🎶 "When it all, it all falls down…" Kanye West launched YZY, a solana-based meme coin, which soared to an eye-popping $3 billion market cap before tanking just hours after its release. The token is supposedly part of a broader "Yeezy Money" ecosystem, which includes Ye Pay, "a crypto payments processor," and YZY Card. As with most Ye-related news, this move wasn't without controversy, as accusations of insider trading came within hours of launch, but at least it's stirring less anger than Cracker Barrel's new logo? The S&P 500 fell 0.4% and the Nasdaq 100 gave back 0.5% while the Russell 2000 outperformed with a 0.2% advance. The benchmark US index has now declined for five straight sessions, tying its longest losing streak since April 2024. 🧠 Trivia time… Check out our weekly Snacks Seven Quiz. Here's a sample question: |

|

|

With the armed forces seeing its active-duty personnel slump to a record low last year, the US military is deploying a new tactical force: influencers. While recruitment posters used to focus on patriotism and advertising campaigns lauding the ability to "Be All You Can Be," the US military is pivoting to paid partnerships with "Call of Duty"-playing Twitch streamers and fitness influencers to lure their fan bases with both the excitement and discipline that the military offers. How did we get here? With the US troop ranks numbering 60% fewer than their peak in 1968 and the Army missing its recruitment goals two years in a row, something had to change. |

- So it did: enter operation social influencer. Beyond the rise of #MilTok and paid partnerships with content creators, at the Army's 250th anniversary event in June, more than 30 influencers got a prime spot to broadcast the parade, which we've gathered some highlights from here.

- Another trend that's less fun is also helping the military: young Americans are entering the workforce at a tough time, with 18- to 19-year-olds facing a 15.6% unemployment rate in July, the highest rate since 2020. That's driving a pickup in military curiosity, with terms like "Navy salary" or "Air Force benefits" trending upward, as we've charted.

|

|

|

So far, the social strategy, aided by youth labor pains, is working. In March, the US military said it was tracking strong recruiting figures across branches in 2025, with the Army having signed up ~73% of its goal in the first five months of the recruiting year. General James Mingus, the Army's vice chief of staff, said, "We've seen momentum unlike we have seen in probably a decade." And it looks likely to continue as prominent figures in the administration post fitness challenges raking in hundreds of thousands of views. |

| |

Just In: CYT-108 Expands Into Oncology — last chance to invest at $3/share |

The minimum investment is $501. |

|

|

For the first time in years, Walmart missed on earnings. The company reported second-quarter adjusted earnings per share of $0.68, below analysts' predicted $0.73. Sales came in above expectations at $177.4 billion, topping analyst forecasts of $175.9 billion, per FactSet. |

- Walmart raised its full-year sales growth guidance to a range of 3.75% to 4.75%, up from its previous range of 3.0% to 4.0% growth.

- Management also nudged the outlook for full-year adjusted earnings per share up by 2 cents at each end to a range of $2.52 to $2.62.

- The company has said that it intends to use its massive supply chain, dominant market position, and logistical expertise to keep prices low despite newly added tariffs putting upward pressure on costs.

|

"Upward pressure on costs" is key here, because Walmart earnings are interesting for investors well beyond Walmart. It's far from the only company taking it on the chin when it comes to costs, and it's a good bet that this isn't the last time this year that a C-suite is going to gesture delicately in the direction of tariffs to justify what happened to their bottom line. |

|

|

If there's a good thing for Walmart, at least, it's that it's Walmart, and you'd be hard pressed to find another company in America with as much leverage to squeeze its suppliers on price. That being said, the fact that even Walmart is having trouble getting blood out of the stone is a surefire signal that the cost problem is going to be hard to solve. |

|

|

Zachariah Reitano, the CEO of Ro, spoke to Sherwood News about how the telehealth company is helping foil "a lot of the flaws in our healthcare system" by delivering popular weight-loss drugs directly to consumers — especially the large pool of people who may be prescribed these drugs but can't afford it. And there's a reason drugmakers partner with Ro, as well as huge athletes like Charles Barkley and, as of yesterday, Serena Williams. See Williams' video. |

|

|

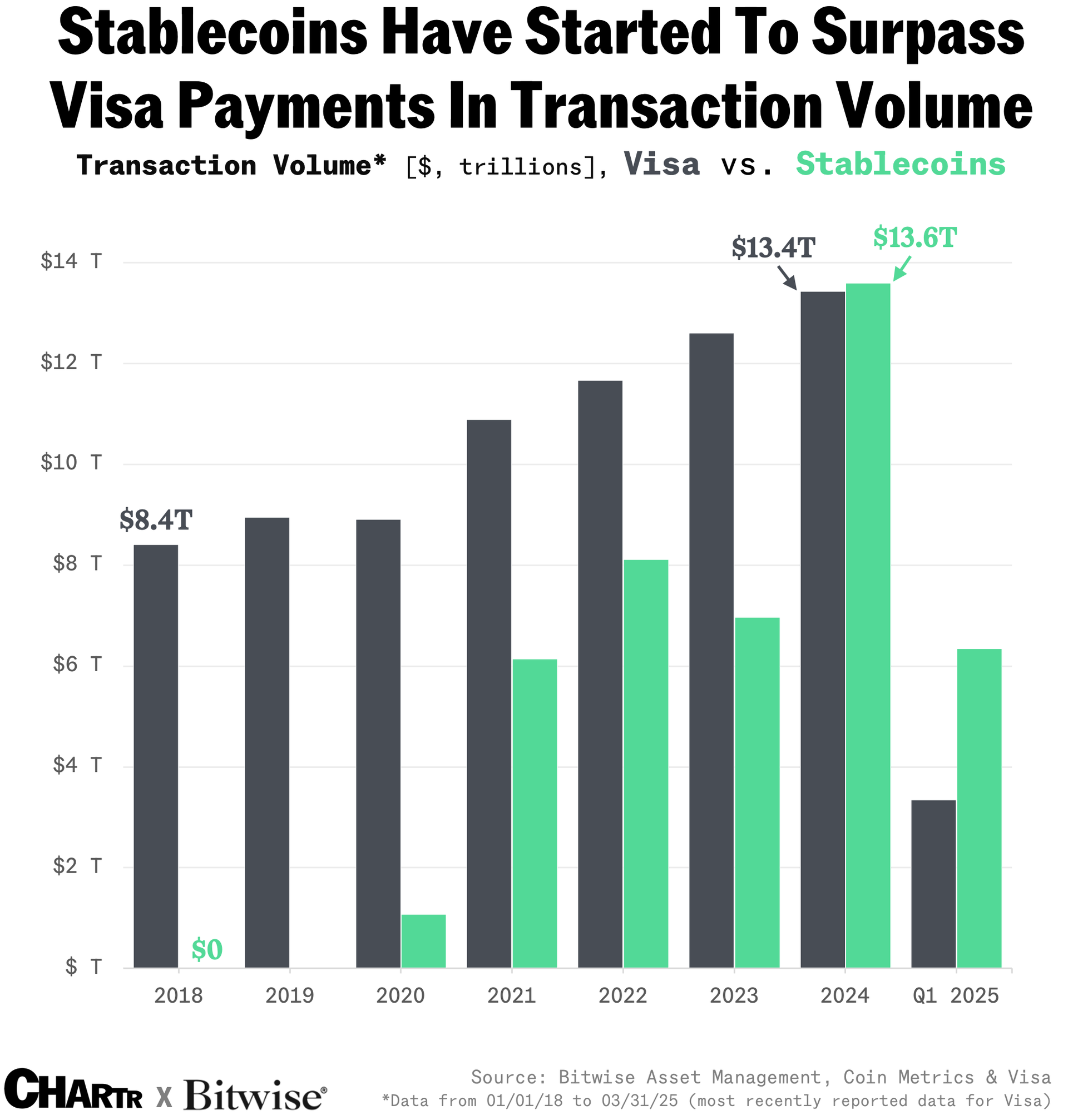

Stablecoins are changing how we pay for things. |

|

|

Yesterday's Big Daily Movers |

- Chinese EV maker Nio surged after the company unveiled the latest model of its electric SUV, a rival to Tesla's Model Y

- Coty sank as investors digested the cosmetics and fragrance conglomerate's disappointing Q4 results

- Paramount Skydance flew up 15% amid a spike in call-buying

- HP Enterprise rose on an upgrade from Morgan Stanley

|

|

| - Earnings expected from Williams-Sonoma and BJ's Wholesale Club

|

Advertiser's disclosures:

1 The minimum investment is $501 (167 units). This is a paid advertisement for Cytonics Regulation A+ Offering. Please read the offering circular and related risks on the Cytonics StartEngine page. Investing in private company securities is not suitable for all investors because it is highly speculative and involves a high degree of risk. It should only be considered a long-term investment. You must be prepared to withstand a total loss of your investment. Private company securities are also highly illiquid, and there is no guarantee that a market will develop for such securities. 2 No Advice on Investment; Risk of Loss: Prior to making any investment decision, each investor must undertake its own independent examination and investigation, including the merits and risks involved in an investment, and must base its investment decision—including a determination whether the investment would be a suitable investment for the investor—on such examination and investigation. Crypto assets are digital representations of value that function as a medium of exchange, a unit of account, or a store of value, but they do not have legal tender status. Crypto assets are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not currently backed nor supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies, stocks, or bonds. Trading in crypto assets comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks and risk of losing principal or all of your investment. In addition, crypto asset markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. Crypto asset trading requires knowledge of crypto asset markets. In attempting to profit through crypto asset trading, you must compete with traders worldwide. You should have appropriate knowledge and experience before engaging in substantial crypto asset trading. Crypto asset trading can lead to large and immediate financial losses. Under certain market conditions, you may find it difficult or impossible to liquidate a position quickly at a reasonable price. The opinions expressed represent an assessment of the market environment at a specific time and are not intended to be a forecast of future events, or a guarantee of future results, and are subject to further discussion, completion and amendment. The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations. You should consult your accounting, legal, tax or other advisors about the matters discussed herein. |

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to Snacks and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and The Wrap for quality reads. |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment