Arista Networks, which rose 17% after delivering stellar earnings after the close on Tuesday and enjoying a host of price target hikes across Wall Street thereafter. Declines were led in part by AMD which fell 6% after the chip company delivered a modest bottom-line miss and a big beat on sales for the second-quarter. Elsewhere… |

- Shopify soared 22% after the e-commerce giant missed Q2 revenue estimates but said it expects revenue to grow at a mid- to high 20s percentage.

- Match Group rose double digits after the Tinder and Hinge parent topped analysts' revenue estimates after-the-bell Tuesday and told Wall Street to expect more of the same in Q3.

- McDonald's rose nearly 3% after the Big Mac maker posted a US sales rebound in the second quarter — a comeback after a rough start to the year.

- IonQ finished virtually flat ahead of earnings tech juggernaut Amazon reporting that it held 854,207 shares of the quantum computing stock at the end of Q2.

- Power producer and energy trader NRG dove double digits after adjusted earnings fell short of Wall Street expectations and GAAP results swung to a surprise loss.

- Disney shares fell 2.7% even as the media giant beat Q3 estimates, raised its full-year outlook, and reportedly struck a $1.6 billion streaming deal between ESPN and WWE. Shares of TKO, which owns WWE, dropped 5%.

- Astera Labs surged nearly 30% after the chips, boards, and integrated circuit maker delivered strong top and bottom line Q2 results after the bell Tuesday.

- Uber closed flat even after the ride-hailing giant posted upbeat second-quarter and unveiled a beefy new stock buyback plan.

- Shares of Super Micro Computer tumbled 18% after disappointing fourth-quarter results, which saw the server company whiff on sales and earnings.

- Rivian shares dipped 4% after the EV maker topped revenue estimates for the second-quarter, but losses came in higher-than-expected. Meanwhile, Lucid shares fell 10% after the luxury EV maker also saw Q2 losses pile up.

- Snap's stock plunged 17% after the social media company narrowly missed earnings expectations and ad revenue slowed.

- Oscar Health managed to rise almost 4% despite the health insurance company reporting earnings that missed estimates even after giving investors a look under the hood last month.

- Novo Nordisk slipped nearly 4% after it reported growing sales of its blockbuster GLP-1 drugs but reiterated that knockoffs were eating at its weight-loss business.

|

— Luke Kawa, Markets Editor & Nia Warfield, Markets Writer |

|

|

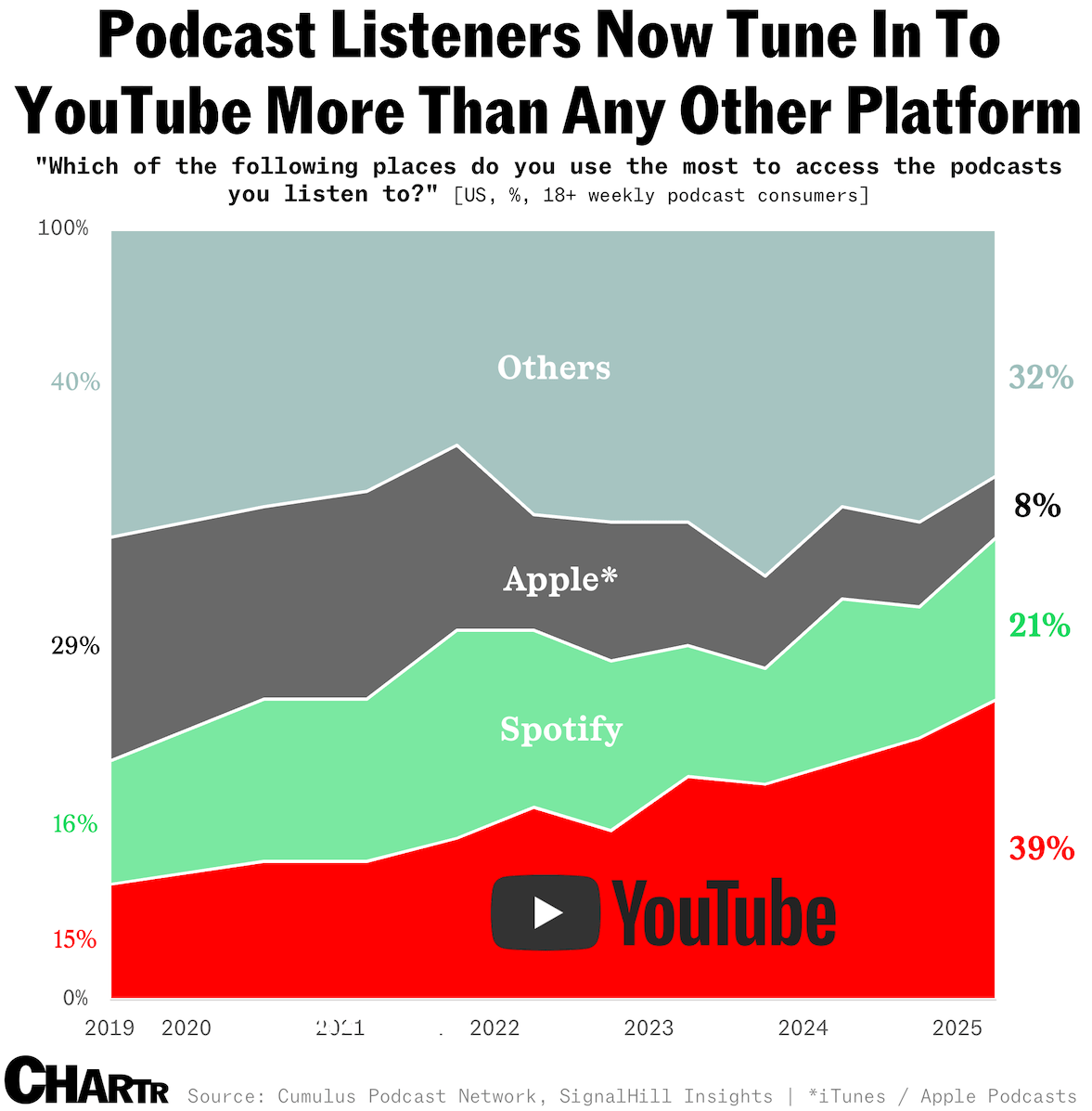

Podcasts are increasingly YouTube ft. everyone else — even tech giants like Amazon are restructuring to favor video-first podcasts led by hosts with big personalities. Read more. |

|

|

There don't seem to be as many stashed away outside Tesla's Texas factory where they're made, despite declining sales. Read more. |

|

|

(Jakub Porzycki/Getty Images)) |

Duolingo soars as it reports strong Q2 numbers, breaking slump Duolingo reported Q2 results after the close today, soundly beating expectations and soaring in after-hours trading. Read more. |

|

|

- Lyft sinks in after-hours trading on disappointing earnings and lower-than-expected sales

The company posted revenue of $1.59 billion, shy of the $1.61 billion Wall Street expected. - DoorDash rises after-hours on earnings beat

The company also beat on revenue but missed on gross order value.

- Still lagging FanDuel, DraftKings reports better-than-expected Q2 revenue

Despite all that marketing, profitability has been patchy. - AppLovin falls in after-hours trading as tepid top-line beat fails to impress

AppLovin, the company that reminds everyone of a character from Superbad, reported results that investors seem to think are super bad. - Airbnb reports Q2 revenue beat

Gross bookings grew 11% to $23.5 billion ahead the Street's estimates of $22.6 billion.

- Bumble falls after mixed earnings report

The company also announced that it appointed a new CFO.

- Joby dips on a steeper quarterly loss than Wall Street expected

It's not easy running a business in a new market with an unproven product and essentially zero sales.

- Dividend darling Realty Income's Q2 revenue beats expectations

The company reported adjusted funds from operations per share of $1.05 vs. Wall Street expectations of $1.06.

- Digital analytics company Amplitude beat analyst expectations on the top line in the second quarter.

The digital analytics SAAS company posted adjusted EPS of $0.01, in line with estimates, on better than expected revenues of $83.3 million.

- Gen Z are less likely to favor fully remote working compared with millennials and boomers

Per a new Gallup survey, it turns out young workers do want to go back to the office... sometimes.

- OpenAI offering ChatGPT to federal agencies for a buck

OpenAI's new partnership with the General Services Administration will grant any federal agency access to the chatbot for $1 per year.

- Bitcoin ETFs continue to bleed as Galaxy CEO warns bitcoin treasuries "have peaked"

Bearish sentiment on bitcoin appears to be rising, with options traders betting on a move below $100,000. - From 2017 to 2022, Uber customers reported incidents of sexual assault or sexual misconduct every 8 minutes in the US

New reporting from The New York Times reveals that Uber has not disclosed the severity of its sexual assault problem.

- Ethereum gets another treasury company as SEC washes its hands of liquid staking

Cosmos Health secured up to $300 million to accumulate ethereum.

|

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to The Wrap and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and Snacks for quality reads. We care what you think! If you have any feedback or comments, feel free to reply and let us know your thoughts! |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment