Hi! Bot to go: Anthropic is gifting its Claude AI model to US government departments for just $1, the company announced yesterday — days after OpenAI offered ChatGPT to federal agencies at the same price point. Today we're exploring: |

- The "recession" recession: Chatter about an economic slowdown has quietened.

- Pacemaker: On is ahead of Hoka in the running shoe foot race.

- Extreme poverty: One in ten people still live on less than $3 a day.

|

Have feedback for us? Just hit reply - we'd love to hear from you! |

Like a lot of us, CEOs are done talking about recession |

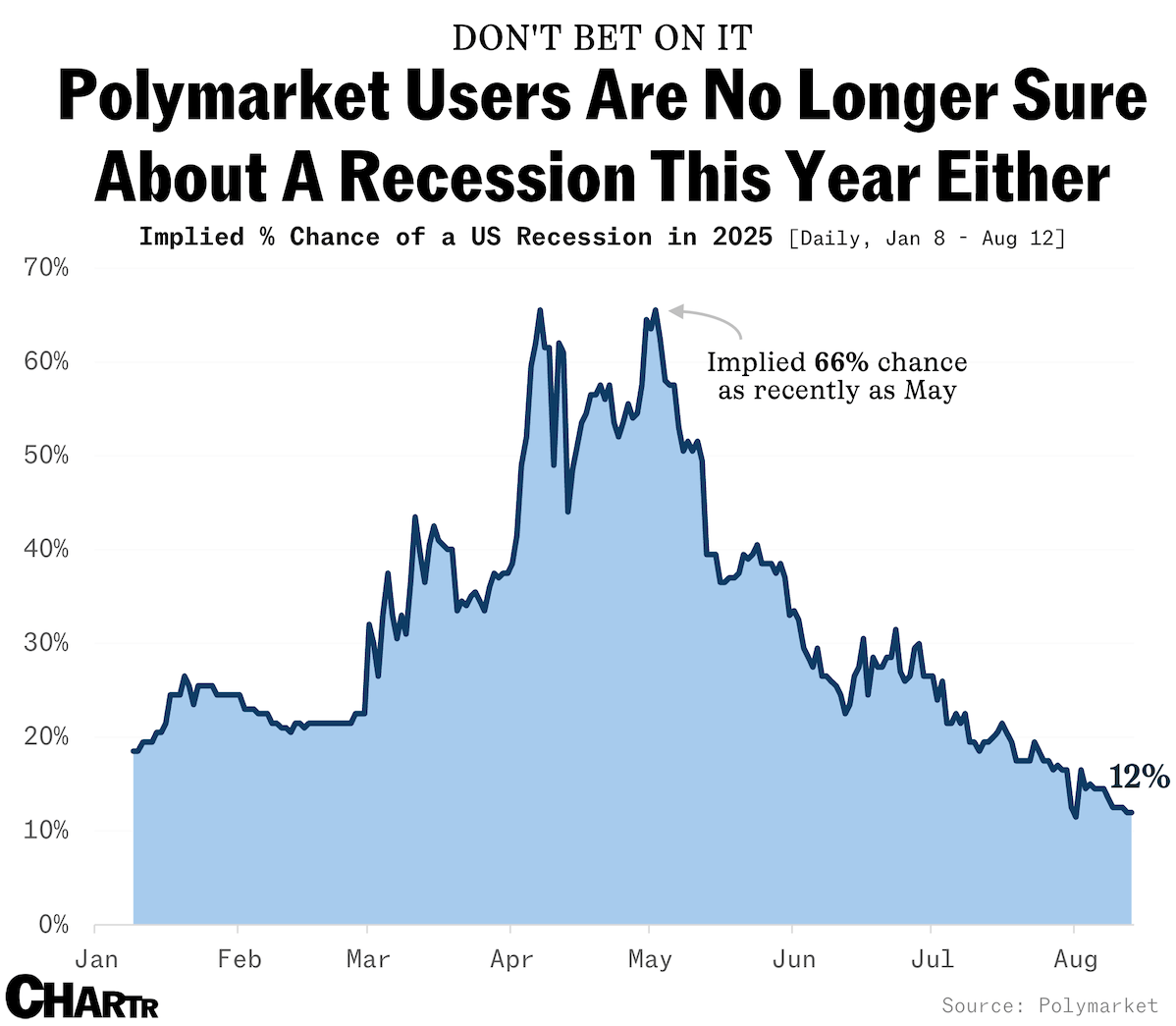

References to recession on S&P 500 earnings calls are, well, receding. That's according to new reporting from Bloomberg, with data showing that CEOs at America's top companies have mentioned "recession" (and related synonyms) just 273 times on calls this quarter, down from a whopping 862 in Q1 this year. As we move further into the year, analysts, investors, and now CEOs all seem to be sharing a brighter outlook on the wider economic picture — the collective fears of economic contraction assuaged by rising stocks, optimism about rate cuts, a bumper earnings season, and the cheery realization that "hey, maybe tariffs don't definitely mean a recession's around the corner." That seems to be the prevailing view on Polymarket, the world's biggest prediction market site, too. |

As of Aug 12, with more than $9 million staked on the question so far, the implied odds of a recession happening in the US in 2025 sat at a mere 12% on Polymarket. That's down more than 50% from peaks in April and May, when President Trump's tariffs kicked into high gear. Clearly, it's not just chief execs who've felt the weight of a looming recession begin to lighten a little as the year's gone on. |

On Running is widening its lead over rival shoe brand Hoka |

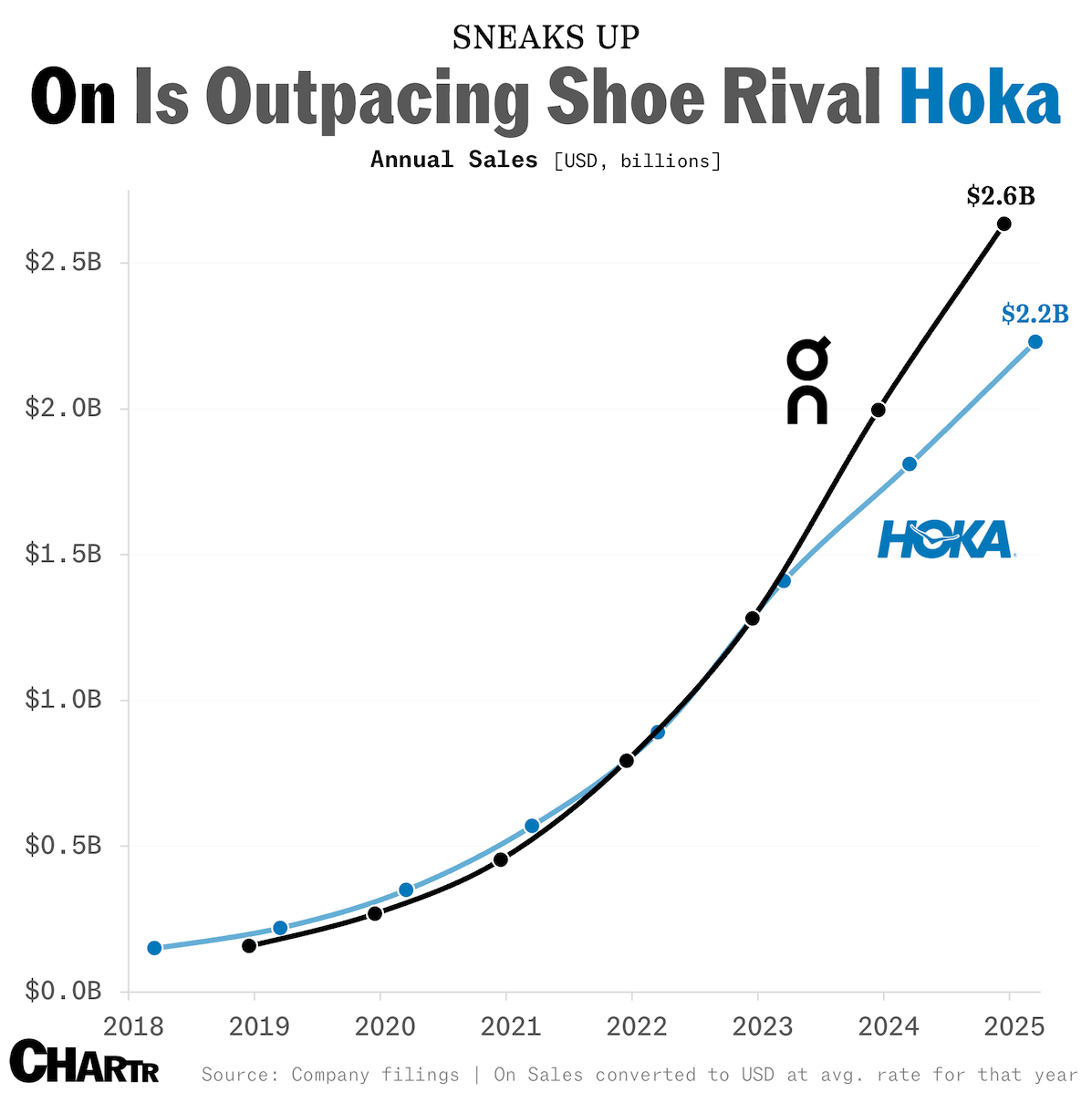

For those in the business of Reading Things Online last summer, it felt like you couldn't go more than a few weeks without seeing a new piece on how upstart running shoe brands like On and Hoka had industry behemoths like Adidas, Nike, and New Balance quaking in their sneakers. Media (and investor) hype around the two athletic shoe sellers might have subsided a little, but both brands continue to make huge strides forward, as runners around the world add Clifton 10s and Cloudsurfers to their collections, and workers adopt the comfort-first sneakers to return to the office in style. |

With strikingly similar origin stories — Hoka was founded in the French Alps by two athletes in 2009, while On Holding was launched by three a year later in Zurich, Switzerland — the brands' tracks have also barely diverged in the years since. In 2012, American footwear giant Deckers snapped up Hoka One One, as it was at the time, for a reported $1.1 million. On, meanwhile, signed Swiss tennis legend Roger Federer as a brand representative in 2019, giving him a 3% stake in the company before going public two years later. |

For most of the past six or so years, On and Hoka's sales had broadly run neck and neck, with not much to split the two Europe-birthed brands. However, the former has really started to kick on in recent years, with On Holdings reporting ~$2.6 billion in sales last year and announcing another impressive quarter yesterday, in which sales jumped 38% (currency-adjusted). The Hoka brand isn't exactly a slouch, posting $2.2 billion in revenue for the last fiscal year, but investors' expectations maybe got ahead of reality. Hoka notched just ~20% sales growth in its latest quarter, and Deckers' stock has been crushed this year, dropping nearly 50%, as Hoka sales have started to slow in the all-important US market. |

|

|

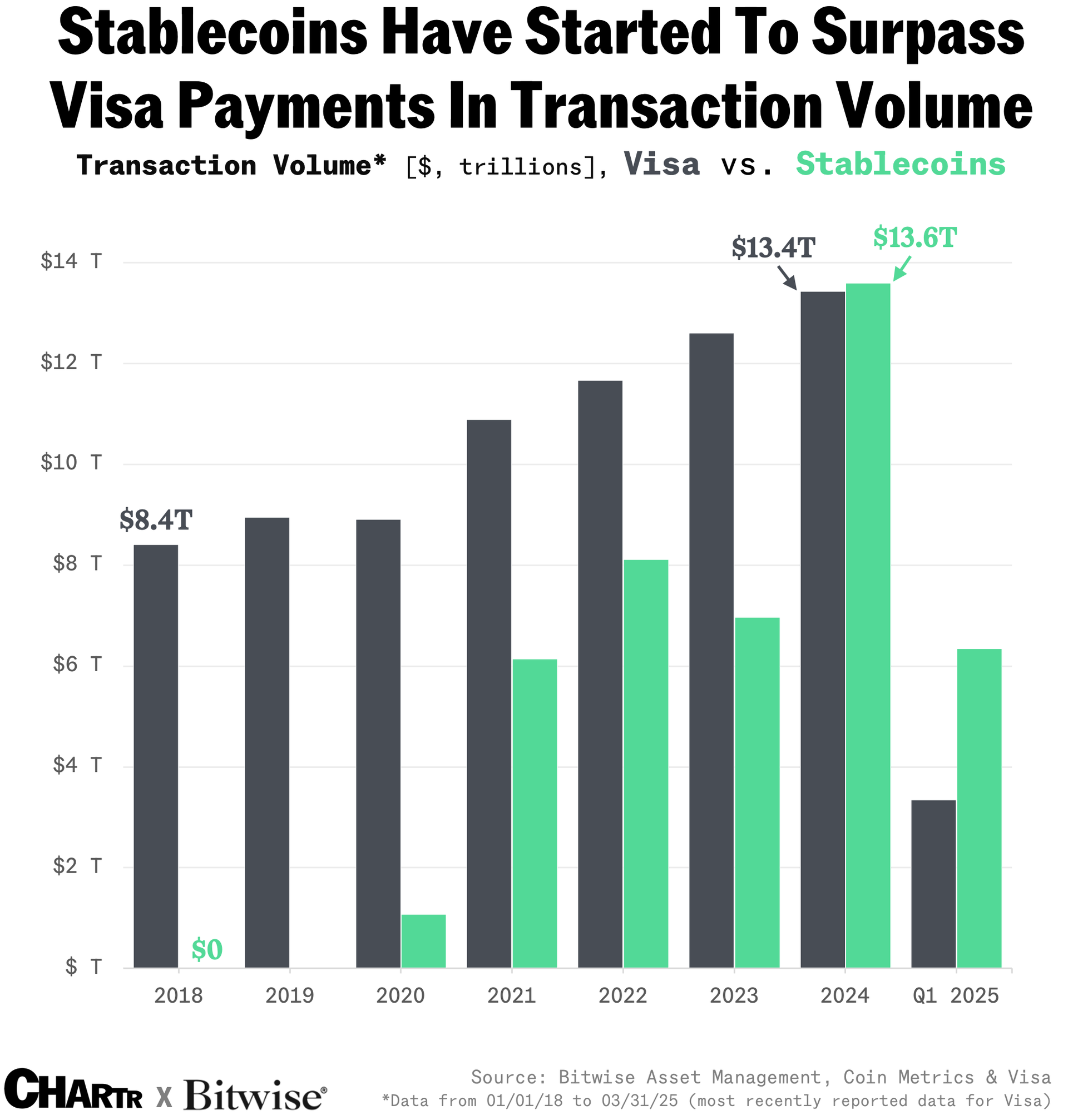

Stablecoins are changing how we pay for things. |

If traditional payment companies aren't getting nervous, they should be. Why? At the current growth rate, stablecoins could be on track to take over. Stablecoins are one of the killer apps of crypto. They're digital representations of the U.S. dollar that move over blockchains like Ethereum. While bank wires take 24 hours, stablecoins settle in seconds— the same time it takes to send a text. Stablecoins only started getting off the ground in 2019. Last quarter, they were used in more than $6 trillion worth of transactions. And Congress just passed a historic stablecoins bill that aims to make them more secure and trustworthy. Expect to see a lot more people and businesses pay for things with stablecoins. For this and more of the biggest stories moving crypto markets, check out the Bitwise Crypto Market Review—60+ charts and tables created by the specialists at Bitwise. |

|

|

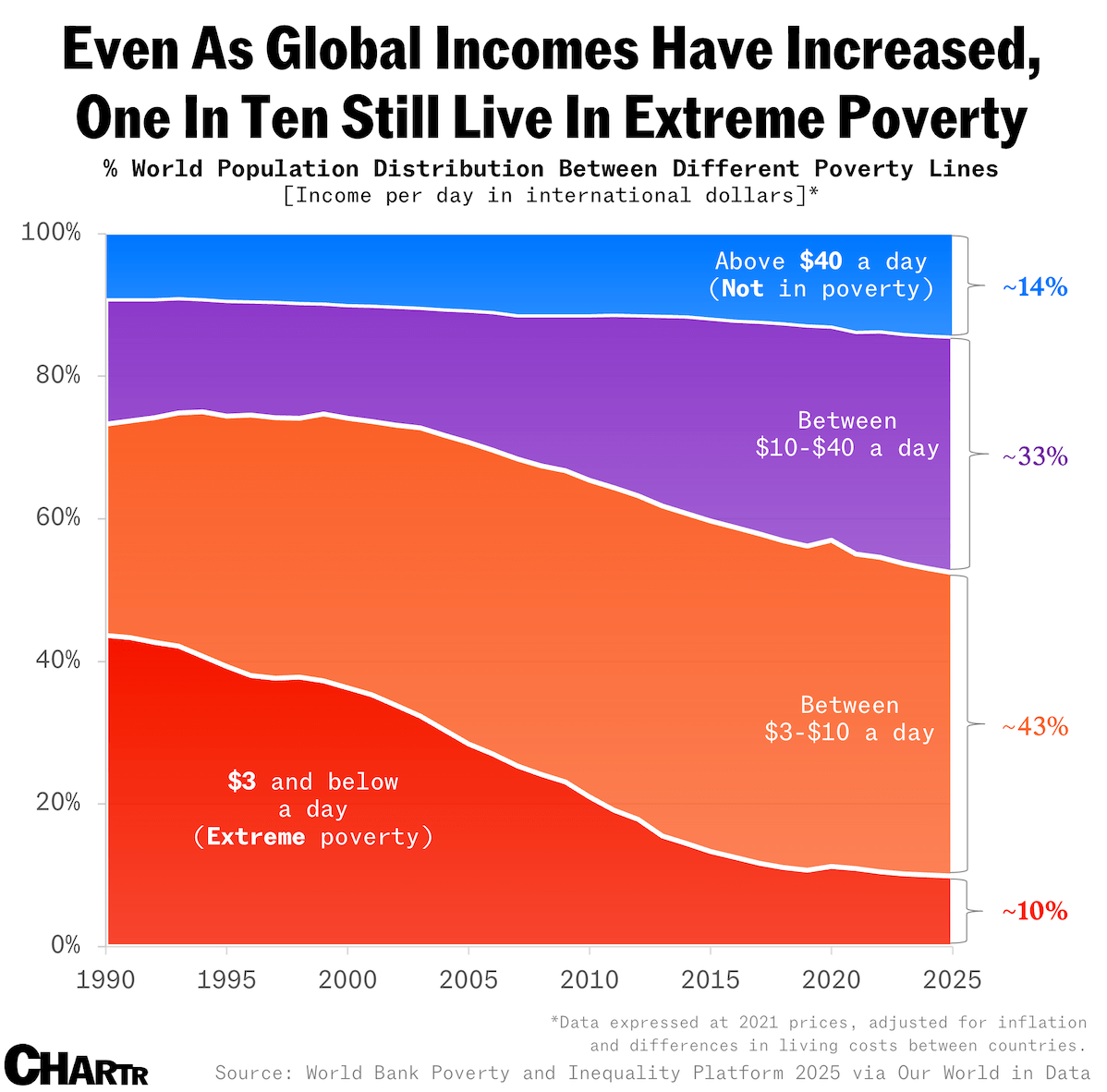

Why were 125 million people just added to last year's extreme poverty estimates? |

In 2015, the United Nations outlined the goal of eradicating extreme poverty for all people everywhere by 2030. Back then, the threshold for extreme poverty — defined by the International Poverty Line (IPL) — was people living on less than $1.25 a day, estimates for which were measured by the World Bank. With inflation biting globally, the IPL was updated to $2.15 at the end of 2022.

Now, the IPL has been raised significantly again, as outlined in this fascinating deep-dive from Our World in Data released Monday. As of June, the threshold for extreme poverty was hiked to $3 per day, a ~40% increase; with it, 125 million additional people have now been categorized by the UN as "extremely poor" at last year's count, up to 817 million people worldwide. |

Of course, a large part of the IPL adjustment reflects inflation. However, the poverty line has also increased in real terms as global incomes have risen. Indeed, the new data shows that the bottom tenth of the global wealth distribution can now buy around 16% more than the old data showed, per the report. So, even though more people are falling below a raised IPL, this doesn't mean that the world is necessarily poorer. Despite all of the remarkable progress that's been made, the original goal of eradicating extreme poverty by 2030 now looks almost impossible — the number of people below the new IPL shrunk by just over 1% from 2024 to 2025, compared with the average 3% annual decline seen from 1990 to 2020. Wherever the goal posts, though, 808 million people — more than the combined populations of the US and the EU — living on less than $3 a day in 2025 remains hard to fathom. |

|

|

- Cracked: Fabergé, the luxury jeweller renowned for its ornate imperial Russian Easter eggs, was bought by a US tech investment company for $50 million on Monday.

- Taylor Swift announced her 12th studio album "The Life of a Showgirl" on August 12, at 12:12 a.m. ET, after a 12-pic carousel on Instagram.

- A new survey from The Conference Board found that just 50% of Americans said they'd reorder a product if they learned it was US-made — down from 60% in 2022.

- Earnings snapshot: On Monday, 133-year-old photography company Kodak warned that, owing to a $500 million debt pile, it may soon have to cease operations.

- Meta shares closed at their highest level in the company's history yesterday, with the stock hitting $790 following a string of excellent earnings reports in recent quarters.

|

|

|

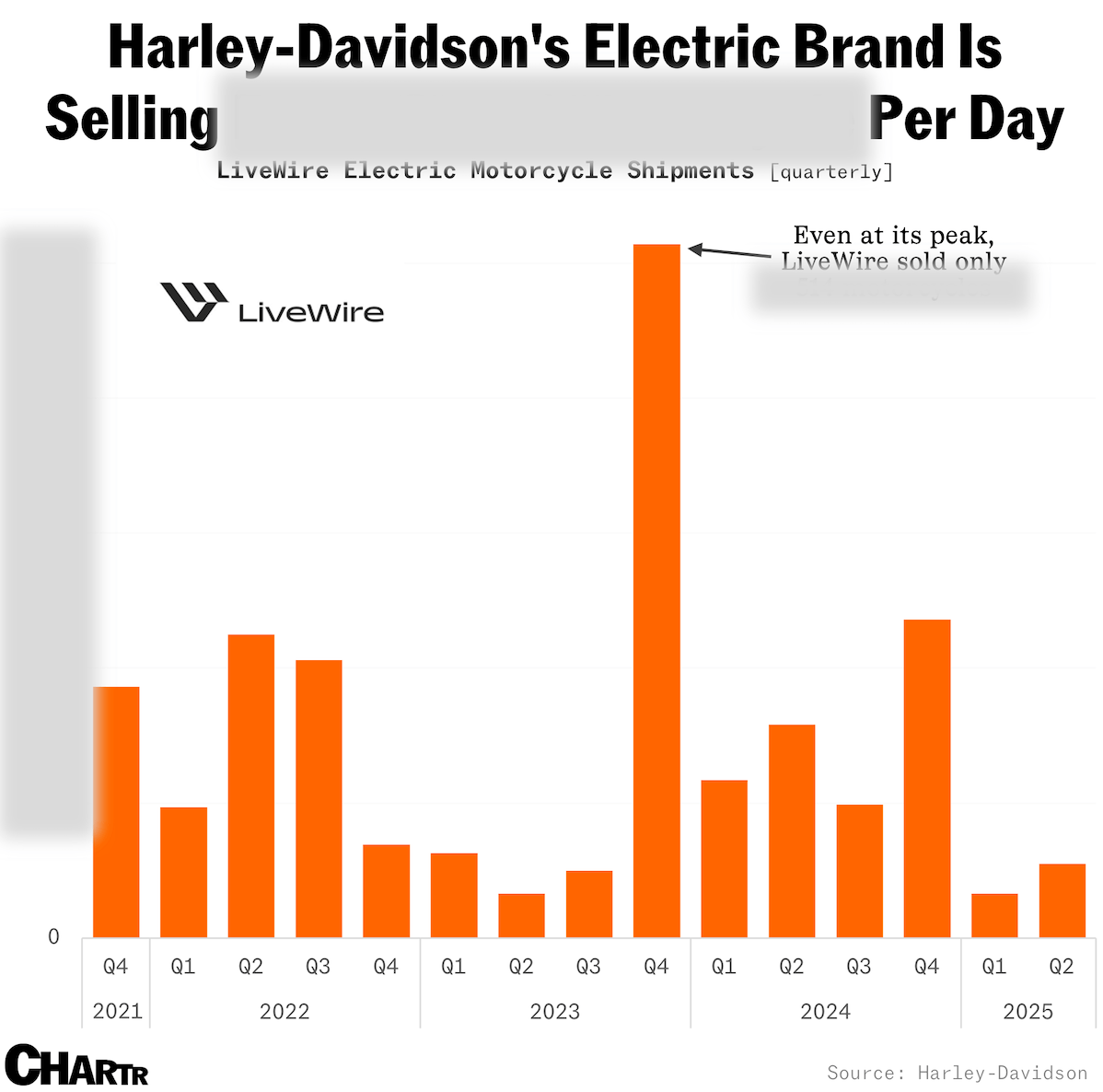

Off the charts: How many bikes did LiveWire, Harley-Davidson's electric bike brand, sell last quarter? [Answer below]. A) 55 B) 55 thousand C) 550 thousand |

Not a subscriber? Sign up for free below. |

Advertiser's disclosures: 1 No Advice on Investment; Risk of Loss: Prior to making any investment decision, each investor must undertake its own independent examination and investigation, including the merits and risks involved in an investment, and must base its investment decision – including a determination whether the investment would be a suitable investment for the investor – on such examination and investigation. Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not currently backed nor supported by any government or central bank. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional currencies, stocks, or bonds. Trading in cryptocurrencies comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks and risk of losing principal or all of your investment. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. Cryptocurrency trading requires knowledge of cryptocurrency markets. In attempting to profit through cryptocurrency trading, you must compete with traders worldwide. You should have appropriate knowledge and experience before engaging in substantial cryptocurrency trading. Cryptocurrency trading can lead to large and immediate financial losses. Under certain market conditions, you may find it difficult or impossible to liquidate a position quickly at a reasonable price. The opinions expressed represent an assessment of the market environment at a specific time and are not intended to be a forecast of future events, or a guarantee of future results, and are subject to further discussion, completion and amendment. The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice, or investment recommendations. You should consult your accounting, legal, tax or other advisors about the matters discussed herein. |

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment