Even though the news has been filled with stories of people's inappropriate and disastrous relationships with AI chatbots, OpenAI CEO Sam Altman reassured a group of journalists that "way under 1 percent" of users have problematic relationships with ChatGPT. Even if we take this statement as true, that would mean a startlingly high number of people have a harmful parasocial relationship with ChatGPT, by our calculations. Perhaps to change the topic, Altman also said he'd "like to have" Google's Chrome browser. On Friday, the S&P 500 fell 0.3% while the Nasdaq 100 and Russell 2000 each gave back 0.5%. Healthcare was the best-performing S&P 500 sector ETF, and there was one big reason why. More on that below.

🧠 Trivia time… Test your knowledge on recent business news. Which fast-food restaurant saw the most growth in same-stores sales last quarter? |

- Domino's

- Dutch Bros

- Popeyes

- Taco Bell

|

|

|

On the campaign trail, President Donald Trump told Americans that surging energy costs would be stopped and prices would be cut in half when he took office. US oil drilling was already at record highs before the election, but the Trump administration has put a renewed focus on fossil fuels and nuclear power. That said, it's also curtailing long-standing energy efficiency standards and scaling back incentives to speed up the switch to renewables. To see how it's going, let's dig into Trump's flagship One Big Beautiful Bill Act: |

- An analysis of the act's energy provisions by Energy Innovation, a nonpartisan energy and climate think tank, anticipates power generation capacity will actually fall by 340 gigawatts nationally by 2035, with consumers paying up to 18% more for electricity. It also predicted a staggering amount of lost GDP and jobs.

- On the other hand, the business-friendly Tax Foundation estimates the bill will create way more jobs overall, though it doesn't carve out energy-related impacts specifically.

|

- The Rhodium Group forecasts the average household will pay between $78 and $192 more annually; Energy Innovation puts it at an average $170 extra per year.

- It's not just about the cost per watt rising, but a slew of other changes that will raise prices in sneaky ways, as broken down in our scenario of a low-income renter.

|

Part of the problem is that Trump's policies minimize renewables, which means more dependence on natural gas plants and therefore higher natural gas costs. Solar plants and wind farms can come online in a year or two, whereas natural gas plants take years longer — especially with a current five-year backlog on a key piece of equipment. |

|

|

Whether or not Trump is a fan of wind turbines (we're kidding, he's definitely not), tariffs and other measures will make it harder to add the cheapest, most quickly deployed power options to the grid when they're needed the most. |

|

|

Step into the Future with Nasdaq-100 Micro Index Options (XND®) |

- Compact Exposure: Engage with the NDX® at 1/100th notional size, offering flexibility without large commitments.

- Cash Settlement: Simplify transactions by settling in cash at expiration, eliminating the need for physical delivery of underlying assets.

- European Style Options: Exercise only at expiration, thereby eliminating early assignment risk.

- Tax Benefits: Enhance overall returns with potentially favorable tax treatment.

- Versatile Use: Generate income or manage risk through hedging against market volatility.

|

|

|

Stories we're obsessed with |

- Can AI fix Stitch Fix? The subscription clothes company for people who hate shopping and want someone else to dress them on the daily recently posted its first top-line growth in three years and hopes its new AI "Style Assistant" and AI-powered visual tools can bring more growth. Unfortunately for Stitch Fix, its active user figure — basically anyone who's actually getting "fixes" and buying items — is still dropping, as we charted here. And while the CEO thinks that having an in-app AI stylist will draw new customers, we have our doubts.

- What the billionaires bought: UnitedHealth Group enjoyed its biggest daily gain since March 2020, soaring double digits after filings revealed Warren Buffett's Berkshire Hathaway bought the stock in the second quarter. But he wasn't alone — UnitedHealth Group is now this hedge fund's second-biggest position. Can these billionaires provide the shot in the arm the beleaguered healthcare giant needs?

|

|

|

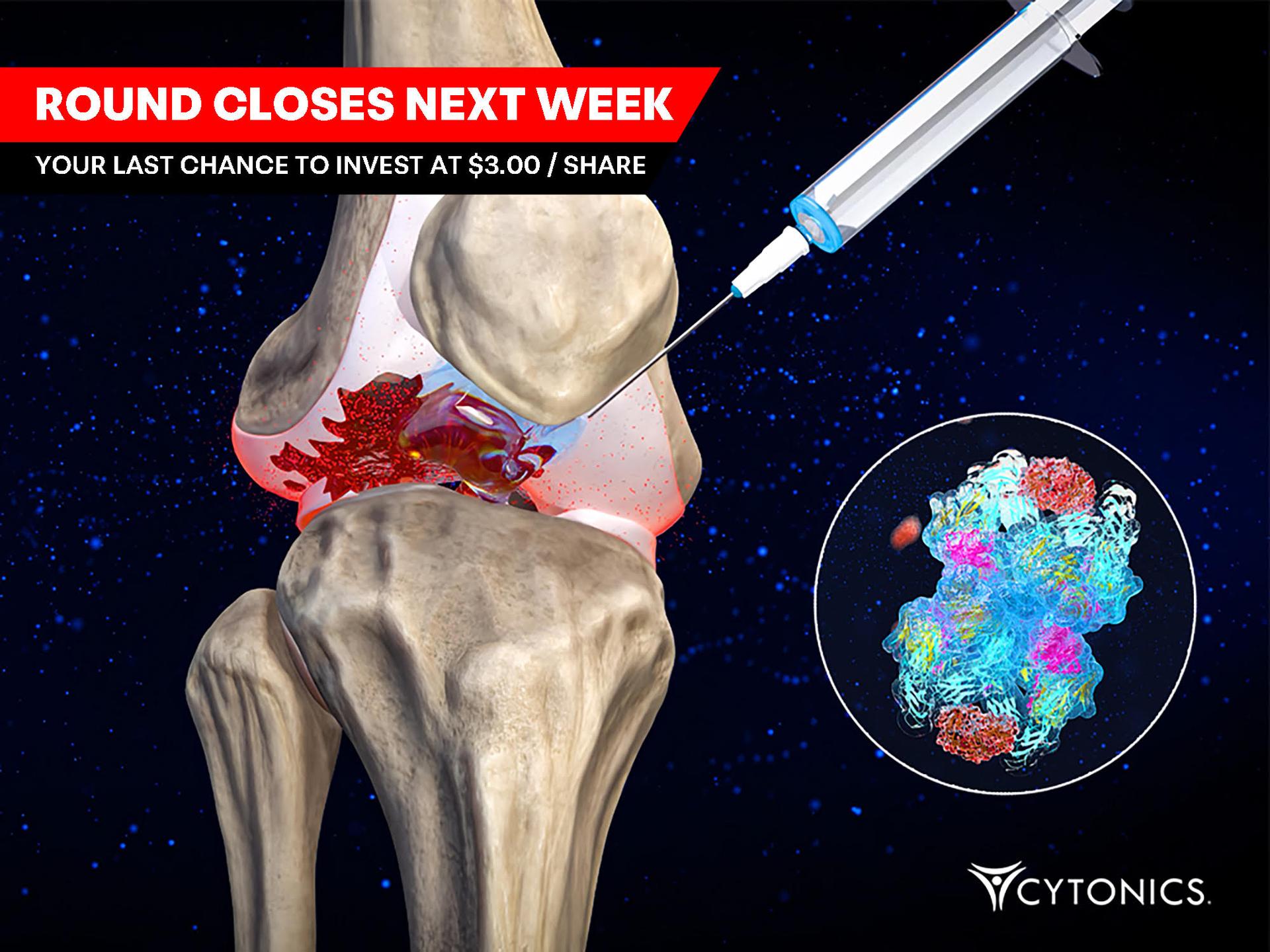

No gatekeeping, just real science. |

The minimum investment is $501. |

While Big Tech scrambles to keep up with tariffs, biotech companies are quietly building. One of those is Cytonics. They've already treated over 10,000 patients with their first-generation biologic therapy for osteoarthritis — and now, their next-gen drug CYT-108 could become the first disease-modifying therapy for OA. This is your chance to invest before Big Pharma catches on. Invest in Cytonics at $3.00/share — only until next week.1 |

|

|

- Monday: Earnings expected from Palo Alto Networks

- Tuesday: Earnings expected from Home Depot, Medtronic, Keysight Technologies, and Jack Henry & Associates

- Wednesday: Fed meeting minutes. Earnings expected from Baidu, Lowe's, Target, Estée Lauder, Viking, XpengTJX, The Nordson Corp, and Analog Devices

- Thursday: Earnings expected from Walmart, Alibaba, Intuit, Workday, and Ross

- Friday: Earnings expected from Williams-Sonoma and BJ's Wholesale Club

|

|

|

Advertiser's disclosures:

Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or digital asset or any representation about the financial condition of any company. Additionally, nothing contained herein should be construed as tax advice. Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security, digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or digital asset or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. Investing in options carries unique risks. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. 1 The minimum investment is $501 (167 units). This is a paid advertisement for Cytonics Regulation A+ Offering. Please read the offering circular and related risks on the Cytonics StartEngine page. Investing in private company securities is not suitable for all investors because it is highly speculative and involves a high degree of risk. It should only be considered a long-term investment. You must be prepared to withstand a total loss of your investment. Private company securities are also highly illiquid, and there is no guarantee that a market will develop for such securities. |

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to Snacks and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and The Wrap for quality reads. |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment