Everything goes wrong for US stocks, with the S&P 500 posting its biggest loss in months |

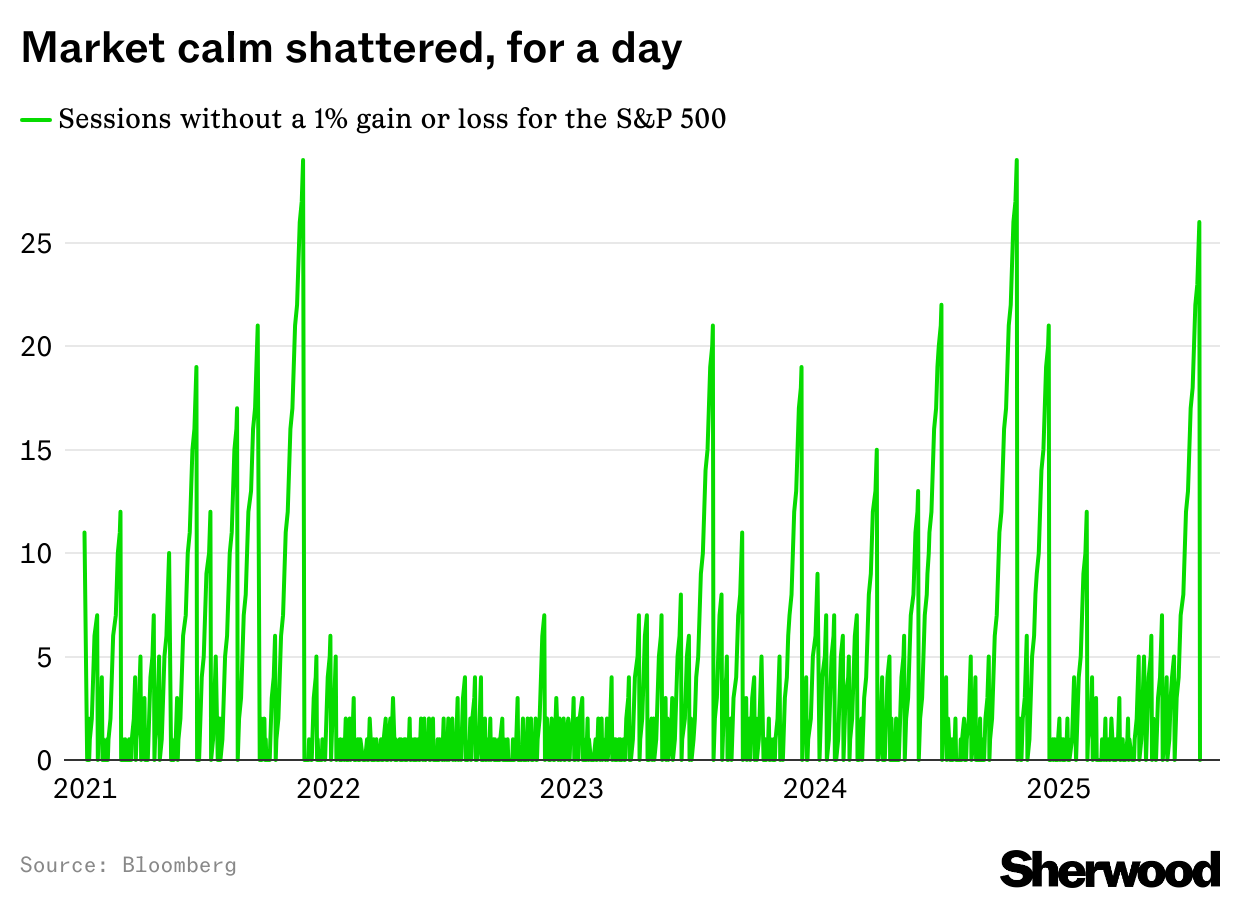

A trio of troubles sank US stocks on Friday: Amazon's lackluster guidance after the bell on Thursday, President Donald Trump's plans for more tariff hikes starting August 7, and a string of poor economic data headlined by lower-than-expected job growth in July. The S&P 500 had its first daily move of at least 1% in 26 sessions, and it was to the downside: the benchmark index finished off 1.6%, while the Nasdaq 100 and Russell 2000 each slumped 2%. |

Defensively oriented S&P sector ETFs — healthcare, consumer staples, and utilities — were the only ones to go positive on the session. Consumer discretionary and tech each slumped 2%, with seven sector ETFs falling at least 1%. Gains were led by Monolithic Power, which rose 10%, and First Solar, which jumped 5.3% after the solar panel developer posted a surprise Q2 earnings beat and a sunnier full-year outlook. On the flip side: Coinbase helped lead declines with shares falling 16.9% after the largest US crypto exchange posted disappointing Q2 results on Thursday. Sticking with earnings… |

- Amazon shares continued to stumble, falling 8% as investors focused on the tech giant's weaker-than-expected operating income forecast for the current quarter and massive capex spend.

- Moderna shares slipped 6.6% after the vaccine maker reported Q2 results that beat Wall Street estimates but lowered its full-year revenue guidance.

- Exxon fell 1.8% after reporting better-than-expected Q2 earnings and sales early Friday, despite warning weeks ago that soft prices would crimp profits.

- Riot Platforms fell 17% after the bitcoin mining company reported Q2 earnings after the bell Thursday that missed on revenue amid rising mining costs.

|

- Joby Aviation rose 3% after the air taxi maker announced a partnership with defense tech firm L3Harris Technologies to develop military aircraft. L3Harris shares closed flat.

- Tesla shares ticked 1.8% lower after EV sales fell in Sweden, Denmark, the Netherlands, and France — marking the seventh straight monthly drop in those countries.

|

— Luke Kawa, Markets Editor & Nia Warfield, Markets Writer |

|

|

"Speculation is far from dead," says Steve Sosnick, chief strategist at Interactive Brokers. Read more. |

|

|

Spot crypto ETFs trading in the US saw $12.8 billion of inflows last month, a record high for the investment vehicles, according to Bloomberg senior analyst Eric Balchunas. This translates to $600 million in inflows per day, which is double the average. Read more. |

|

|

- You're getting paid nothing for risking money in the stock market, per the equity risk premium

Yeah, stocks are still on a 4% or higher earnings yield... but when bonds offer the same, what do you do?

- Trump fires BLS commissioner over disappointing jobs report

The weak jobs numbers come as the administration has sought to fend off criticisms of how its shifting trade policies have impacted the economy.

- All eyes are on Hims' weight-loss biz ahead of Monday earnings

The company's stock, which is up more than 150% this year, has been on a wild ride. - US homeowners are more locked in than they've been for 40 years

With mortgage rates near 7%, buyers are holding back and sellers are staying put — leaving the housing market frozen. - Jury rules that Tesla was partly to blame for 2019 autopilot crash, awards $329 million in damages

This was the first such case to go to a jury trial and opens Tesla up for more liability in the future.

- Amazon, Google, Microsoft, and Meta spent a record $88 billion on capex last quarter

AI is expensive.

- And yes, even Apple is leaning into AI spending

After taking a more disciplined approach, Apple is spending more on AI capex, but didn't give much info on strategy. - Ikea sales fell for the first time since the pandemic; now it's setting up stores in Best Buy

The two retailers are teaming up on a new "shop-in-shop" concept in the US. - Nintendo's Switch 2 is selling at more than twice the pace of the original

Nintendo reported its fiscal first-quarter earnings on Friday.

- Nintendo finally gets hit by the tariff blue shell, will hike prices of the original Switch in the US

Nintendo said the price adjustments will go into effect over the weekend.

- CEO Andy Jassy's answer on Amazon's cloud business cost shareholders nearly $100 billion

When you're explaining, you're losing. - Kimberly-Clark jumps after Q2 earnings beat and full-year guidance hike

The Huggies and Kleenex maker said demand held strong across its lineup of household essentials.

|

|

|

Was this email forwarded to you? Don't miss out on future stories — subscribe to The Wrap and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and Snacks for quality reads. We care what you think! If you have any feedback or comments, feel free to reply and let us know your thoughts! |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment