Disappointing US economic data weighs on stocks |

Bad economic news was bad news for stocks, which slumped to their lows of the day after the ISM Services Index came in at 50.1 in July, while economists had been looking for a reading of 51.5. Major indexes clawed back some of their losses but still ended mostly in the red, with the S&P 500 off 0.5% and the Nasdaq 100 down 0.7%, while the Russell 2000 bucked the trend with a 0.6% advance. Most S&P sector ETFs fell on the day, with utilities leading the way down. Axon shares jumped 16%, leading S&P 500 gains, after the law enforcement equipment maker reported much better-than-expected Q2 earnings and sales after the close Monday. Leading decliners was Vertex Pharmaceuticals, which sank 20% despite posting a second-quarter earnings beat, after the company said it would stop development of one of its next-generation pain medicines. Elsewhere... |

- Pfizer jumped 5% after the drugmaker reported earnings results that beat Wall Street's Q2 expectations and raised its full-year outlook.

- Shares of Core Scientific were up 3% after a report from the Financial Times saying some of the company's "top shareholders" are crying foul over the terms of its all-stock takeover by CoreWeave and are planning to vote against the deal. CoreWeave shares were up 5.5%

- Navitas Semiconductor, the tiny chipmaker that went parabolic in late May after earning a spot in Nvidia's supply chain, tumbled 16% after reporting Q2 results.

- Shares of CRISPR Therapeutics slid 6.7% after the Swiss biotech missed Wall Street's Q2 expectations, despite growing excitement around its flagship gene-editing therapy.

- Coinbase shares fell 6.3% after the largest US crypto exchange suffered an outage on Base, its Ethereum layer-2 network, and halted operations for 29 minutes due to an "unsafe head delay."

- Yum! Brands shares fell 5% after the KFC and Taco Bell parent reported lower-than-expected Q2 results amid a slowdown in consumer spending at its key US franchises.

|

— Luke Kawa, Markets Editor & Nia Warfield, Markets Writer |

|

|

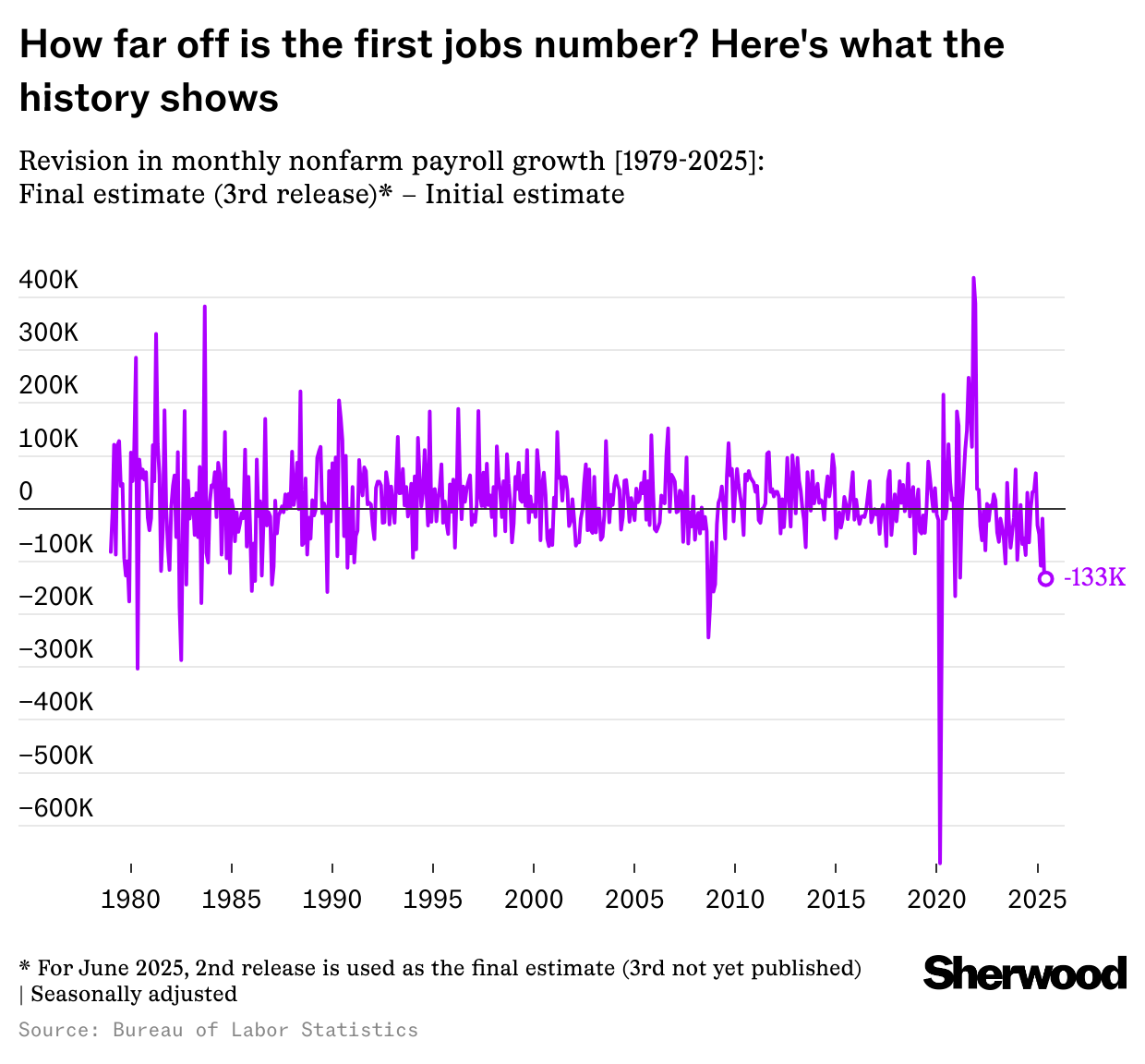

The revisions wiped out over 250,000 "job gains" from prior months — the biggest non-Covid drop since 1979. Read more. |

|

|

Step into the Future with Nasdaq-100 Micro Index Options (XND®) |

Looking to modernize your investment approach? XND® index options offer a streamlined way to engage with the dynamic Nasdaq-100 Index (NDX®): |

- Compact Exposure: Engage with the NDX® at 1/100th notional size, offering flexibility without large commitments.

- Cash Settlement: Simplify transactions by settling in cash at expiration, eliminating the need for physical delivery of underlying assets.

- European Style Options: Exercise only at expiration, thereby eliminating early assignment risk.

- Tax Benefits: Enhance overall returns with potentially favorable tax treatment.

- Versatile Use: Generate income or manage risk through hedging against market volatility.

|

|

|

McDonald's revival of a fan favorite is a window into America's consumption habits. Read more. |

|

|

Evan Spiegel, founder and CEO of Snapchat

(Frederic J. Brown/Getty Images) |

Snap dives after narrowly missing earnings expectations Snap slightly missed expectations, posting EPS of $-0.16 and $1.34 billion in sales in its second-quarter earnings report. FactSet analyst consensus had an EPS of $-0.15 and revenue of $1.35 billion. Read more. |

|

|

Advertiser's disclosures: Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or digital asset or any representation about the financial condition of any company. Additionally, nothing contained herein should be construed as tax advice. Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security, digital asset or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or digital asset or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. Investing in options carries unique risks. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. |

Was this email forwarded to you? Don't miss out on future stories — subscribe to The Wrap and get your daily dose of financial news straight to your inbox. Craving more insights in your inbox? Subscribe to Chartr and Snacks for quality reads. We care what you think! If you have any feedback or comments, feel free to reply and let us know your thoughts! |

|

|

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate... See more |

|

|

|

No comments:

Post a Comment