Hello! Redistricting plans have put the Supreme Court's landmark 2019 decision on gerrymandering into the spotlight… So now, many Americans are searching up what that term actually means. Today we're exploring: |

- Red noise: YouTube is dominating the host-centric, video-integrated podcast world.

- RTO FOMO: Gen Z are less likely to prefer remote work than millennials and boomers.

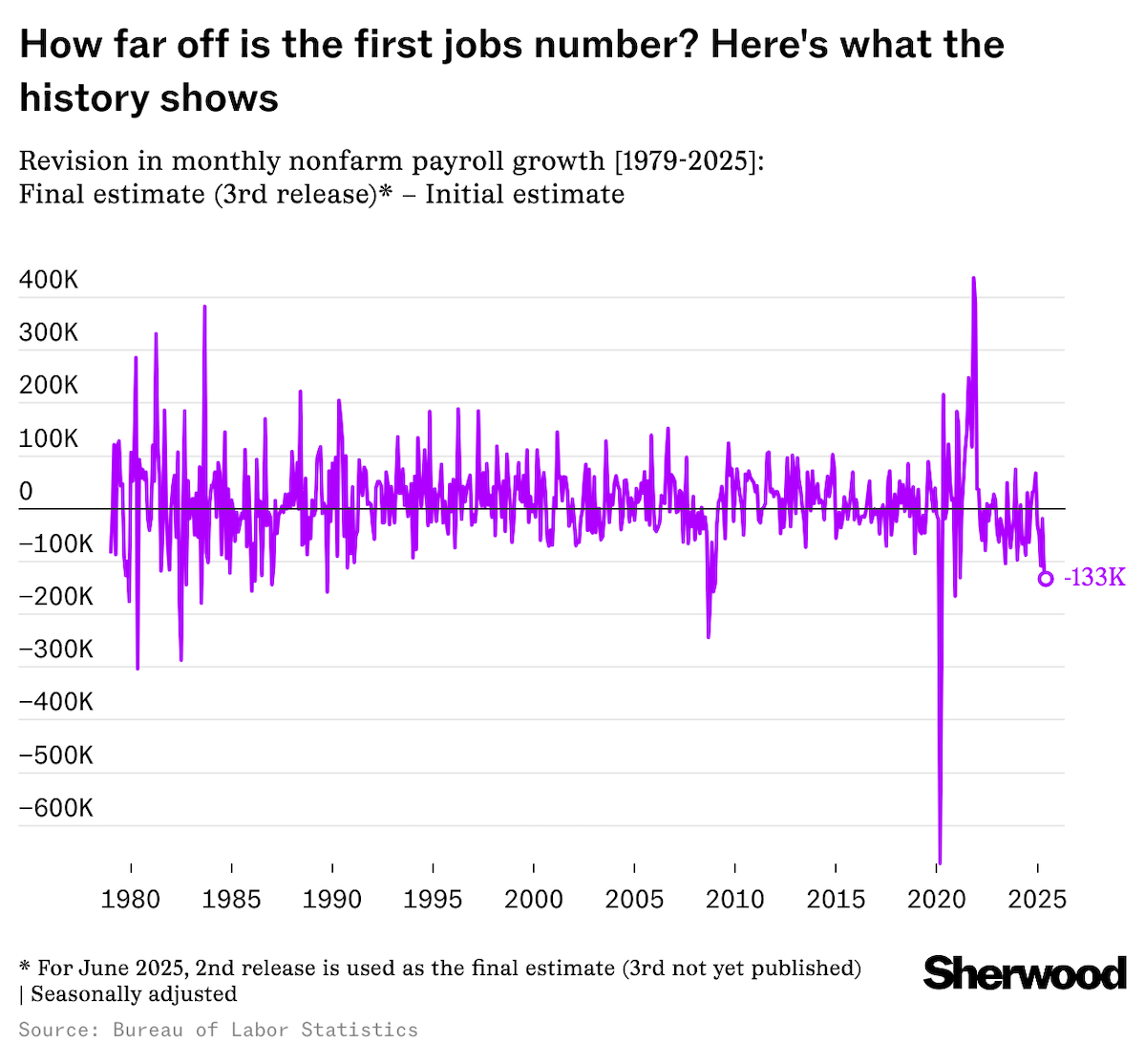

- Stat wars: How big, and how common, are jobs data revisions?

|

Have feedback for us? Just hit reply - we'd love to hear from you! |

In the world of podcasts, YouTube is now the elephant in the room — just like in TV |

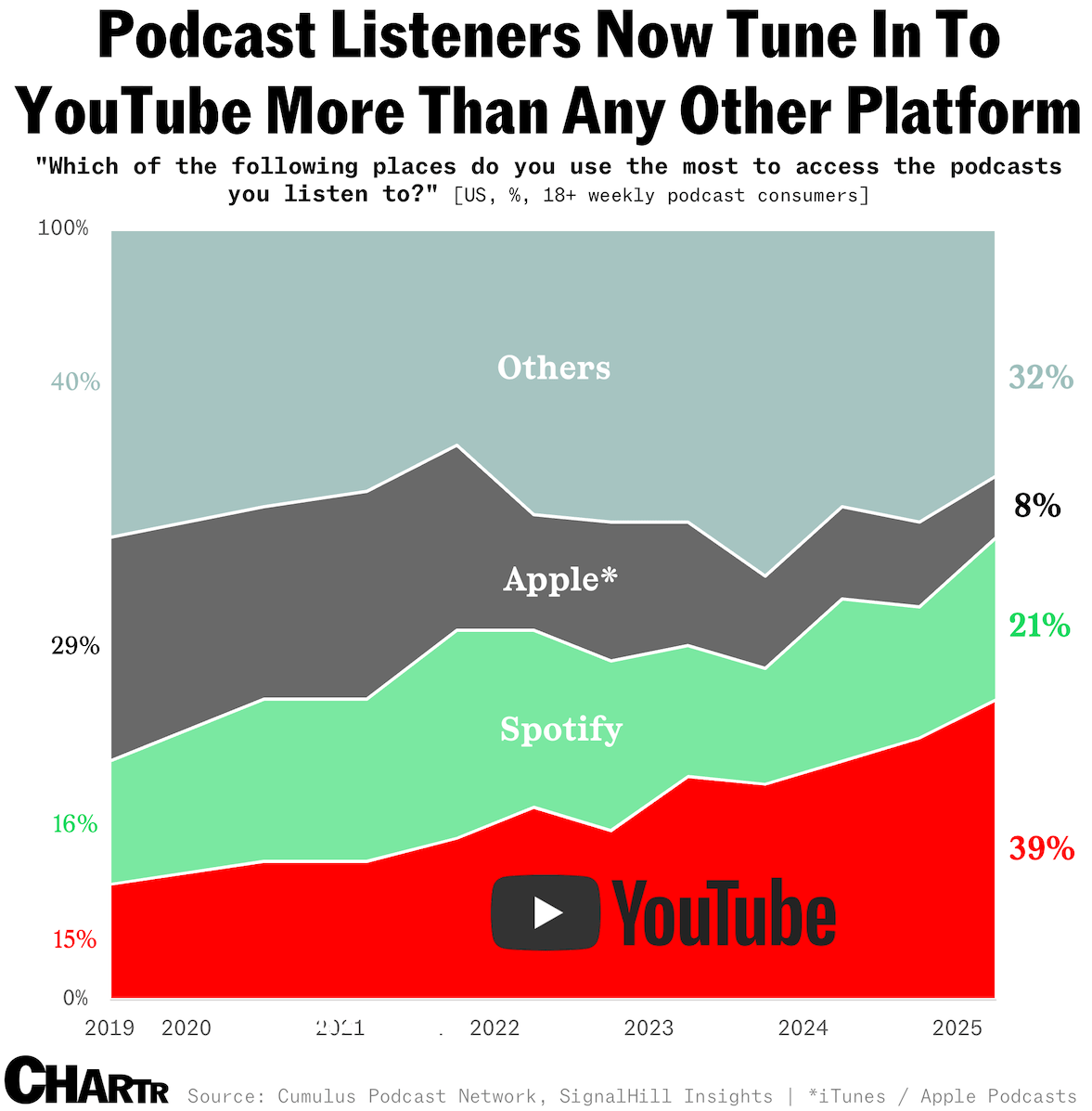

Earlier this week, Amazon announced it would be restructuring its Wondery podcast business, cutting 100+ jobs and splitting out its existing narrative-driven studio from some of its more personality-focused shows. The decision comes as the podcast industry reinvents itself. In June, Spotify laid off 5% of staff in its podcast division, while radio conglomerate Audacy shut down its audio-centric podcast business Pineapple Street Studios after nine years. But the elephant in the room amongst all of this upheaval is YouTube — the viral internet video giant that became a TV, music, advertising, and now podcast giant. Per an April survey conducted by Cumulus Media and media research firm Signal Hill Insights, 39% of all weekly podcast consumers use YouTube as their primary platform, more than double the share from late 2019. Indeed, YouTube itself estimated that more than a billion people a month were watching podcasts as of February. |

A large part of YouTube's popularity comes from how podcast listeners across generations now consume the medium — nearly three-quarters of the respondents said they watch podcasts more often than listening to them. Quite a stat for an "audio" medium... though YouTube's podcast domination echoes its success in TV — where it is routinely beating out Disney, Netflix, Paramount, and NBCUniversal. |

At the heart of those video-first podcasts are big personality hosts like Joe Rogan, Mel Robbins, and Amy Poehler, who have amassed legions of highly engaged, targeted listeners (and watchers). Indeed, since YouTube started to share the most popular podcast shows on the platform in May, host-centric podcasts have been topping the leaderboard consistently in the US, with six out of the top 10 shows revolving around the host's persona, according to the latest released weekly figures (see chart on the web here). It seems the days where the biggest podcasts were true crime shows are long gone. |

Gen Z are less likely to favor fully remote working compared with millennials and boomers |

Since the pandemic, working from home has not only endured as a pretty standard practice for office-based companies, but also remains a requisite for some job seekers accustomed to having at least some days where their commute time is measured in seconds rather than minutes or hours. Now, several years on from a string of Covid-induced lockdowns, the novelty of doing one's job in a room of one's own may have finally worn off... especially for the youngest cohort of employees. |

New kids on the (office) block |

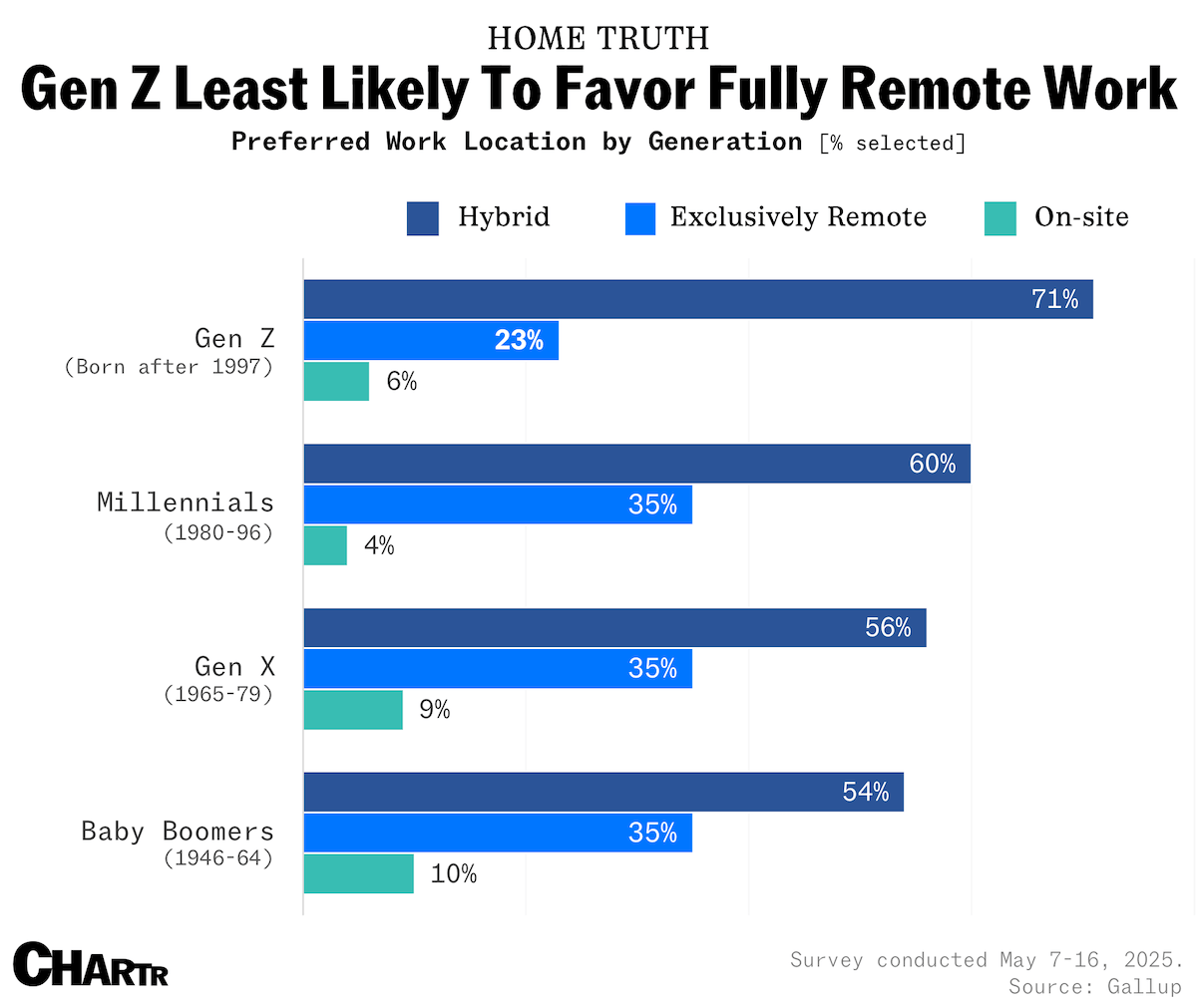

A recent Gallup survey found that fully remote work was least popular with Gen Z among all age groups surveyed, with only 23% saying they preferred working from home full time — considerably less than the 35% of millennial, Gen X, and baby boomer respondents who favored the wholly WFH model. |

Gallup outlined one factor that could be driving a desire to return to the office: Gen Z is statistically the loneliest generation. The same survey found that 27% of Gen Z reported feeling lonely the day before — almost 3x the share of boomers. Even so, while a large faction of Gen Z don't want to be at home permanently, they definitely don't want to be in the office all the time either, with only 6% of Gen Z preferring to be totally on-site. Indeed, most seem to want options: while hybrid was the preferred work setup across all generations, it was by far the top pick for younger participants (71%). Another reason for Gen Z's office push could be that being in a coworking environment might translate to better engagement. An earlier Gallup poll, cited by Business Insider in January, found that only 30% of workers under 35 years old reported feeling engaged at work last year — dipping below the older cohort for the first time in the survey's history. |

|

|

This is not a recommendation of individual securities. A purchase of TOPT ETF does not represent a purchase of the individual securities displayed. The specific securities and their relative weighting in the Fund can change at any time. For Google, now known as Alphabet, there are two types of stock, Alphabet Class A (GOOGL) and Alphabet Class C (GOOG). The A share class includes voting rights and the C share class does not. |

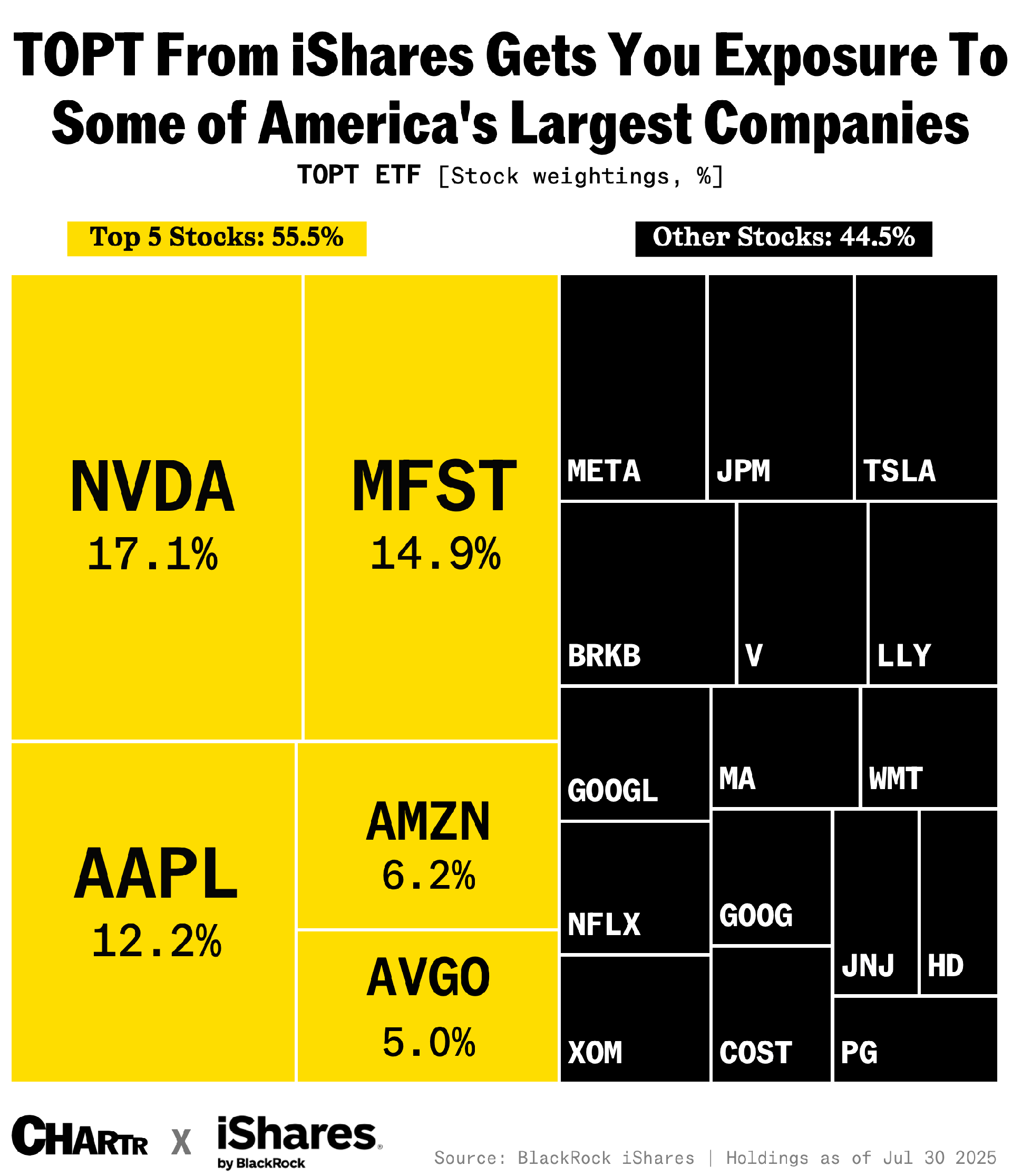

Invest in America's largest companies with iShares |

The U.S. stock market has performed very well overall in the past five years. But nearly 41% of individual stocks are down in the same timeframe.1 Diversification is a key tool investors may use to manage the risk of owning the "wrong" stocks in a rising market. While past performance doesn't guarantee future returns, shares of the 20 largest publicly traded U.S. companies also contributed 59% of the S&P 500's total return over the last five-years.2 If you're looking for a way to get diversified large-cap exposure3 without picking individual stocks, the iShares Top 20 U.S. Stocks ETF (TOPT) provides access to the 20 biggest companies in the U.S. by market cap. All in a single trade, via a low-cost and tax-efficient ETF wrapper. |

|

|

Just how common are jobs data revisions? |

After months of strong showings, July's job numbers came in weak last Friday, with the US economy adding just 73,000 jobs last month. But the bigger surprise came after the print, when President Trump fired Bureau of Labor Statistics Commissioner Erika McEntarfer on Tuesday, asserting that the job data was "rigged" to harm his administration. Key to the claim was a sharp downward revision to May and June's payroll growth, which slashed a combined 258,000 jobs from earlier estimates. That dragged the average job gain over the past three months to just 35,000 — the weakest since the early days of the pandemic. So, just how unusual are major revisions? |

The BLS actually routinely updates its initial payroll estimates as more employer data rolls in (often from late survey responses), while seasonal adjustments and changing population trends also play a role. According to BLS data, the May to June revisions mark the largest two-month drop since 1979 (excluding the Covid era), far exceeding the typical monthly average revision of 51,000 since 2003. Still, they're not without precedent: figures for March 2020 saw a swing of 672,000, while September 2008 was revised down by 244,000. |

|

|

- OpenAI is reportedly in talks for a share sale that would value the group at $500 billion, which would make it the world's most valuable private technology group.

- Space race sequel: NASA is fast-tracking plans to put the first nuclear reactor on the moon by 2029 — just ahead of China and Russia's joint effort, which they're aiming to deploy by the mid-2030s.

- According to Uber, 180 million people took at least one ride or ordered one delivery per month in the company's second quarter.

- Here comes the money: Disney's ESPN will be paying more than $1.6 billion to WWE for the exclusive rights to stream the sport's biggest events, including WrestleMania.

- Fewer S&P 500 companies are disclosing board diversity data, with just 60% reporting their female director counts in 2025 — down from 91% a year earlier, per a new report.

|

|

| iShares TOPT ETF tracks the performance of the largest 20 companies in the S&P 500 — a one-ticker solution that gives you exposure to big U.S. market movers. Discover TOPT in full. |

|

|

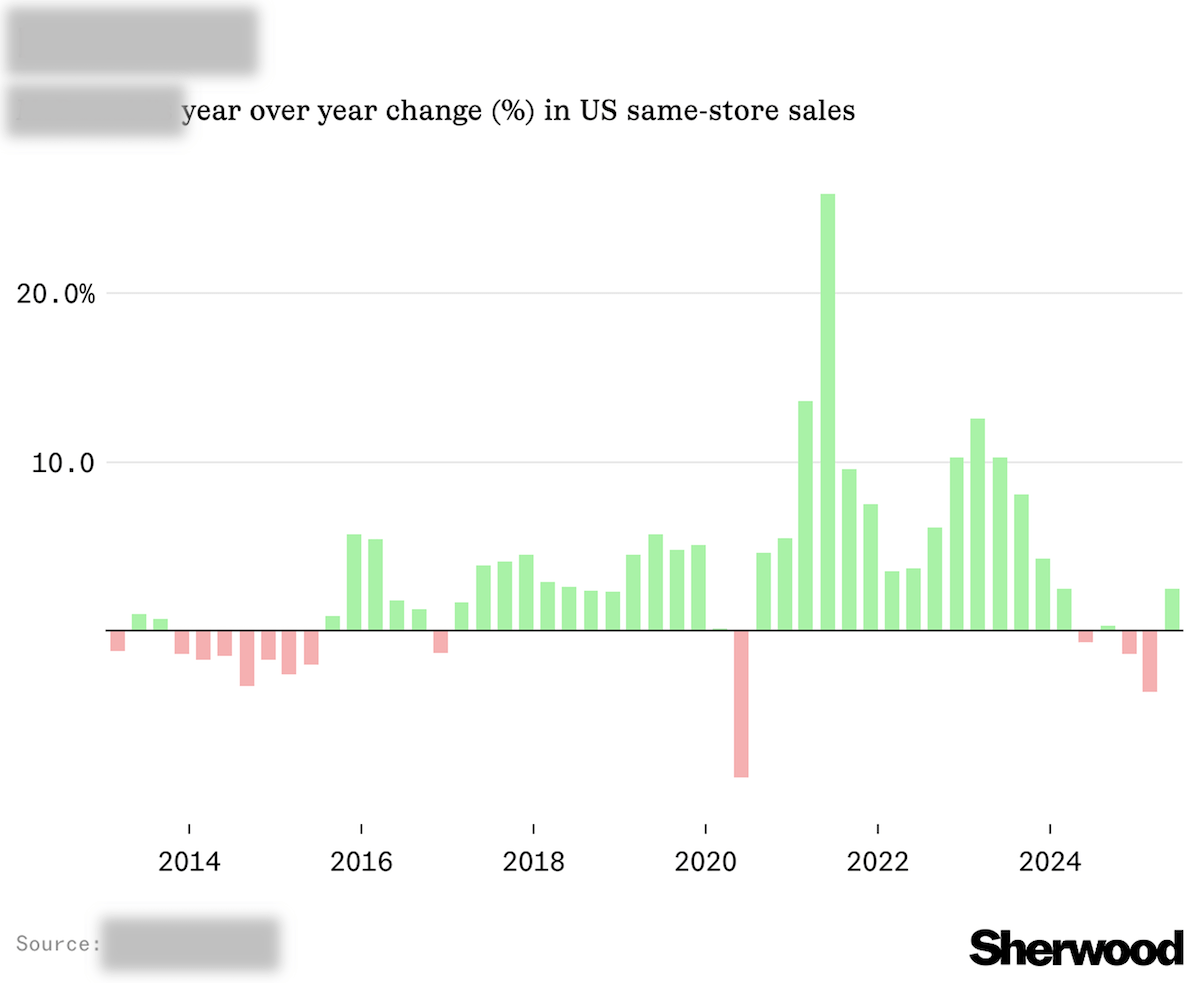

Off the charts: Which fast food chain finally saw its US sales rebound in its most recent quarter, after posting its steepest same-store sales drop since early Covid in Q1 25? [Answer below]. |

Not a subscriber? Sign up for free below. |

Advertiser's disclosures: 1 Source: Morningstar with data from 9/1/2019 – 6/20/2025. Based on stocks in the S&P U.S. Total Market Index. 2 Source: Morningstar and Bloomberg as of 6/20/2025. Past performance is no guarantee of future results. See article for further details. 3 The ETF is concentrated in 20 individual stocks that can cover up to 8 sectors. Holdings are subject to change. For current holdings, visit: iShares TOPT website. Visit www.iShares.com to view a prospectus, which includes investment objectives, risks, fees, expenses and other information that you should read and consider carefully before investing. Investing involves risk, including possible loss of principal. Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and the general securities market. The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, "BlackRock"). The iShares Funds are not sponsored, endorsed, issued, sold or promoted by S&P Dow Jones Indices LLC, nor does this company make any representation regarding the advisability of investing in the Funds. BlackRock is not affiliated with S&P Dow Jones Indices LLC. BLACKROCK and iSHARES are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners. iCRMH0825U/S-4696208 |

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment