In partnership with | | | | | | | of Americans admit to hiding from their neighbors. |

|

|

|

| | | Disney's ESPN inks a deal with the NFL. OpenAI is poised to become the world's most valuable private company. Newsletter exclusive: Why are women using AI less than men?

|

|

| | Disney Shares Dip as TV Weakness Offsets Parks Gains, ESPN Deal | Disney stock slid 3% Wednesday, even as the company beat quarterly earnings expectations and raised full-year guidance. The market's problem: Revenue missed by a hair, and linear TV revenues fell 15%. | The bright spot was Disney's experiences segment, encompassing parks and cruises, which climbed 8% on strong demand. Streaming also chipped in, adding 2.6 million Disney+ and Hulu subscribers. | On the content side, Disney will merge Hulu into Disney+, unifying its streaming footprint. | The bigger strategic announcement came from sports: Disney is giving the NFL a 10% stake in ESPN. In exchange, ESPN takes control of NFL Network, NFL RedZone, the league's fantasy platform, and rights to three additional games per season, bringing its total to 28. The deal comes just ahead of ESPN's $29.99/month streaming launch this month. | As The Ringer notes, this marks the end of the NFL's two-decade live-TV experiment. NFL Network, launched in 2003 to rival ESPN, struggled with distribution and never became the powerhouse the league envisioned. Now, instead of funding its own network, the NFL can focus on selling broadcast rights to the highest bidder. | The deal raises bigger questions. With the NFL now owning 10% of ESPN, will the network's reporters still be free to investigate owners and league controversies? Only time will tell. | The agreement still needs government approval, and according to Sports Business Journal, it might not become official until late 2026. |

| | |

| | | | The real losers in this deal are the football fans. | To watch every game in the 2025 NFL season without cable, you'd need subscriptions to at least half a dozen streaming services and YouTube TV. Which will run you up to $1,500 — and that was before this deal. After this deal, it'll be even more. | Now you might say, "Well why wouldn't I just watch the whole season on cable?" And the answer to that question is: You can't. Because Amazon now owns the rights to Thursday night football, and Netflix also has the rights to select games. | So if you're a serious football fan, you have to stream, and streaming just got even more expensive. |

| |

| | |

| | OpenAI Eyes $500B Valuation in Employee Share Sale | OpenAI is reportedly in talks for a new secondary share sale that would value the company at $500 billion, up from a $300 billion valuation earlier this year. The deal would let current and former employees sell several billion dollars' worth of shares. | If it closes, OpenAI becomes the most valuable private company in history, worth more than Coca-Cola, Johnson & Johnson, and Palantir — and ranking as the 20th-most-valuable company in the world. | Twenty years ago, a company in this position would have gone public, like Google did in 2004, when it was making the inflation-adjusted equivalent of $5.4 billion in annual sales. Today, OpenAI, a 10-year-old company, has more than doubled that: Its run rate is now $12 billion, and it's on track to hit $20 billion in annual recurring revenue by December. ChatGPT has almost 700 million weekly active users, up from 400 million in February, meaning roughly 13% of the world's internet population engages with it every week. | The private markets now offer what the public markets used to promise: capital, brand reach, and — most critically — liquidity: | Capital: OpenAI has raised ~$60 billion without ringing a bell.

Brand: Global awareness comes from social media, not a CNBC feature.

Liquidity: The sale is reportedly exclusive to current and former employees who want to cash out. This isn't even about investment; it's about liquidity — the thing public markets used to do best.

| The public markets used to be the endgame. Now they're just an option — and increasingly, not the preferred one. | |

|

| | | | OpenAI has every reason to be a public company. And yet, it's staying private because in 2025, the private markets can do everything the public markets can do, minus SEC scrutiny. | You can't really blame them. Why go public when you can just do this? No one loses — not your investors, not your founders, not your employees. The only loser here is the retail investor who doesn't get access. | Private market investors enjoy first dibs on elite companies at lower prices, while public markets fight over whatever's left, often at inflated valuations. Figma's IPO was textbook: Insiders got in cheap, retail got either one share or none, and by the time trading opened, the price had already spiked 250%. | We've flipped the script. Public markets used to democratize wealth creation – they don't anymore. | So look, congratulations to OpenAI and to its employees. But just remember, the rest of America isn't celebrating alongside you, because the rest of America can't buy in. All we can do is sit around, read the news, and watch you get rich. |

| |

| | |

| | | | This is a headline win for employees — but it may deepen one of OpenAI's biggest problems: retention. In the past two years, over a quarter of OpenAI's research leads have left — and the AI talent war has only become more fierce, with firms offering salaries that match, and in some cases exceed, salaries of professional athletes. | Startup equity is meant to keep talent invested in the company's future. But by making it easy and lucrative for employees to cash out, OpenAI has inadvertently undermined the very retention mechanism startup equity was meant to create. | The company now offers secondary sales roughly twice a year; a decade ago in Silicon Valley, employees typically couldn't sell until an IPO or acquisition. | There's a balance to strike: Too little liquidity, employees get frustrated and leave. Too much, and they can leave with enough money to start their own competitor. The question is whether OpenAI has tipped too far toward the latter. | Anthropic has taken a more measured approach: It waited until 2025 to launch its first large-scale buyback, limited sales to 20% of equity, and capped proceeds at $2 million per person. That may have helped it keep an 80% two-year retention rate, compared with OpenAI's 67%. | My thesis: High liquidity drives high attrition. |

| |

| | |

| | | | Run rate is a financial metric that projects a company's recent revenue or earnings over a full year by taking results from a short period, such as a month or a quarter, and multiplying them to estimate annual performance. It is often used to gauge growth momentum but can be misleading if short-term results are unusually high or low. |

| |

| | |

| | ____________sponsored content ____________ |

|

| Wrestling with projects? Let us help. |

|

| | Basecamp is the no-BS project management tool that makes sense immediately. No onboarding saga. No notification hell. Just one clean place to see who's doing what, what's done, and what's totally on fire. |

|

| | ____________sponsored content ____________ |

|

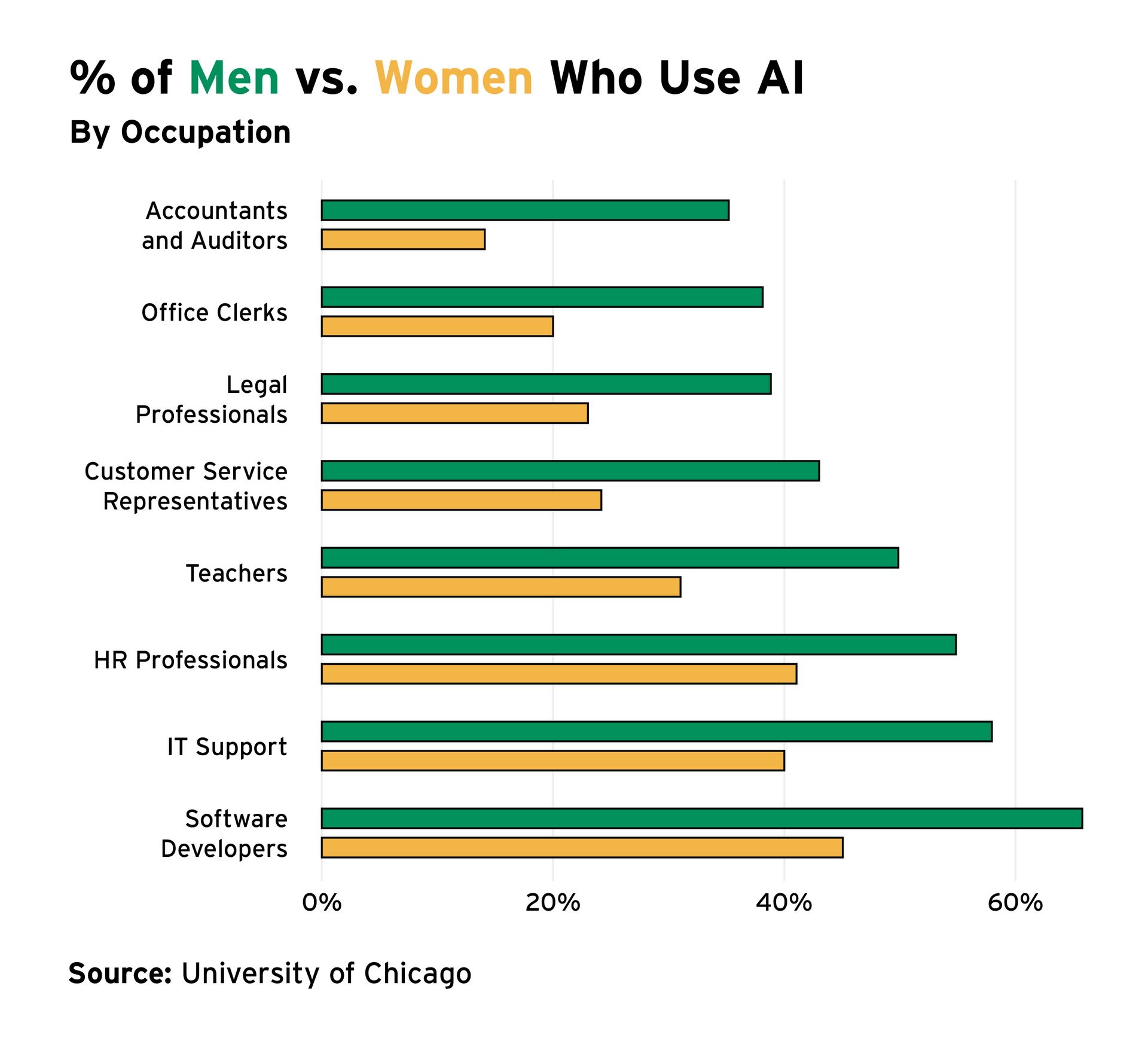

| | Newsletter Exclusive: Why Women Use AI Less — and Why It Matters | Across nearly all regions, sectors, and occupations, women are 20% less likely than men to use AI. Among users of ChatGPT's app, 85% are men. | Women are more likely to see using AI as "cheating," less likely to trust it with their data, and less likely to believe their company supports its use. | The reasons for this gap aren't entirely clear, but the consequences are. | AI skills increase your chances of getting a higher-paying job. This is especially important for women: Recent UN research showed that women, who are overrepresented in entry-level office jobs, are three times more likely to have their job replaced by AI. | Some data: | College graduates with AI skills are almost twice as likely to receive an interview offer after applying for a job. In the U.K., jobs requiring AI skills commanded a 77% higher wage premium over jobs requiring a master's degree. Even in nontech roles, jobs requiring AI knowledge offer 28% higher salaries on average.

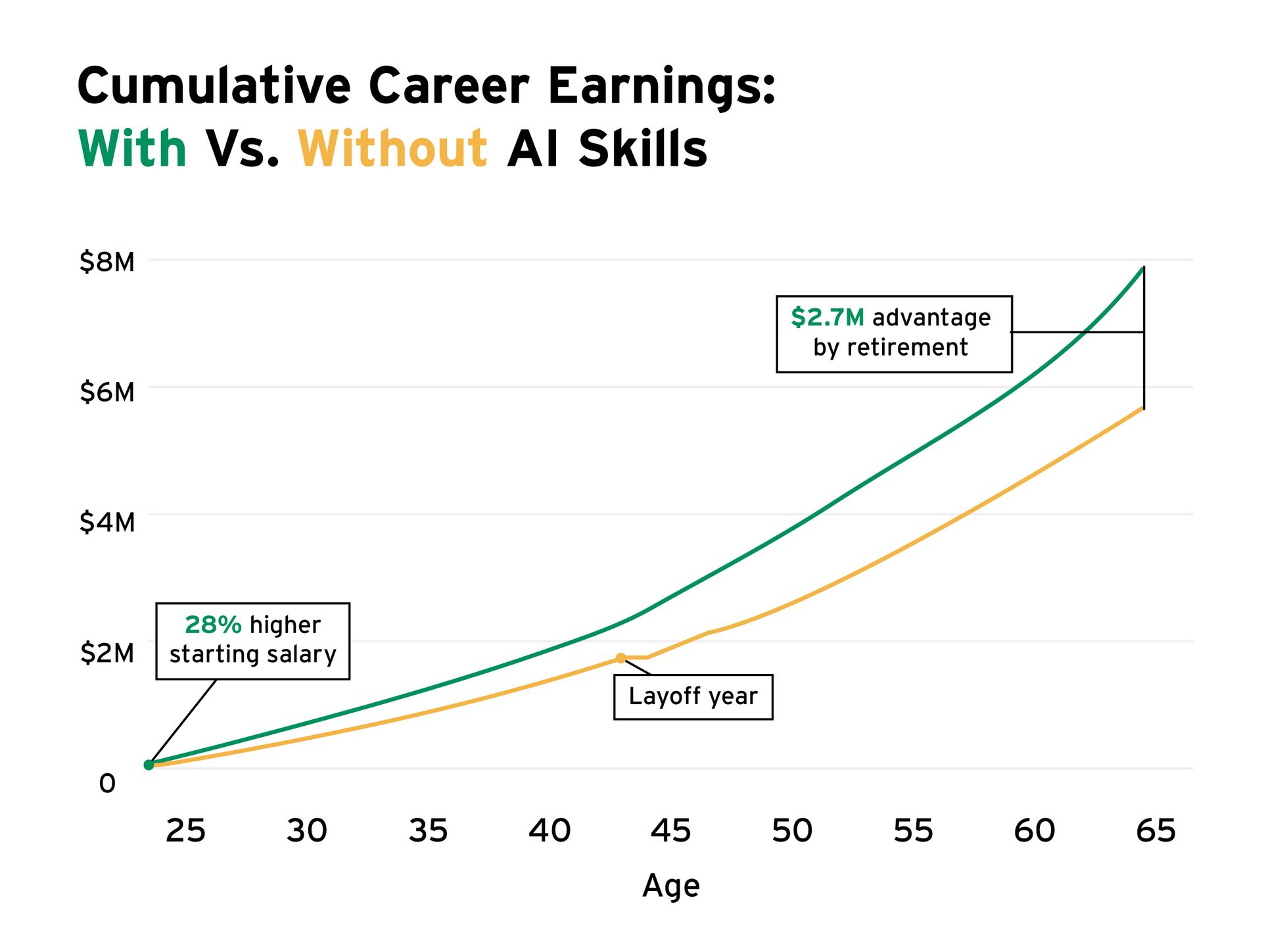

| | This is a multi-million-dollar opportunity. The benefits of having AI skills, or the consequences of not having them, will compound over the course of your career. | Here's a rough example: | A fictional woman starts her career at age 25 with a $60,000 salary, plans to work until 65, and earns 3% cost of living raises each year. | | Without AI skills, she switches jobs three times, and each move nets a 10% salary bump. She also endures one layoff that costs her a full year's pay. Over the course of her work life, she will earn roughly $5.2 million in salary income. | With AI skills, she will get a 28% higher starting salary, switch jobs five times, again with 10% bumps, and never have to deal with a prolonged period of unemployment. Over the course of her work life, she will earn almost $8 million in salary income. | A higher starting salary, more job-switch opportunities, and better job security compound over decades into a $2.7 million advantage. | So why aren't women using AI? | Part of this is about risk perception. Women are more risk-averse than men and may fear potential consequences of using AI more than men do. | A study of business school students found that when professors explicitly allowed ChatGPT, men and women used it at the same rate (~80%). But when it was prohibited, usage among women dropped 38 percentage points, while usage among men dropped half as much — creating a 20-point gender gap. Researchers dubbed this the "good girl" effect. | Findings from the University of Chicago add weight to this theory. When workers were asked why they weren't using AI, women were 11 percentage points more likely than men to cite a lack of training as the reason. | I believe this is less about a "good girl" effect and more likely a case of "smart woman precaution." In environments with vague or no AI policy, women face harsher penalties for using it. | In another study, participants were asked to assess code written by another engineer with or without AI assistance. The code was identical; the only difference was how it was purportedly written. | When reviewers believed an engineer had used AI, they rated that engineer as 9% less competent, despite reviewing identical work. The competence penalty was more than twice as harsh for female engineers, who faced a 13% reduction in perceived competence compared with 6% for male engineers. | Many engineers anticipated this competence penalty and avoided using AI to protect their professional reputations. Those who most feared competence penalties — disproportionately women and older engineers — were precisely those who adopted AI least. I believe their choices weren't a question of behavior informed by gender/age, but by an intelligent risk assessment that takes biases into account. | There are two conclusions here. First: Companies need clear AI policies. "No AI policy" is a bad AI policy; it creates uncertainty and leaves marginalized employees more vulnerable to backlash or bias. If AI is allowed, say so. If it isn't, make that clear too. | | Second: More women need to start using AI more frequently. You don't need to become an expert or spend hours a day reading about neural networks. You just need to start. Even small, practical AI skills can meaningfully boost your value in the job market. | | As Scott says, don't let perfect be the enemy of good. | This is a "DEI" problem. If the gap continues, it will broaden and compound gender inequalities in income and career advancement. | But it's also a leaving-billions-of-dollars-on-the-table problem. As Solène Delecourt and Katelyn Cranney, co-authors of an impressive review on gender gaps in AI, put it: | "Economically, a persistent gender gap could mean enormous productivity and innovation losses — as women's skills, ideas, and perspectives are left untapped. … Generative AI is capable of boosting U.S. productivity by nearly 20% over a decade, so a 25% gender usage gap could cost hundreds of billions of dollars in lost economic gains." |

|

| | | It's Scott-free August, so the Markets podcast and newsletter are taking a break until August 25th. Looking for something to read in the meantime? No Mercy / No Malice has guest posts from Kyla Scanlon, Jessica Tarlov, and yours truly, Mia Silverio. Subscribe here. |

| | |

| | | Ed and Aswath Damodaran, Professor of Finance at NYU's Stern School of Business, discussed AI hype, America's country risk in 2025, and how markets have become more reactive than predictive. Listen here. |

| | |

| | | | | | |

|

No comments:

Post a Comment