Sydney Sweeney's controversial American Eagle ad campaign still has legs. After President Trump called the ad the "HOTTEST" out there in a Truth Social post, American Eagle stock skyrocketed 23%. Trump contrasted the ad with "disgraceful" campaigns from Jaguar and Bud Light, and referred to this billionaire as "NO LONGER HOT." The S&P 500 shook off its worst day since May with its best day since May yesterday, as all of Friday's worries were seemingly washed away over the weekend. The S&P 500 posted a 1.5% gain in a widespread rally, the Nasdaq 100 gained 1.9%, and the Russell 2000 led the way with a 2.1% advance, with the small-cap index the only one of the trio to completely erase Friday's drop. |

|

|

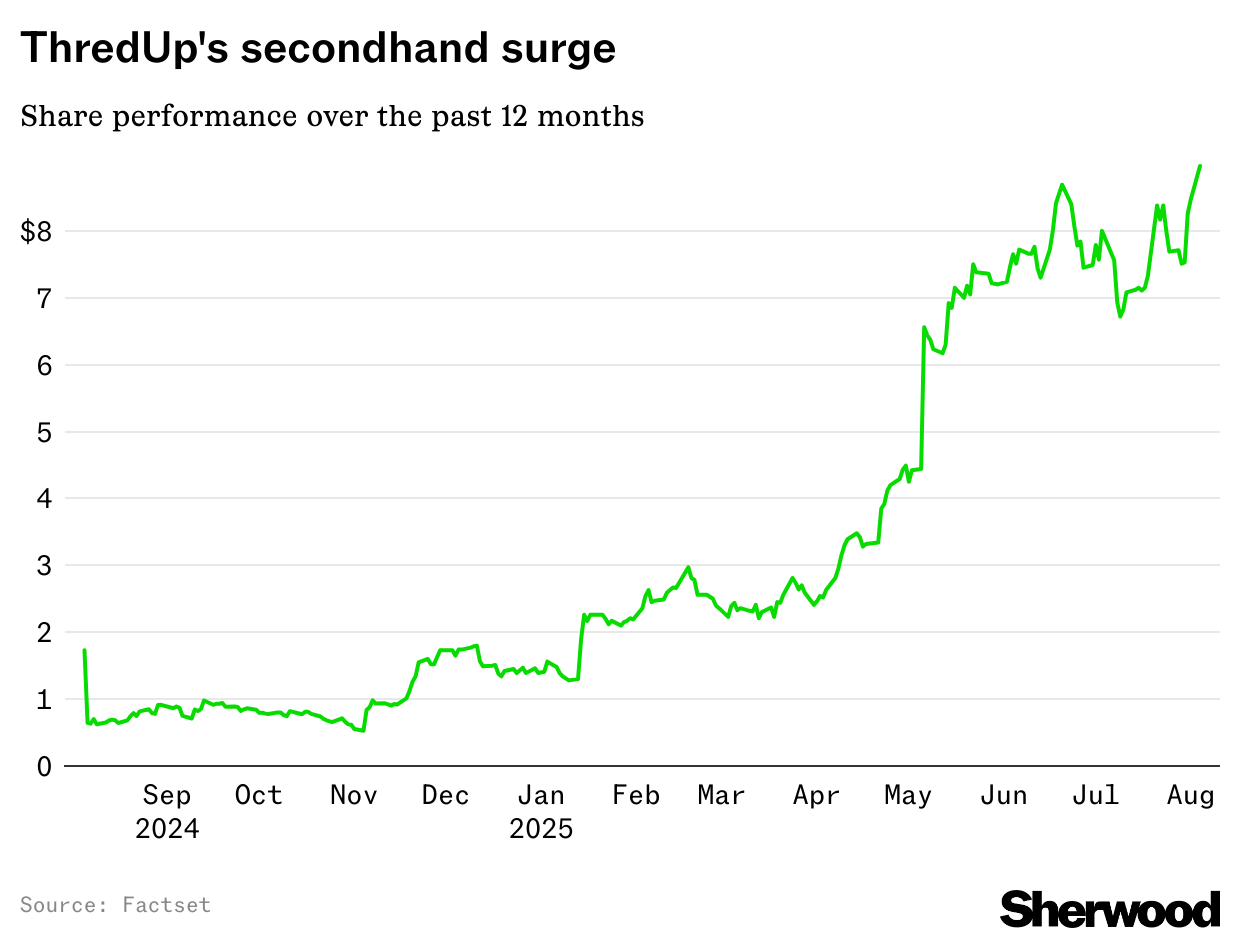

ThredUp, which reported fantastic earnings after the bell yesterday, is having a huge main character moment. After spending much of the last two years trading below a buck, shares of the online consignment platform have surged more than 500% in the past 12 months — outpacing nearly every other name in retail — as secondhand shopping hits the mainstream and growth last year outpaced the broader retail clothing market by 5x. The company has become a magnet for Gen Z's thrift obsession and shoppers trading fast fashion for quality secondhand goods. But CEO James Reinhart says the rally isn't just about riding the vibes. In a Q&A with Sherwood News, he breaks down how the company got its groove back. Reinhart credited ThredUp's recent success to a powerful synergy between a major consumer shift and the site's proprietary technology, doubling down on innovation and embedding an AI-first mentality to completely reshape the customer experience in several important ways. Beyond the company's focus on AI, he also covered: |

|

|

On one hand, ThredUp's turnaround story is about being at the right place at the right time and jumping to capitalize on that opportunity. On the other hand, it's also a story of looking to the future, with the company prioritizing the hottest buzzword of the decade: AI. As Reinheart told us, its "continuous investment in automation and AI technology" is what allows it to scale up multiple unique offerings. And as the reaction to ThredUp's latest earnings shows, the market is loving it. |

|

|

American Engineered Ag Drones Aim to Beat Foreign Competition |

While many foreign manufacturers treat agriculture as one-size-fits-all, Texas-based Hylio takes a different approach with their ARES HYL-150 agricultural drone. Built with US and allied components, the ARES is tailored to help farms understand their crops and tackle specific agricultural pain points. The ARES delivers up to 70 acres/hour coverage at a rate of 2 gallons per acre with its 13-gallon payload, obstacle avoidance radar, and swarm-enabling technology. But it's more than raw performance; Hylio partners with farmers and operators to customize solutions for their unique conditions – from soil types to crop varieties to local challenges. With more than 1M acres treated, 800+ drones sold, and $30M+ in lifetime revenue1, Hylio is growing fast and is ready to accelerate even more. Invest today!2 1 Lifetime revenue is for 9 years. |

|

|

Palantir, the data analytics, AI software, and defense and intelligence contractor, had a lot to live up to with its earnings report after the bell Monday, as Wall Street expected the kind of outstanding growth that has driven the company's shares to rise more than 500% over the past year. Luckily for Palantir and all its investors, the report was very good. Before the earnings hit, the company's 104% year-to-date gain was enough to make it the top-performing stock in the S&P 500. For what it's worth, its 340% gain last year also made it No. 1 in 2024 after joining the index in September. That run has pushed Palantir into the elite echelon of Corporate America and made shareholders roughly $300 billion wealthier in just the last 12 months. At least on paper. But it has also pushed Palantir's valuation — as measured by price-to-sales and price-to-earnings ratios — to arguably lunatic levels, on par with some of the nosebleediest peaks of the tech stock bubble of the late 1990s and early 2000s. Another way to say it: Palantir is the most expensive stock in the S&P 500. One chink in Palantir's armor is its largest customer: the US government. When news hit that the government was looking to reduce its reliance on key contractors like Palantir, the stock whipsawed. On the other hand, the government can be a very profitable customer; late last month, the US Army and Department of Defense announced a 10-year software procurement deal with Palantir that has a ceiling of $10 billion, which would be among the company's largest deals ever. |

|

|

Palantir's current valuations imply remarkable confidence from investors that the company will be able to produce exceptionally fast growth alongside exceptionally fat profit margins for most of the next decade — something exceptionally difficult to do in a supposedly competitive market economy. Yet once again, Palantir looks to have surpassed expectations, and the stock rose in after-hours trading as it not only beat analysts' predictions, but, almost equally important in the current market environment, boosted its guidance for the future as well. |

|

|

President Trump recently floated a major change to the way America protects private intellectual property rights. Currently, inventors pay a series of fixed fees — typically around a few thousand dollars — regardless of the patent's "worth." Trump, however, suggested patent holders pay a percentage of the overall value of their patents, which could raise billions of dollars in revenue for the government. These fees could balloon for companies with large portfolios of high-value patents. This interactive chart shows which companies could be hit the hardest. |

|

|

13 Million People Lose Weight With This App's Scientific Method |

Summer fun got you off track? You're not alone — and you don't need extreme diets to reset. The Simple app helps over 18 million users build healthy habits and lose weight without counting calories. Sonica, for example, lost 139 lbs and regained health. Snacks readers get 50% off — start your personalized quiz today! |

|

|

Yesterday's Big Daily Movers |

|

|

- Earnings expected from Pfizer, Caterpillar, BP, Marriott, Duke Energy, DuPont, Yum! Brands, Advanced Micro Devices, Super Micro Computer, Amgen, Arista, Opendoor, Snap, Lucid, and Rivian

|

Advertiser's disclosures:

2 The minimum investment is $328.60. Please read the offering circular and related risks at https://www.startengine.com/offering/hylio.This is a paid advertisement for Hylio's Regulation CF Offering. This Reg CF offering is made available through StartEngine Primary, LLC. Past performance is no guarantee of future results. Investing in private company securities is not suitable for all investors because it is highly speculative and involves a high degree of risk. It should only be considered a long-term investment. You must be prepared to withstand a total loss of your investment. Private company securities are also highly illiquid, and there is no guarantee that a market will develop for such securities. This was a paid for ad. Sherwood Media has been compensated for this ad by the Hylio Reg CF Campaign hosted on StartEngine. |

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to Snacks and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and The Wrap for quality reads. |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment