Stocks hit record high as July inflation data bolsters rate cut bets |

Stocks shot to fresh intraday records Tuesday after in-line July inflation data fortified bets that the Federal Reserve would deliver its first interest rate cut of 2025 next month. The S&P 500 rose 1.1%, the Nasdaq 100 climbed 1.3%, and the Russell 2000 soared 2.9%. That marked the S&P 500's first record close of August, with the tech-heavy Nasdaq 100 booking a record close as well. All 11 S&P 500 sector ETFs went positive on the day, with communication services, tech, and materials leading the way. Gains on the day were led by chip stocks NXP and On Semiconductor, which jumped 7.2% and 6.1%, respectively. Declines were led by law enforcement equipment maker Axon Enterprise, which fell 6.1%. Elsewhere… |

- Meta jumped 3.1%, ending the day at $790 — its highest closing price in history. The stock has been on a tear following a series of excellent earnings reports.

- Shares of On Holding leapt 8.9% after the Swiss sneaker maker reported strong Q2 sales and offered a sunny outlook as the brand gains traction in the "RTO apparel" market.

- D-Wave Quantum were up 6.5% to close the day. Sherwood News spoke with its CEO, following the quantum computing company's Q2 sales beat last week, about its potential to expand into AI model training.

- e.l.f. Beauty shares rose another 4.5% after Morgan Stanley upgraded shares of the popular cosmetics brand to "overweight" and hiked its price target to $134 from $114 on Monday.

- Five Below shares also bounced 4.5% after Loop Capital hiked its rating on the stock from "hold" to "buy" and lifted its price target to $165.

- Tilray shares climbed 3.2%, extending a rally, as investors continue to pile into the cannabis company, fueled by a report that President Trump is considering weed reform.

- Circle shares ticked up 1.3%, paring back from a 15% premarket surge after the fintech firm's first earnings report as a public company topped revenue estimates but missed on earnings per share.

- Nvidia closed largely flat despite a new report from The Information saying that China's internet regulator has ordered local tech companies to suspend their purchases of Nvidia chips.

- Spirit Aviation shares plunged 40% after the discount airliner issued a dire warning about its ability to survive as a going concern without more cash. Rival airlines including Delta, American, Southwest, and JetBlue were all up amid this news and inflation data showing a jump in ticket prices for July.

- Plug Power dipped 3.4% after the hydrogen fuel cell developer reported mixed second-quarter results after the bell on Monday, but said it plans to achieve gross margin breakeven in Q4.

|

— Nia Warfield, Markets Writer |

|

|

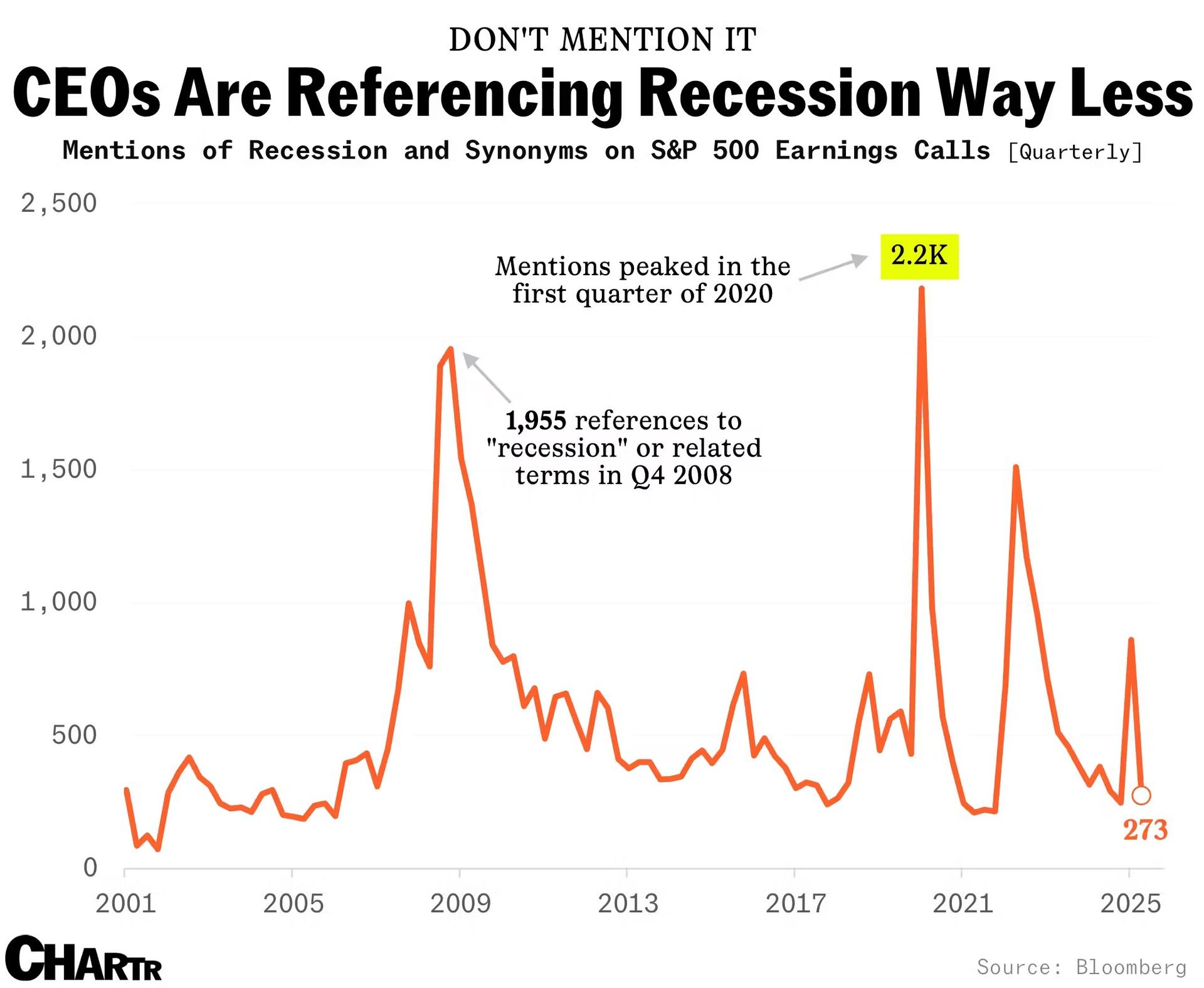

References on S&P 500 earnings calls dropped steeply; data shows that CEOs at America's top companies have mentioned "recession" (and related synonyms) just 278 times on calls this quarter, down from a whopping 862 in Q1 this year.

See what Polymarket users are predicting. |

|

|

"Where will ethereum be in 10 years? Let's rearrange that question: where will the global financial system be in 10 years? Answer: on ethereum." Read more. |

|

|

(Kevin Carter/Getty Images) |

Cava tanks after slashing outlook, missing on revenue

Cava plunged after it reported sales that missed Wall Street expectations and slashed its outlook. The company reported revenue of $280.6 million, less than the $285.6 million analysts polled by FactSet predicted. It also reported same-store sales growth of 2.1%, less than the 6.1% the Street was hoping for. Read more. |

|

|

- Without providing evidence, Tesla's Elon Musk accuses Apple of favoring OpenAI

Other AI apps have topped the App Store, including Grok.

- Peter Thiel's Founders Fund bets on ETHZilla, while Thiel-staked BitMine announces $24.5 billion fundraise

Spot ethereum ETFs trading in the US saw for the first time on Monday daily inflows exceeding the $1 billion mark. - Tesla lowers its prices more than other EV makers

Tesla lowered its prices 9% in July — versus 4% for all EVs — to move inventory ahead of the $7,500 tax credit sunset. - CoreWeave delivers top- and bottom-line beat in Q2

The recently IPO'd AI darling just reported second-quarter earnings.

- Rigetti Computing posts lower-than-expected Q2 sales

Rigetti Computing just reported second-quarter results.

- Hims CEO sells shares for $33.4 million

The sale comes a week after the company reported quarterly revenue numbers that disappointed investors.

- EV maker Nio falls as its weekly registrations come in lower and Citigroup trims its holding

Nio shares fell 9% today. - In a gambit, Perplexity offers $34.5 billion to Google for Chrome browser

The audacious move by the AI startup may be an effort to position itself in case of a Google antitrust breakup. - Anthropic offers Claude AI to federal agencies for $1

In pursuit of additional juicy government contracts, Anthropic follows OpenAI to offer federal agencies access to Claude for $1 per year.

- Chainlink outperforms as the protocol's total value secured reaches a new record of $93 billion

Last week, Chainlink also rolled out an on-chain reserve that amasses its native token.

- After insider buying binge, broadcaster Sinclair soars on plans for a strategic review

The company said it would review its operations, potentially leading to mergers or divestitures, sending shares higher.

| |

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to The Wrap and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and Snacks for quality reads. We care what you think! If you have any feedback or comments, feel free to reply and let us know your thoughts! |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment